What are travel credit cards, and how do they work?

Travel credit cards are financial products that offer various rewards and benefits geared towards frequent travelers. They typically earn you points or miles for every dollar spent on eligible purchases. These rewards can be redeemed for flights, hotel stays, car rentals, and other travel-related expenses. Travel credit cards may also include perks like travel insurance, airport lounge access, and no foreign transaction fees.

How do I choose the best travel credit card for my needs?

Choosing the best travel credit card depends on your travel habits, spending patterns, and preferences. Consider factors like the type of rewards offered (points, miles, or cash back), the card’s annual fee, sign-up bonuses, earning rates, redemption options, and additional travel perks. Analyzing these features will help you find a card that aligns with your lifestyle and offers the most value.

What are the benefits of using a travel credit card over other types of credit cards?

Travel credit cards provide unique advantages for travelers, such as earning rewards specifically tailored to travel expenses. Additionally, many travel credit cards offer travel-related perks like free checked bags, priority boarding, and travel insurance. Some cards also waive foreign transaction fees, making them ideal for international travelers.

What is a sign-up bonus, and how can I qualify for it?

A sign-up bonus is a promotional offer provided by the credit card issuer to entice new cardholders. To qualify for a sign-up bonus, you usually need to meet specific spending requirements within a certain timeframe after opening the account. The bonus can be in the form of points, miles, or cash back, and it’s a great way to jump-start your rewards earning.

Do travel credit cards charge foreign transaction fees?

Not all travel credit cards charge foreign transaction fees. Many of the top-tier travel cards waive these fees, making them ideal for international travel. However, it’s essential to read the card’s terms and conditions to confirm this before using it abroad.

How can I maximize the rewards earned with my travel credit card?

To maximize rewards, use your travel credit card for everyday expenses and large purchases. Take advantage of bonus categories and special promotions to earn more points or miles. Consider combining your travel credit card with loyalty programs to stack rewards and get even more value out of your purchases.

There’s getting away from things, and there’s getting away from things. A trip to the Cook Islands is the latter.

Impossibly beautiful and criminally underrated, the string of 15 islands, hidden away in the middle of the South Pacific, is an utter delight. One island’s soaring mountains are matched by another’s coral beaches, while the growing tourism industry is already world-class.

But getting there cheaply can be tough. Flights to this obscure archipelago aren’t frequent and typically require you to part with a sizeable some of cash.

But points can save you. With a little patience and a lot of flexibility, it’s possible to find flights to the Cook Islands for a fraction of the cost. Leaving you plenty to spare for all those beachside coconut drinks.

Let’s take a look at the best ways to get to the Cook Islands using points and miles.

Where do flights to the Cook Islands leave from?

The Cook Islands are a long, long, long way away. Flights to the islands aren’t frequent from the US, and if you’re anywhere but the West Coast or Hawaii, you’ll need to find a positioning flight. In fact, Hawaii is the only place in the US that currently has direct flights to the islands’ Rarotonga Airport, and even then, dates are slim.

Outside of Hawaii, there are only three other airports servicing the islands: Sydney, Auckland, and Tahiti. That means if you can’t score a flight with Hawaiin Airlines, you’ll be flying seven hours past the Cook Islands to Australia or New Zealand, then flying another seven back to your destination.

Using these airports as the base for any of your searches is ideal.

Some things to consider

In this piece, we’re going to focus on finding the most direct redemptions for your flights to the Cook Islands. By that, we mean the simplest choice for using your points. We’ll cover a small part at the end about building your own super high-value itinerary by booking multiple legs. That has too many variables to cover in one piece, but we’ll give you enough to go on and maybe you’ll find an even better deal.

Best ways to get to the Cook Islands using points and miles: Hawaiian Airlines

We’ll start with the obvious and most direct choice for any flight to the Cook Islands: Hawaiian Airlines. As the only airline with direct flights from the US, it offers the fastest and simplest way to get there.

With that said, the direct flight in question leaves from Honolulu once a week. That means all but the tiniest fraction of Americans will need a flight to Hawaii first.

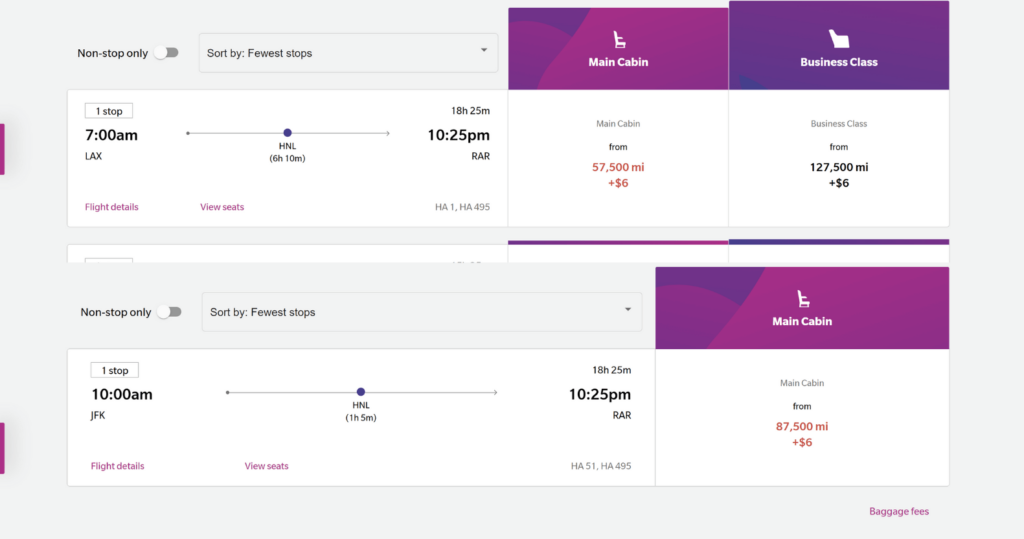

Hawaiian Airlines uses a dynamic pricing system, so the rates for flights fluctuate depending on a number of factors. Thankfully, it’s more stable than most and the airline even gives a baseline for specific distances. In this case, you can find a ton of availability for flights to the Cook Islands from Honolulu for around 27,000 miles. I found some other rates going as high as 55,000 miles over peak holiday times but that didn’t seem to be the norm.

If you’re booking a flight from Los Angeles all on one reservation it’s possible to find some for around 57,000 miles although they do fluctuate a fair amount. New York naturally costs more with rates as high as 87,000 miles—you do get a pretty solid direct flight to Honolulu though, so it’s still only two flights.

How to earn enough Hawaiian Miles to book flights to the Cook Islands

Hawaiian Miles are fairly easy to earn compared to some other currencies thanks to its partnership with American Express. Anyone with a card like the American Express Platinum Card® or the American Express® Gold Card

could use an intro bonus to grab those flights.

The Platinum, for example, has as high as 175,000-point intro bonus, earned after spending $12,000 within six months of opening the card. You’d comfortably cover at least one leg of any of the routes mentioned above.

- Best for: Luxury Perks

American Express Platinum Card®

As high as 175,000 Membership Rewards® Points

Offer Details:

You may be eligible for as high as 175,000 Membership Rewards® points after you spend $12,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Why we like it

The Amex Platinum was once the sole dominating force in the luxury credit card space. While it now faces some stiff competition, it still offers unbeatable perks like unprecedented airport lounge access, elite status at Hilton and Marriott, and some outstanding statement credits making the mammoth $895 worth it for some.

Reward details

Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings.

You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

Pros & Cons

Pros

-

Large intro bonus

Incredible lounge access

-

Statement credits worth over $3,500 annually.

-

Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

Cons

-

The $895 annual fee is brutally high. Too high for many that can’t, or don’t want to take full advantage of its benefits.

-

Points-earning rates are low unless spending directly on flights or with the Amex Portal.

-

Some of the benefits, like travel credits, are more limited and are harder to use than competing cards’ offerings.

Best ways to get to the Cook Islands using points and miles: Air Canada Aeroplan

Air Canada’s Aeroplan is a strong and steady option for any Star Alliance flight thanks to its zone and distance-based award chart. Any flights between zones are assigned a points value based on how far the passengers fly. Keep in mind that this includes different legs, so a direct flight to a city will require fewer points than a flight with a stopover.

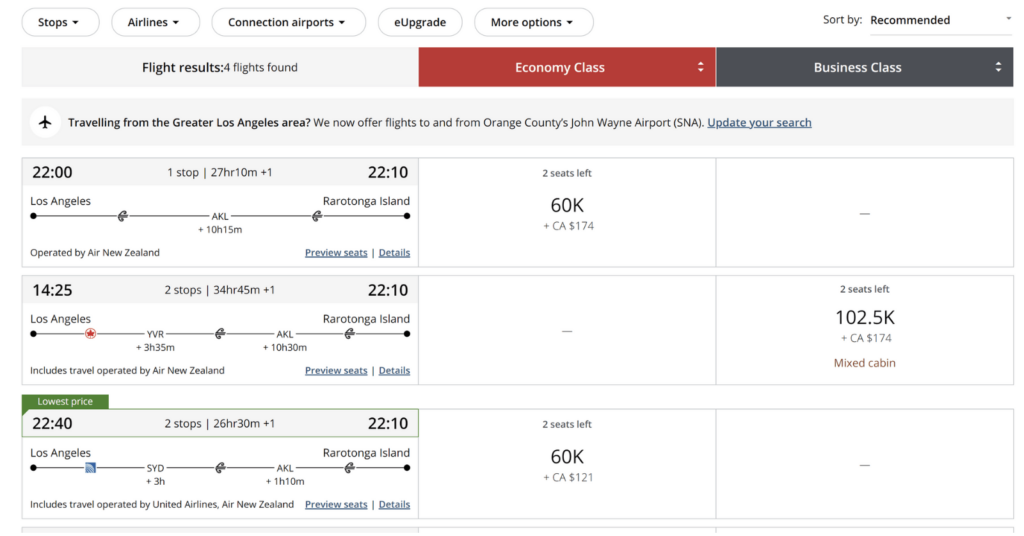

Air Canada’s primary partners in this case will be Air New Zealand and United, with the best options generally coming from the former. With ANZ you can grab a flight from LAX to Auckland then head on to the Cook Islands for 60,000 points plus around $100—not too shabby at all. If the dates don’t worry you, you can opt for a similar rate but route your flight through Sydney. This will be a much longer journey so I’d advise going for the Auckland route.

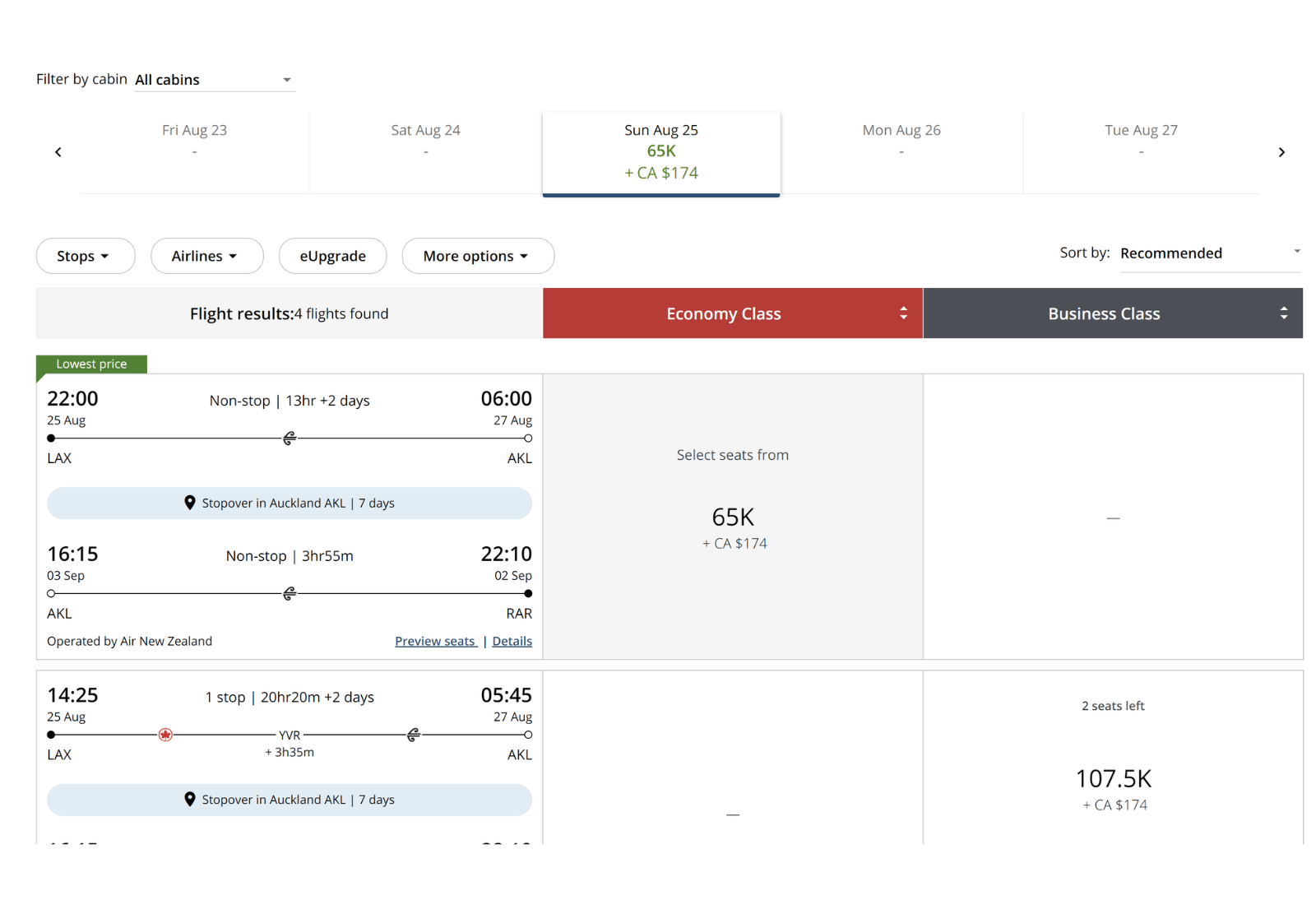

One cool twist to Aeroplan is the 5,000-point stopover perk. If you felt like making your trip a little longer you could opt to stay in Auckland for a while for just 5,000 points more. In the example above, I’ve grabbed a week in the Kiwi capital for the extra points. These are an excellent way to maximize your points and build a longer trip.

How to earn enough Aeroplan Points to book flights to the Cook Islands

Aeroplan is an incredibly easy points system to earn. American Express, Capital One, Chase, and Bilt all partner with the Canadian airline, so earning and transferring points is easy. You could open a card and take advantage of its current intro bonus.

That combined with another card could earn you roundtrip flights to the Cook Islands.

- Best for: Overall Travel

Capital One Venture X Rewards Credit Card

75,000 Bonus Miles

Offer Details:

Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

Why we like it

The Capital One Venture X is a direct competitor to the Chase Sapphire Reserve, and for many seeking a simpler earning scheme with premium perks, it could be the better option. But the Venture X truly shines with one benefit in particular: four free authorized users. Plus, every year on your cardholder anniversary you get 10,000 points to use for travel.

Reward details

10 Miles per dollar on hotels and rental cars booked through Capital One Travel

5 Miles per dollar on flights and vacation rentals booked through Capital One Travel

2 Miles per dollar on every purchase

Pros & Cons

Pros

-

Its great intro bonus of 75,000 miles is worth well over $1,000 when transferred to partner airlines and hotels, or a flat rate $750 when redeemed on the Capital One Travel Portal.

-

Cardholders get a bonus of 10,000 miles each year after their first account anniversary, which is nothing to shrug off, especially when a little bit short of that business class flight. It’s worth almost $200 depending on how you use it.

-

The $300 annual credit for purchases made on the Capital One Travel Portal, combined with the yearly free miles, more than annul the $395 annual fee.

-

Four authorized users can be added for free.

-

Enjoy access to 1,300+ lounges worldwide, including Capital One Lounge locations and participating Priority Pass™ lounges, after enrollment

-

A generous offering of travel insurance, protections and reimbursements round out an excellent array of benefits.

Cons

-

The $300 credit is a bit less flexible than the Chase Sapphire Reserve’s comparable benefit.

-

Miles earning is the same as the Sapphire Reserve on portal-based purchases, but less on general travel spending.

-

Capital One transfer partners are solid, but still don’t include any US-based airlines or hotels.

Terms Apply

Best ways to get to the Cook Islands using points and miles: United MileagePlus

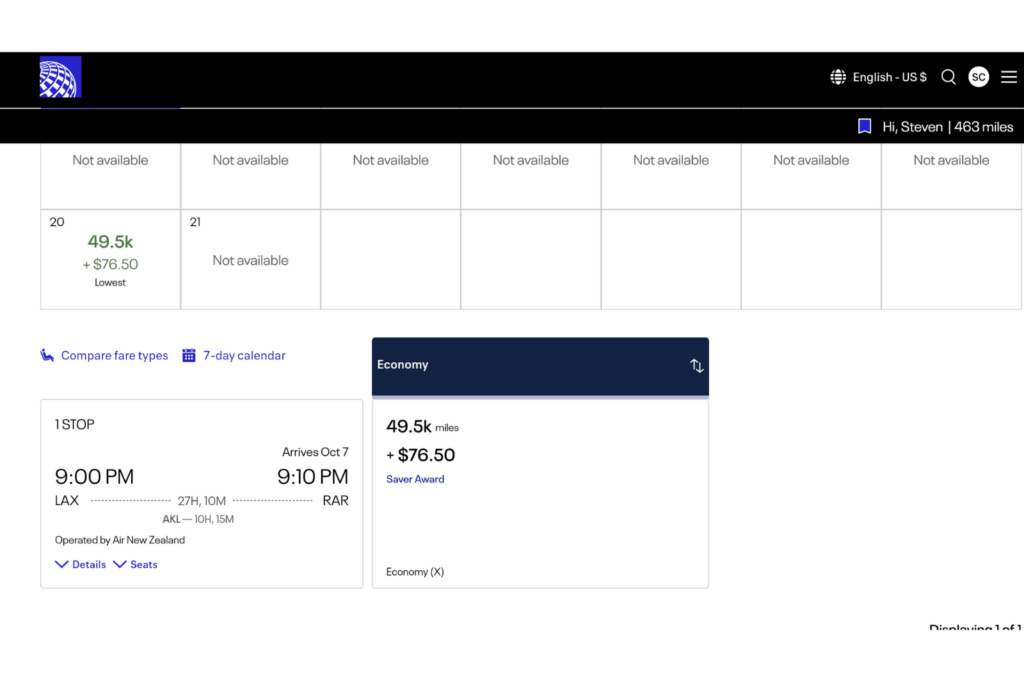

Even better than Aeroplan’s rates is United Airlines. The American carrier is also a Star Alliance member, allowing you to book the same Air New Zealand flights to the Cook Islands. Despite United not having an award chart, its dynamic system is far more forgiving than most. In this case, I was able to find the exact same flight from LAX to Raratonga for just 49,000 miles plus $76.

United’s rate calendar also makes this far easier. In fact, I’d recommend it for searching for dates with Aeroplan too, to compare.

Of course, these rates can fluctuate, so just take a look at the calendar for the month you feel like going.

Interestingly, you could be sneaky with your United’s Excursionist Perk here, and maybe wrangle a free flight in the middle of this route, too. But it’s slightly more complex than Aeroplan’s version.

How to earn enough United MileagePlus miles to book flights to the Cook Islands

The downside to United’s MileagePlus program compared to Aeroplan is the ease with which you can earn them. While Air Canada partners with multiple credit card companies, United is only tied to Chase at the moment.

Luckily that’s far from a bad thing. Opting for one of Chase’s Sapphire cards, like the Chase Sapphire Preferred® Card will get you close to covering roundtrip flights to the Cook Islands.

- Best for: Beginner Travelers

Chase Sapphire Preferred® Card

75,000 Bonus Points

Offer Details:

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Chase Sapphire Preferred Card is the ultimate all-around travel credit card—it fits perfectly into almost any points-earner’s wallet. Points novices can enjoy a significant intro bonus and easy to grasp spending categories with an approachable annual fee. The more experienced can utilize its high value earning potential as a secondary card and also gain access to Chase’s strong travel booking portal.

Reward details

5x on travel purchased through Chase Travel℠.

3x on dining, select streaming services and online groceries.

2x on all other travel purchases.

1x on all other purchases.

Pros & Cons

Pros

The $50 dollar hotel credit for stays purchased on the Chase Travel Portal already cuts the already approachable $95 annual fee significantly.

10% anniversary points boost – each account anniversary you’ll earn bonus points equal to 10% of your total purchases made the previous year.

Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

Along with all of the above, cardholders also have access to a string of travel protections like rental coverage, cancellation insurance, and purchase protection.

Cons

It’s subject to Chase’s 5/24 rule. So, if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Competing cards like the Capital One Venture have a better earning rate for non-bonus spend.

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

Terms Apply

Best ways to get to the Cook Islands using points and miles: Combine and conquer

The last option for finding flights to the Cook Islands requires a little more grunt work on your end. As you can tell, flights are extremely limited by the airports that service Raratonga. Opting for one of these is by far the most straightforward way to do things but getting creative and combining sweet spots can pay dividends.

For example, All Nippon Airways (ANA) is an incredible program—arguably the best out there. But working flights into Raratonga Airport is complex. It does however have incredible deals from the US to Auckland. You can grab a roundtrip from anywhere in the US to Auckland for just 75,000 points. From there, you could switch to Air Canada and grab the flight from Auckland to the Cook Islands for 12,500 points.

In that case, you’re looking at 50,000 points total each way, which comes out slightly more than the best United flight. But remember, United’s rates luctuate, while ANA and Aeroplan have award charts.

Chop and change the airlines you use and you might be able to find a stellar deal. If the flights depart on awkward dates in the middle, you can even use points to stay the night in the airport and get a better rate.

The point

Redeeming flights to the Cook Islands is no easy feat. It’ll take a good amount of patience and flexibility with dates but it’s definitely possible. United, Air Canada, and Hawaiin Airlines are the core programs you’ll need to snatch a great deal and jet off to this South Pacific paradise.

Read also: The Best Cook Islands Resorts and Hotels

by your friends at The Daily Navigator

by your friends at The Daily Navigator