Overview

If you came here to work out how to get to Banff using points and miles, I have some bad news.

You can’t.

But it’s okay. You can’t fly there directly anyway. Instead, you’d grab a flight to nearby Calgary. It’s just a 90-minute drive away, and since it’s a good idea to grab a rental car on your visit anyway, you’re simply adding a bonus road trip.

If you’re unfamiliar with Banff, you’re in for something special. The spectacular national park nestled in the Canadian Rockies is an outdoor enthusiast’s dream. Soaring mountains, bewitching blue lakes, and a sneaky-brilliant little resort town draw upwards of four million visitors a year. Basically, you’re late to the party.

If all that sounds good, here’s our guide for how to get to Banff using points and miles.

Pre-booking logistics

As mentioned in the introduction, Banff doesn’t have its own airport—it’s just a small town in a big national park, after all. Your point of arrival will be Calgary Aiport, which is around a 90-minute drive from the town.

Any research queries you complete should focus on Calgary, or at a big push Vancouver which is three hours away. I’d only recommend the latter if you’re adding Banff as part of a longer road trip.

There are plenty of ways to get to Banff from Calgary, but I’d recommend grabbing a rental car to give yourself the most freedom on your trip. I might even have a few sneaky ways to help you save on those costs, too.

Before you learn how to get to Banff using points and miles

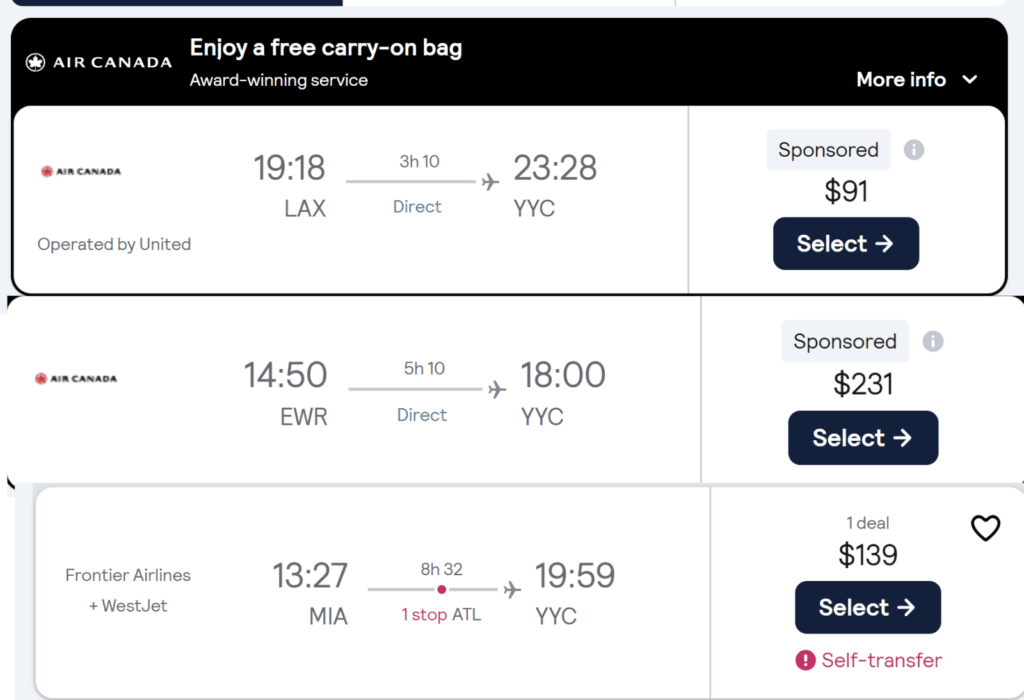

Start any search with a traditional cash booking query. This helps you get perspective on the value you’re receiving for your points flights as well as letting you know which airlines and airports fly into Calgary.

Something important to note here is the relatively cheap flights from some cities. A direct flight from Los Angeles can cost as little as $91 if you travel light with a carry-on only. That’s low enough for many of us to consider saving our points for a bigger redemption, but we’ll check the value later on.

Remember, flight prices will be dictated by the peak and off-peak seasons. Expect Calgary to get a ton of tourists in the summer and winter, with spring and fall being a little less busy.

How to Get to Banff using points and miles: Air Canada Aeroplan

Air Canada’s Aeroplan is a great place to start. Not only because it’s Canada’s flagship airline and commands a good deal of the aerospace, but because its zonal and distance-based award chart offers generous rates that can be relied on at any time of the year.

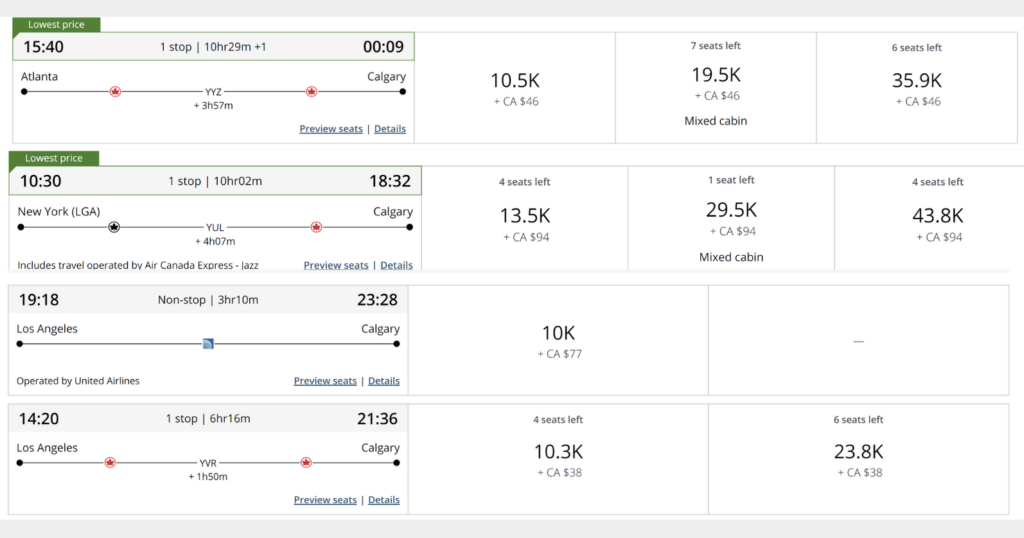

From Los Angeles, it’ll run anywhere from 8,400 to 20,000 depending on the route you take. A simple direct flight is just 10,000 points. Switching coasts, you’ll find a direct flight for 23,000 points, or opt for a stopover for 13,000 points plus around $25 in taxes and fees. Technically speaking, this is probably the best deal as it offers the highest points value. Moving down the coast, you’ll find some solid deals for around 11,000 and 15,000 points from Atlanta and Miami.

But, as I alluded to in the previous section, it’s worth noting you’d be paying 77 CAD ($56) in taxes and fees for a 10,000-point direct flight with United from Los Angeles. You could purchase the same flight (albeit without baggage) for $78. That’s terrible value. The moral of the story here is to be careful with the taxes and fees. The same applies to some of the further away flights. Many of the rates fluctuate heavily.

In light of the fees, only use Aeroplan if one of the next options is unavailable to you.

How to earn enough Aeroplan points

One big plus for Aeroplan is the ease with which you can earn points. Most of the major credit card issuers transfer points to the airline, including American Express, Chase, Capital One, and Bilt.

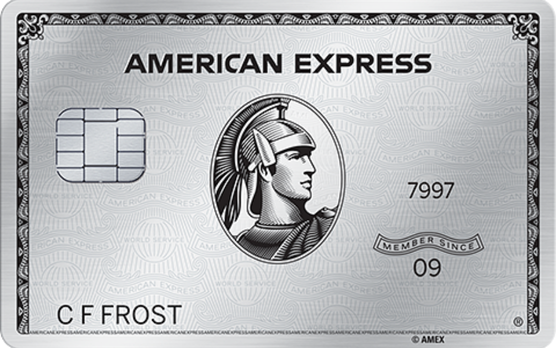

Grabbing a card like the American Express Platinum Card® and earning the as high as 175,000-point intro bonus would earn you enough for four roundtrips to Calgary from Los Angeles. That’s a pretty epic return on the $12,000 of spending required to earn the bonus.

- Best for: Luxury Perks

American Express Platinum Card®

As high as 175,000 Membership Rewards® Points

Offer Details:

You may be eligible for as high as 175,000 Membership Rewards® points after you spend $12,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Why we like it

The Amex Platinum was once the sole dominating force in the luxury credit card space. While it now faces some stiff competition, it still offers unbeatable perks like unprecedented airport lounge access, elite status at Hilton and Marriott, and some outstanding statement credits making the mammoth $895 worth it for some.

Reward details

Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings.

You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

Pros & Cons

Pros

-

Earn as high as 175,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership.

-

Incredible lounge access

-

Statement credits worth over $3,500 annually.

-

Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

Cons

-

The $895 annual fee is brutally high. Too high for many that can’t, or don’t want to take full advantage of its benefits.

-

Points-earning rates are low unless spending directly on flights or with the Amex Portal.

-

Some of the benefits, like travel credits, are more limited and are harder to use than competing cards’ offerings.

How to get to Banff using points and miles: United MileagePlus

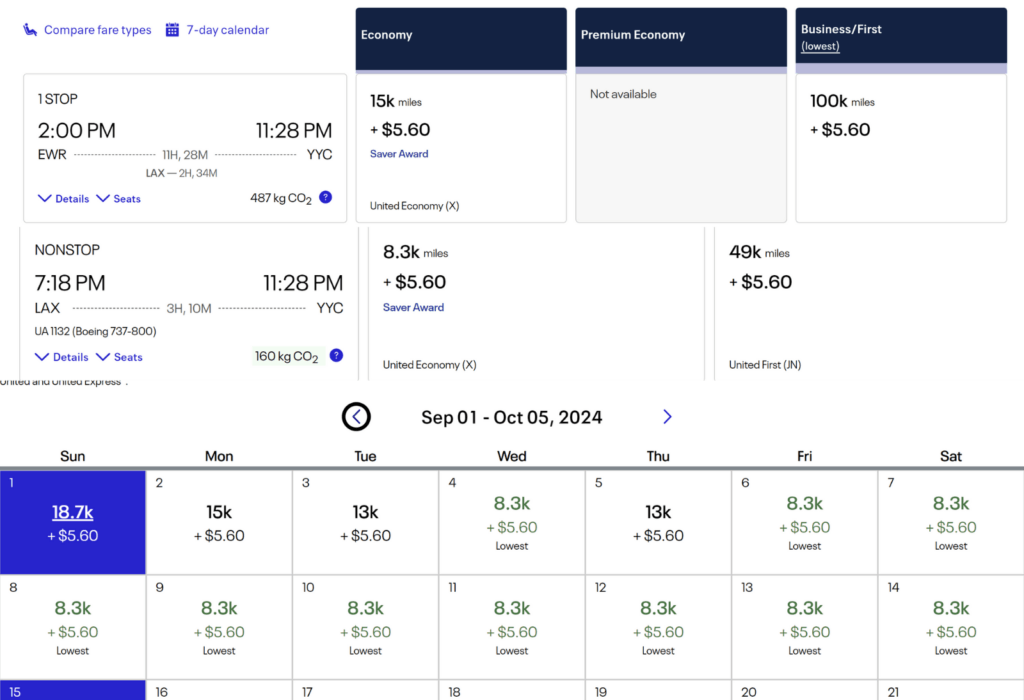

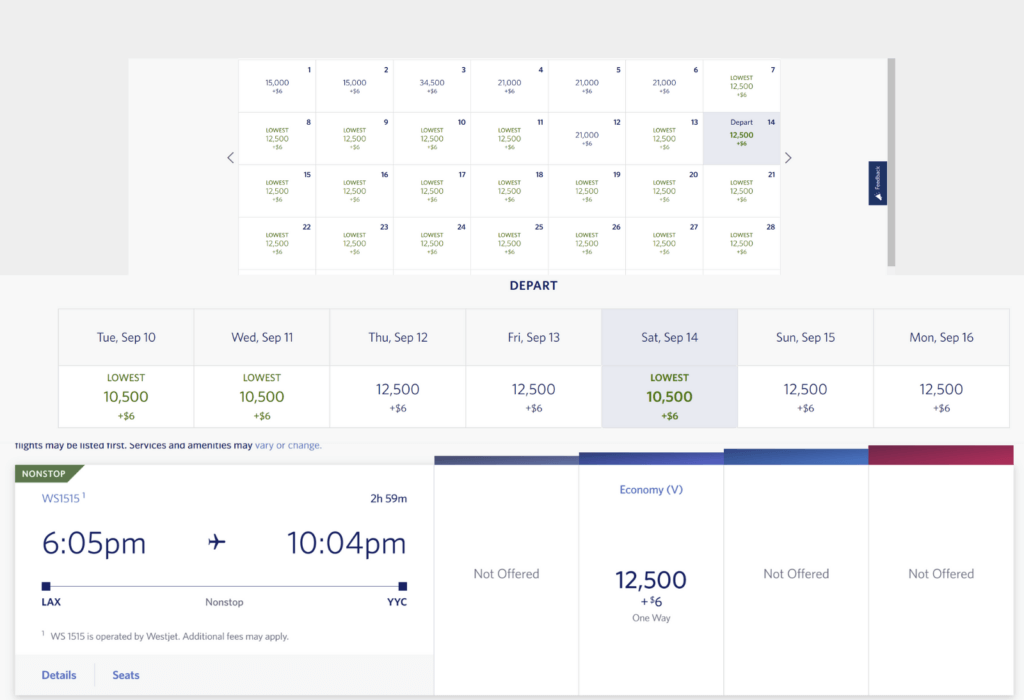

Starting with Aeroplan helps to show how much value United Airlines’ Mileage Plus can offer us. The program uses a dynamic system, which means rates can fluctuate, but unlike Delta’s SkyMiles, United retains some semblance of stability. Its saver rates, particularly in off-peak seasons can be spectacular, as is the case with Calgary flights. Better yet, those fees we found on Air Canada’s portal disappeared.

The same United flight we found on the Aeroplan site is just 8,300 miles and tacks on just $5.60 in fees. It’s a similar pattern on the East Coast, with the New York flights enjoying the same $5.60 in taxes along with 15,000 miles.

Of course, the downside is peak times. July rates show only a couple of those rock-bottom rates, while the winter months often have low rates of 43,000 miles. Hone in on United for the off-season to reap the best value.

It’s worth noting, however, that despite the low fees, some of these flights still aren’t phenomenal value. You can purchase the United flight from LA to Calgary for $76, which gives the 8,300-mile flight a points value of just 0.8 cents each. You’d need a cash price of around $100 to get that point value above 1 cent. If not, consider paying cash.

How to earn enough United MileagePlus miles

MilagePlus miles aren’t as easy to earn as other programs, but there are still a few avenues to take. Chase is the only major credit card issuer that allows transfers to the airline, so opening a card like the Chase Sapphire Reserve® can give you a solid injection of free travel.

The card has an intro bonus of 125,000 points, earned after spending $6,000 within three months of opening the card. Once those drop into your account, you’re free to move them to your United account.

As an add-on, the card comes with an annual $300 travel credit. You could use this credit to help cover your car rental for your trip. That’s a huge win.

- Best for: Luxury Travel

- Annual Fee: $795

- Variable APR: 19.49% - 27.99% Variable

- Reward Rate: 1X - 10X

- Recommended Credit: 740-850

Chase Sapphire Reserve®

125,000 bonus points

Offer Details:

Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

Why we like it

This card just got a major re-vamp and you can now get more than $2,700 in annual value with Sapphire Reserve!

Reward details

8x points on Chase TravelSM

4x points on flights and hotels booked direct

3x points on dining

1x points on all other purchases

Pros & Cons

Pros

-

The points are worth up to 2 cents a piece when used directly on Chase’s Ultimate Rewards Portal, offering a simple but high-value use for your points.

-

Plenty of excellent transfer partners allow points to be maximized

-

Some excellent partnerships with Doordash and Lyft add to its value.

-

Priority Pass membership allows access to over 1,300+ airport lounges and restaurants.

Cons

-

It’s subject to Chase’s 5/24 rule. So if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

-

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

Terms Apply

How to get to Banff using points and miles: American Airlines AAdvantage miles

American Airlines disappointed everyone when it switched to a dynamic system a few years ago. Luckily, that only applied to its own flights, so it’s a hugely valuable program for those traveling with its partner airlines. In this case, it’s a mixed bag.

Some rates drop as low as 6,500 miles at off-peak times with just $5.60 in taxes and fees from its main hub in Dallas. While those rates aren’t too hard to find, they’re not consistent and will require you to be flexible to find them. At other times rates soar into the 30,000s. It’s a similar pattern wherever you try and fly from regardless of whether it’s a direct or connecting flight.

Your best bet is to use the calendar feature to see where and when the best rates are.

How to earn enough AAdvantage miles

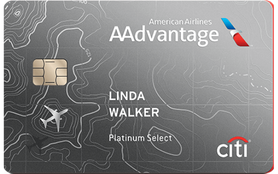

American Airlines is one of the harder airline currencies to earn. Unfortunately, no credit card issuers allow transfers to the AAdvantage programs so you’re bound to fly with the airline and its partners or open a co-branded card.

Luckily, American Airlines offers a few strong cards with solid intro bonuses that could comfortably cover the costs of a flight to Calgary. We’d recommend the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®. It’s an excellent earner, has no annual fee, and currently has a 50,000-mile intro bonus earned after spending $2,500 within three months of opening the card.

- Best for: American Airlines Fans

- Annual Fee: $ $0 intro annual fee, $99 after the first year

- Regular APR: 20.74% - 29.74% (Variable)

- Reward Rate: 1X - 2X

- Recommended Credit: 690-850

Citi®/AAdvantage® Platinum Select® World Elite Mastercard®

50,000 Bonus Points

Offer Details:

50,000 American Airlines AAdvantage bonus miles after you spend $2,500 on purchases in the first 3 months from account opening.

Why we like it

The Citi® / AAdvantage® Platinum Select® World Elite Mastercard® is a strong airline-centric card to have in your travel toolbox if your main airport is an American Airlines hub like Boston, Chicago, Dallas, or Charlotte, or if you just have a preference for the airline. Regular business travelers may want to upgrade for luxury perks like lounge access, but for everyone else, the low annual fee, 50,000 point intro bonus, solid miles-earning categories, and free checked bag perks are more than enough to validate the space in your wallet.

Reward details

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, and on eligible American Airlines purchases

Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases

Pros & Cons

Pros

The strong 50,000-point intro bonus is worth as much as $750, earned after spending $2,500 in three months.

Cardholders and up to four companions can enjoy a free first checked bag on any domestic American Airlines flight, comfortably justifying the $99 fee when used.

The card earns 2X miles for gas and dining purchases

Each eligible mile earned with the card also earns a loyalty point towards American Airlines elite status

A generous 25% discount on in-flight purchases when using the card round out the benefits

Preferred boarding on American Airlines flights

Cons

American Airlines miles can’t be transferred to other airlines or hotels (although they can be used to book AA partner flights)

Premium perks are reserved for pricier cards

Terms Apply

How to get to Banff using points and miles: Delta SkyMiles

It’s always a good day when Delta doesn’t let us down. For international travel, it’s an increasingly temperamental program, but sticking to North America can offer tremendous value for point and miles enthusiasts.

It’s no different in this scenario—flights here cost as little as 10,000 SkyMiles from Los Angeles and a palatable 12,500 from New York. Both of those flights come in at just $5.60 in taxes and fees. Those are off-peak rates, but there is a ton of availability at the lowest rate making it an easy option during those months. There are a lot of direct flights which does make this an extremely attractive option—especially as many will only be heading to Banff for a long weekend trip.

Peak season does see a major spike, but there’s not a huge fluctuation in the lowest price—making it a reliable (but high) option in those months if you have some SkyMiles kicking around in your account. Cash prices can be high at that time, too, so it might not be a completely terrible redemption.

Read also: Want to fly Delta One? Try these strategies

How to earn enough Delta SkyMiles

Earning Delta SkyMiles is pretty damn easy thanks to its partnership with American Express and its hoard of co-branded cards. If you’re a big fan of the program, you could run through three big intro bonuses with Amex and a further three with Delta, gifting you hundreds of thousands of SkyMiles.

If you’re only searching for a quick injection of miles, we’d recommend the Delta SkyMiles® Gold American Express Card. It’s the most accessible of the line thanks to its low annual fee (waived the first year) and a solid intro bonus.

- Best for: Delta Airline Lovers

- Annual Fee: $0 intro annual fee for the first year, then $150

- APR: 19.49% - 28.49% Variable

- Reward Rate: 1X - 2X

- Recommended Credit: Good to Excellent

Delta Skymiles® Gold American Express Card

Earn up to 90,000 Bonus Miles

Offer Details:

Earn 70,000 Bonus Miles after you spend $3,000 in purchases with your new Card, and an additional 20,000 bonus miles after you make an additional $2,000 in purchases on the Card, both within your first 6 months. Ends 04/01/2026.

Why we like it

The Delta SkyMiles® Gold American Express Card isn’t a showstopper, but it’s an excellent example of an airline card that’s easy to keep in your wallet. Its annual fee is $0 for the first year and then $150 the years after, but if you and a partner fly one round-trip a year with Delta, its free checked bag benefit already makes up for that fee. Throw in a solid intro bonus and simple rewards-earning categories, and it’s almost a no-brainer for anyone with even a little domestic US travel on the horizon.

Reward details

2X miles on Delta Purchases

2X miles at restaurants

2X miles at U.S. supermarkets

1X miles on all other eligible purchases.

Every mile you earn brings you closer to the places you want to go. Turn them into your next trip, use them for seat upgrades, and more.

Pros & Cons

Pros

The intro bonus is earned by spending an extremely achievable $5,000 in six months—well within a realistic budget for many.

The free first-checked bag for everyone on the booking more than validates the $150 annual fee.

A simple 2X miles on dining at restaurants (including U.S. takeout and delivery), and U.S. supermarket transactions make earning points simple.

$200 Delta flight credit after spending $10,000 annually is a nice reward that shouldn’t be too hard to meet

Card members get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. The discount is not applicable to partner-operated flights or to taxes and fees.

No foreign transaction fees. Enjoy international travel without additional fees on purchases made abroad.

Cons

SkyMiles award redemption rates on Delta’s partners can be pricey

Its 2X miles on Delta purchases is lower than what its sister cards earn

How to get to Banff using points and miles: British Airways Executive Club

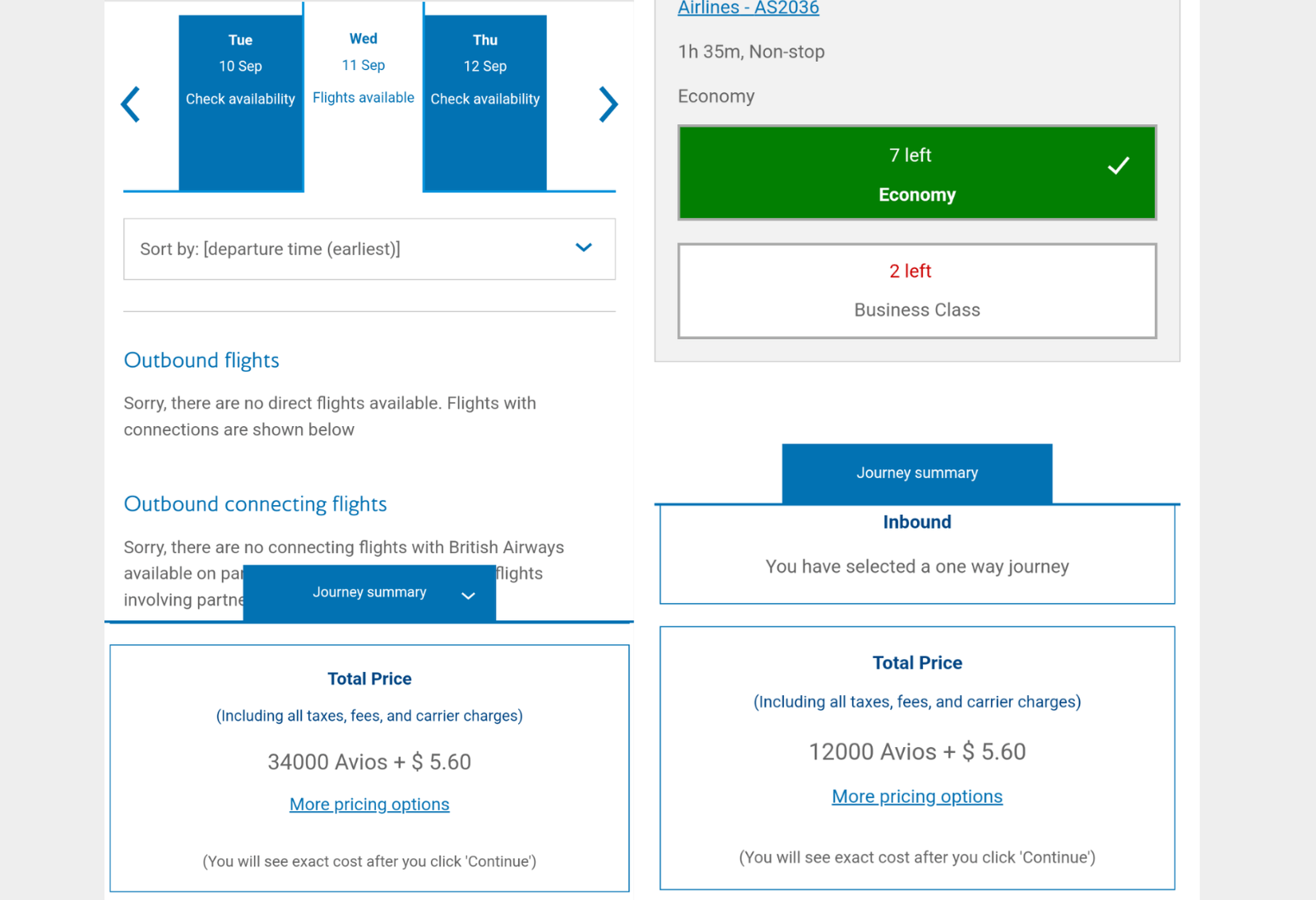

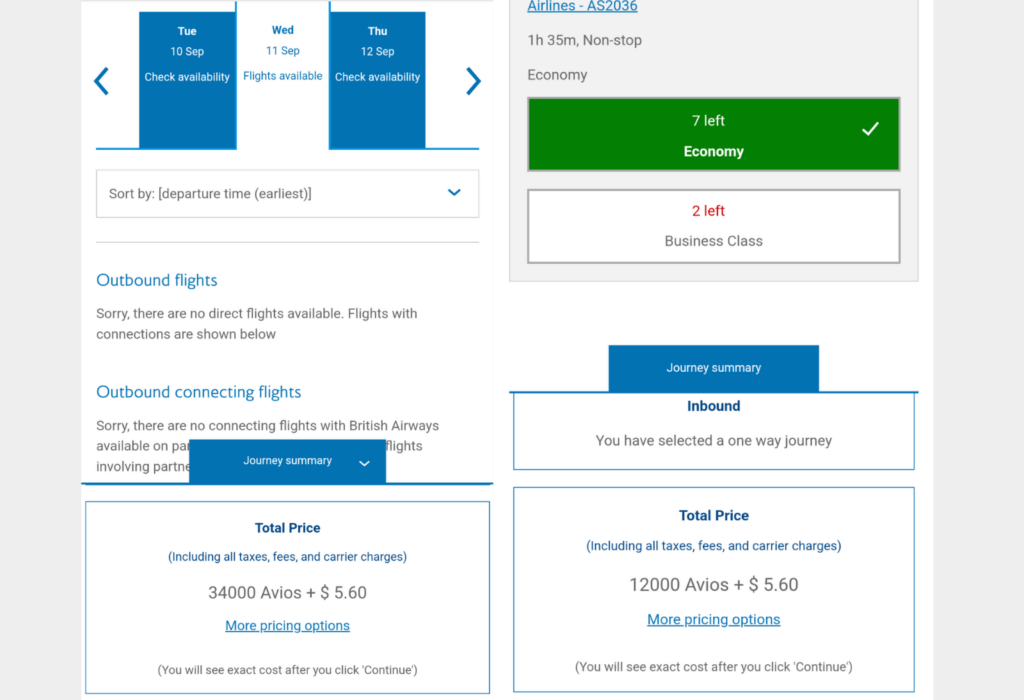

Using Britsh Airways Executive Club to get to Banff is a bit of a curve ball. Most of its flights will be with either of its American-based partners American Airlines or Alaska Airlines. The big advantage the customer is given here is steady rates. While American’s prices will rise and fall based on whatever metric it prefers, British Airways sets rates based on the distance flown.

In general, this works best for shorter flights. So if you’re flying from the Northwest, it’s a good option. The further away the flight, the less value you’ll generally find. With that said, if you’re set on a peak-time date and rates elsewhere are brutal, you might still find a better rate.

Rates from Seattle are 12,000 Avios while Miami flights will run at 34,000 Avios. You can assume everything between will be priced accordingly.

How to earn enough British Airways Executive Club Avios

British Airways Avios are some of the easiest points to earn. Almost all the major credit card issuers transfer points to the airline. In fact, even Citi transfers to Qatar Airways which in turn allows points to move between itself and British Airways.

It’s easy to throw a combination of different points and miles from Amex, Chase, Capital One, and Citi to find enough to get to Calgary for almost nothing. We’d recommend a card like the Capital One Venture X Rewards Credit Card. It’s a spectacular card offering a huge 75,000-mile intro bonus after spending $4,000 within 3 months of opening the card. Throw in its slew of high-end perks and you’ve got a winner.

- Best for: Overall Travel

Capital One Venture X Rewards Credit Card

75,000 Bonus Miles

Offer Details:

Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

Why we like it

The Capital One Venture X is a direct competitor to the Chase Sapphire Reserve, and for many seeking a simpler earning scheme with premium perks, it could be the better option. But the Venture X truly shines with one benefit in particular: four free authorized users. Plus, every year on your cardholder anniversary you get 10,000 points to use for travel.

Reward details

10 Miles per dollar on hotels and rental cars booked through Capital One Travel

5 Miles per dollar on flights and vacation rentals booked through Capital One Travel

2 Miles per dollar on every purchase

Pros & Cons

Pros

Its great intro bonus of 75,000 miles is worth well over $1,000 when transferred to partner airlines and hotels, or a flat rate $750 when redeemed on the Capital One Travel Portal.

Cardholders get a bonus of 10,000 miles each year after their first account anniversary, which is nothing to shrug off, especially when a little bit short of that business class flight. It’s worth almost $200 depending on how you use it.

The $300 annual credit for purchases made on the Capital One Travel Portal, combined with the yearly free miles, more than annul the $395 annual fee.

Four authorized users can be added for free.

Enjoy access to 1,300+ lounges worldwide, including Capital One Lounge locations and Priority Pass™ lounges, after enrollment

A generous offering of travel insurance, protections and reimbursements round out an excellent array of benefits.

Cons

The $300 credit is a bit less flexible than the Chase Sapphire Reserve’s comparable benefit.

Miles earning is the same as the Sapphire Reserve on portal-based purchases, but less on general travel spending.

Capital One transfer partners are solid, but still don’t include any US-based airlines or hotels.

Terms Apply

The point

Getting to Banff isn’t possible without stopping in Calgary first, but there are plenty of high-value redemptions allowing you to get to the city using points and miles. If you’re smart with travel credits, it’s even possible to cover some of your rental car, too.

by your friends at The Daily Navigator

by your friends at The Daily Navigator