Overview

Chase has an outstanding arsenal of points-earning credit cards gifting customers the opportunity to earn anywhere from 60,000 to 100,000 super-valuable Chase Ultimate Rewards® points from a single introductory bonus offer.

But so many of us have no idea how to maximize the value of a big Chase Ultimate Rewards bonus, squandering thousands on one horribly overpriced flight, and rationalizing it as a good thing because we saved a little money.

Don’t get me wrong, saving money is good. But if I told you instead of saving $400 on a flight to Los Angeles, you could save $750+ in direct value on flights to Asia or $10,000 in experiential value on an incredible business class flight, would you rethink your strategy?

In this piece, I’m going to show you how to maximize the value of a big Chase Ultimate Rewards bonus, as well as some other bits and bobs to ensure you understand what you’ve got at your disposal.

Why are Chase Ultimate Rewards points valuable

Before we get started, you need to grasp why Chase points are so valuable. To the uninitiated, it may make more sense to save up airline miles, like British Airways Avios, United MileagePlus, or Air Canada Aeroplan.

While those are helpful to have, it’s more helpful to understand that 75,000 Chase Ultimate Reward points can be converted into any of those airline points systems. Chase has 11 airline transfer partners and 3 hotel transfer partners. Generally speaking, using these partners strategically is how to maximize the value of a big Chase Ultimate Rewards bonus.

- Best for: Beginner Travelers

Chase Sapphire Preferred® Card

75,000 Bonus Points

Offer Details:

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Chase Sapphire Preferred Card is the ultimate all-around travel credit card—it fits perfectly into almost any points-earner’s wallet. Points novices can enjoy a significant intro bonus and easy to grasp spending categories with an approachable annual fee. The more experienced can utilize its high value earning potential as a secondary card and also gain access to Chase’s strong travel booking portal.

Reward details

5x on travel purchased through Chase Travel℠.

3x on dining, select streaming services and online groceries.

2x on all other travel purchases.

1x on all other purchases.

Pros & Cons

Pros

The $50 dollar hotel credit for stays purchased on the Chase Travel Portal already cuts the already approachable $95 annual fee significantly.

10% anniversary points boost – each account anniversary you’ll earn bonus points equal to 10% of your total purchases made the previous year.

Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

Along with all of the above, cardholders also have access to a string of travel protections like rental coverage, cancellation insurance, and purchase protection.

Cons

It’s subject to Chase’s 5/24 rule. So, if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Competing cards like the Capital One Venture have a better earning rate for non-bonus spend.

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

Terms Apply

Which programs can I transfer my Chase Ultimate Rewards points to?

Here’s a list of all Chase’s partners and the conversion rate between them.

Aer Lingus AerClub: 1:1

Air Canada Aeroplan – 1:1

Air France/KLM Flying Blue – 1:1

British Airways Avios – 1.1

Emirates Skywards Miles – 1:1

Iberia Plus: 1:1

IHG Rewards Points – 1:1

JetBlue TrueBlue Points – 1:1

Marriott Bonvoy Points – 1:1

Singapore Airlines KrisFlyer – 1:1

Southwest Airlines Rapid Rewards – 1:1

United Airlines MileagePlus Miles – 1:1

Virgin Atlantic Flying Club – 1:1

World of Hyatt points – 1:1

Each of these programs has pros and cons, with value to be found in different scenarios. I’m not a huge fan of ranking programs by value unless it’s clearly head and shoulders above the rest.

For example, World of Hyatt is miles better value than the other two hotel programs on the list because of its generous award chart system. But while British Airways Avios may not provide high value on long-haul routes leaving the UK, it can be incredible for partner flights in the US.

We call these reliable high-value redemptions “sweet spots.” Most airlines have a sweet spot or two (sometimes many more) that can make it a smart transfer choice. Learning these sweet spots and applying them in your scenario is how to maximize the value of a big Chase Ultimate Rewards bonus.

Sweet spots will make up the bulk of today’s list and should inform your points and miles strategy going forward.

What’s a Chase Ultimate Rewards point worth?

We’re going to dive right in and look at some of the best value redemptions Chase and its transfer partners can offer you. Some are incredible business class redemptions, while others are rock-bottom rates for economy flights that could fund you for a long time.

The goal of any redemption is maximizing the value of an individual point. We’ve estimated Chase Ultimate Rewards points to be valued at anywhere from 0.7-2 cents each. That’s a broad range and is representative of the ways you can use those points.

One thing to consider is the use of Chase’s own travel portal. In most situations, I’d never recommend using points on a credit card issuer’s portal, as the value is generally stuck at 1 cent per point. While it’s not terrible, it’s possible to get far better value by transferring.

Chase is an exception depending on the card you own. If you have the Chase Sapphire Preferred® Card in your wallet your points can be redeemed for 1.25 cents on the portal, while the Chase Sapphire Reserve® Credit Card affords you 1.5 cents per point.

By this reasoning, if the best redemption value you can find by transferring points is less than 1.5 or 1.25 cents per point respectively, you’re maximizing your points by booking on the Chase Travel℠ portal. If the transfer option is above 1.5 cents or 1.25 cents, you’re getting better value per point by moving them out of your Chase account.

How do we work out the value?

To work out the value of a Chase point (or any point) you need to do a quick calculation.

Find the cash rate of the flight you want to book.

Find the points rate of the same flight as well as the fees.

Deduct the fees from the cash rate.

Divide the cash rate by the points rate.

Multiply by 100 to get your cents per point value.

For example: We find a flight from New York to LA for $500 or 20,000 points plus $50 in taxes and fees.

We deduct $50 from $500 = $450.

We divide $450 by 20,000 points = 0.225.

We multiply by 100 = 2.25.

So in this situation, we’re getting 2.25 cents per point. That’s an excellent redemption. You can apply this to any points redemption with any airline.

Your personal value matters

Before diving into the best ways to maximize your points, it’s important to remember that the value of a point isn’t the be-all and end-all. If you’re truly maximizing your points, you’ll wait until you need a crazy high-value business-class flight. In that case, a $10,000 flight could be booked for 70,000 points, getting you an insane 14 cents per point.

But if you fly multiple times a year, that same bonus could earn you four or more economy flights at a 1.7 cents per point rate.

If that matters to you, then it’s high value.

Consider what your goal is for your points before booking. Now let’s get to it.

How to maximize the value of a big Chase Ultimate Rewards bonus

Let’s take a look at some of the best ways to maximize the value of your Chase intro bonus. In general, we should always be searching for outsized value in program sweet spots. Some of Chase’s transfer partners are more useful than others, so we’ll cover some of the big ones and the best options in each.

British Airways Awards

British Airways Executive Club has tremendous potential for your Chase points. While longer flights aren’t always the best option with them, multiple short-haul purchases are how to maximize the value of a big Chase Ultimate Rewards bonus.

British Airways operates a distance-based award chart, both for its own flights and its partners. This offers a ton of scope for funding a long Europe trip or even a Caribbean getaway.

Zip around Europe for $31

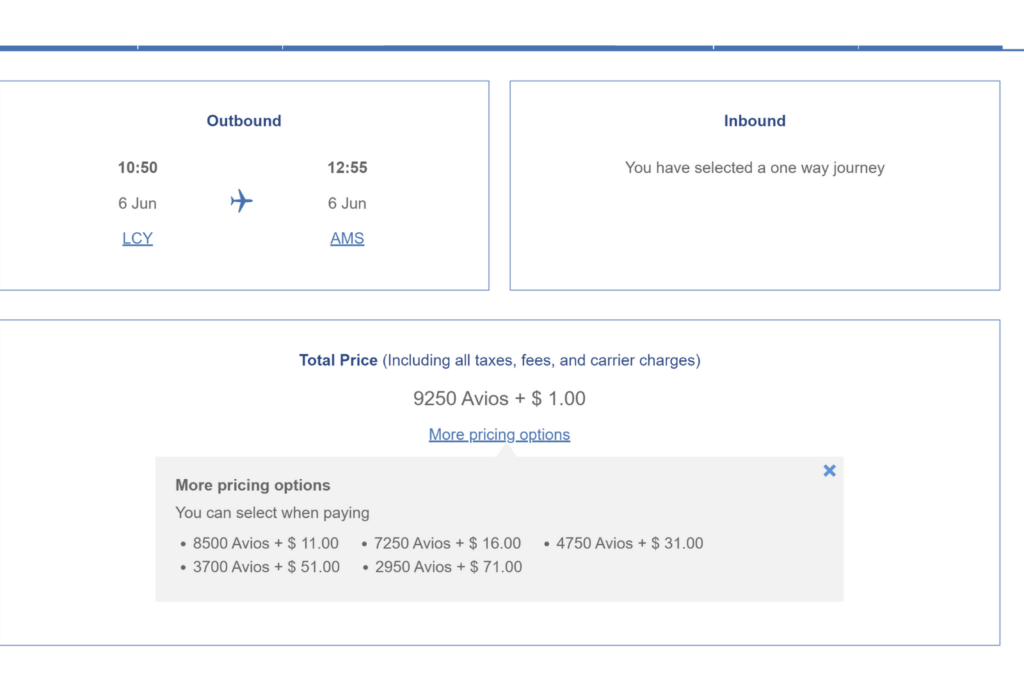

If you’ve got a Europe trip planned with London as your first destination, you can use British Airways’ super low rates to get to other destinations on the continent. The airline charges 4,750 Avios for flights up to 650 miles, then jumps to 7,250 Avios for the next bracket up to 1,150 miles.

Taxes and fees run at around $31, so it’s still costing a little. But remember you get baggage included on award flights, so even if you found a nice budget airline flight, you’ll probably still end up paying up to $100 in baggage or other nonsense.

Don’t be spooked by the first Avios rate you see. The airline has added alternate options with lower taxes. The best value option is to go for the 4,750 Avios option.

Fly to the Caribbean with American Airlines (then island-hop)

British Airways has a strong partnership with American Airlines and it can be wrangled into one of the best ways to get to the Caribbean. It uses a similar distance-based award chart to its own but with slightly different rates. Using this, it’s possible to fly to the Caribbean for as little as 8,250 miles. Taxes and fees will differ depending on where you go, but it’s still an excellent deal. You could even bump up to business class for 16,500 Avios.

A cheeky hack to see more of the Caribbean is to use BA’s island-hopper deals. Flying between islands can be frustratingly expensive for such short flights, but British Airways operates fifth freedom flights within the Caribbean using aircraft that have flown from London.

Fifth freedom flights are simply routes operated by a carrier that doesn’t start or finish in its own country. British Airways operates several of these flights in the Caribbean to add more profit and expand its base. For example, it might run a once-weekly flight to St. Kitt’s from London, and fly three flights within the islands before it returns to the UK.

In this scenario, the airline prices its award rates the same as its European flights, so you can fly between the islands for the same 4,750 Avios rate if it’s under 650 miles. That’s a pretty awesome deal.

How to maximize the value with a huge Qsuite flight on Qatar Airways

On the other end of the spectrum from Britsh Airways’ short-haul economy and business flights, we have a long-haul flight on one of the most luxurious business class seats on the market—Qatar Airways’ Qsuite.

Firmly in the spectrum of aspirational travel experiences, the Qsuite can be ludicrously expensive to book in cash. Prices regularly hit $10,000 one-way for a flight from New York to Doha, making it impossible for the majority of us to sensibly book that route.

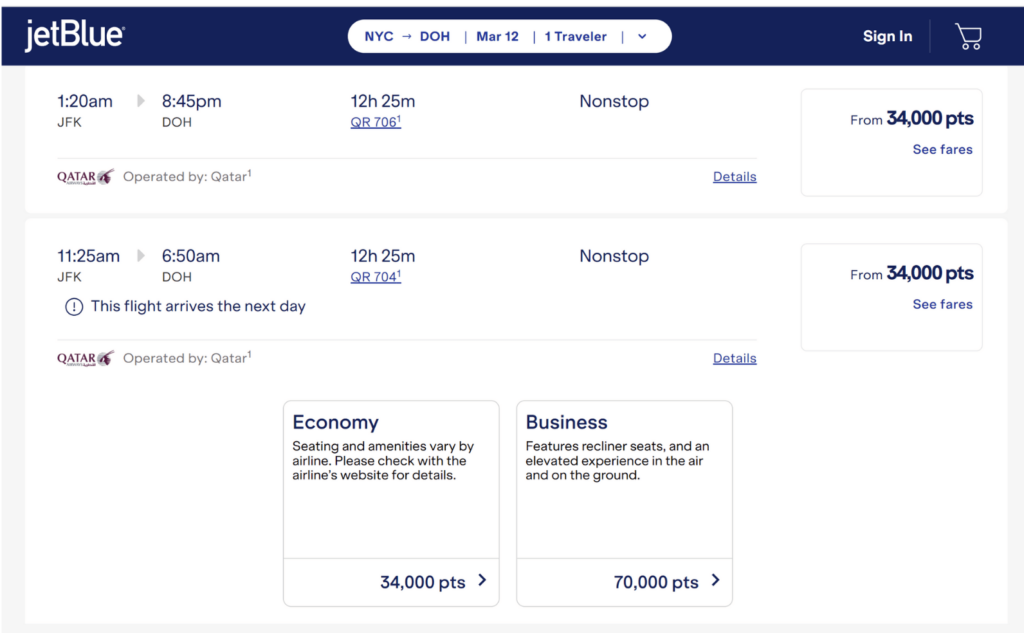

But with just 70,000 Chase Ultimate Reward points, you can book that $10,000 flight for just $7.50.

Qatar flights can be booked on two of Chase’s transfer partners:British Airways and JetBlue. Both will offer the same rate of 70,000 but British Airways passes on more taxes and fees (around $100) while JetBlue offers the rock-bottom $7.50 mentioned above.

How to book a Qsuite with JetBlue

I’d recommend checking out our article diving into the Qsuite to get all the details but, in general, the toughest aspect of booking the Qsuite is finding availability. To get around the energy-draining search process, head to the American Airlines website and search there using its award availability calendar.

Instead of searching for individual dates, you can skim through each month until you see some availability open. The further in advance you can search, the better. I’m talking a year in the future.

How to maximize the value with World of Hyatt

Generally speaking, flight redemptions offer far more value than hotels. World of Hyatt may be one of the few exceptions to this rule.

Again, technically speaking, unless you’re redeeming at an extremely expensive hotel, the cent-per-point rate may still be lower, but the sheer generosity of Hyatt’s award chart means its experiential and convenience values are through the roof.

Why is World of Hyatt so valuable?

While most other hotels shifted to a dynamic pricing model years ago, World of Hyatt retains its easy-to-understand award chart. While it has made some negative changes recently, the overall value remains strong. Chase is the only credit card issuer that allows transfers to Hyatt.

Hyatt classifies each of its properties on a scale from 1-8, with 8 being the highest-rated and most luxurious hotels and 1 being the more budget-friendly options in cheaper markets. From there, it assigns an off-peak, standard, and peak-time nightly rate to its standard, club, suite, and premium suite rooms. So really, it has four award charts.

Standard room off-peak rates at Category 1 hotels start at just 3,500 points a night, with a premium suite peak time rate in a Category 8 property hitting 90,000 points. Everything else falls between those numbers.

While that seems like a huge gap, 90,000 points for an ultra-luxury Hyatt property is a great deal when compared with similar Hilton or Marriott hotels. I’ve seen Hampton Inns priced at 90,000 Honors points before.

What kind of properties can you book?

High-end luxury for huge value

At the high end of the scale, there are hotels like the Ventana Big Sur. This remarkable hotel often costs you over $2,000 a night for a standard room. Using points, it’s possible to grab an off-peak award rate of just 35,000 points a night.

Fuel an entire trip with Category 1 hotels

Don’t think that just because a property is Category 1 it’s not amazing. The key to finding unbelievable hotels in this bracket is looking at cheaper markets abroad. In the US, these hotels might be more limited to airport hotels or smaller market destinations, but abroad, they can be epic.

Remember, off-peak rates start at 3,500 points. If you can string enough of them together, you could stay at one of these hotels for 17 nights. For free.

The Park Hyatt in Chennai, India is a perfect example of this. It’s the only Park Hyatt in the Category 1 bracket and the only Category 1 hotel to feel 10 times more luxurious. Sure, it’s an odd market, but if you’re a savvy saver, you can be open to new adventures. For 3,500 a night, it’s worth a look.

- Best for: Business Travel

Chase Ink Business Preferred® Credit Card

100,000 Bonus Points

Offer Details:

Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

Why we like it

The Ink Business Preferred Business Card pulls attention with its big intro bonus, currently sitting at 100,000 points. That’s worth in $1,000 cash back, $1,500 toward travel when redeemed through Chase Travel℠, or even more when transferring to Chase’s travel partners like Hyatt, United Airlines, British Airways and more. But the card shows its real value with its high-earning bonus-spending categories. Freelancers and business owners alike will earn 3 points per dollar on the first $150,000 spent on travel and select business categories each account anniversary year.

Reward details

3X points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

1X point per $1 on all other purchases – with no limit to the amount you can earn

Pros & Cons

Pros

-

Simply put, for small business owners and freelancers, it’s one of the best cards for turning business spending into valuable travel.

-

It also offers some stellar protections including a comprehensive reimbursement on damaged or stolen cell phones, and primary rental car coverage.

-

It has a reasonable $95 annual fee.

-

If you have another Chase card like the Sapphire Preferred or Reserve, or even a cash back earning Chase card, you can pool your points and make them more valuable.

Cons

-

It does lack some of the juicier benefits attached to other business credit cards like The Business Platinum Card® from American Express. But with the low fee, it’s hard to argue with its value proposition.

-

It’s subject to Chase’s 5/24 rule. So if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Terms Apply

How to maximize the value with Iberia

Iberia is an underutilized airline in the grand scheme of things. The Spanish carrier only really comes into the equation when considering Spain and because of this, many pass over the value of its transatlantic rates.

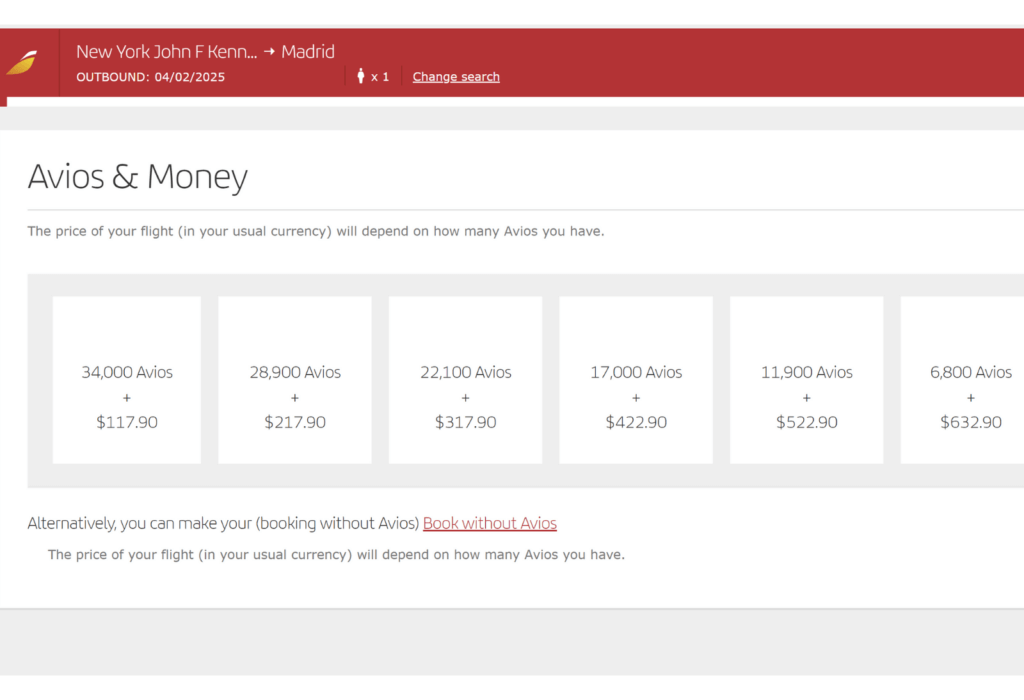

Fly in a lie-flat business class seat to Europe for 34,000 points

Widely regarded as one of the best deals in the points and miles world, it’s possible to book a business class lie-flat seat from the US for just 34,000 Avios each way*.

There are some caveats to this:

- You’ll only be able to book the flights from select airports like JFK, Chicago O-Hare, and Washington Dulles.

- You’ll only be able to fly into Madrid or Barcelona.

- You need to use off-peak rates. The standard and peak rates will jump up to at least 50,000 points each.

If you can find availability, you’re in for a treat.

Roundtrip economy flights to Europe for 34,000

Keeping with the same rough rates, you can book a roundtrip ticket in economy for just 34,000 Avios from the same airports. While it’s not getting you quite as high a cent-per-point value compared to the business class redemption, you’ll still be able to cover the cost of flying yourself to Spain with a hefty Chase bonus.

Again, these are off-peak rates, so it’s best to find the flights at that rate first, and then plan your trip around them.

- Best for: Luxury Travel

- Annual Fee: $795

- Variable APR: 19.49% - 27.99% Variable

- Reward Rate: 1X - 10X

- Recommended Credit: 740-850

Chase Sapphire Reserve®

125,000 bonus points

Offer Details:

Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

Why we like it

This card just got a major re-vamp and you can now get more than $2,700 in annual value with Sapphire Reserve!

Reward details

8x points on Chase TravelSM

4x points on flights and hotels booked direct

3x points on dining

1x points on all other purchases

Pros & Cons

Pros

-

The points are worth up to 2 cents a piece when used directly on Chase’s Ultimate Rewards Portal, offering a simple but high-value use for your points.

-

Plenty of excellent transfer partners allow points to be maximized

-

Some excellent partnerships with Doordash and Lyft add to its value.

-

Priority Pass membership allows access to over 1,300+ airport lounges and restaurants.

Cons

-

It’s subject to Chase’s 5/24 rule. So if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

-

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

Terms Apply

How to maximize the value with a business class seat on the longest flight in the world

The longest flight in the world currently clocks in at just under 19 hours on average. It’s operated by Singapore Airlines and flies between New York’s JFK and Singapore’s Changi Airport. It’s an absolute monster of a flight, and despite Singapore Airlines being one of the best carriers in the world, it’s not one you want to spend in economy.

Singapore’s business class is rivaled only by Qatar’s, with the Southeast Asian nation’s flagship airline renowned for its impeccable service and attention to detail. You could transfer your Chase points to Singapore and book a business class seat for around 108,000 points.

Or, you could opt for Air Canada’s Aeroplan instead. The Canadian carrier partners with Singapore and offers the same flight for just 87.5 thousand points. That’s a 20,000-point saving that you could put to good use with a flight to the Caribbean or four short-haul flights in Europe.

One of the big things about business class, especially if you’re doing it for the experience, is getting enough time to take it in. With a 19-hour flight, you get more than ample time to take in the food, the service, the entertainment, and all that with a full eight hours of sleep in a lie-flat seat.

It’s important to note that Singapore Business Class is different from Singapore Suites. If you want to try and book a suite, you can only do so on Singapore’s KrisFlyer portal. The same route in a suite would cost closer to 150,000 points.

Opportunistic deals

All the options we’ve covered thus far are based on sweet spots. This means they’re fairly reliable and can be counted on if the specifications are met (i.e., peak times, location, etc).

Other times, however, opportunity comes a-calling, and you might find yourself with an excellent chance to maximize the value of a big Chase Ultimate Rewards bonus. Of course, if you haven’t opened a card yet, these tips might not be there by the time you earn the bonus.

Air France/ KLM Flying Blue Promo Rewards

Flying Blue does have some strong rates regularly, but the dynamic nature means sometimes you’re unable to maximize your points. However, the program releases monthly Promo Rewards, offering sale prices from select airports that can often offer exceptional value.

At the time of writing, there are economy flights from Chicago and Boston to Europe for 15,000 Flying Blue miles and a business class flight from Montreal to Europe for 37,500 miles. I’ve seen plenty of similar rates from American airports in the past. Make a point to check the promo page regularly and see if you can take advantage.

United Airlines Featured Awards

United Airlines is actually an extremely valuable transfer partner for Chase Ultimate Reward points. It’s a dynamic system, which means rates can fluctuate and, on the whole, rates have gone up since it ditched its award chart.

But, in a similar manner to Flying Blue, United has a “Featured Awards” section. Select destinations and cabin classes will have reduced rates on specific dates. Simply select the origin airport that applies to you, then see what’s available. You’ll be able to scan a pricing calendar, too, to give you a bit more flexibility.

Transfer bonus offers

While this isn’t necessarily a sweet spot, it’s an important concept to take into account. If an airline and Chase agree to a 25% transfer bonus, you’re getting more value for your money.

Using the Qsuite flight from earlier, if Chase and JetBlue agreed on a 25% transfer bonus (they have in the past), you’d only be spending 64,000 points on that unbelievable experience. Always keep up to date on the bonuses.

Should you ever use the Chase Travel portal?

This is one of the few times where we can say the travel portal isn’t a bad option. Here are a few times you may opt to use the portal and why.

- There’s no availability on the dates you need and you have no flexibility. The Chase Travel℠ portal has no blackout dates, so you’re not bound by award availability.

- The award rate is more than the travel portal rate. Check how many points you’d need, considering the 1.5, 1.25, or 1 cent per point value you’ll get from your card on the portal. That can change things drastically.

- If they’re close in price, consider how many points or elite markers you’ll earn by opting for the travel portal. You don’t earn on award flights; you do on the portal.

The Point

Having a hoard of Chase points is a valuable thing. How to maximize the value of a big Chase Ultimate Rewards bonus is an even more valuable thing. Its diverse range of transfer partners offers the best opportunity to earn outsized value for your points, but even the Chase Travel℠ portal has its merits.

by your friends at The Daily Navigator

by your friends at The Daily Navigator