Overview

Credit card points are supposed to be useful. In reality, they often feel like a moving target. You finally wrap your head around one program, then a bank tweaks the rules, devalues redemptions, or introduces a “limited-time enhancement” that somehow makes things worse. You’re solving a Sudoku puzzle that’s fighting back.

But it’s important to remember that winning here isn’t about luck. It’s about understanding one ecosystem (or all of them) deeply enough to know where the value actually lives, and where you’re being nudged into mediocre redemptions.

That’s where Citi ThankYou Rewards shines. It doesn’t get the same attention as Amex or Chase, but under the hood, it’s one of the most efficient programs on the market, especially if you care about earning fast and accessing airline partners other banks don’t touch.

The Bottom Line

Citi ThankYou Rewards remains one of the most underrated programs in the points world. It combines strong earning rates with an outstanding transfer partner list, which helps galvanize its value. Whether you want a straightforward 2% return on every dollar or a more advanced strategy that ends with a lie-flat seat, Citi’s setup can handle both. Plus, with its new-look cards on the market, there’s never been a better time to try.

What is Citi ThankYou Rewards?

ThankYou Rewards is Citi’s in-house loyalty system. Like other general credit card programs, you earn points by using certain Citi credit cards, and they act as a central pool where your rewards live until you decide what to do with them.

Citi splits its cards into two camps: “cashback” cards and “points” cards. On the surface, they look separate, but for those in the know, they work together fabulously. Depending on how you structure things, your rewards can function like a flexible cash reserve or a dedicated travel fund.

Whether you hone in solely on Citi or use it as part of a broader strategy (we recommend the latter), it’s more than worth checking out.

What Is Citi Cashback?

For those not accustomed to points, cashback is the most attractive type of Citi rewards. As suggested, specific cashback products will reward the account holder with specific amounts of cashback when spending with the card. In short, spend money, earn a percentage back, and redeem when you’re ready.

Different cards have different earning rates. Some might offer flat-rate earning schemes (like 2% cashback on all purchases) or reward specific categories with higher earnings (like 3% on travel and 4% on gas).

This route is ideal if you value certainty. There’s no award availability to hunt for and no transfer charts to memorize. A dollar earned is a dollar redeemed. Many people value this, and it’s the most flexible currency to earn.

Typically, you can redeem cashback in the following ways:

Direct deposits to your bank account

Statement credits against your balance

Paper checks mailed to you

Gift cards valued at roughly one cent per point

Checkout redemptions via Amazon or PayPal

Why choose to earn cashback?

Predictability. Most points programs require effort to exceed one cent per point. Cashback locks that in automatically. It’s simple, stable, and easy to justify if your goal is offsetting real expenses rather than planning aspirational travel. If you earn $500 in cashback, you can do whatever you want with it.

Why wouldn’t you choose to earn cashback?

Cashback has a hard ceiling. One dollar is always one dollar. By opting for steadiness, you’re missing out on the opportunity to double, triple, or even quadruple the value of your earnings. Yes, you can only do this with travel, but for regular flyers or hotel users, this can represent wild savings and unbelievable experiences.

If premium or free travel is even vaguely on your radar, pure cashback will feel limiting fast.

Best American Express cashback cards

Citi Custom Cash® Card earns 5% cash back on your top eligible spend category and 1% on all other purchases.

- Citi Double Cash® Credit Card earns 2% unlimited cash back on your purchases.

- Best for: Everyday Earning

Citi Strata Premier℠ Card

75,000 Bonus Points

Offer Details:

75,000 Bonus Points after you spend $4,000 on purchases in your first 3 months of account opening - redeemable for $750 in gift cards or travel rewards at thankyou.com

Why we like it

The Citi Strata Premier Card is an underrated travel credit card that offers both high points-earning potential and simplicity. While the mid-tier card doesn’t come with any premium benefits, its earning on popular spending categories is almost unmatched. Holders earn 3X points on air travel, hotels, gas stations, supermarkets, and restaurants, making it ludicrously easy to accrue points. Throw in the healthy 75,000-point bonus and you’ve got a great haul of rewards on your hands.

Reward details

10 points per $1 spent on Hotels, Car Rentals, and Attractions booked on CitiTravel.com.

3 points per $1 on Air Travel and Other Hotel Purchases, at Restaurants, Supermarkets, Gas, and EV Charging Stations.

1 Point per $1 spent on all other purchases

Pros & Cons

Pros

The 75,000-point intro bonus is worth $750 in gift cards and well over $1,000 when transferred to travel partners, making the $95 dollar annual fee an afterthought. You could ignore the card for a decade, and it would still be worth it.

Its earning potential is phenomenal: Earning 3X points on categories like gas and supermarkets, which are part of the average American’s biggest expenses, means the Citi Strata Premier will work hard for you on a daily basis.

Cardholders get a $100 hotel benefit each year on a hotel purchase of $500 or more. Not the greatest perk in the world, but a nice saving on an unexpected hotel stay that wipes out the yearly fee itself.

As it’s a World Elite Mastercard, cardholders will enjoy varied benefits like Lyft credits, upgrades and breakfast at select hotels, and cell phone protection.

Cons

Citi’s transfer partners are mainly foreign airlines, so using the points on US-based carriers will require some extra research.

Other mid-tier cards may offer some more interesting perks.

Terms Apply

What Are Citi ThankYou Points?

ThankYou Points are the super-valuable, but pickier cousins of Citi Cashback. These are specifically designed, Citi-specific currencies that can be used to redeem flights, hotels, and more. Cards like the Strata Premier earn points that can be transferred to airline and hotel partners or redeemed on the Citi Travel Portal.

This is where value opens up. Instead of locking yourself into a fixed return, you’re trading flexibility for immense savings or premium travel. Used well, these points can be worth far more than a cent each.

How are ThankYou points redeemed?

Generally speaking, points can be used in the following ways:

Transfers to partners: The real prize (more on this later)

Citi Travel Center: Fixed-rate redemptions at one cent per point

Cash or statement credits: Your safety net

Retail redemptions: Convenient, but poor value

How much is a point worth

The value of a Citi ThankYou Point depends on how you use it. Generally, they’re valued at 1 cent each on the bottom end, and anywhere from 2 to 10+ cents on the high end. Redeeming for any less than 1 cent should be a major no-go. You’d have been better off just using cashback.

Best Citi points cards

Citi Strata℠ Card earns between 1-5x points per dollar

Citi Strata Premier® Card earns between 1-10x points per dollar

Citi Strata Elite℠ Card earns between 1.5-12x points per dollar

- Best for: American Airlines Fans

- Annual Fee: $ $0 intro annual fee, $99 after the first year

- Regular APR: 20.74% - 29.74% (Variable)

- Reward Rate: 1X - 2X

- Recommended Credit: 690-850

Citi®/AAdvantage® Platinum Select® World Elite Mastercard®

50,000 Bonus Points

Offer Details:

50,000 American Airlines AAdvantage bonus miles after you spend $2,500 on purchases in the first 3 months from account opening.

Why we like it

The Citi® / AAdvantage® Platinum Select® World Elite Mastercard® is a strong airline-centric card to have in your travel toolbox if your main airport is an American Airlines hub like Boston, Chicago, Dallas, or Charlotte, or if you just have a preference for the airline. Regular business travelers may want to upgrade for luxury perks like lounge access, but for everyone else, the low annual fee, 50,000 point intro bonus, solid miles-earning categories, and free checked bag perks are more than enough to validate the space in your wallet.

Reward details

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, and on eligible American Airlines purchases

Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases

Pros & Cons

Pros

The strong 50,000-point intro bonus is worth as much as $750, earned after spending $2,500 in three months.

Cardholders and up to four companions can enjoy a free first checked bag on any domestic American Airlines flight, comfortably justifying the $99 fee when used.

The card earns 2X miles for gas and dining purchases

Each eligible mile earned with the card also earns a loyalty point towards American Airlines elite status

A generous 25% discount on in-flight purchases when using the card round out the benefits

Preferred boarding on American Airlines flights

Cons

American Airlines miles can’t be transferred to other airlines or hotels (although they can be used to book AA partner flights)

Premium perks are reserved for pricier cards

Terms Apply

The Best of Both Worlds

Similar to other credit card issuers, Citi allows accountholders with cashback cards and points-earning cards to combine their rewards. So, if you have a cashback card that earns 3% on work supplies, you’re effectively earning 3x points per dollar if you’d prefer. Remember, this is only possible if you hold at least one of each.

Can You Share Citi ThankYou Points?

Citi is one of the most generous programs when it comes to sharing points with friends and family. As long as the other person has an active account (in good standing, of course), you can share up to 100,000 points in a calendar year with no fees or any other limits. Compared to some programs, like American Express, this is amazing.

How to Redeem Points

As suggested earlier, there are multiple ways to redeem your hard-earned ThankYou points. Of course, if you’ve read any of our other pieces, you’ll know which method we think you should use.

Transfer to a partner

By a considerable distance, the best value use of your ThankYou Points is to transfer them to one of Citi’s high-value transfer partners. By doing this, you’ll move beyond the 1-cent valuation and take advantage of super-strong redemptions found in different airline and hotel programs.

Here’s the full list of transfer partners:

AeroMexico Rewards 1:1

Air France-KLM Flying Blue 1:1

American Airlines AAdvantage 1:1

Avianca LifeMiles 1:1

British Airways Executive Club 1:1

Cathay Pacific Asia Miles 1:1

Choice Privileges 1:1

Emirates Skywards 1:0.8

Etihad Guest 1:1

EVA Air Infinity MileageLands 1:1

JetBlue TrueBlue 1:1

Leading Hotels of the World 5:1

Preferred Hotels & Resorts 1:4

Qantas Frequent Flyer 1:1

Qatar Airways Privilege Club 1:1

Singapore Airlines KrisFlyer 1:1

Thai Airways Royal Orchid Plus 1:1

Turkish Airlines Miles&Smiles 1:1

Virgin Atlantic Flying Club 1:1

Virgin Red 1:1

Wyndham Rewards 1:1

Some of these partners, like Virgin, Turkish, Singapore, American, and Air France/KLM, are tremendously valuable and can score you incredible redemptions. The addition of American Airlines is also a big deal, as it’s currently the only major credit card issuer that allows this transfer.

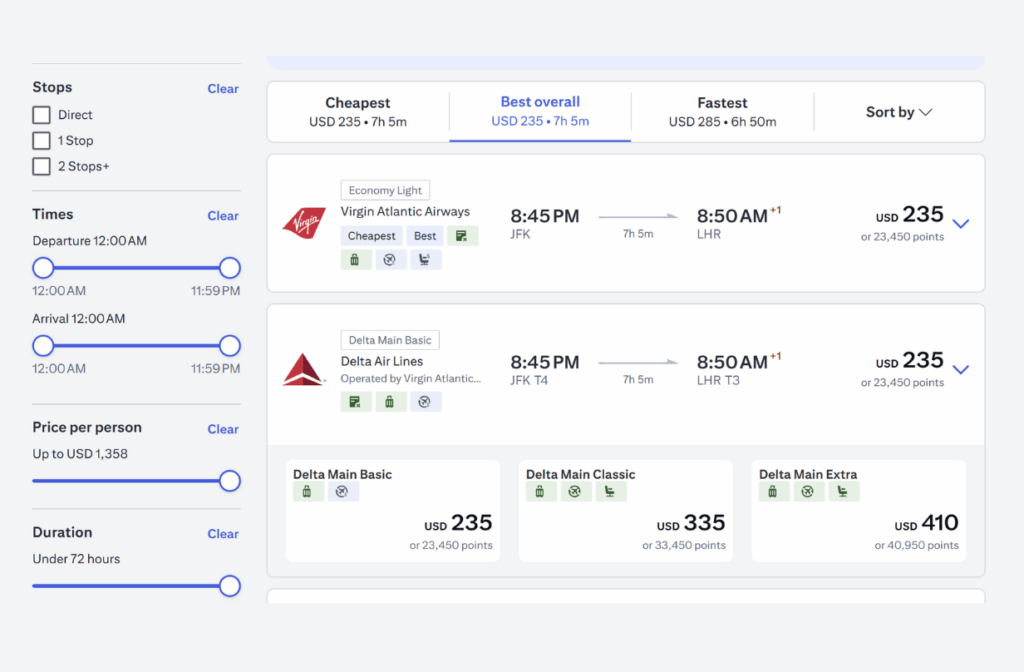

Use the Citi travel site

The next best option is to use the Citi Travel site. While you’re only tied to 1 cent a point, nowhere near their potential, it can work as a decent fallback if you’re short of cash to pay for a flight and can’t find a good transfer redemption.

It works very simply. You log in and use the site like you would any other travel aggregator. When you select a flight, it’ll show the cash value and points value. A $500 flight will cost 50,000 points and so on. Just make sure you select points at checkout.

Other uses

You can also redeem your points for statement credits, which can be good to offset spending on the card if you’ve maybe spent a little too much. Again, this isn’t something you should prioritize if you’re seeking value.

Lastly, you can redeem them for gift cards or other retail options. We advise against this, as you’ll often find points values dropping below that 1-cent benchmark, and you never want that.

The Point

Citi ThankYou Rewards isn’t flashy, and it doesn’t try to be. But from a pure numbers standpoint, it’s one of the most efficient ecosystems available. Its cards come with high earning rates and low fees, they have excellent transfer partners, and a setup that rewards people who think strategically. Don’t brush Citi aside because it’s not as popular as the others. We regularly rank its cards as some of the best on the market.

by your friends at The Daily Navigator

by your friends at The Daily Navigator