- What is Air Canada’s Aeroplan?

- What is the Aeroplan Award Chart?

- Use the Aeroplan Award Chart within North America

- Use the Aeroplan Award Chart to travel to Europe

- Use the Aeroplan Award Chart to travel to Asia

- Use the Aeroplan Award Chart to travel to South America

- Use the Aeroplan 5,000 point stopover perk

- The point

What are travel credit cards, and how do they work?

Travel credit cards are financial products that offer various rewards and benefits geared towards frequent travelers. They typically earn you points or miles for every dollar spent on eligible purchases. These rewards can be redeemed for flights, hotel stays, car rentals, and other travel-related expenses. Travel credit cards may also include perks like travel insurance, airport lounge access, and no foreign transaction fees.

How do I choose the best travel credit card for my needs?

Choosing the best travel credit card depends on your travel habits, spending patterns, and preferences. Consider factors like the type of rewards offered (points, miles, or cash back), the card’s annual fee, sign-up bonuses, earning rates, redemption options, and additional travel perks. Analyzing these features will help you find a card that aligns with your lifestyle and offers the most value.

What are the benefits of using a travel credit card over other types of credit cards?

Travel credit cards provide unique advantages for travelers, such as earning rewards specifically tailored to travel expenses. Additionally, many travel credit cards offer travel-related perks like free checked bags, priority boarding, and travel insurance. Some cards also waive foreign transaction fees, making them ideal for international travelers.

What is a sign-up bonus, and how can I qualify for it?

A sign-up bonus is a promotional offer provided by the credit card issuer to entice new cardholders. To qualify for a sign-up bonus, you usually need to meet specific spending requirements within a certain timeframe after opening the account. The bonus can be in the form of points, miles, or cash back, and it’s a great way to jump-start your rewards earning.

Do travel credit cards charge foreign transaction fees?

Not all travel credit cards charge foreign transaction fees. Many of the top-tier travel cards waive these fees, making them ideal for international travel. However, it’s essential to read the card’s terms and conditions to confirm this before using it abroad.

How can I maximize the rewards earned with my travel credit card?

To maximize rewards, use your travel credit card for everyday expenses and large purchases. Take advantage of bonus categories and special promotions to earn more points or miles. Consider combining your travel credit card with loyalty programs to stack rewards and get even more value out of your purchases.

I wish I’d written this article midway through my flight to Bangkok earlier this year. It would have given it a little extra “oomph.”

But, you see, when you’re flying halfway around the world in business class, your priorities are elsewhere. I was busy taking advantage of the champagne and high-end dining options, before kicking back on my fully lie-flat seat. It was pretty incredible.

That flight should have cost around $3,800.

I paid $60.

And how did I manage that? I have Air Canada’s Aeroplan award chart program to thank.

Never heard of the Aeroplan award chart?

Well, now you have. And if you’re serious about points and miles, it might just become one of the most valuable tools in your arsenal.

In this article, we’ll be taking a deep dive into the Aeroplan award chart, to discover the best ways to book cheap business class flights around the world.

What is Air Canada Aeroplan?

Air Canada Aeroplan is the name of Air Canada’s loyalty program. As with almost every airline or hotel, customers can sign up and earn points by flying with Air Canada or one of its partners. Those points can be accumulated and redeemed for flights or other products and experiences related to the airline.

It’s also the base for earning elite status with the airline. The more you fly or spend, the higher up the rankings you go. Each status ranking enjoys different perks, like priority boarding, free checked luggage, and even upgrades when available. The highest status in this case is Air Canada Super Elite Status.

Elite status is great, but our focus today is purely on point redemption, and Aeroplan is up there amongst the most valuable programs on the market in this respect. Why? Because of the outstanding Aeroplan Award Chart.

What is the Aeroplan Award Chart?

To understand what the Aeroplan Award Chart is, we need to look at the broader trajectory of airline and hotel loyalty programs. Each airline uses its own method of dictating the value of its award flights. While every program is slightly different, they generally break down into two styles: dynamic pricing and award charts.

Dynamic pricing

Dynamic pricing, as the name suggests, features fluctuating rates depending on a number of variables. For example, it may tie an award seat to the demand for that flight or to the cash price. The truth is, besides a few, we don’t know the exact formula these programs use. The algorithm, if there is one, is entirely up to the airline. This can cause some programs, like Delta SkyMiles, to have obscenely high rates one day and then sudden drops the next.

These programs do have their uses, but they can be hard to rely on. Finding high value can be a game of patience of opportunism, and as such, shouldn’t be the centerpiece for any strong credit card strategy.

Award charts

Award charts, on the other hand, use predetermined rates based on set factors to price their award flights. The airlines can do this in several ways. A chart could be based on the distance flown, the geographical area, or some other criteria. The Aeroplan Award Chart uses a combination of these, with a distance chart for flights between each zone. We’ll look at this in-depth later on.

In general, the set values of award charts tend to allow better value than their dynamic counterparts because of so-called “sweet spots.” This is just the nickname for reliable, super high-value redemptions. These sweet spots are what we’ll base most of this article’s information around.

How does the Air Canada Aeroplan Award Chart work?

The Aeroplan Award Chart is fairly simple to understand. It uses a combination of zonal and distance-based values to assign values for flights. Each geographic region of the world is assigned a zone number, and a chart is generated for travel within and between those zones.

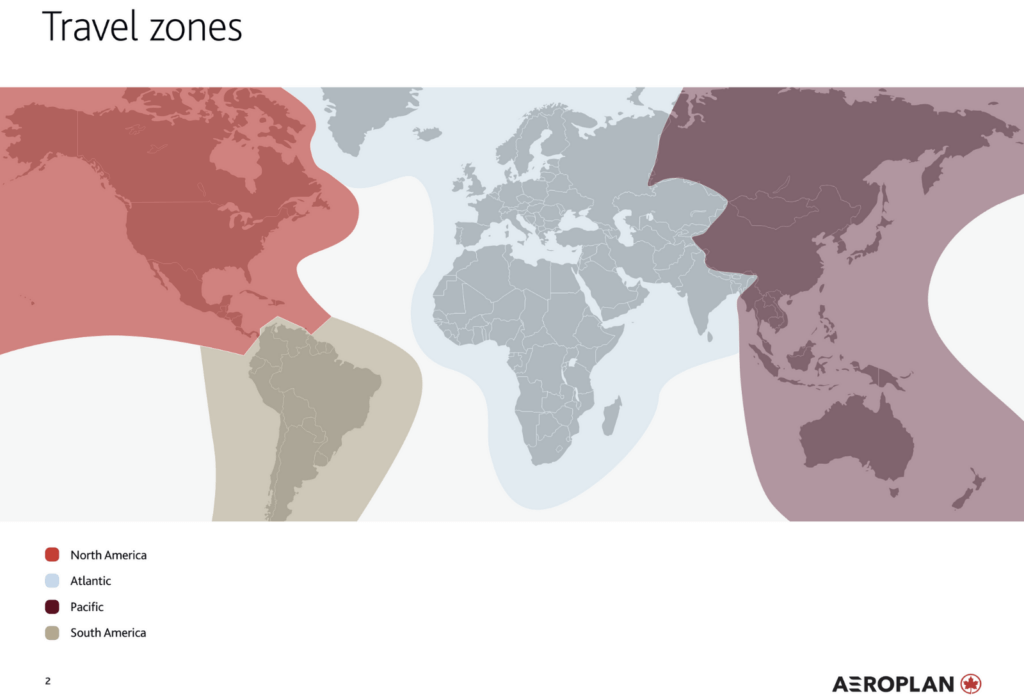

The four zones are:

- North America (Central America through Canada)

- Atlantic (Europe, Africa, India, and the Middle East)

- Pacific (Southeast and Eastern Asia and Oceania)

- South America (South America, obviously)

The key thing to notice here is the sheer size of some of these regions. The Atlantic region stretches from Cape Town to the UK and out to Mumbai, covering everywhere in between. These huge regions are what help us maximize the sweet spots.

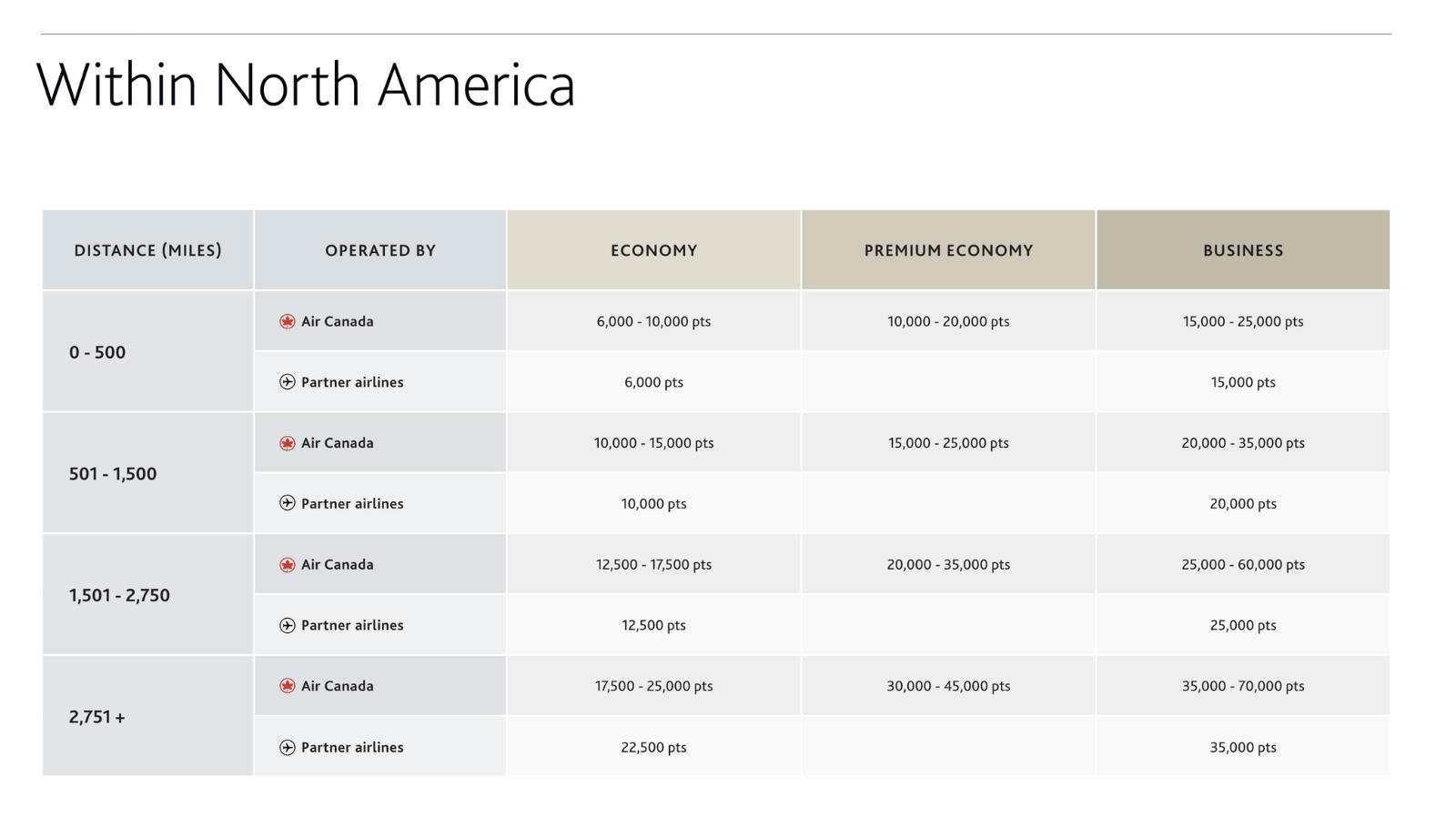

As you can see from the chart, Air Canada sets rates based on distance flown within a region. It also sets two rates: one for its own flights and one for partners. The partner rates have one value, while the Air Canada flights can fluctuate within a range.

In general, we want to focus on the partner rates as these are steadier and provide higher value. Air Canada has over 50 partners around the world and growing. It’s also ditched most of its fuel surcharges, so you’re not going to see any brutal add-on fees when flying with airlines notorious for it, like Lufthansa.

Aeroplan’s use varies depending on where you want to fly, so we’ll break things down into region-specific sections, starting with travel within North America.

How to earn Aeroplan points

If you’re new to the points world, you may wonder how you’re supposed to earn points with Air Canada when you never fly with the airline. Thankfully, you don’t need to, and earning Aeroplan points is incredibly easy. Here’s how to do it.

Fly with Air Canada and its partners

This isn’t the easiest way to do it, but make sure if you do ever fly with Air Canada or one of its many partners that you put your membership details down on the booking to earn any points you can. It’s a small injection depending on how much you fly, but these do add up and can be the difference between getting that dream flight and missing out.

Transfer credit card points

This is where you can earn some serious mileage. American Express, Capital One, and Chase all transfer to Aeroplan so opening a card from any of these issuers and hitting the intro bonus can earn you a ton of points quickly.

Here are a few of our favorite cards that can all grab you at least 60,000 points after hitting the spending goal.

- Best for: Overall Travel

Capital One Venture X Rewards Credit Card

75,000 Bonus Miles

Offer Details:

Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

Why we like it

The Capital One Venture X is a direct competitor to the Chase Sapphire Reserve, and for many seeking a simpler earning scheme with premium perks, it could be the better option. But the Venture X truly shines with one benefit in particular: four free authorized users. Plus, every year on your cardholder anniversary you get 10,000 points to use for travel.

Reward details

10 Miles per dollar on hotels and rental cars booked through Capital One Travel

5 Miles per dollar on flights and vacation rentals booked through Capital One Travel

2 Miles per dollar on every purchase

Pros & Cons

Pros

Its great intro bonus of 75,000 miles is worth well over $1,000 when transferred to partner airlines and hotels, or a flat rate $750 when redeemed on the Capital One Travel Portal.

Cardholders get a bonus of 10,000 miles each year after their first account anniversary, which is nothing to shrug off, especially when a little bit short of that business class flight. It’s worth almost $200 depending on how you use it.

The $300 annual credit for purchases made on the Capital One Travel Portal, combined with the yearly free miles, more than annul the $395 annual fee.

Four authorized users can be added for free.

Enjoy access to 1,300+ lounges worldwide, including Capital One Lounge locations and Priority Pass™ lounges, after enrollment

A generous offering of travel insurance, protections and reimbursements round out an excellent array of benefits.

Cons

The $300 credit is a bit less flexible than the Chase Sapphire Reserve’s comparable benefit.

Miles earning is the same as the Sapphire Reserve on portal-based purchases, but less on general travel spending.

Capital One transfer partners are solid, but still don’t include any US-based airlines or hotels.

Terms Apply

- Best for: Foodies

American Express® Gold Card

Earn as high as 100,000 Membership Rewards® Points

Offer Details:

You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Why we like it

The American Express® Gold Card takes your dining and grocery spending to the next level, offering an impressive 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year, and 4X Membership Rewards® points per dollar spent at U.S. supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

To put this into perspective, if you spend $8,400 annually on dining and groceries, which aligns with the average American’s spending, you could earn enough points for a roundtrip flight to Hawaii. Meanwhile, the bonus alone is worth over $1,000, adding significant value to your everyday spending.

Reward details

4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

1X Membership Rewards® point per dollar spent on all other eligible purchases.

Pros & Cons

Pros

-

Earn 4X Membership Rewards® points per dollar spent at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

-

Earn 4X Membership Rewards® points per dollar spent at U.S. supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

-

Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

-

Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

-

Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

-

Get up to $100 in statement credits each calendar year for dining at U.S. Resy restaurants or making other eligible Resy purchases. That’s up to $50 in statement credits semi-annually. Enrollment required.

-

Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys, totaling up to $120 per year. Enrollment required.

-

Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

-

Apply with confidence. Know if you’re approved for a Card with no impact to your credit score. If you’re approved and you choose to accept this Card, your credit score may be impacted.

Cons

-

$325 annual fee

-

No major travel perks like its bigger sibling, the Amex Platinum

- Best for: Beginner Travelers

Chase Sapphire Preferred® Card

75,000 Bonus Points

Offer Details:

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Chase Sapphire Preferred Card is the ultimate all-around travel credit card—it fits perfectly into almost any points-earner’s wallet. Points novices can enjoy a significant intro bonus and easy to grasp spending categories with an approachable annual fee. The more experienced can utilize its high value earning potential as a secondary card and also gain access to Chase’s strong travel booking portal.

Reward details

5x on travel purchased through Chase Travel℠.

3x on dining, select streaming services and online groceries.

2x on all other travel purchases.

1x on all other purchases.

Pros & Cons

Pros

The $50 dollar hotel credit for stays purchased on the Chase Travel Portal already cuts the already approachable $95 annual fee significantly.

10% anniversary points boost – each account anniversary you’ll earn bonus points equal to 10% of your total purchases made the previous year.

Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

Along with all of the above, cardholders also have access to a string of travel protections like rental coverage, cancellation insurance, and purchase protection.

Cons

It’s subject to Chase’s 5/24 rule. So, if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Competing cards like the Capital One Venture have a better earning rate for non-bonus spend.

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

Terms Apply

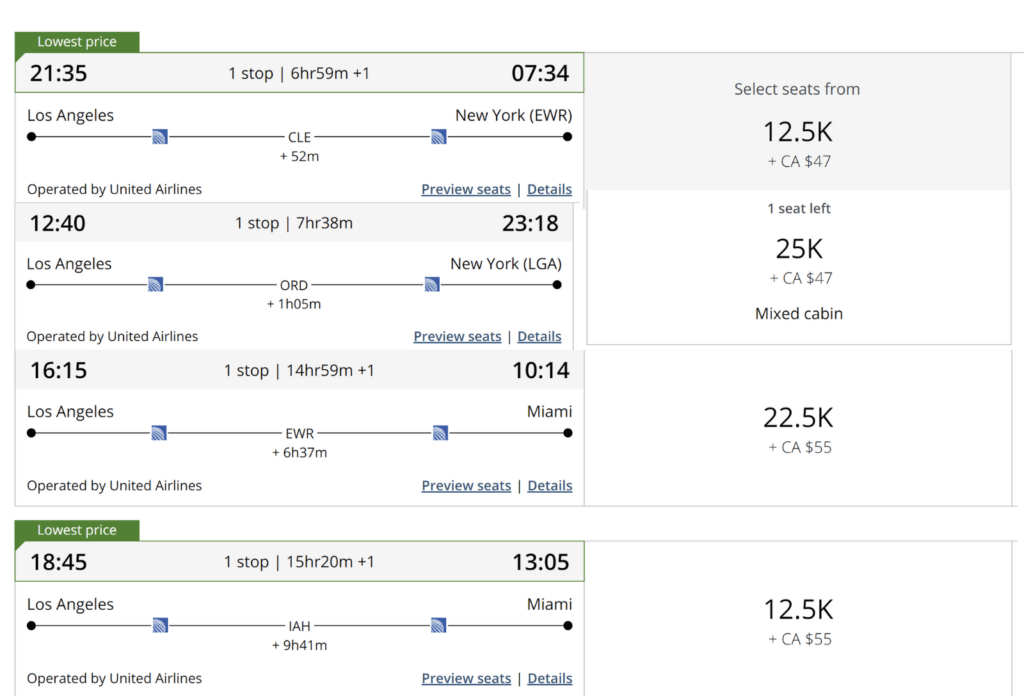

Using the Aeroplan Award Chart within North America

For the sake of comparison, the distance between New York and Los Angeles is around 2,445 miles. By this reasoning, a partner flight between these cities booked using the Aeroplan Award Chart would cost 12,500 points in economy and just 25,000 in business. Its own flights will fluctuate far more than that.

As you can see from the picture, the 12,500-point rate checks out in economy. There’s a ton of availability, too, so grabbing a flight at this rate wouldn’t be hard. You’ll only be paying that 47 CAD fee charge which is around $35.

The business class rate also matches, with the one shown above at the 25,000-point rate. If you look under the figure it says “Mixed Cabin,” which means only part of this journey will be in business class. In this instance, the longer leg is in business so it may still be worth it. But be careful about booking a flight with a small percentage. You could end up with a one-hour flight in business and five hours in economy for the same price as a full business class ticket.

Another important thing to note is the route taken. In the third example, above, you’ll see a flight from LA to Miami. While the direct distance from California to Florida falls well under the 12,500-point threshold, this flight has a layover in New York. That detour is significant enough to take it beyond the 2,750-mile limit and into the 22,500-point range. Be very careful with this.

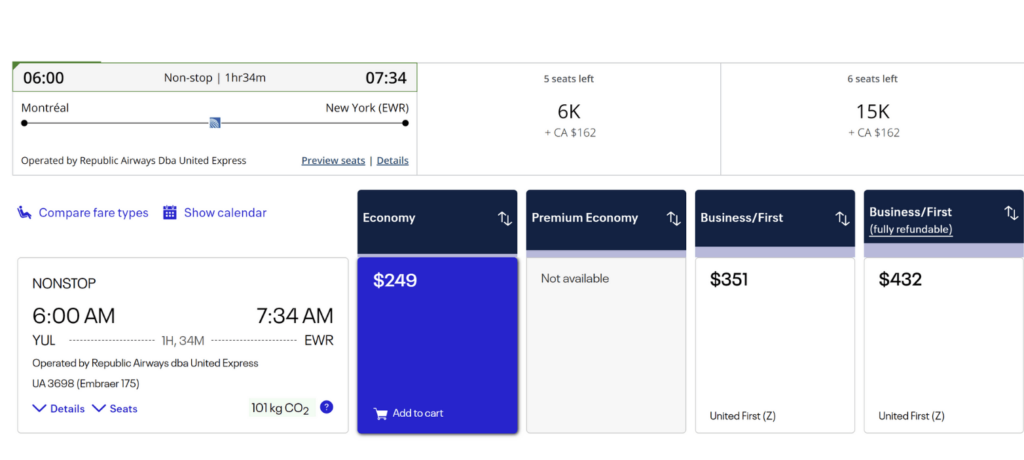

The true “sweet spot” in this chart, however, is the short-haul flights under 500 miles. For example, this flight between Montreal and New York would typically cost around $250. You can redeem it for 6,000 points plus $117. Even with the fees, you still get 2.2 cents per point.

Business class availability

As United is Air Canada’s US-based partner, every flight shown will be with them. The downside to this is United’s recent reluctance to release business class availability. Economy award space is wide open, but I had to search a while to find business class seats, and they have a layover.

Your best bet is to search for saver rates on United’s calendar view. In the past, this was fairly reliable and matched Aeroplan availability, but recent months have seen a downturn in this. As with any business class flight, your best chance is to search as far ahead as possible.

Be patient with your search within the US. It can be frustrating, but there’s some incredible value to be found.

Within other regions

Aeroplan has similar charts for each of its four regions. We won’t go into depth with each of these, as we don’t want to keep you here all day, but you can run through them yourself here.

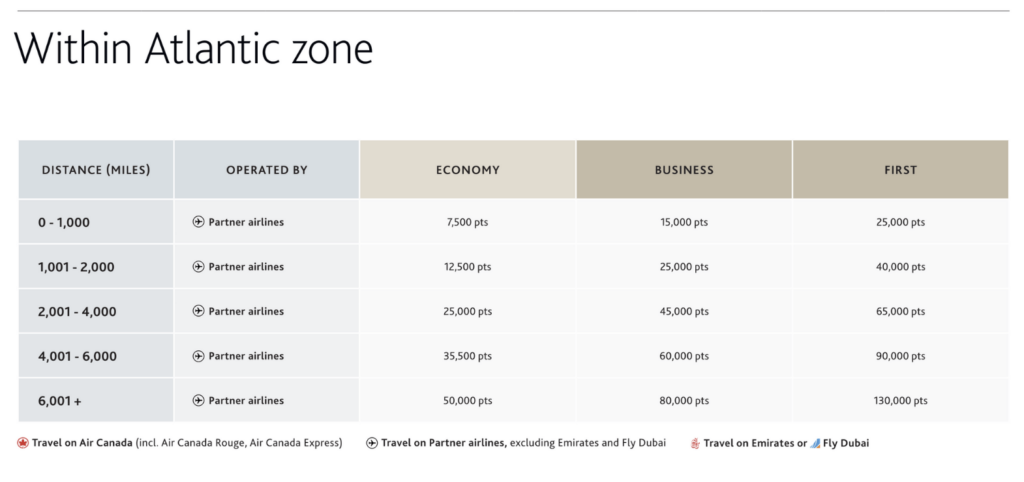

They function similarly to the North American one, just without the Air Canada segment. The rates aren’t bad, with the Atlantic region starting at just 7,500 points in economy and 15,000 points for business. The sheer volume of airline partners makes them valuable, as there’s almost always a route for you to take with Aeroplan. Keep it on your radar if you intend to do some country-hopping around Europe or the Middle East.

Remember how huge some of these zones are. There’s scope for serious value.

Using the Aeroplan Award Chart to travel to Europe in business class

The Aeroplan Award Chart comes into its own for longer flights. The range for its partner flights is huge, with its lowest one covering any distance between 0 and 4,000 miles. That’s a big enough distance to fly you from New York to Frankfurt. The second band goes to 6,000 miles which takes you as far as Baghdad if you were so inclined.

Economy rates are 35,000 in the first band, with business class flights coming in at 60,000 points. That’s an incredible redemption for a flight that can regularly cost well over $2,000. The example shown is a pre-Christmas date, with availability. That’s grabbing you almost 4 cents per point on Singapore Airlines, one of the best carriers on the planet.

Remember, any destination within that 4,000-mile range will be set at the 60,000-point business class award rate. That’s giving you access to the entirety of Western Europe on a luxury flight for pennies.

If you’re flying from the West Coast, you will have to move up one band for the same flights. But that’s still only 10,000 points more.

Or…if you felt like paying less, you could use a positioning flight by dropping 6,000 points to fly to New York. But let’s face it, it’s only 4,000 points more to fly business class the whole way.

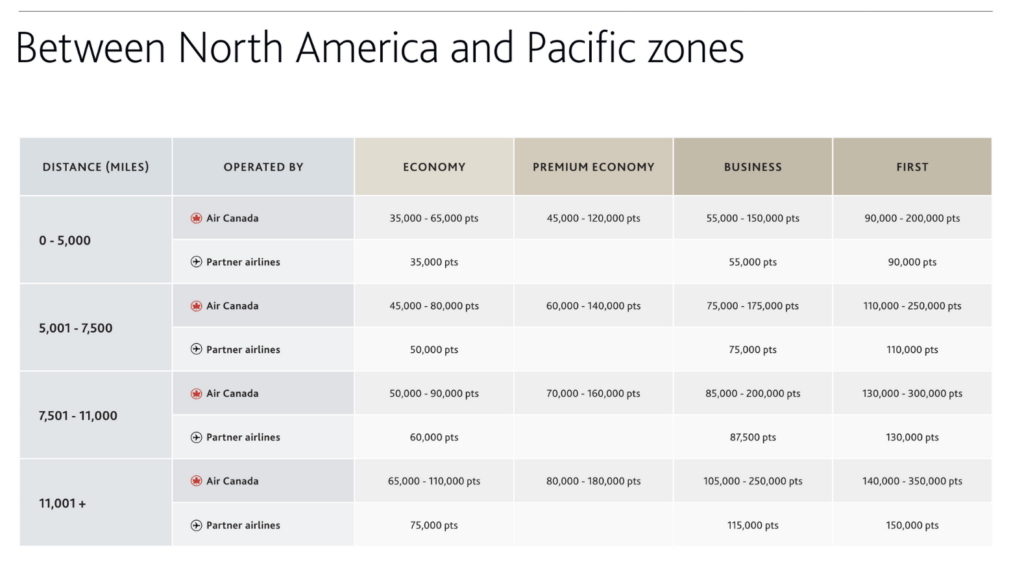

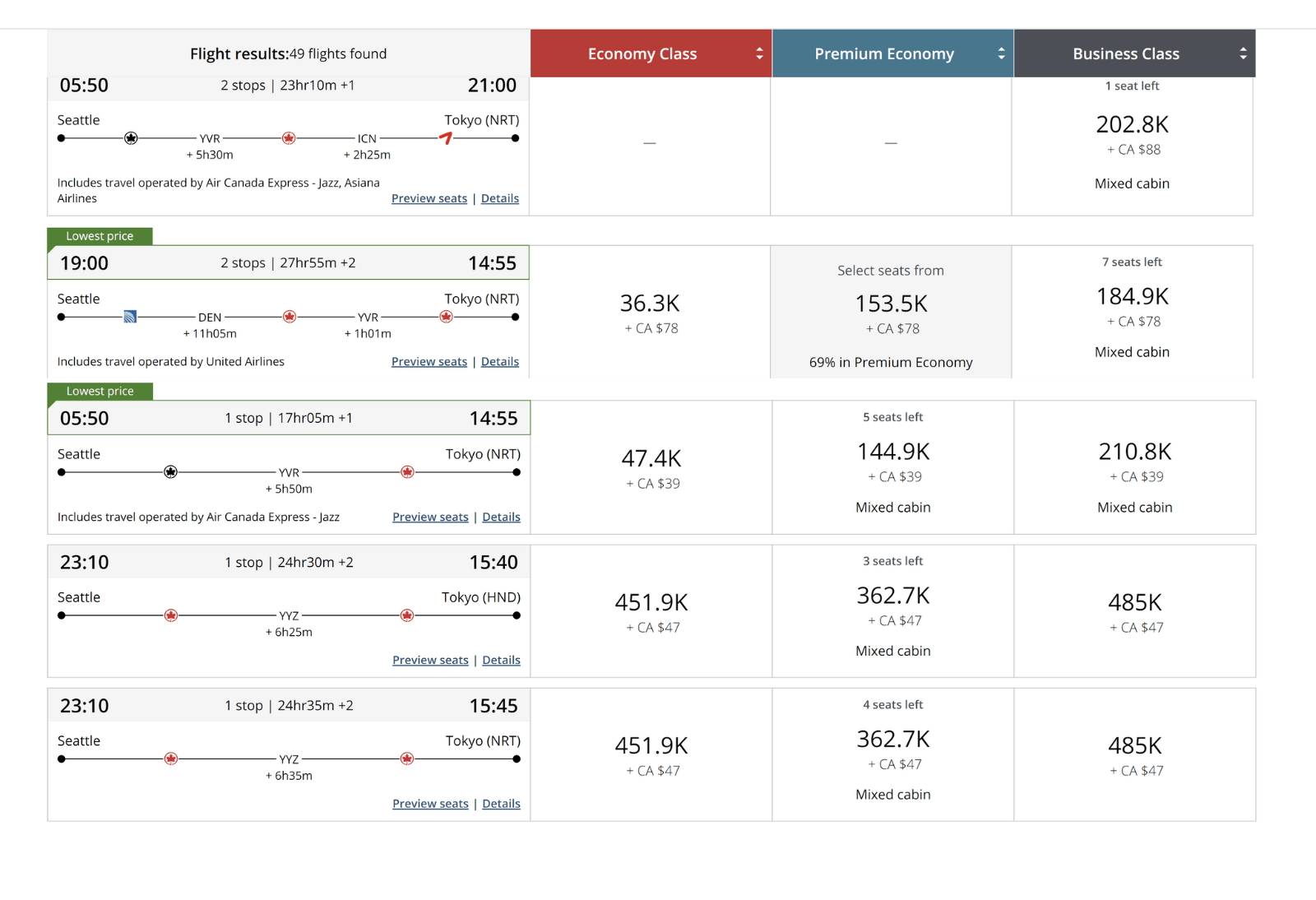

Using the Aeroplan Award Chart to travel to Asia in business class

Those on the East Coast may get the best rates to Europe, but West Coasters can enjoy the best rates to Asia and Oceania.

But, with that said, it’s definitely not as sweet. In the past, it was possible to grab a flight from Seattle to Tokyo for 60,000 points in business class with ANA. Frustratingly, ANA is no longer showing on Aeroplan’s portal, making it impossible to book the flight until further notice.

Still, 80,000 points in business class to pretty much anywhere in Eastern Asia is pretty amazing.

It’s also worth checking in on Air Canada’s own flights in this region. While they are generally higher in most parts of the world, I found some good economy rates in the 40-50,000 range. This isn’t great, but if you’re stuck on options and cash prices are high, the math can still work out.

The South Pacific always falls under the Pacific Region, and while there’s really only one flight you’d want to book with it, it’s a strong deal. You can fly from San Francisco to Tahiti for just 35,000 points each way.

Things to be wary of

The biggest issue you’ll come up against, besides availability, is wild routes. There aren’t quite as many direct flights to Asia in the Aeroplan system as in Europe, and the connecting routes you’ll stumble on can be utterly chaotic. Not only is this inconvenient for traveling, but it bumps rates sky-high. As a rule, don’t waste your points on these. It’s far better to pay for the flight and use those points for a stronger redemption further down the line.

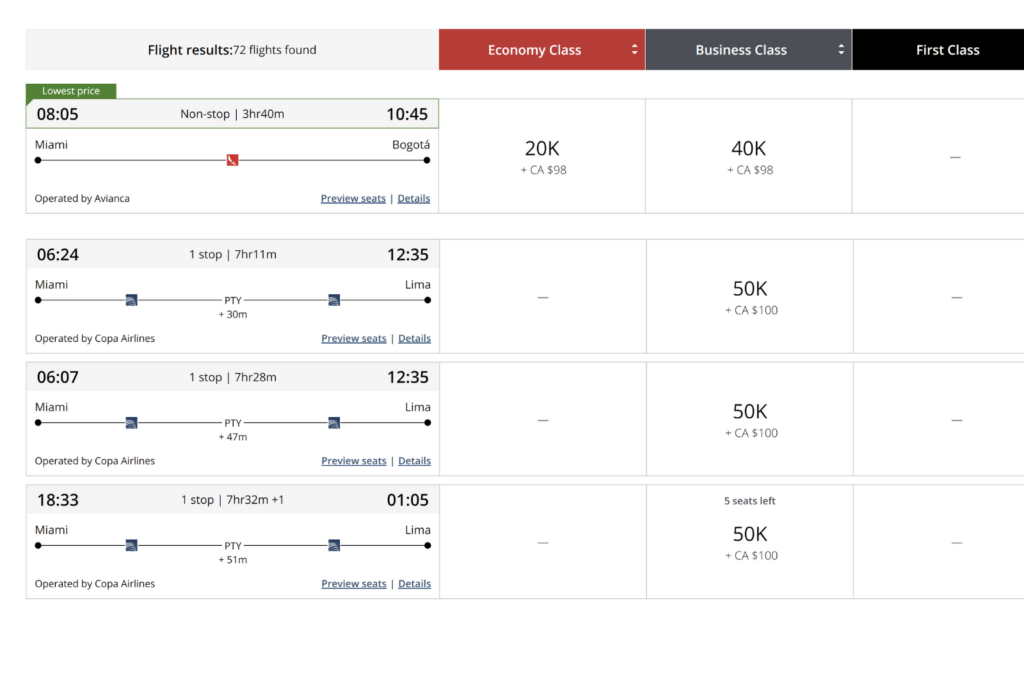

Using the Aeroplan Award Chart to travel to South America in business class

The North America to South America award chart is the simplest of them all. Mainly because it’s the smallest geographical region to deal with. Naturally, origin airports in the south of the US will fare better here, so Miami, Dallas, Houston, San Diego, and Los Angeles should all be target airports for positioning flights.

It’s possible to grab a business class flight for just 40,000 points with an Aeroplan partner. To stay in that bracket, you’ll need to fly less than 2,500 miles, which gives you a good amount of scope. Miami to Bogota for example, is only 1,500 miles. Miami to Lima is just over that figure at 2,600 miles. The latter would be 50,00 points in business class—not too bad at all.

Availability is wide open on a lot of these flights. My first three searches all came up with economy and business class availability with Avianca at the rates mentioned above. The Peru flights were with Copa Airlines.

Use the 5,000-point stopover perk with the Aeroplan Award Chart

This is a tremendous way to maximize your points by adding in a separate destination for just 5,000 points. A stopover in this case is defined as a connection in one city lasting over 24 hours before moving on to the final destination.

Whatever the rate was for the original flight, you simply add 5,000 points and you don’t need to worry about the rate fluctuating because of the distance.

It’s one of the most flexible stopover perks around, and there are only a few rules you need to follow.

- The stopover cannot be in the US or Canada.

- You can’t backtrack through the same city.

- The total distance flown can’t be more than double the distance of the direct route.

- It can’t last longer than 45 days.

- You can do one stopover on a one-way itinerary, and two on a roundtrip.

This can be a huge deal as it can often mean two long business class flights on a single itinerary for just 5,000 more. Depending on the situation, you could save as much as 40,000 points in a single transaction.

You should also be careful to check the rates of both flights individually first, however. Because of the nature of Air Canada’s zonal charts, sometimes it can be better to avoid the stopover perk.

The point

Air Canada’s Aeroplan program is one of the best platforms for redeeming points and miles at maximum value, thanks to its extensive (and generous) geographical and distance-based award chart.

Read also: The Best Cook Islands Resorts and Hotels

by your friends at The Daily Navigator

by your friends at The Daily Navigator