Overview

Recently, we’ve seen some of the highest welcome bonuses in the history of travel credit cards. We’re talking offers potentially worth several thousand dollars in free travel that you can score this year.

In the past few years, I’ve managed to accrue more than 1.5 million points from welcome bonuses alone. If you patiently wait for good deals, you’ll be floored at the amount of rewards you can get with extremely little effort. Your best bet is to follow the advice you read here—believe us when we tell you a deal is worth jumping on.

But guess what: Even we points-obsessed travelers who constantly monitor deals cannot always see some of the best deals on the market. That’s where CardMatch comes to the rescue.

Here’s a quick look at one of the most powerful tools in the points-earning game.

What is Cardmatch?

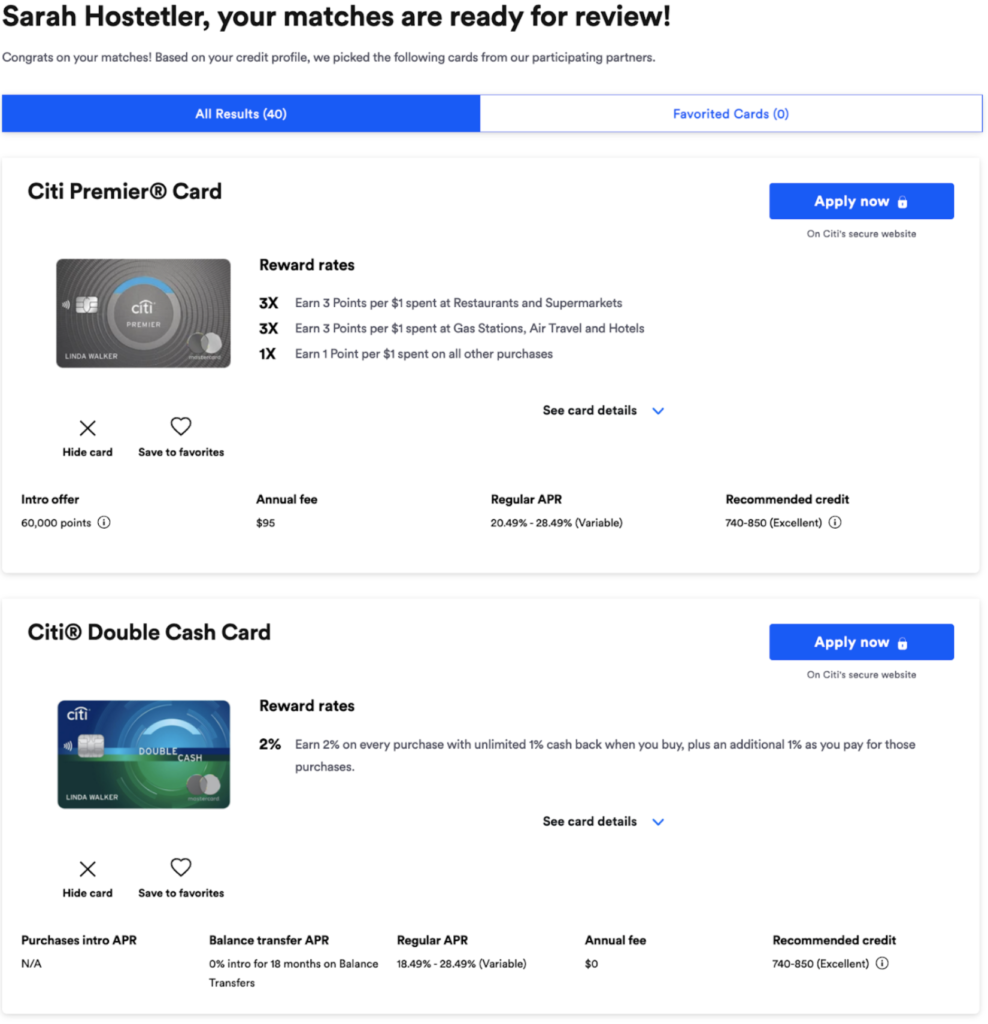

The welcome bonuses you see on a credit card issuer’s website (or even via Smart Points) are publicly available offers. Anyone who applies, and is approved, is eligible to earn these intro offers.

But banks occasionally target would-be customers for significantly better bonuses. Sometimes they come via snail mail in a shiny pamphlet. Sometimes you’ll receive an email. But often, you’ll get nothing at all.

That’s right—you could be targeted for loads of amazing offers and have no idea.

CardMatch is a tool that helps you to sniff out these secret offers. By entering some personal information, it will query most credit card issuers to see if you qualify for any bonuses that are better than the public offer.

But you may find that you qualify for bonuses worth several hundred dollars more than most other people.

Elevated bonuses through CardMatch

For example, some users have received a better welcome offer for The Platinum Card® from American Express, to the tune of 150,000 points after spending $8,000 on eligible purchases in the first six months of opening an account. That’s a solid 70,000 points higher than the current publicly available bonus, which is totally wild. You could book a roundtrip business class flight to South Africa with a bonus like that—which could easily cost $6,000+ in cash.

Some users may also be targeted for 100,000 or 125,000-point welcome bonuses for The Platinum Card® from American Express.

Other reports show elevated offers for the American Express® Gold Card, which is offering a bonus as big as 90,000 points after spending $4,000 in the first six months of account opening.

- Best for: Luxury Perks

The Platinum Card® from American Express

As high as 175,000 Membership Rewards® Points

Offer Details:

You may be eligible for as high as 175,000 Membership Rewards® Points after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Why we like it

The Amex Platinum was once the sole dominating force in the luxury credit card space. While it now faces some stiff competition, it still offers unbeatable perks like unprecedented airport lounge access, elite status at Hilton and Marriott, and some outstanding statement credits making the mammoth $695 worth it for some.

Reward details

Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel® up to $500,000 on these purchases per calendar year

Earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel®

Pros & Cons

Pros

Earn as high as 175,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership.

Incredible lounge access

Statement credits worth over $1,000 annually.

Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

Cons

The $695 annual fee is brutally high. Too high for many that can’t, or don’t want to take full advantage of its benefits.

Points-earning rates are low unless spending directly on flights or with the Amex Portal.

Some of the benefits, like travel credits, are more limited and are harder to use than competing cards’ offerings.

Here are a few examples of what 150,000 Amex points can get you if you score the Amex Platinum 150k offer:

- Roundtrip to Europe in business class: Transfer 126,000 Amex points to Avianca Lifemiles to book a roundtrip flight on United Polaris in business class from the US to Europe

- 16 flights on American Airlines: Transfer Amex points to British Airways Avios and book up to 16 one-way flights on American Airlines that are under 1,151 miles in distance

- Roundtrip to Japan in business class: Transfer as few as 75,000 miles to ANA Mileage Club to book a roundtrip business class flight to Japan on ANA during the low season

- About $2,000 worth of travel on Delta Air Lines: Delta SkyMiles are worth 1.3 cents on average when redeemed for domestic flights on the carrier, meaning 150,000 Amex points transferred to Delta would be worth about $1,950!

How to use CardMatch to find bigger welcome offers

CardMatch is super easy to use, and it doesn’t affect your credit in any way.

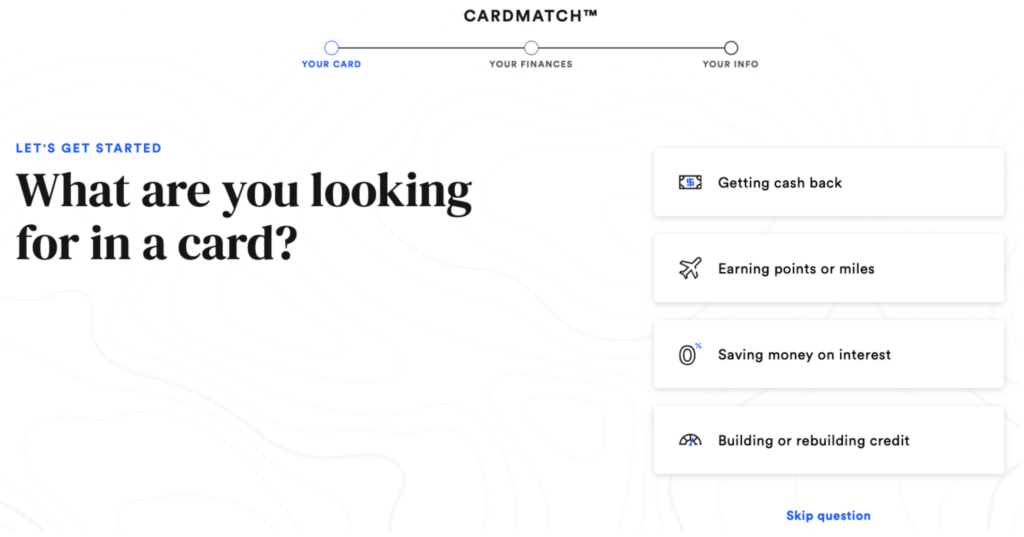

When you first visit the site, you’ve got the option to fill out a questionnaire which will help the tool narrow down targeted offers that are most relevant to your goals. Are you looking for a card that earns travel rewards? Do you use multiple cards depending on the spending category? Are you willing to pay an annual fee?

After you’ve answered these questions, you’ll need to fill out some personal information so CardMatch can locate your credit details and search each credit card issuer for special deals. You’ll have to enter:

- Employment status

- Income

- Monthly rent/mortgage payments

- Name

- Address

- Last four digits of your Social Security number

- Email address

Again, there is no hard pull on your credit, so there’s no risk to your credit when using CardMatch.

After you’ve submitted this information, you’ll see a list of cards recommended for you—even if you’re not targeted for any offers. As you can see, I’m not currently targeted for any increased bonuses.

But you may find that you qualify for bonuses worth several hundred dollars more than most other people.

Note: It’s especially important to ensure you’re getting the highest possible bonus before applying for American Express cards, making it worth double checking with CardMatch before applying with a public offer. That’s because Amex enforces a once-per-lifetime rule on their card bonuses. If you’ve ever earned the bonus before, you aren’t eligible to earn the bonus again (unless otherwise specified).

Final Thoughts

Using CardMatch could net you a welcome bonus worth tens of thousands of extra points than the publicly available offer. There are often crazy generous targeted bonuses floating around (such as the Amex Platinum 150k offer) that would-be cardholders overlook because they don’t even know the offers exist.

We’ll always tell you when we spot an increased publicly available bonus worth opening— but it’s still worth a quick CardMatch search before you submit an application. The offers are updated regularly, so even if you weren’t targeted last week, things may be different today.

by your friends at The Daily Navigator

by your friends at The Daily Navigator