- Before you start

- Use Lufthansa to travel to Germany with points and miles

- Use Air Canada’s Aeroplan to travel to Germany with points and miles

- Use United’s MileagePlus to travel to Germany with points and miles

- Use Delta SkyMiles to travel to Germany using points and miles

- Use American Airlines AAdvantage to travel to Germany using points and miles

- Travel around Germany with points and miles

- The point

What are travel credit cards, and how do they work?

Travel credit cards are financial products that offer various rewards and benefits geared towards frequent travelers. They typically earn you points or miles for every dollar spent on eligible purchases. These rewards can be redeemed for flights, hotel stays, car rentals, and other travel-related expenses. Travel credit cards may also include perks like travel insurance, airport lounge access, and no foreign transaction fees.

How do I choose the best travel credit card for my needs?

Choosing the best travel credit card depends on your travel habits, spending patterns, and preferences. Consider factors like the type of rewards offered (points, miles, or cash back), the card’s annual fee, sign-up bonuses, earning rates, redemption options, and additional travel perks. Analyzing these features will help you find a card that aligns with your lifestyle and offers the most value.

What are the benefits of using a travel credit card over other types of credit cards?

Travel credit cards provide unique advantages for travelers, such as earning rewards specifically tailored to travel expenses. Additionally, many travel credit cards offer travel-related perks like free checked bags, priority boarding, and travel insurance. Some cards also waive foreign transaction fees, making them ideal for international travelers.

What is a sign-up bonus, and how can I qualify for it?

A sign-up bonus is a promotional offer provided by the credit card issuer to entice new cardholders. To qualify for a sign-up bonus, you usually need to meet specific spending requirements within a certain timeframe after opening the account. The bonus can be in the form of points, miles, or cash back, and it’s a great way to jump-start your rewards earning.

Do travel credit cards charge foreign transaction fees?

Not all travel credit cards charge foreign transaction fees. Many of the top-tier travel cards waive these fees, making them ideal for international travel. However, it’s essential to read the card’s terms and conditions to confirm this before using it abroad.

How can I maximize the rewards earned with my travel credit card?

To maximize rewards, use your travel credit card for everyday expenses and large purchases. Take advantage of bonus categories and special promotions to earn more points or miles. Consider combining your travel credit card with loyalty programs to stack rewards and get even more value out of your purchases.

Is Schnitzel on your mind? Taken by a thirst only quenchable by a freshly tapped Märzen at Oktoberfest? Maybe you have simpler dreams, and fancy enjoying a yodel to yourself atop the Bavarian Alps?

Whatever your Bavarian or Berliner bucket list, there’s only one thing for it: get a flight to Germany booked ASAP.

If that’s easier said than done financially, don’t worry. It’s possible to travel to Germany with points and miles for almost nothing, and in this guide, we’ll be diving into some of the best ways to do so.

Lederhosen at the ready, let’s travel to Germany with points and miles.

Before you start

Before you travel to Germany with points and miles you need to do a little research. Perform a few searches on a good travel aggregator like Skyscanner or Google Flights to help you gauge a cash-price range and the airports you’re most likely to fly in and out of. Remember, if you’re not based in a major city, you may have to consider a positioning flight.

Germany is a pretty big country, but there are one or two hubs like Frankfurt and Munich that a huge number of travelers will be routed through regardless of their final destination. When you start your points and miles search it’s important to look for redemptions to these cities first. In many cases, it could be cheaper to fly there and book a separate flight or even a train to your final destination.

As a last resort when things are looking hopeless, remember that Europe is far more connected than the US. Cheap flights with airlines like Ryanair mean airports in other countries are a viable option, too. And don’t forget trains from the likes of Paris only take around 5.5 hours.

I’ve said it before and I’ll say it again—be flexible.

Using Lufthansa to travel to Germany with points and miles

A default for many hoping to travel to Germany with points and miles is the country’s flagship carrier, Lufthansa. And why wouldn’t you want to try out some German service on the way? The airline is highly regarded, and its new range of business class products is some of the best on the market.

The big problem here is that Lufthansa doesn’t allow points transfers from any of the major credit card issuers so unless you’re a frequent flyer or have a card with the carrier itself, you’re unlikely to have many of its points.

There are ways around this, though. The airline is a Star Alliance founding member, so we can use some of its partners’ programs to nab a seat for almost nothing.

But beware, Lufthansa has some rough fees, so make sure you use an airline that doesn’t pass them onto you.

Using Air Canada’s Aeroplan to travel to Germany with points and miles

Up first is arguably the best option in terms of simplicity and affordability—Air Canada’s Aeroplan program. It’s partnered with some of the most popular airlines to fly routes to Germany like Lufthansa, United, and Singapore Airlines.

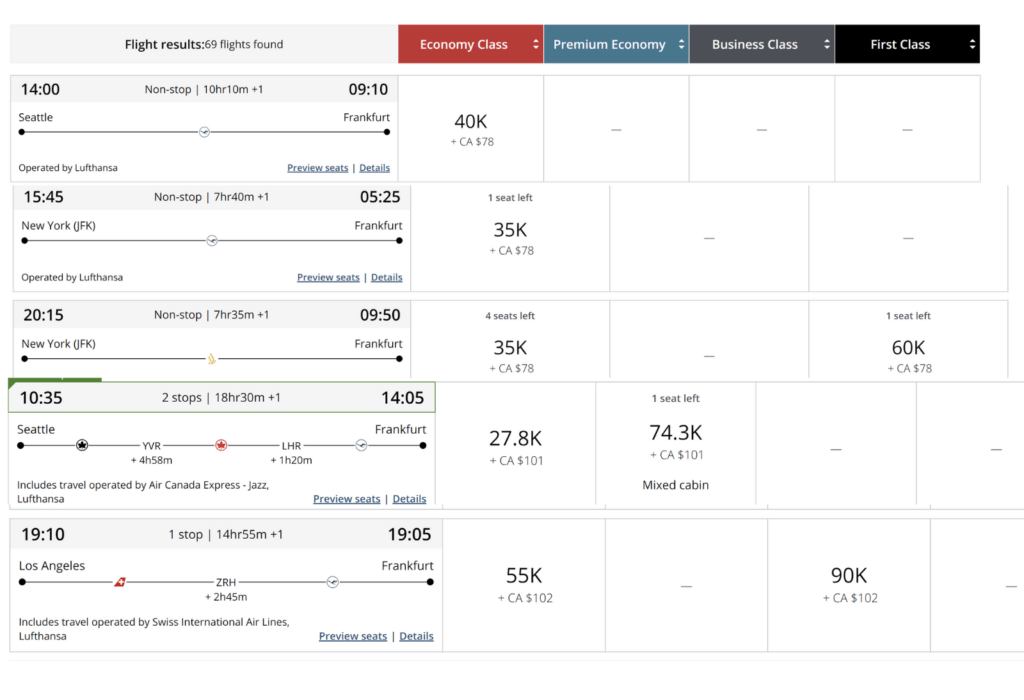

Better than that, it boasts a high-value award chart that sets rates based on geographical zones and the distance flown. If you’re flying from the East Coast, Frankfurt falls just below the upper threshold for its lowest band of award flights. That means you can grab a direct economy flight for just 35,000 points each way with around $56 in taxes and fees. As you can see from the image, that’s with United and Lufthansa flights mainly. You can also grab a cheaper flight for around 31,000 points with Air Canada itself, but it’s not a direct flight.

The best deal I found was a 60,000 pointer on Singapore Airlines’ tremendous business class product. That’s something more than worth checking out. Keep in mind that Singapore’s business class is not the “Singapore Suite”—you can only book that on Singapore’s website.

If you’re coming from the West Coast, it’ll cost a little more as, of course, you’re flying farther. A nonstop flight from somewhere like Seattle will still only cost 40,000 points, so it’s not a huge increase considering the distance. Business class seats are 70,000 points to Frankfurt from the West Coast if you fly direct. I did find some Swiss Air flights routing through Zurich for 90,000, which is much higher but a cool experience if you’re interested.

I also spotted a few of these super-low 27,000-point flights if you’re fine with a couple of layovers, too.

How to earn enough Aeroplan points to travel to Germany with points and miles

Aeroplan is valuable not just for its generous award chart, but for the ease with which it’s possible to earn points. Most of the major credit card issuers transfer points to the airline, including American Express, Chase, Capital One, and Bilt.

Grabbing a card like the American Express Platinum Card® and earning the as high as 175,000-point intro bonus would earn you more than enough for a roundtrip in economy or a one-way in business class. You’ll just need to spend $8,000 within six months to earn the points.

- Best for: Luxury Perks

American Express Platinum Card®

As high as 175,000 Membership Rewards® Points

Offer Details:

You may be eligible for as high as 175,000 Membership Rewards® points after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Why we like it

The Amex Platinum was once the sole dominating force in the luxury credit card space. While it now faces some stiff competition, it still offers unbeatable perks like unprecedented airport lounge access, elite status at Hilton and Marriott, and some outstanding statement credits making the mammoth $895 worth it for some.

Reward details

Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings.

You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

Pros & Cons

Pros

-

Earn as high as 175,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership.

-

Incredible lounge access

-

Statement credits worth over $3,500 annually.

-

Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

Cons

-

The $895 annual fee is brutally high. Too high for many that can’t, or don’t want to take full advantage of its benefits.

-

Points-earning rates are low unless spending directly on flights or with the Amex Portal.

-

Some of the benefits, like travel credits, are more limited and are harder to use than competing cards’ offerings.

Using United’s MileagePlus to travel to Germany with points and miles

United’s MileagePlus program stands out as a dynamic system, contrasting sharply with Aeroplan, raising concerns about its perceived poor value. Thankfully, despite some fluctuating prices, United’s program remains far more stable than some of its close competitors (we’re looking at you, Delta).

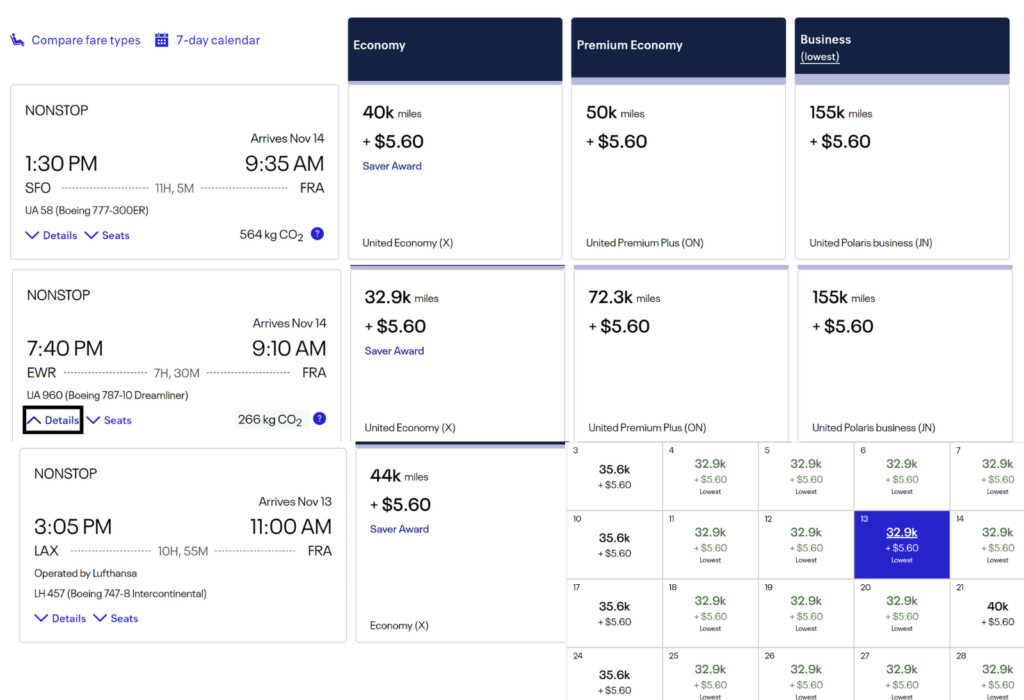

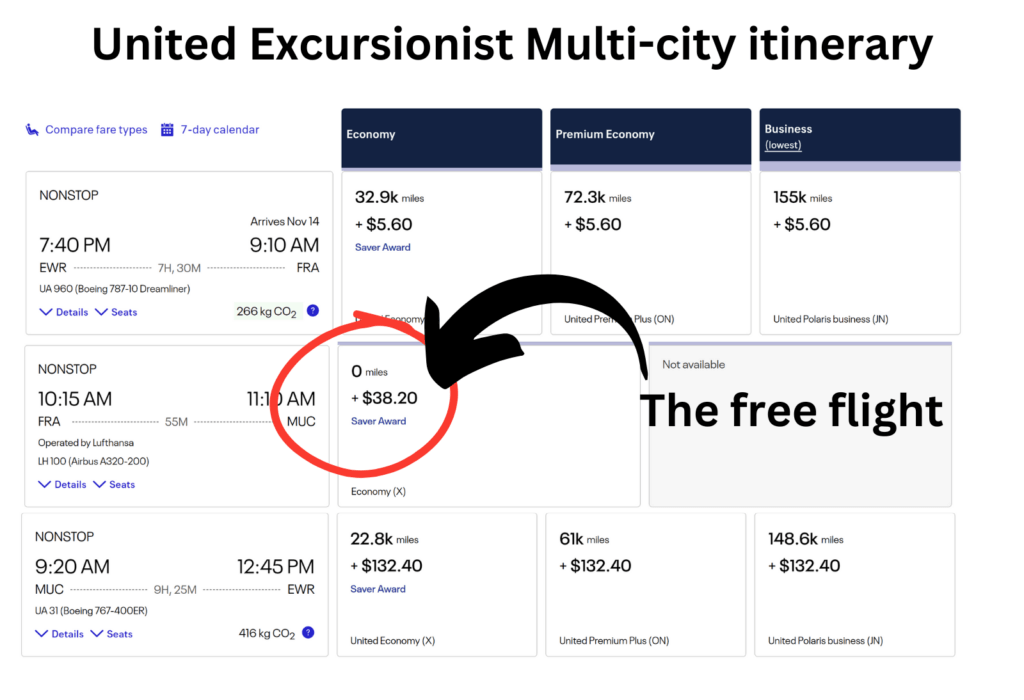

From the image below, you can see award availability is wide open for as little as 32,000 miles one-way in economy with just $5.60 in taxes and fees. Depending on the month, that minimum rises to around 40,000 miles.

The best value flights are the United-operated ones, but you’ll find Star Alliance partners Lufthansa and Singapore in there too for a little bit more. The business class redemptions leave a lot to be desired on any of the airlines with the lowest being around 88,000 in my searches.

The good news is that the West Coast won’t pay much more either. It’s only 40,000 miles at the low end with tons of availability from most major airports on the Pacific Coast.

How to earn enough United MileagePlus Miles to travel to Germany with points and miles

United has great rates but it’s slightly less accessible than its Canadian partner, Aeroplan. In this case, the only way to earn United MileagePlus miles is to open a co-branded card with the airline or transfer points from a Chase account.

I’d recommend opening one of the Sapphire cards, like the Chase Sapphire Preferred® Card. It comes with a 75,000-point intro bonus earned after spending $5,000 within three months. That’s more than enough to get you to Germany for free, and just enough for the cheapest roundtrip option from the East Coast.

- Best for: Beginner Travelers

Chase Sapphire Preferred® Card

75,000 Bonus Points

Offer Details:

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Chase Sapphire Preferred Card is the ultimate all-around travel credit card—it fits perfectly into almost any points-earner’s wallet. Points novices can enjoy a significant intro bonus and easy to grasp spending categories with an approachable annual fee. The more experienced can utilize its high value earning potential as a secondary card and also gain access to Chase’s strong travel booking portal.

Reward details

5x on travel purchased through Chase Travel℠.

3x on dining, select streaming services and online groceries.

2x on all other travel purchases.

1x on all other purchases.

Pros & Cons

Pros

The $50 dollar hotel credit for stays purchased on the Chase Travel Portal already cuts the already approachable $95 annual fee significantly.

10% anniversary points boost – each account anniversary you’ll earn bonus points equal to 10% of your total purchases made the previous year.

Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

Along with all of the above, cardholders also have access to a string of travel protections like rental coverage, cancellation insurance, and purchase protection.

Cons

It’s subject to Chase’s 5/24 rule. So, if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Competing cards like the Capital One Venture have a better earning rate for non-bonus spend.

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

Terms Apply

Using Delta SkyMiles to travel to Germany with points and miles

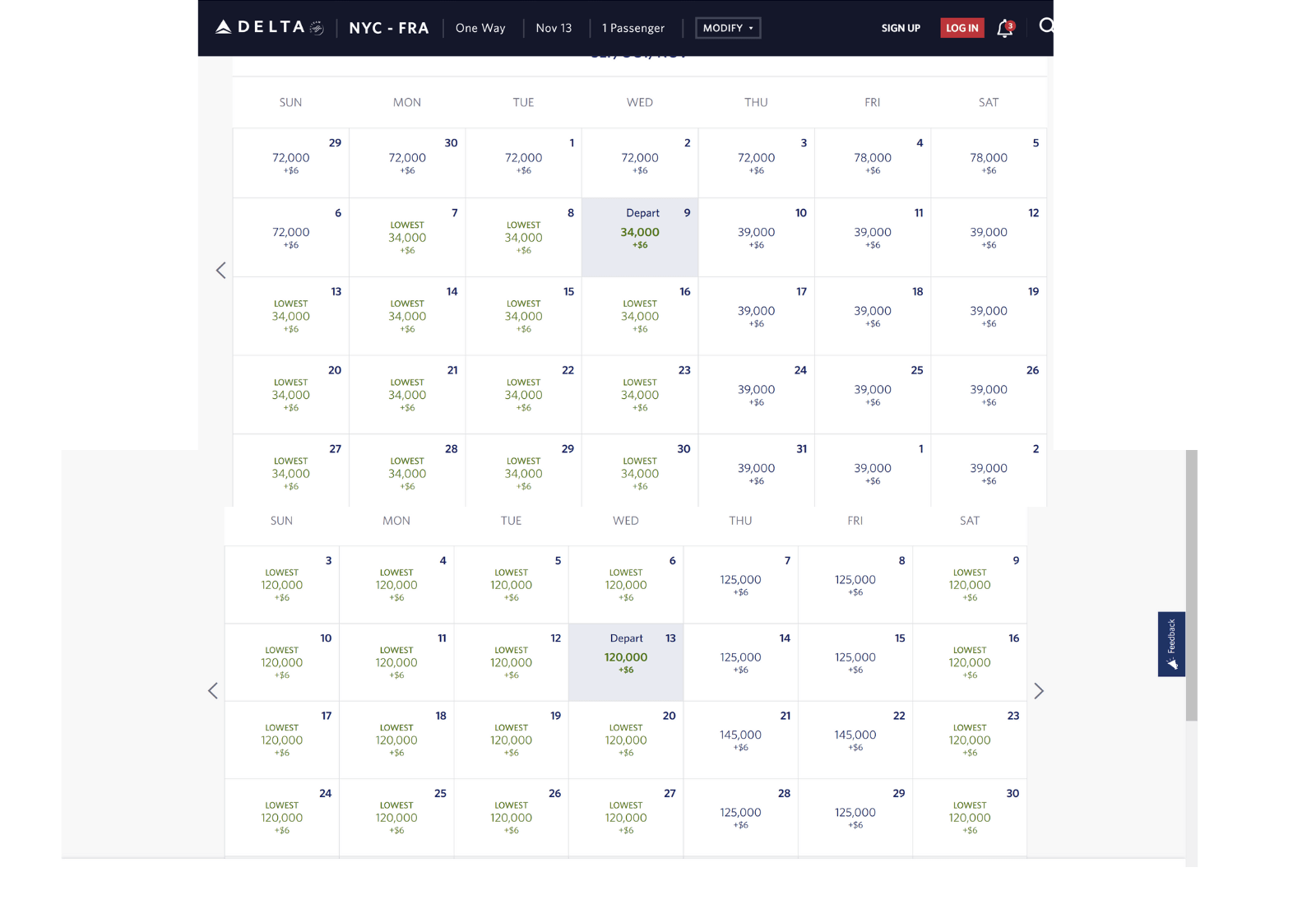

It’s not often I put Delta on one of these lists, but my searches have been surprisingly fruitful with the US’ favorite airline. As with United, Delta’s SkyMiles prices its award flights using a dynamic system…a temperamental one. It’s not uncommon for rates to skyrocket well above 100,000 points for transatlantic flights, with business class seats in particular hitting eye-watering heights.

But the selection of NYC to Frankfurt flights offered is actually pretty fair. In the off-season, there’s a good number of dates offering flights for as little as 34,000 SkyMiles for a direct flight on the airline itself. That is basic economy, so you won’t be able to pick your seat or any of the basic perks almost everyone else gets, but it’s a good deal.

West Coasters, on the other hand, are getting the rough end of the stick. Flights start at 120,000 SkyMiles—a brutal rate by any standard. Avoid at all costs.

Don’t bother with business class flights either. If you want to fly Delta One, look at KLM or Virgin as the rates on Delta’s page are borderline comical.

How to earn enough Delta SkyMiles to travel to Germany with points and miles

Delta SkyMiles, despite their relative awkwardness, are worthy of your time for the simple fact that it’s easy to earn them. Any one of the American Express rewards cards allows transfers to the airline, and the Delta co-branded family of cards is one of the strongest out there.

If you’re a casual Delta passenger, I’d recommend the Delta SkyMiles® Gold American Express Card. It’s the most accessible of the line thanks to its low annual fee (waived the first year) and a solid intro bonus of 40,000 SkyMiles earned after spending $2,000 within six months. With an average of just $500 of spend a month, those points are an achievable goal for a significant chunk of the population.

- Best for: Delta Airline Lovers

- Annual Fee: $0 intro annual fee for the first year, then $150

- APR: 19.74%-28.74% Variable

- Reward Rate: 1X - 2X

- Recommended Credit: Good to Excellent

Delta Skymiles® Gold American Express Card

50,000 Bonus Miles

Offer Details:

Earn 50,000 Bonus Miles after you spend $2,000 in eligible purchases on your new Card in your first 6 months of Card Membership.

Why we like it

The Delta SkyMiles® Gold American Express Card isn’t a showstopper, but it’s an excellent example of an airline card that’s easy to keep in your wallet. Its annual fee is $0 for the first year and then $150 the years after, but if you and a partner fly one round-trip a year with Delta, its free checked bag benefit already makes up for that fee. Throw in a solid intro bonus and simple rewards-earning categories, and it’s almost a no-brainer for anyone with even a little domestic US travel on the horizon.

Reward details

2X miles on Delta Purchases

2X miles at restaurants

2X miles at U.S. supermarkets

1X miles on all other eligible purchases.

Every mile you earn brings you closer to the places you want to go. Turn them into your next trip, use them for seat upgrades, and more.

Pros & Cons

Pros

-

The intro bonus is earned by spending an extremely achievable $2,000 in six months—well within a realistic budget for many.

-

The free first-checked bag for everyone on the booking more than validates the $150 annual fee.

-

A simple 2X miles on dining at restaurants (including U.S. takeout and delivery), and U.S. supermarket transactions make earning points simple.

-

$200 Delta flight credit after spending $10,000 annually is a nice reward that shouldn’t be too hard to meet

-

Card members get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. The discount is not applicable to partner-operated flights or to taxes and fees.

-

No Foreign Transaction Fees. Enjoy international travel without additional fees on purchases made abroad.

Cons

-

SkyMiles award redemption rates on Delta’s partners can be pricey

-

Its 2X miles on Delta purchases is lower than what its sister cards earn

Using American Airlines AAdvantage to travel to Germany with points and miles

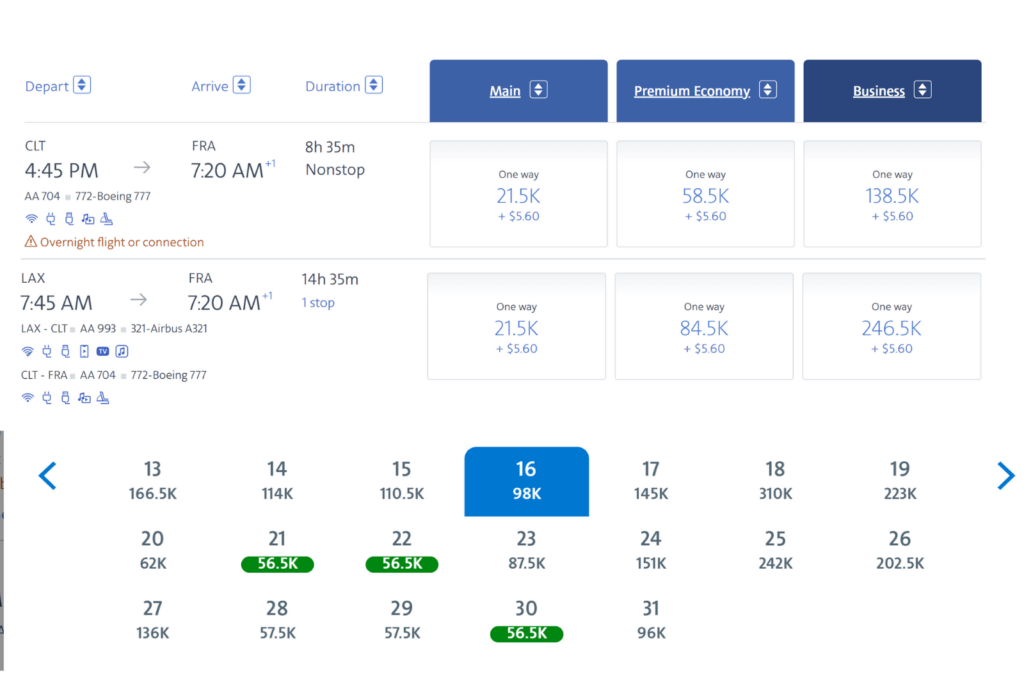

If you can find a solid store of AAdvantage miles, American Airlines is arguably the best airline to use to travel to Germany with points and miles. Charlotte seems to be the major hub for direct flights from the East Coast, and if you can get yourself there, you’ll find nonstop flights for as little as 21,500 miles in economy. That’s an epic deal allowing you to get a roundtrip for just over 40,000 miles.

If you want to get a bit fancy, you can even grab a business class flight on the same route for 56,500 miles—the best of all today’s options.

Ready for the best news? You’ll find the exact same rates from the West Coast. That’s a hell of a lot of flying for less than 25,000 miles or less than 60,000 miles in business. Availability is currently wide open, too, with more than ample opportunity for premium seats.

How to earn enough American Airlines AAdvantage miles to travel to Germany with points and miles

The one downside to the epic rates on show in America’s portal is that its points aren’t as easy to earn as the others mentioned in today’s list. The airline doesn’t have any major credit card transfer partners, so you’ll need to be more deliberate with your earning strategy.

You can earn by flying with the airline and its partners, but unless you’re in the air regularly, it’s unlikely you’ll pull a significant amount. The other option is a co-branded credit card. Thankfully, American does have some strong options, including the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®. It’s an excellent earner, has no annual fee, and currently has a 50,000-mile intro bonus earned after spending $2,500 within three months of opening the card.

That’s a roundtrip from Los Angeles to Frankfurt in return for spending $833 a month. That’s a pretty damn good deal.

- Best for: American Airlines Fans

- Annual Fee: $ $0 intro annual fee, $99 after the first year

- Regular APR: 20.74% - 29.74% (Variable)

- Reward Rate: 1X - 2X

- Recommended Credit: 690-850

Citi®/AAdvantage® Platinum Select® World Elite Mastercard®

50,000 Bonus Points

Offer Details:

50,000 American Airlines AAdvantage bonus miles after you spend $2,500 on purchases in the first 3 months from account opening.

Why we like it

The Citi® / AAdvantage® Platinum Select® World Elite Mastercard® is a strong airline-centric card to have in your travel toolbox if your main airport is an American Airlines hub like Boston, Chicago, Dallas, or Charlotte, or if you just have a preference for the airline. Regular business travelers may want to upgrade for luxury perks like lounge access, but for everyone else, the low annual fee, 50,000 point intro bonus, solid miles-earning categories, and free checked bag perks are more than enough to validate the space in your wallet.

Reward details

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, and on eligible American Airlines purchases

Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases

Pros & Cons

Pros

The strong 50,000-point intro bonus is worth as much as $750, earned after spending $2,500 in three months.

Cardholders and up to four companions can enjoy a free first checked bag on any domestic American Airlines flight, comfortably justifying the $99 fee when used.

The card earns 2X miles for gas and dining purchases

Each eligible mile earned with the card also earns a loyalty point towards American Airlines elite status

A generous 25% discount on in-flight purchases when using the card round out the benefits

Preferred boarding on American Airlines flights

Cons

American Airlines miles can’t be transferred to other airlines or hotels (although they can be used to book AA partner flights)

Premium perks are reserved for pricier cards

Terms Apply

After you travel to Germany with points and miles…you need to travel around Germany

As I mentioned earlier, the vast majority of the flights you’ll find will route through Frankfurt with a few others hitting Munich or Berlin. There’s a good chance Frankfurt isn’t your destination of choice, though. So what’s next when you get there? You have options.

Travel overland

Before you dive straight into the next section and look for more free flights, consider the long way around…only it’s not really that long. In many cases grabbing a train can be quicker than looking for another flight. The fastest trains from Frankfurt to Munich and Berlin are both under four hours. If you factor in a recheck and the typical two hours of breathing space until your next flight, there’s a good chance you’d arrive there before the flight touched down.

On top of that, your train will arrive in the city center, and you’ll still need another hour or so to get there from the airport.

Plus, it’s a lovely way to travel.

Using points within Germany

But, if you’re set in your budgeting ways or don’t fancy the more romantic route, there are still ways to fly for almost nothing to your final destination.

There are some mad redemptions you can do if you’re truly trying to avoid paying, like flying with British Airways from Frankfurt to London and then onto Munich—but I think your priorities would be a little skewed in that case.

Delta offers a few sporadic flights for around 10,000 SkyMiles, but you will pay around 100 euros in taxes which heavily decreases the value. Air Canada and United both have some solid rates of 7,500 and 6,000, respectively, with between $60 to $100 in fees.

One solid way you could do it, depending on which flights were cheaper, is to use United’s Excursionist Perk. For example, say the flight from New York to Frankfurt was cheaper than the flight to Munich, so you opt for the former. The flight back from Munich is priced well, though, so instead of booking a roundtrip or two separate one-ways, you book a multi-trip itinerary.

In this situation, the flight from Frankfurt will cost zero miles, with only $32 in taxes. From a points perspective, that’s a tremendous option.

The point

Flights to Germany may be limited to the main hubs in Frankfurt and Munich but, as this article shows, there’s no shortage of outstanding value to be found using the US’ biggest airlines.

by your friends at The Daily Navigator

by your friends at The Daily Navigator