- Before searching for business class flights to London

- Use British Airways to book business class flights to London

- Use American Airlines to book business class flights to London

- Use ANA to book business class flights to London

- Use United to book business class flights to London

- Use Virgin Atlantic to book business class flights to London

- The point

What are travel credit cards, and how do they work?

Travel credit cards are financial products that offer various rewards and benefits geared towards frequent travelers. They typically earn you points or miles for every dollar spent on eligible purchases. These rewards can be redeemed for flights, hotel stays, car rentals, and other travel-related expenses. Travel credit cards may also include perks like travel insurance, airport lounge access, and no foreign transaction fees.

How do I choose the best travel credit card for my needs?

Choosing the best travel credit card depends on your travel habits, spending patterns, and preferences. Consider factors like the type of rewards offered (points, miles, or cash back), the card’s annual fee, sign-up bonuses, earning rates, redemption options, and additional travel perks. Analyzing these features will help you find a card that aligns with your lifestyle and offers the most value.

What are the benefits of using a travel credit card over other types of credit cards?

Travel credit cards provide unique advantages for travelers, such as earning rewards specifically tailored to travel expenses. Additionally, many travel credit cards offer travel-related perks like free checked bags, priority boarding, and travel insurance. Some cards also waive foreign transaction fees, making them ideal for international travelers.

What is a sign-up bonus, and how can I qualify for it?

A sign-up bonus is a promotional offer provided by the credit card issuer to entice new cardholders. To qualify for a sign-up bonus, you usually need to meet specific spending requirements within a certain timeframe after opening the account. The bonus can be in the form of points, miles, or cash back, and it’s a great way to jump-start your rewards earning.

Do travel credit cards charge foreign transaction fees?

Not all travel credit cards charge foreign transaction fees. Many of the top-tier travel cards waive these fees, making them ideal for international travel. However, it’s essential to read the card’s terms and conditions to confirm this before using it abroad.

How can I maximize the rewards earned with my travel credit card?

To maximize rewards, use your travel credit card for everyday expenses and large purchases. Take advantage of bonus categories and special promotions to earn more points or miles. Consider combining your travel credit card with loyalty programs to stack rewards and get even more value out of your purchases.

Main is arguably one of the most underrated destinations in the US. The tiny state is a Northeastern breath of fresh air, pairing stunning coastlines with character-laden towns and cities…and of course…the lobster is okay.

But its size and the relative proximity of major airport hubs like Boston and New York mean cheap flights to Maine can be a little scarce. When the busy season kicks in, competition might soar for the limited seats along with prices.

One way to ensure you always get cheap flights to Maine is to use points and miles. Here are the best ways to do just that.

Important info before you get started

Searching for cheap flights to Maine isn’t hard. Despite the comparatively small number of flights, there are still enough options to get there with points and miles plus a few dollars in taxes. For this guide, we’ll focus on Portland International Jetport, as it’s the largest and best-connected hub in the state.

If you struggle for award space or have more than enough time to get there slowly, you can fly into Boston, which will have a ton of availability. The two-hour drive down to Portland is spectacular.

As with any search, keep yourself as flexible as possible with dates, airports, and airlines.

Which airlines fly into Portland, Maine?

Portland Jetport (PWM) is serviced by all the major US airlines. You’ll find Delta. American, United, JetBlue, and Southwest, as well as budget airlines Frontier, Breeze, and Sun Country.

Among those airlines, you’ll find direct flights to and from the following cities:

- Atlanta

- Baltimore

- Cincinnati

- Charlotte

- Charleston

- Chicago

- Dallas

- Detroit

- Denver

- Fort Myers

- Miami

- Minneapolis

- Nashville

- New York City

- Norfolk

- Orlando

- Philadelphia

- Pittsburgh

- Raleigh-Durham

- Washington, DC

- Westchester

That’s not a huge list and, with the exception of Denver, Dallas, and Minneapolis, almost every flight is either East Coast or Northeastern. Please don’t be upset if I classify your city as Northeastern. You know what I mean.

If you’re not based around any of these cities, you’ll need to look at connecting flights.

How to find cheap flights to Maine with Delta

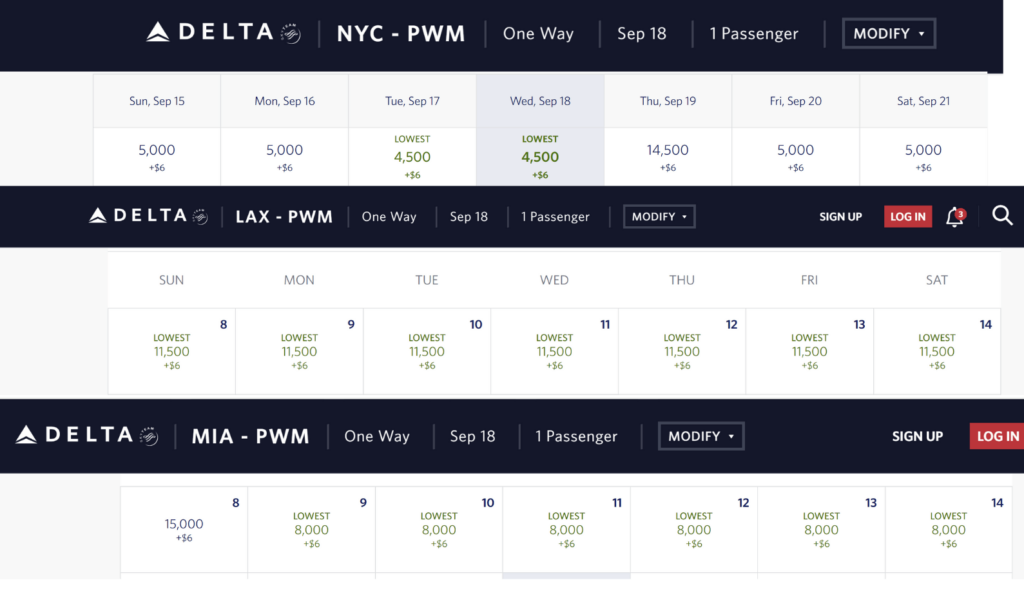

Grabbing cheap domestic flights is one of the few areas where Delta’s SkyMiles program actually delivers. For other purposes, its dynamic pricing system can be a nightmare for points and miles enthusiasts.

Flights to Maine can still fluctuate, but it’s an easy search from any of the cities with direct flights into PWM. Miami, which would require a connection, has a ton of September availability for just 8,000 SkyMiles plus $6. If you moved the starting point to Los Angeles, that rate would rise to 11,500 with the same taxes and fees.

Grabbing a closeby direct flight from New York starts at just 4,500 SkyMiles.

Typically, I’d recommend checking out Virgin Atlantic or KLM for these redemptions as they’re often far better value. In this case, just stick with Delta’s own portal.

You can also check out the Delta SkyDeals page, too. You can often find some extra value there. At the time of writing, there are no flights to Maine included in the list, but a roundtrip from Miami to Boston is only 9,000 SkyMiles. If you’re game for the drive, that’s excellent value.

How to earn enough Delta SkyMiles

SkyMiles is an incredibly easy airline currency to earn thanks to its array of co-branded credit cards and partnership with American Express. Opening a Delta card like the Delta SkyMiles® Gold American Express Card would be a great idea for anyone hoping to fly domestically in the future.

- Best for: Foodies

American Express® Gold Card

Earn as high as 100,000 Membership Rewards® Points

Offer Details:

You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Why we like it

The American Express® Gold Card takes your dining and grocery spending to the next level, offering an impressive 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year, and 4X Membership Rewards® points per dollar spent at U.S. supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

To put this into perspective, if you spend $8,400 annually on dining and groceries, which aligns with the average American’s spending, you could earn enough points for a roundtrip flight to Hawaii. Meanwhile, the bonus alone is worth over $1,000, adding significant value to your everyday spending.

Reward details

4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

1X Membership Rewards® point per dollar spent on all other eligible purchases.

Pros & Cons

Pros

-

Earn 4X Membership Rewards® points per dollar spent at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

-

Earn 4X Membership Rewards® points per dollar spent at U.S. supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

-

Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

-

Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

-

Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

-

Get up to $100 in statement credits each calendar year for dining at U.S. Resy restaurants or making other eligible Resy purchases. That’s up to $50 in statement credits semi-annually. Enrollment required.

-

Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys, totaling up to $120 per year. Enrollment required.

-

Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

-

Apply with confidence. Know if you’re approved for a Card with no impact to your credit score. If you’re approved and you choose to accept this Card, your credit score may be impacted.

Cons

-

$325 annual fee

-

No major travel perks like its bigger sibling, the Amex Platinum

How to find cheap flights to Maine with United

United only operates direct flights to Maine from four cities (Denver, Chicago, New York, and DC), but as those are incredibly popular hubs in their own right, Maine is in turn connected to the entire country.

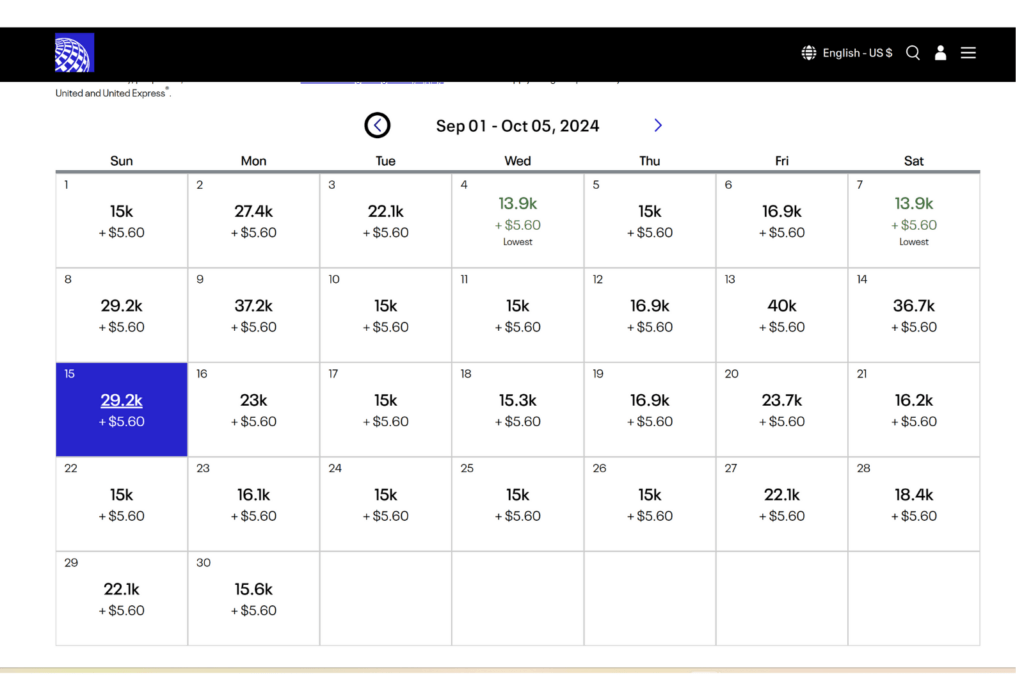

United does operate a dynamic system similar to Delta but, on the whole, it’s a far more forgiving program thanks to its saver rates. These low-priced award flights often compete with the best award charts out there.

However, from the calendar view above you can see Delta has United beaten in this case. The lowest price in the entire month of September for a flight from Miami to Portland is 13,900 miles. Moving the origin to LAX sees a similar trend. Opting for one of its direct flights from Denver, the lowest is still in the 13,000s but has far more availability at that rate.

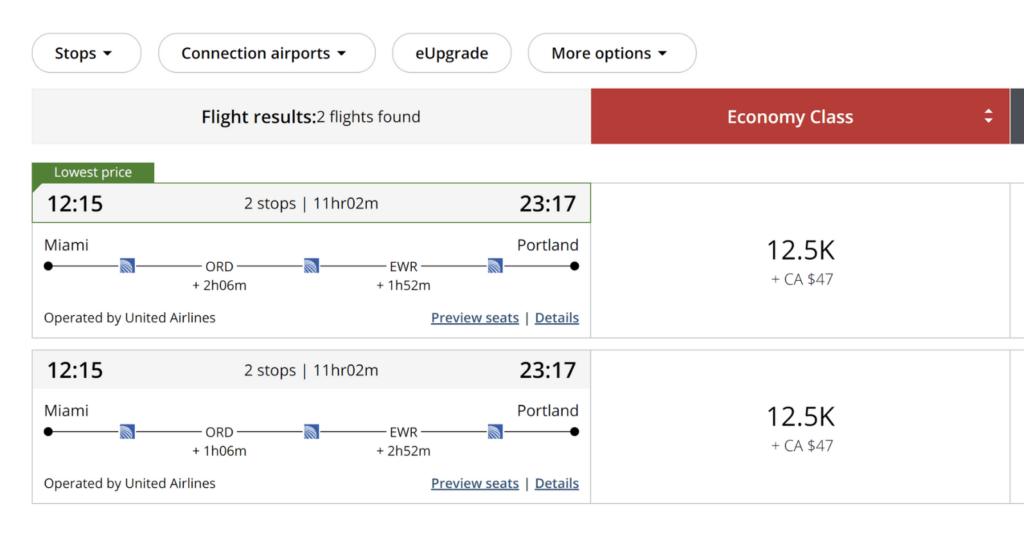

You can check out Air Canada’s Aeroplan portal to try and find some better rates. As the airline utilizes a distance and zonal-based chart, the Miami to Portland flight would be around 12,500 points with $47 CAD in taxes and fees. Oddly, availability isn’t matching between the two airlines like it used to so you may have to do some digging or call the airline, Singapore Airlines also has rates hovering around 14,000 points.

How to earn enough points and miles to fly with United

If you’re opting to use United’s slightly better rates, the best option is to open a Chase card like the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®. The Reserve comes with a 100,000-point intro bonus earned after spending $5,000 within three months of opening the card. But the Chase Sapphire Preferred is offering 75,000 bonus points after spending $5,000 in the first three months. There are enough points in those bonuses to earn you two roundtrips to Portland.

- Best for: Beginner Travelers

Chase Sapphire Preferred® Card

75,000 Bonus Points

Offer Details:

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Chase Sapphire Preferred Card is the ultimate all-around travel credit card—it fits perfectly into almost any points-earner’s wallet. Points novices can enjoy a significant intro bonus and easy to grasp spending categories with an approachable annual fee. The more experienced can utilize its high value earning potential as a secondary card and also gain access to Chase’s strong travel booking portal.

Reward details

5x on travel purchased through Chase Travel℠.

3x on dining, select streaming services and online groceries.

2x on all other travel purchases.

1x on all other purchases.

Pros & Cons

Pros

The $50 dollar hotel credit for stays purchased on the Chase Travel Portal already cuts the already approachable $95 annual fee significantly.

10% anniversary points boost – each account anniversary you’ll earn bonus points equal to 10% of your total purchases made the previous year.

Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

Along with all of the above, cardholders also have access to a string of travel protections like rental coverage, cancellation insurance, and purchase protection.

Cons

It’s subject to Chase’s 5/24 rule. So, if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Competing cards like the Capital One Venture have a better earning rate for non-bonus spend.

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

Terms Apply

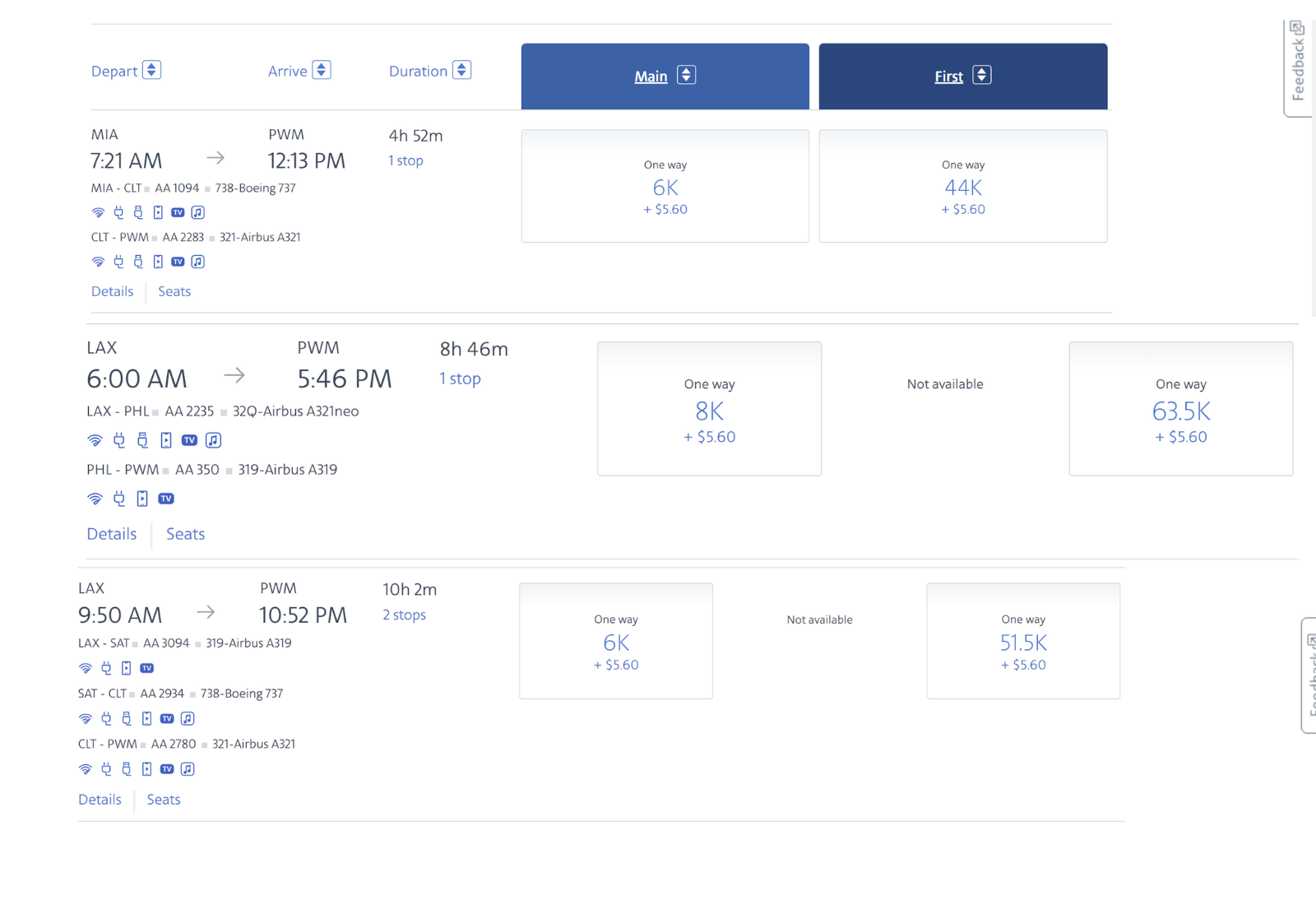

How to find cheap flights to Maine with American Airlines

American Airlines offers some of the best rates of them all, even beating out Delta’s low prices in some cases. A flight from Miami, for example, on the same September 18 date used for the earlier SkyMiles search is just 6,000 miles plus $5.60 in taxes. That’s pretty impressive.

If you’re willing to take two stops, you can get that same rate all the way from Los Angeles. Sure it’ll take a little longer, but that’s a long flight for just 6,000 miles.

I’d often recommend British Airways Executive Club for booking American routes, but even the short trips from New York cost more than the American portal. If you have the miles available, this is your best deal.

How to earn enough miles to fly with American

The downside to using American Airlines for cheap flights to Maine is that the carrier’s miles are harder to earn than others. It has almost no transfer partners, so opening a general travel card won’t serve you well here. It does have its own co-branded line of cards, however, and the 50,000-mile intro bonus loaded on the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® has more than enough to fly you to Maine multiple times from anywhere in the country. You’ll just need to spend $2,500 within three months of opening the card.

- Best for: American Airlines Fans

- Annual Fee: $ $0 intro annual fee, $99 after the first year

- Regular APR: 20.74% - 29.74% (Variable)

- Reward Rate: 1X - 2X

- Recommended Credit: 690-850

Citi®/AAdvantage® Platinum Select® World Elite Mastercard®

50,000 Bonus Points

Offer Details:

50,000 American Airlines AAdvantage bonus miles after you spend $2,500 on purchases in the first 3 months from account opening.

Why we like it

The Citi® / AAdvantage® Platinum Select® World Elite Mastercard® is a strong airline-centric card to have in your travel toolbox if your main airport is an American Airlines hub like Boston, Chicago, Dallas, or Charlotte, or if you just have a preference for the airline. Regular business travelers may want to upgrade for luxury perks like lounge access, but for everyone else, the low annual fee, 50,000 point intro bonus, solid miles-earning categories, and free checked bag perks are more than enough to validate the space in your wallet.

Reward details

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, and on eligible American Airlines purchases

Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases

Pros & Cons

Pros

The strong 50,000-point intro bonus is worth as much as $750, earned after spending $2,500 in three months.

Cardholders and up to four companions can enjoy a free first checked bag on any domestic American Airlines flight, comfortably justifying the $99 fee when used.

The card earns 2X miles for gas and dining purchases

Each eligible mile earned with the card also earns a loyalty point towards American Airlines elite status

A generous 25% discount on in-flight purchases when using the card round out the benefits

Preferred boarding on American Airlines flights

Cons

American Airlines miles can’t be transferred to other airlines or hotels (although they can be used to book AA partner flights)

Premium perks are reserved for pricier cards

Terms Apply

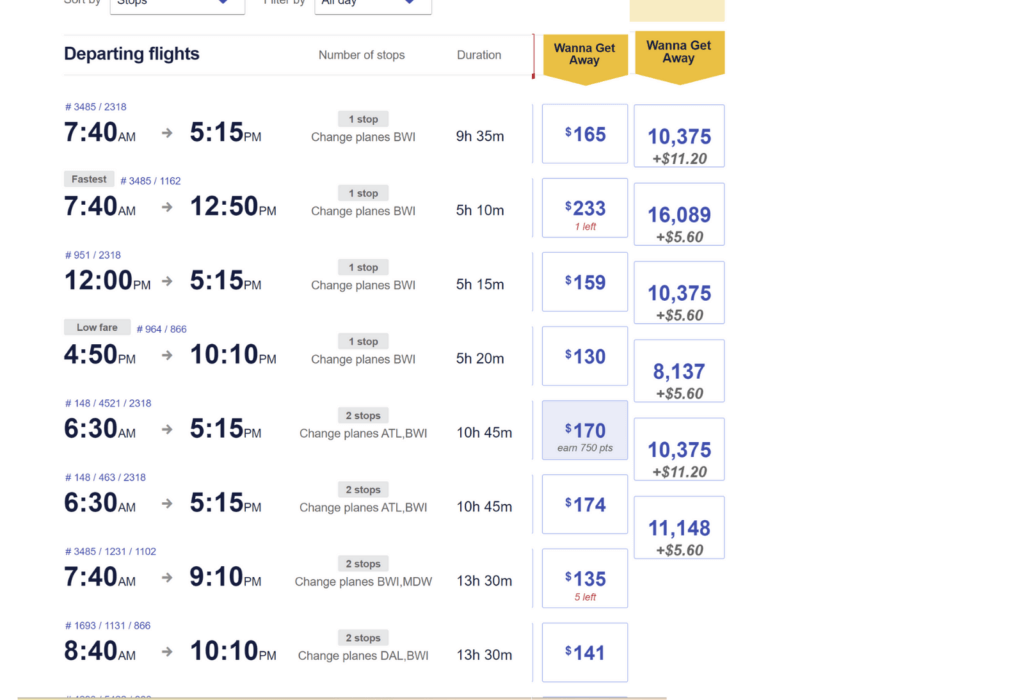

How to find cheap flights to Maine with Southwest

Southwest is a bit of an outlier on this list because, in short, you don’t really need much advice to use it. Southwest’s Rapid Rewards points rates are tied directly to the cash price of any given flight.

Because of that, it’s unlikely you’ll ever find an insane deal.

But it’s also almost impossible to get a bad deal either.

If you look at the first flight on that list, you’ll see the cash price is $165. To book it as an award flight would cost you 10,375 points. If we divide $165 by 10,375 we get about 1.6 cents per point. If you run the same calculation down the line, you’ll get a small fluctuation between about 1.4 cents and 1.6 cents per point.

While you can do far better than this on other airlines, it’s worth keeping this in your arsenal, especially for last-minute trips. Another perk of Southwest is the lack of blackout dates—every seat can be booked as an award flight. So if there’s no availability on other carriers, it’s still possible.

How to earn enough miles to fly with Southwest

You can transfer points from your Chase account to Southwest, so keep in mind either of the Sapphire cards mentioned earlier. However, the Southwest Rapid Rewards® Plus Credit Card is a stellar option and I’d recommend it for any American who inclines to travel domestically.

- Best for: Beginner Southwest Points

Southwest Rapid Rewards® Plus Credit Card

50,000 bonus points

Offer Details:

Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Why we like it

The Southwest Rapid Rewards® Plus Credit Card is the popular airline’s entry-level card and offers solid value for those who fly with the carrier at least once a year. It comes with a few easy-to-use perks like 3,000 Southwest points every year after your first cardmember anniversary and two EarlyBird check-ins per year (ends December 31st, 2025). It’s a good option for those who want to earn Southwest points on an ongoing basis and not have to pay a high annual fee.

Reward details

2 points per $1 spent on Southwest Airlines® purchases

2 points for every $1 you spend at gas stations and grocery stores on the first $5,000 in combined purchases per anniversary year

1X points on all other purchases.

Pros & Cons

Pros

Select a Standard seat within 48 hours prior to departure, when available.

The 3,000 annual bonus points are worth around $40 towards travel on Southwest.

25% discount on Southwest in-flight purchases when paying with the card

The intro bonus can be used for collecting points for the Companion Pass benefits

Elite status can be earned with day-to-day spending, and not just flights.

Cons

Southwest points cannot be transferred or used with any airline partners.

Terms Apply

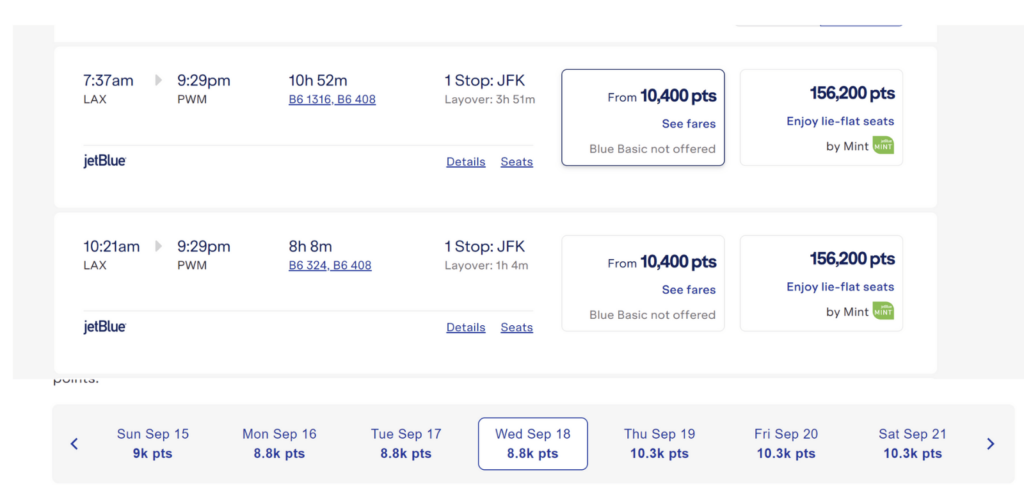

How to find cheap flights to Maine with JetBlue

JetBlue operates similarly to Southwest, with its miles hovering between 1.3 and 1.6 cents each. With that in mind, you can find flights from Miami for as low as 8,000 miles. Moving to the West Coast, there are plenty of flights for around 10,400 miles. A super-short hop from the New York City area would only set you back 4,400 miles on a cheaper day.

Just remember, though. 4,400 miles on JetBlue might be technically less valuable than a 6,000-mile flight with another airline. It’s all about perceived value.

How to earn enough miles to fly with JetBlue

JetBlue TrueBlue allows transfers from Chase Ultimate Rewards®, Citi ThankYou® Rewards, and American Express Membership Rewards®, giving you a wide range of cards to choose from. A card like the American Express Platinum Card® gifts you as high as 175,000 points after spending $12,000 within six months of opening the card. Based on some of the rates shown, that’s enough for 10 flights from Miami to Portland.

- Best for: Luxury Perks

American Express Platinum Card®

As high as 175,000 Membership Rewards® Points

Offer Details:

You may be eligible for as high as 175,000 Membership Rewards® points after you spend $12,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Why we like it

The Amex Platinum was once the sole dominating force in the luxury credit card space. While it now faces some stiff competition, it still offers unbeatable perks like unprecedented airport lounge access, elite status at Hilton and Marriott, and some outstanding statement credits making the mammoth $895 worth it for some.

Reward details

Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings.

You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

Pros & Cons

Pros

-

Earn as high as 175,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership.

-

Incredible lounge access

-

Statement credits worth over $3,500 annually.

-

Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

Cons

-

The $895 annual fee is brutally high. Too high for many that can’t, or don’t want to take full advantage of its benefits.

-

Points-earning rates are low unless spending directly on flights or with the Amex Portal.

-

Some of the benefits, like travel credits, are more limited and are harder to use than competing cards’ offerings.

The point

Despite being a little off-the-beaten-track, finding cheap flights to Maine isn’t tough when you have the right points available. A quick search of the main carriers can pay dividends while smaller airlines like Southwest and JetBlue can cover you when availability is low elsewhere.

by your friends at The Daily Navigator

by your friends at The Daily Navigator