Non-stop flights to Seoul, South Korea

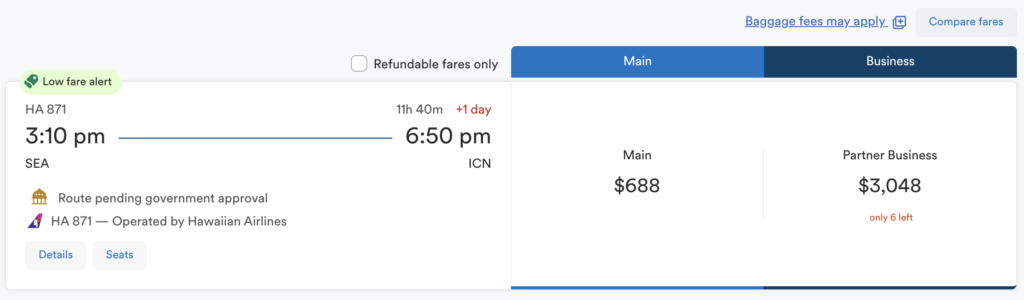

Beginning September 12, Alaska Airlines is launching five weekly, nonstop flights from Seattle to Seoul. The new flights are possible thanks to Alaska’s merger with Hawaiian Airlines last year.

The good news for travelers is that, because the route is new, you can score some amazing deals. The flight path will be the following:

| City Pair | Departure | Arrival | Frequency | Aircraft |

|---|---|---|---|---|

| Seattle – Seoul Incheon | 3:25 p.m. | 6:50 p.m. +1 | W, Th, F, Sa, Su | A330 |

| Seoul Incheon – Seattle | 8:50 p.m. | 3:00 p.m. | M, Th, F, Sa, Su | A330 |

What credit cards can I use to book Alaska Airlines flights

Alaska Airlines does have a co-branded credit card, but you can also use Chase and American Express cards to book flights on Alaska Airways. Unfortunately, you cannot directly transfer Chase or AmEx points to Alaska, but you can transfer them to other airline partners and book through them.

For example you can transfer Chase points to Iberia or British Airways and then use Avios to book Alaska Airlines flights.

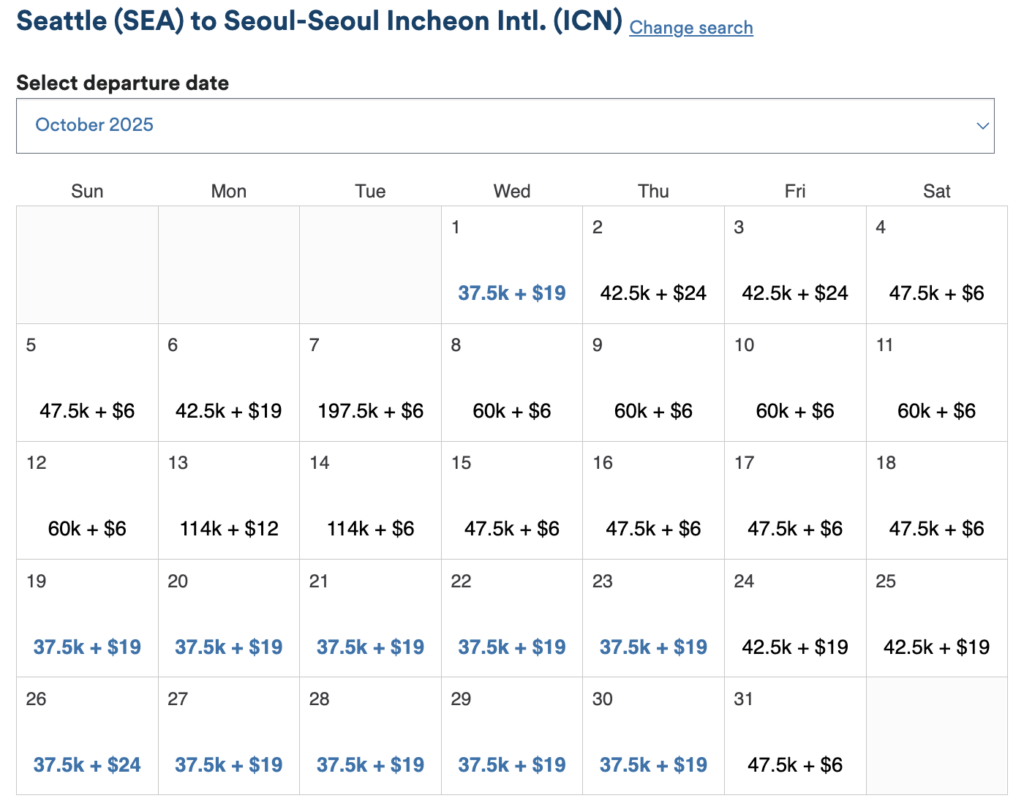

In October, you can score an economy flight to Seoul for as little as $668 or 37,500 Mileage Plan miles one-way. A business-class seat will cost you ~250,000 miles one-way, though. You can find even better deals if you’re willing to do a short layover.

- Best for: Beginner Travelers

Chase Sapphire Preferred® Card

75,000 Bonus Points

Offer Details:

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Chase Sapphire Preferred Card is the ultimate all-around travel credit card—it fits perfectly into almost any points-earner’s wallet. Points novices can enjoy a significant intro bonus and easy to grasp spending categories with an approachable annual fee. The more experienced can utilize its high value earning potential as a secondary card and also gain access to Chase’s strong travel booking portal.

Reward details

5x on travel purchased through Chase Travel℠.

3x on dining, select streaming services and online groceries.

2x on all other travel purchases.

1x on all other purchases.

Pros & Cons

Pros

The $50 dollar hotel credit for stays purchased on the Chase Travel Portal already cuts the already approachable $95 annual fee significantly.

10% anniversary points boost – each account anniversary you’ll earn bonus points equal to 10% of your total purchases made the previous year.

Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

Along with all of the above, cardholders also have access to a string of travel protections like rental coverage, cancellation insurance, and purchase protection.

Cons

It’s subject to Chase’s 5/24 rule. So, if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Competing cards like the Capital One Venture have a better earning rate for non-bonus spend.

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

Terms Apply

Alaska is also launching daily flights from Seattle to Tokyo beginning May 12, so keep an eye on any price drops for that route too.

I also highly recommend assessing which cards in your wallet can transfer points to Alaska’s Mileage Plan. Perhaps you have enough points from a few different cards to fly in business class for free.

- Best for: Luxury Perks

American Express Platinum Card®

As high as 175,000 Membership Rewards® Points

Offer Details:

You may be eligible for as high as 175,000 Membership Rewards® points after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Why we like it

The Amex Platinum was once the sole dominating force in the luxury credit card space. While it now faces some stiff competition, it still offers unbeatable perks like unprecedented airport lounge access, elite status at Hilton and Marriott, and some outstanding statement credits making the mammoth $895 worth it for some.

Reward details

Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings.

You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

Pros & Cons

Pros

-

Earn as high as 175,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership.

-

Incredible lounge access

-

Statement credits worth over $3,500 annually.

-

Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

Cons

-

The $895 annual fee is brutally high. Too high for many that can’t, or don’t want to take full advantage of its benefits.

-

Points-earning rates are low unless spending directly on flights or with the Amex Portal.

-

Some of the benefits, like travel credits, are more limited and are harder to use than competing cards’ offerings.

Read Also

- Best for: Business Travel

Chase Ink Business Preferred® Credit Card

100,000 Bonus Points

Offer Details:

Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

Why we like it

The Ink Business Preferred Business Card pulls attention with its big intro bonus, currently sitting at 100,000 points. That’s worth in $1,000 cash back, $1,500 toward travel when redeemed through Chase Travel℠, or even more when transferring to Chase’s travel partners like Hyatt, United Airlines, British Airways and more. But the card shows its real value with its high-earning bonus-spending categories. Freelancers and business owners alike will earn 3 points per dollar on the first $150,000 spent on travel and select business categories each account anniversary year.

Reward details

3X points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

1X point per $1 on all other purchases – with no limit to the amount you can earn

Pros & Cons

Pros

-

Simply put, for small business owners and freelancers, it’s one of the best cards for turning business spending into valuable travel.

-

It also offers some stellar protections including a comprehensive reimbursement on damaged or stolen cell phones, and primary rental car coverage.

-

It has a reasonable $95 annual fee.

-

If you have another Chase card like the Sapphire Preferred or Reserve, or even a cash back earning Chase card, you can pool your points and make them more valuable.

Cons

-

It does lack some of the juicier benefits attached to other business credit cards like The Business Platinum Card® from American Express. But with the low fee, it’s hard to argue with its value proposition.

-

It’s subject to Chase’s 5/24 rule. So if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

by your friends at The Daily Navigator

by your friends at The Daily Navigator