What are travel credit cards, and how do they work?

Travel credit cards are financial products that offer various rewards and benefits geared towards frequent travelers. They typically earn you points or miles for every dollar spent on eligible purchases. These rewards can be redeemed for flights, hotel stays, car rentals, and other travel-related expenses. Travel credit cards may also include perks like travel insurance, airport lounge access, and no foreign transaction fees.

How do I choose the best travel credit card for my needs?

Choosing the best travel credit card depends on your travel habits, spending patterns, and preferences. Consider factors like the type of rewards offered (points, miles, or cash back), the card’s annual fee, sign-up bonuses, earning rates, redemption options, and additional travel perks. Analyzing these features will help you find a card that aligns with your lifestyle and offers the most value.

What are the benefits of using a travel credit card over other types of credit cards?

Travel credit cards provide unique advantages for travelers, such as earning rewards specifically tailored to travel expenses. Additionally, many travel credit cards offer travel-related perks like free checked bags, priority boarding, and travel insurance. Some cards also waive foreign transaction fees, making them ideal for international travelers.

What is a sign-up bonus, and how can I qualify for it?

A sign-up bonus is a promotional offer provided by the credit card issuer to entice new cardholders. To qualify for a sign-up bonus, you usually need to meet specific spending requirements within a certain timeframe after opening the account. The bonus can be in the form of points, miles, or cash back, and it’s a great way to jump-start your rewards earning.

Do travel credit cards charge foreign transaction fees?

Not all travel credit cards charge foreign transaction fees. Many of the top-tier travel cards waive these fees, making them ideal for international travel. However, it’s essential to read the card’s terms and conditions to confirm this before using it abroad.

How can I maximize the rewards earned with my travel credit card?

To maximize rewards, use your travel credit card for everyday expenses and large purchases. Take advantage of bonus categories and special promotions to earn more points or miles. Consider combining your travel credit card with loyalty programs to stack rewards and get even more value out of your purchases.

Summer is fast approaching, and Europe is calling. Well, not calling…it’s turned its head nonchalantly from its table in a streetside cafe, tipped its spritz in your general direction, and suggested you come enjoy a drink or five.

Europe’s cooler. What can we say?

But it’s a long flight, and you want your travel days to match your Aperol-sipping style. You want to fly Delta One. And you want to know how to fly Delta One cheaply.

We’ve got you covered as best we can. It’s not an easy feat. But here’s how to book Delta One seats to Europe this summer for cheap,

What is Delta One?

Delta One is among the most sought-after luxury products in the airline industry. Its combination of high-end lie-flat seats, SkyClub access, and renowned service have rightfully earned it a revered spot at the top of the US flight-food-chain.

The experience starts well before you board, with Sky Priority kicking in the second you arrive at the airport. Expect accelerated check-in and security, access to the much-lauded SkyClub lounges at select hubs, and priority boarding.

Once you’re on board, the luxury takes over. Each seat can be closed off for maximum privacy, allowing you to enjoy Delta’s industry-beating in-flight entertainment, chef-curated meals, and 180-degree recline beds. It’s a big deal, and can make those brutal overnight transatlantic flights a breeze. To top it off, passengers will receive a little bag of luxury goodies to help them stay relaxed and get refreshed before disembarking.

How much does Delta One cost?

As the most popular carrier in the US, turning left on a Delta flight is a travel aspiration for many of us. But, of course, the price point even for shorter flights can be eye-watering. Learning how to fly Delta One cheaply is a travel-hacking feat within itself, but we’ll do what we can do to help.

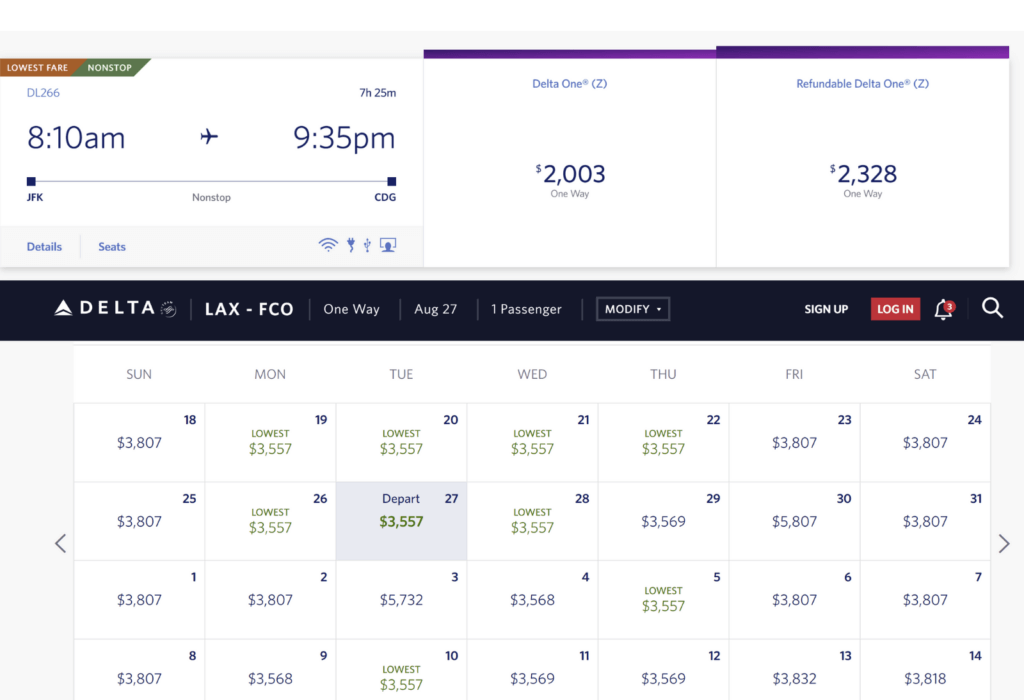

A quick search of flights from JFK to Paris, London, and Rome highlights one-way rates between $1,700 and $3,000 depending on the date you leave. If we push it a little further afield and search for Los Angeles flights, the average is dragged up to the $3,500 mark. Don’t be surprised to see some dates skyrocket depending on popularity and time of day.

Either way, that’s a lot of money to drop on a one-way flight—often quadruple the economy price or more.

Which aircrafts have Delta One?

Before specifying where you can guarantee a Delta One seat, it’s important to make the distinction between Delta One and Delta First Class. Delta One is the airline’s most premium product, while First Class is a slightly inferior product used for shorter routes.

In this day and age, the definition of first class and business class is blurred. Most airlines have done away with the “first class” concept completely. So in this case, don’t make the mistake of assuming Delta First Class is a better experience than One. It’s just confusing branding.

Luckily, working out which flights support Delta One is far easier.

Deta One is supported on any international flight longer than 6.5 hours regardless of aircraft type, as well as some transcontinental domestic routes. International examples would be from big hubs like JFK, ATL, and LAX heading to London, Paris, Rome, or Amsterdam. Some domestic routes supporting Delta One would be JFK to LAX, Atlanta to Hawaii, or D.C to LAX.

Be aware that some of these domestic routes may be listed as Delta First Class. In this case, double-check with the airline or an aircraft seat mapper like Seat Guru.

How to book Delta One seats to Europe this summer for cheap

Avoiding those sky-high fares is the name of the game, and learning how to book Delta One seats to Europe this summer for cheap is one of the toughest redemptions out there. Booking Delta One may be the most misused points and miles redemption in the US. Delta is incredibly popular, and millions of customers opt to open co-branded credit cards with the airline assuming it to be the best way to fly with the carrier.

Frustratingly, Delta’s SkyMiles program is notorious for exorbitant award rates, rendering the masses of miles accrued useless barring a few strong domestic redemptions. It’s not uncommon to see Delta One seats go for over 300,000 SkyMiles. That’s insane.

To help counter this, we’ll be looking into the best ways to fly Delta One cheaply.

Spoiler alert—it’s not using Delta SkyMiles.

How to book Delta One seats to Europe this summer for cheap using Delta SkyMiles

You can’t.

We could leave this section as short as that, but we’ll elaborate. Delta’s award pricing system is brutally dynamic and pulls no punches with its rates. The cheapest rate for a JFK to LAX flight in Delta One clocks in at 125,000 SkyMiles. Finding anything less than that for any route in Delta One is sorcery. If you manage it, let us know your secrets.

It’s a hard truth to learn, especially because of Delta’s popularity. Unless you’re flying economy for a few select routes, you’re rarely going to find super-high value for your SkyMiles.

If you’re one of the million that opted for a co-branded Delta card and have thousands of SkyMiles sitting in your account, patience is your best bet. Monthly skydeals may highlight something special, but it’ll need to fit your dates and you’ll need to be ready to pounce.

If you decide to pay the full SkyMile rate on an LAX to JFK flight that costs $1,500, you’re getting around 1.2 cents per point. If it’s a solid cash rate day and it drops to $1,000, you’re getting closer to 0.8 cents per point.

For a business class redemption, that’s not what you want to see.

But, if you go for it, we won’t judge. A free flight is a free flight and if you’ve found value in it, then power to you. But understand there are better ways to do this. Let’s take a look at some of the options.

Which credit cards could earn you those points

Currently, there are no Delta co-branded cards that can earn you that volume of points with an intro bonus. If you want to do it quickly, you’ll need to open a few cards in succession, hit the intro bonuses and move on to the next.

You could also open an American Express product, like the American Express Platinum Card®.

That’ll get you as high as 175,000-point head start after spending $8,000 in the first 6 months of Card opening. Better yet, those points can be transferred elsewhere so you’re not bound to Delta. The next section will show you why that’s valuable.

- Best for: Luxury Perks

American Express Platinum Card®

As high as 175,000 Membership Rewards® Points

Offer Details:

You may be eligible for as high as 175,000 Membership Rewards® points after you spend $12,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Why we like it

The Amex Platinum was once the sole dominating force in the luxury credit card space. While it now faces some stiff competition, it still offers unbeatable perks like unprecedented airport lounge access, elite status at Hilton and Marriott, and some outstanding statement credits making the mammoth $895 worth it for some.

Reward details

Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings.

You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

Pros & Cons

Pros

-

Large intro bonus

Incredible lounge access

-

Statement credits worth over $3,500 annually.

-

Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

Cons

-

The $895 annual fee is brutally high. Too high for many that can’t, or don’t want to take full advantage of its benefits.

-

Points-earning rates are low unless spending directly on flights or with the Amex Portal.

-

Some of the benefits, like travel credits, are more limited and are harder to use than competing cards’ offerings.

How to fly Delta One cheaply to Europe using Virgin Atlantic Flying Club

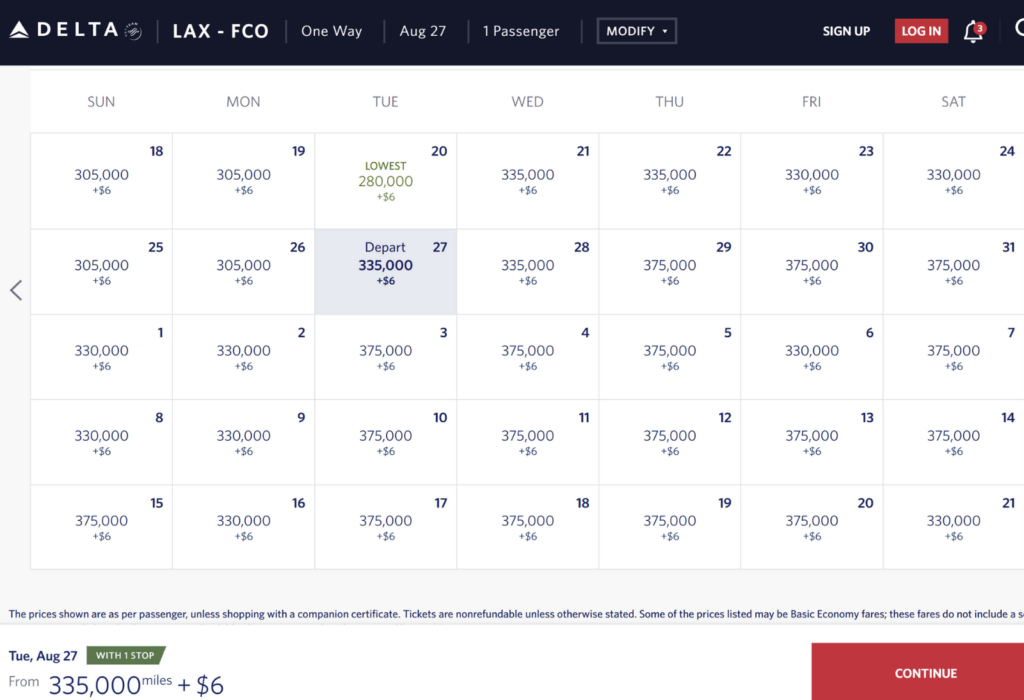

This is more like it. A mere 50,000 points? That’s how to fly Delta One cheaply.

Virgin Atlantic is your friend if you’re hoping to fly Delta One cheaply to Europe this summer. The British airline is a Delta partner and, generally speaking, offers far better rates on Delta flights than the carrier itself.

The main barrier to success is finding so-called “saver awards” which will boast these rock-bottom rates. Delta can be stingy about releasing award space to its partners, especially when it comes to upper-class seats. It may take a little finagling to make dates and rates match up, but trust us; they’re in there occasionally. If you’re looking long-term, keep an eye out for news of availability being released.

Early in 2024, a mass of availability was released for the summer. Naturally, they’ve been swooped up, but keep an eye out and you can pounce.

One other thing—the Virgin platform can be glitchy. Try your best not to throw your computer across the room when searching.

Be patient, because 50,000 points and $6 is pretty spectacular.

Which credit cards could earn you those points?

Virgin Atlantic is one of the easiest programs to earn points and miles with. That’s because it transfers with almost every major credit card. American Express, Chase, Capital One, Bilt, and Citi all allow their points to move into your Virgin account.

With that in mind, any card with an intro bonus over 50,000 points could get you that Delta One flight for almost nothing. But for the sake of variety, here’s the Chase Sapphire Preferred® Card

Its bonus is more than enough to get you there after spending $5,000 within three months of opening an account. Better yet, its annual fee is just $95 a year, making it a valuable and affordable option.

- Best for: Beginner Travelers

Chase Sapphire Preferred® Card

75,000 Bonus Points

Offer Details:

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Chase Sapphire Preferred Card is the ultimate all-around travel credit card—it fits perfectly into almost any points-earner’s wallet. Points novices can enjoy a significant intro bonus and easy to grasp spending categories with an approachable annual fee. The more experienced can utilize its high value earning potential as a secondary card and also gain access to Chase’s strong travel booking portal.

Reward details

5x on travel purchased through Chase Travel℠.

3x on dining, select streaming services and online groceries.

2x on all other travel purchases.

1x on all other purchases.

Pros & Cons

Pros

The $50 dollar hotel credit for stays purchased on the Chase Travel Portal already cuts the already approachable $95 annual fee significantly.

10% anniversary points boost – each account anniversary you’ll earn bonus points equal to 10% of your total purchases made the previous year.

Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

Along with all of the above, cardholders also have access to a string of travel protections like rental coverage, cancellation insurance, and purchase protection.

Cons

It’s subject to Chase’s 5/24 rule. So, if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Competing cards like the Capital One Venture have a better earning rate for non-bonus spend.

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

Terms Apply

Read also: The Best Airline Credit Cards of 2024

How to book Delta One seats to Europe this summer for cheap using KLM/Air France Flying Blue

KLM and Air France’s Flying Blue program is another alternative to using Delta’s own portal. Its rates aren’t quite as low as Virgin’s 50,000, but at just 67,000 miles each way, it’s still an incredible option.

While it’s a good rate, there’s one big reason you’d only opt for this choice if you have a mass of Flying Blue points already in your account: Virgin has all the same transfer partners. By that, I mean if you have enough points to transfer to Flying Blue, you have enough points to transfer to Virgin Atlantic—and since its cheaper, that should be the obvious choice.

If you need to use Flying Blue, you’ll come up with the same availability issues as Virgin. Because Virgin’s search process is easier (when the website works), it’s better to look for flights there and then switch to Flying Blue when you find a flight.

Which credit cards could earn you those points?

Once again, Flying Blue is easy to amass miles for. Amex, Chase, Capital One, and Citi all transfer to Flying Blue, so any combo of cards from those providers can get you to that mark. For example, you could open the Capital One Venture X Rewards Credit Card and hit the $4,000 spending threshold in the first 3 months to earn 75,000 miles—more than enough to redeem that flight.

- Best for: Overall Travel

Capital One Venture X Rewards Credit Card

75,000 Bonus Miles

Offer Details:

Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

Why we like it

The Capital One Venture X is a direct competitor to the Chase Sapphire Reserve, and for many seeking a simpler earning scheme with premium perks, it could be the better option. But the Venture X truly shines with one benefit in particular: four free authorized users. Plus, every year on your cardholder anniversary you get 10,000 points to use for travel.

Reward details

10 Miles per dollar on hotels and rental cars booked through Capital One Travel

5 Miles per dollar on flights and vacation rentals booked through Capital One Travel

2 Miles per dollar on every purchase

Pros & Cons

Pros

-

Its great intro bonus of 75,000 miles is worth well over $1,000 when transferred to partner airlines and hotels, or a flat rate $750 when redeemed on the Capital One Travel Portal.

-

Cardholders get a bonus of 10,000 miles each year after their first account anniversary, which is nothing to shrug off, especially when a little bit short of that business class flight. It’s worth almost $200 depending on how you use it.

-

The $300 annual credit for purchases made on the Capital One Travel Portal, combined with the yearly free miles, more than annul the $395 annual fee.

-

Four authorized users can be added for free.

-

Enjoy access to 1,300+ lounges worldwide, including Capital One Lounge locations and participating Priority Pass™ lounges, after enrollment

-

A generous offering of travel insurance, protections and reimbursements round out an excellent array of benefits.

Cons

-

The $300 credit is a bit less flexible than the Chase Sapphire Reserve’s comparable benefit.

-

Miles earning is the same as the Sapphire Reserve on portal-based purchases, but less on general travel spending.

-

Capital One transfer partners are solid, but still don’t include any US-based airlines or hotels.

Terms Apply

Being realistic about how to fly Delta One cheaply to Europe

As I’ve hopefully made clear, showing you how to fly Delta One cheaply is one thing; executing it is another thing altogether. Delta is notorious for its award rates and even stingier when it comes to partner award availability.

Grabbing those fabled 50,000-point flights with Virgin requires a proactive strategy of searching well in advance of your desired dates and keeping an ear to the ground in the points and miles world for availability releases. When you confirm availability, pounce; it won’t last long.

If you’re truly set on flying Delta One and nothing else matters, you can opt for those big fares on the Deta portal itself.

Keep other options in mind

Delta is sought after by a huge number of American travelers because, for many, it’s all they know. There are plenty of equally strong business class seats with better availabity and better rates. Delta doesn’t make it easy to redeem its premium products, and that’s not going to change any time soon.

The point

Delta’s portal provides the most straightforward method of booking Delta One seats, but its rates are astronomical and equate to bad value. Virgin and Flying Blue offer far better rates, but are plagued with availability problems fueled by Delta’s own partner decisions.

by your friends at The Daily Navigator

by your friends at The Daily Navigator