- What is a Qsuite?

- How to book flights to Qatar in a Qsuite with points and miles

- How to book Qsuite flights to Qatar with Qatar Airways for $100

- How to book Qsuite flights to Qatar with British Airways for $100

- How to book Qsuite flights to Qatar with American Airlines for $7.50

- How to book Qsuite flights to Qatar with JetBlue for almost nothing

- Conclusion

What are travel credit cards, and how do they work?

Travel credit cards are financial products that offer various rewards and benefits geared towards frequent travelers. They typically earn you points or miles for every dollar spent on eligible purchases. These rewards can be redeemed for flights, hotel stays, car rentals, and other travel-related expenses. Travel credit cards may also include perks like travel insurance, airport lounge access, and no foreign transaction fees.

How do I choose the best travel credit card for my needs?

Choosing the best travel credit card depends on your travel habits, spending patterns, and preferences. Consider factors like the type of rewards offered (points, miles, or cash back), the card’s annual fee, sign-up bonuses, earning rates, redemption options, and additional travel perks. Analyzing these features will help you find a card that aligns with your lifestyle and offers the most value.

What are the benefits of using a travel credit card over other types of credit cards?

Travel credit cards provide unique advantages for travelers, such as earning rewards specifically tailored to travel expenses. Additionally, many travel credit cards offer travel-related perks like free checked bags, priority boarding, and travel insurance. Some cards also waive foreign transaction fees, making them ideal for international travelers.

What is a sign-up bonus, and how can I qualify for it?

A sign-up bonus is a promotional offer provided by the credit card issuer to entice new cardholders. To qualify for a sign-up bonus, you usually need to meet specific spending requirements within a certain timeframe after opening the account. The bonus can be in the form of points, miles, or cash back, and it’s a great way to jump-start your rewards earning.

Do travel credit cards charge foreign transaction fees?

Not all travel credit cards charge foreign transaction fees. Many of the top-tier travel cards waive these fees, making them ideal for international travel. However, it’s essential to read the card’s terms and conditions to confirm this before using it abroad.

How can I maximize the rewards earned with my travel credit card?

To maximize rewards, use your travel credit card for everyday expenses and large purchases. Take advantage of bonus categories and special promotions to earn more points or miles. Consider combining your travel credit card with loyalty programs to stack rewards and get even more value out of your purchases.

Flights to Qatar don’t often come cheap. Flights to Qatar in Qatar Airways’ industry-leading Qsuite business class never come cheap.

Unless you’re using points and miles, of course. In that case, they often come for less than a few hundred dollars.

No clue where to start? Fear not; today we’ll be diving head first into how you can redeem your hard-earned points and miles for one of the most luxurious plane seats on the market. We’ll take you through the entire process from start to finish, including the best credit cards to use to earn those flights to Qatar in no time.

What is a Qsuite?

A Qsuite is Qatar Airways’ high-end business-class product. On top of the renowned Qatar Airways in-flight service, passengers enjoy arguably the coolest pods on the market, with options for single, twin, double, and quad layouts depending on who you’re traveling with.

The layout means every seat has aisle access, so no clambering over anyone to go to the bathroom, and the dining options are unbelievable. Many regular travelers opt for a Qsuite over other airlines’ first-class products—it’s that good.

They’re a tremendous product, and few who have flown in it disagree with its recent “World’s Best Business Class Title.” If you’re not sure what to expect, you can have a 360-degree-tour of a suite here.

Keep an eye out for developments, though, as Qatar has announced it is working on a Qsuite 2.0 and an enhanced First Class experience above it. Exciting times.

Does every Qatar Airways flight have Qsuites?

No, and this is important for you to understand when searching for your seat.

Currently, only the following aircrafts can have Qsuites:

- Every Airbus A350-1000

- Select Airbus A350-900s

- Select Boeing 777-200LRs

- Select Boeing 777-300ERs

If you’re flying on a different type of aircraft, you’ll be stuck with the basic business class, and often an even older business class product. These are still great, but it’s nowhere near as strong as the Qsuite itself.

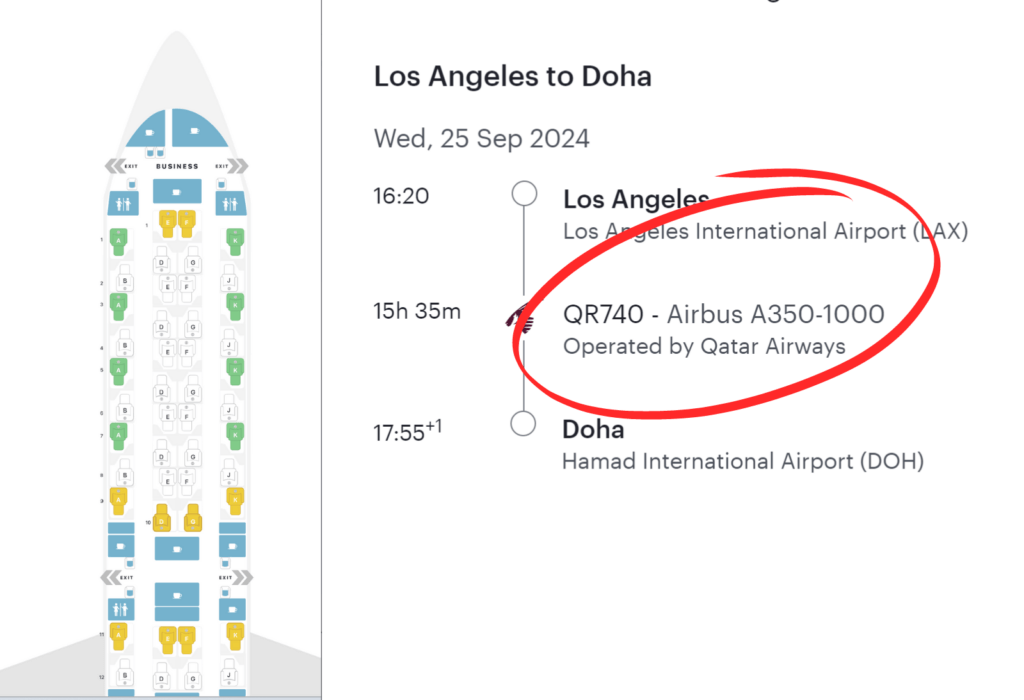

When booking directly with Qatar Airways, flights equipped with a Qsuite layout will display so above the flight details on the search results page..

If you’re booking with a partner, it’s not always as clear. While some closer partners may highlight which flights operate the Qsuite, most will only state “Business Class.”

In this case, you have a few options.

First, click on the flight details and check the aircraft model. If it’s not listed as either an Airbus A350 or Boeing 777, you do not have a Qsuites option on board.

If it’s an Airbus A350-1000, it has a Qsuite configuration, and you can book.

If it’s one of the other three options, you can do one of two things.

- Grab the flight number (eg. QR 756), and head to a layout website like SeatGuru. Enter the flight number, airline, and date, and check the seating layout. It should state “Qsuite Configuration” in the details. If not, the seating chart should show a staggered 1-2-1 layout as shown below.

- Alternatively, head to Qatar Airways’ website and make the same search. Locate the exact same flight by checking the flight number. If the flight has a Qsuite configuration, it will state so above the flight.

Be aware that the airline can switch or alter the scheduled aircraft at any time, so make sure to check every so often as your travel date approaches.

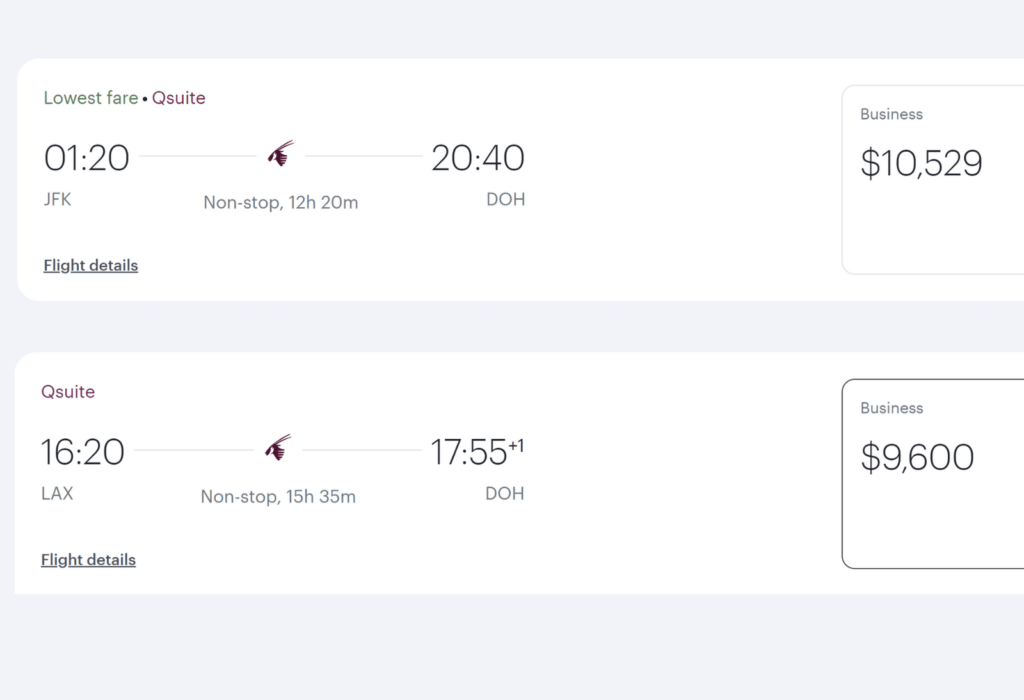

How much do flights to Qatar in a Qsuite cost?

To help understand how much value you can squeeze from your points and miles, it’s best to take a look at the cash price of flights to Qatar in a Qsuite. As you can see from the image below, your best-case scenario is a whopping $9,600 from LAX or over $10,000 from JFK.

Those are insanely expensive tickets the vast majority of us wouldn’t dream of spending, even if we had the money. This should offer you a good indicator of how much value you’ll be gaining by using points and miles—even if you still have some hefty taxes with some options.

How to book flights to Qatar in a Qsuite with points and miles

While booking flights to Qatar with cash is virtually impossible for many of us, points and miles offer us a lot more scope. Qatar Airways has several high-value partners and some decent sweet spots to take advantage of, allowing us to get $10,000 flights to Qatar for a fraction of the price.

Qatar Airways is a member of Oneworld alliance, gifting us some strong partners to book Qatar flights with. As with many popular business-class products, the greatest hurdle to booking a Qsuite seat is award availability.

Read also: The Best Airline Credit Cards of 2024

Award availability for flights to Qatar in a Qsuite

This is when things get complicated. Booking flights with cash is a simple process. There are a ton of seats available on most days—you just need the money to pay for them. Award availability on the other hand is scarce for premium products.

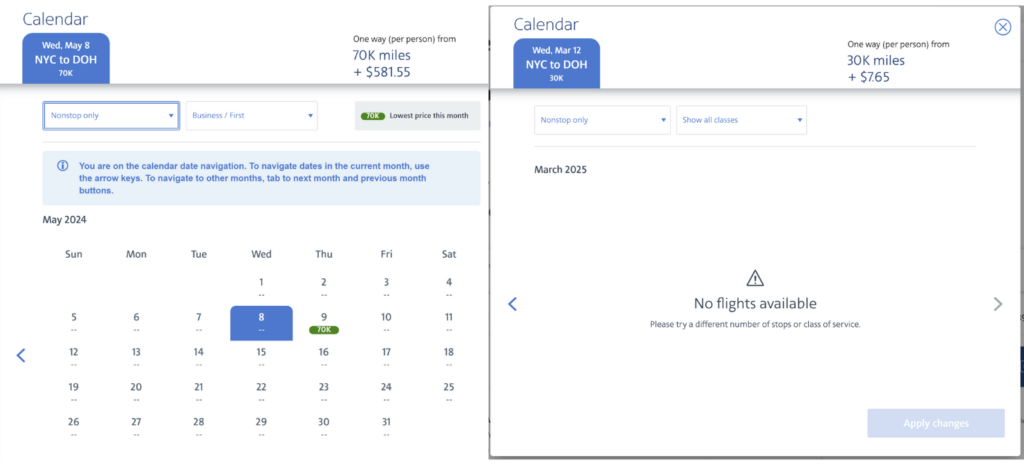

All airlines dedicate a specific number of seats on a flight to award redemptions, but this can change on a whim. In some cases, it’s impossible to find any award availability for a specific product for months at a time. This can be an immense frustration, but patience typically pays dividends in this case.

The best advice is to be as flexible as possible. It’s unlikely the perfect seat will fall upon the exact date you want it to. I’ve done some pretty thorough searching for this year and only found a handful of dates with any availability at all.

However, when we stretch the search parameters all the way to March 2025, we suddenly get a healthier chunk of availability. Therein lies your power—plan a long time out (almost a year), and be flexible with those dates. The single best time to book is the moment Qatar Airways releases its future availability. That’ll require you to either check regularly or keep up to date with online resources.

How to find award availability for flights to Qatar in a Qsuite

As odd as it sounds, the best way to search for Qatar Airways award flights isn’t on the Qatar Airways portal. For reasons unbeknownst to us, the airline prevents customers from viewing award availability unless they have Avios in their account.

You could, in theory, move some points into your account but if every one of them is precious (as it should be), you can use other platforms instead.

British Airways, which also uses Avios, is your best bet for finding Qatar’s availability. Better yet, it’ll have the same rates, so you could book with British Airways too if you can’t transfer to Qatar.

An alternative is American Airlines, but care should be taken with this platform. While it’s correct most of the time, I, and many others, have found multiple discrepancies. One advantage of the American Airlines AAdvantage portal is the calendar view. You can use it to see a broader overview before diving in for a closer look at specific dates.

How to book Qsuite flights to Qatar with Qatar Airways for $100

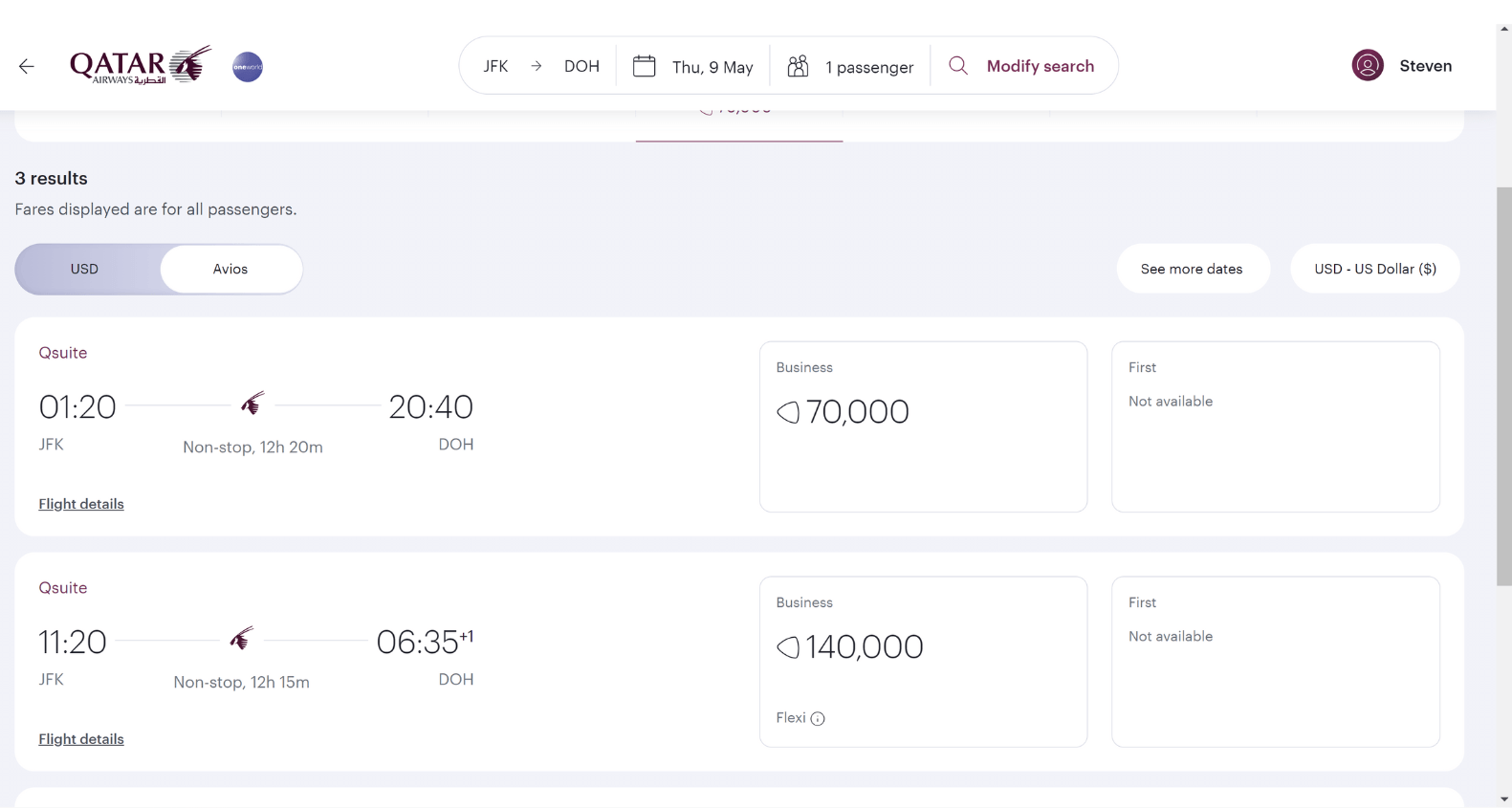

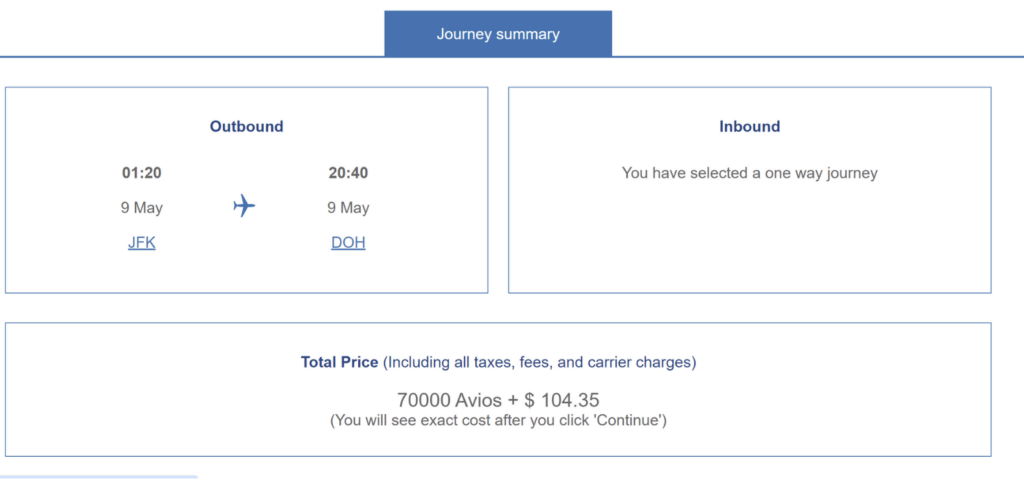

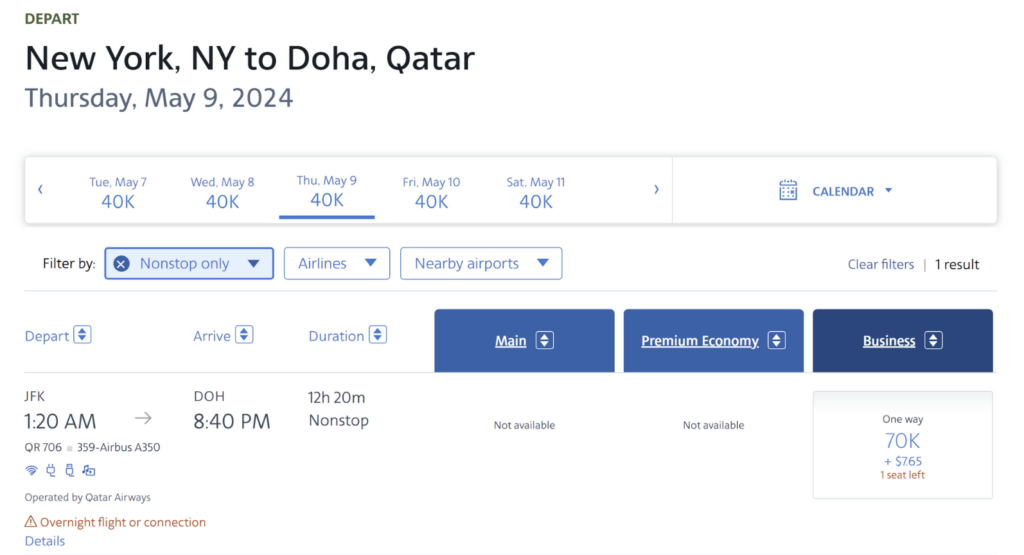

First, we’ll take a look at the Qatar Airways booking platform itself. Thankfully, once the availability issue is solved, you’ll be able to book flights from the US to Doha for just 70,000 Avios and around $100.

Alternatively, if you’re desperate to fly in a Qsuite on a specific date and are okay with losing value, Qatar also offers “flexi” flights. These open up when traditional award availability has run out (or was never there). You’ll generally find these set at double the Avios rate. So you’d expect to pay around 140,000 Avios for a Qsuite flight in this situation. While this is obviously not as strong a value as 70,000, you’re still getting around 7 cents per point on a $10,000 flight, which is tremendous value.

As I mentioned before, you won’t be able to see the availability inside your Qatar portal until you have Avios in your account so it’s best to follow these steps.

- Search for award availability with British Airways or American Airlines.

- Transfer the required points from your credit card or airline account (if needed).

- You can transfer points to Qatar Airways from American Express and Citi.

- You can also move points freely between other Avios-using airlines like British Airways, Aer Lingus, and Iberia. In turn, this means if you don’t have Amex or Citi, you can use Chase or Capital One to move them first to British Airways, then to Qatar.

- Redo the search on Qatar Airways’ booking portal, selecting “Use Avios” before searching.

- Click the desired flight and complete the Avios payment process.

It’s important to remember you need to move points into the account as soon as you’re ready to book. Leaving a few days or even hours between your initial search could mean the availability disappears. Once points leave your credit card account, they’re not coming back.

Which credit card’s intro bonus could earn you those flights to Qatar?

American Express Platinum Card®

The Amex Platinum is the perfect choice for earning you enough points to transfer to Qatar Airways and redeem a flight in a Qsuite. Its current as high as 175,000-point intro bonus would even give you 20,000 points left over.

To hit that intro bonus, you’ll need to spend $8,000 within six months of opening the card. Not bad considering the flight would cost $10,000 in cash,

- Best for: Luxury Perks

American Express Platinum Card®

As high as 175,000 Membership Rewards® Points

Offer Details:

You may be eligible for as high as 175,000 Membership Rewards® points after you spend $12,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Why we like it

The Amex Platinum was once the sole dominating force in the luxury credit card space. While it now faces some stiff competition, it still offers unbeatable perks like unprecedented airport lounge access, elite status at Hilton and Marriott, and some outstanding statement credits making the mammoth $895 worth it for some.

Reward details

Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings.

You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

Pros & Cons

Pros

-

Large intro bonus

Incredible lounge access

-

Statement credits worth over $3,500 annually.

-

Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

Cons

-

The $895 annual fee is brutally high. Too high for many that can’t, or don’t want to take full advantage of its benefits.

-

Points-earning rates are low unless spending directly on flights or with the Amex Portal.

-

Some of the benefits, like travel credits, are more limited and are harder to use than competing cards’ offerings.

How to book Qsuite flights to Qatar with British Airways for $100

The second option for booking flights to Qatar in a Qsuite is British Airways Executive Club (BA). As shown in the previous section, BA is one of the best ways to search award availability for Qatar Airways and, after Qatar joined Avios, it matched Qsuite rates.

In theory, you’ll have access to the same award availability at the same 70,000 Avios rate plus $100 or so in taxes and fees. Systems can sometimes freak out a little, though, so if something doesn’t appear on BA, double-check on Qatar and American and contact the Executive Club. The main difference here is the lack of Qatar’s “flexi” rates, so you’ll only have access to traditional availability.

To book flights to Qatar with British Airways, follow these steps.

- Log into your British Airways Executive Club account.

- Hover or click on the “Book” dropdown menu and select “Book a flight with Avios.”

- Search for your intended dates and route.

- Find your flight and note down the required Avios.

- Transfer Avios into your account (if needed).

- Chase, Capital One, American Express, and Bilt all transfer points to British Airways.

- As with Qatar Airways, you can share Avios between airlines that use the same system.

- Select your flight and complete the purchase.

Which credit card’s intro bonus could earn you those flights to Qatar?

Capital One Venture X Rewards Credit Card

Hitting that 70,000-point mark with Qatar Airways is easy with the Capital One Venture X. This brilliant travel card offers a 75,000-mile intro bonus after spending $4,000 within 3 months of opening the card.

While you won’t need extra lounge access when you fly in a Qsuite as it comes with the ticket, you’re sorted for your next trip as it comes with a complimentary Priority Pass membership, too.

- Best for: Overall Travel

Capital One Venture X Rewards Credit Card

75,000 Bonus Miles

Offer Details:

Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

Why we like it

The Capital One Venture X is a direct competitor to the Chase Sapphire Reserve, and for many seeking a simpler earning scheme with premium perks, it could be the better option. But the Venture X truly shines with one benefit in particular: four free authorized users. Plus, every year on your cardholder anniversary you get 10,000 points to use for travel.

Reward details

10 Miles per dollar on hotels and rental cars booked through Capital One Travel

5 Miles per dollar on flights and vacation rentals booked through Capital One Travel

2 Miles per dollar on every purchase

Pros & Cons

Pros

-

Its great intro bonus of 75,000 miles is worth well over $1,000 when transferred to partner airlines and hotels, or a flat rate $750 when redeemed on the Capital One Travel Portal.

-

Cardholders get a bonus of 10,000 miles each year after their first account anniversary, which is nothing to shrug off, especially when a little bit short of that business class flight. It’s worth almost $200 depending on how you use it.

-

The $300 annual credit for purchases made on the Capital One Travel Portal, combined with the yearly free miles, more than annul the $395 annual fee.

-

Four authorized users can be added for free.

-

Enjoy access to 1,300+ lounges worldwide, including Capital One Lounge locations and participating Priority Pass™ lounges, after enrollment

-

A generous offering of travel insurance, protections and reimbursements round out an excellent array of benefits.

Cons

-

The $300 credit is a bit less flexible than the Chase Sapphire Reserve’s comparable benefit.

-

Miles earning is the same as the Sapphire Reserve on portal-based purchases, but less on general travel spending.

-

Capital One transfer partners are solid, but still don’t include any US-based airlines or hotels.

Terms Apply

How to book Qsuite flights to Qatar with American Airlines for $7.65

Using American Airlines is a similar process to British Airways’ system. There’s a good chance you’ll have used both airlines to search for Qsuite award availability. There are two things to consider when using American Airlines:

- Its miles aren’t as simple to earn unless you have a co-branded card or fly regularly with the airline.

- Its partner award availability can be different from Qatar and British Airways.

The first problem can be solved by opening a co-branded card and hitting the intro bonus. Otherwise, you should opt for British Airways or Qatar.

The second problem is more frustrating but that doesn’t mean it can’t be solved. If award availability doesn’t match up, collect any pertinent information, like flight numbers, dates, and award rate, and call American Airlines AAdvantage. You should be able to book over the phone with an agent. If it’s not the case, there’s a good chance the availability doesn’t exist. This is nicknamed “phantom availability.”

Which credit card’s intro bonus could earn you those flights to Qatar?

Citi® / AAdvantage® Executive World Elite Mastercard®

American Airlines AAdvantage miles can be tricky to earn if you’re not flying regularly with the airline or one of its partners. But opening a cobranded card like Executive World Elite Mastercard is a workaround. It does have a big spending threshold of $7,000 within three months of opening the card, but the 70,000 miles you’ll earn will get you the Qsuite—as well as access to the Admirals Club.

- Best for: American Airlines Fans

- Annual Fee: $ $0 intro annual fee, $99 after the first year

- Regular APR: 20.74% - 29.74% (Variable)

- Reward Rate: 1X - 2X

- Recommended Credit: 690-850

Citi®/AAdvantage® Platinum Select® World Elite Mastercard®

50,000 Bonus Points

Offer Details:

50,000 American Airlines AAdvantage bonus miles after you spend $2,500 on purchases in the first 3 months from account opening.

Why we like it

The Citi® / AAdvantage® Platinum Select® World Elite Mastercard® is a strong airline-centric card to have in your travel toolbox if your main airport is an American Airlines hub like Boston, Chicago, Dallas, or Charlotte, or if you just have a preference for the airline. Regular business travelers may want to upgrade for luxury perks like lounge access, but for everyone else, the low annual fee, 50,000 point intro bonus, solid miles-earning categories, and free checked bag perks are more than enough to validate the space in your wallet.

Reward details

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, and on eligible American Airlines purchases

Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases

Pros & Cons

Pros

The strong 50,000-point intro bonus is worth as much as $750, earned after spending $2,500 in three months.

Cardholders and up to four companions can enjoy a free first checked bag on any domestic American Airlines flight, comfortably justifying the $99 fee when used.

The card earns 2X miles for gas and dining purchases

Each eligible mile earned with the card also earns a loyalty point towards American Airlines elite status

A generous 25% discount on in-flight purchases when using the card round out the benefits

Preferred boarding on American Airlines flights

Cons

American Airlines miles can’t be transferred to other airlines or hotels (although they can be used to book AA partner flights)

Premium perks are reserved for pricier cards

Terms Apply

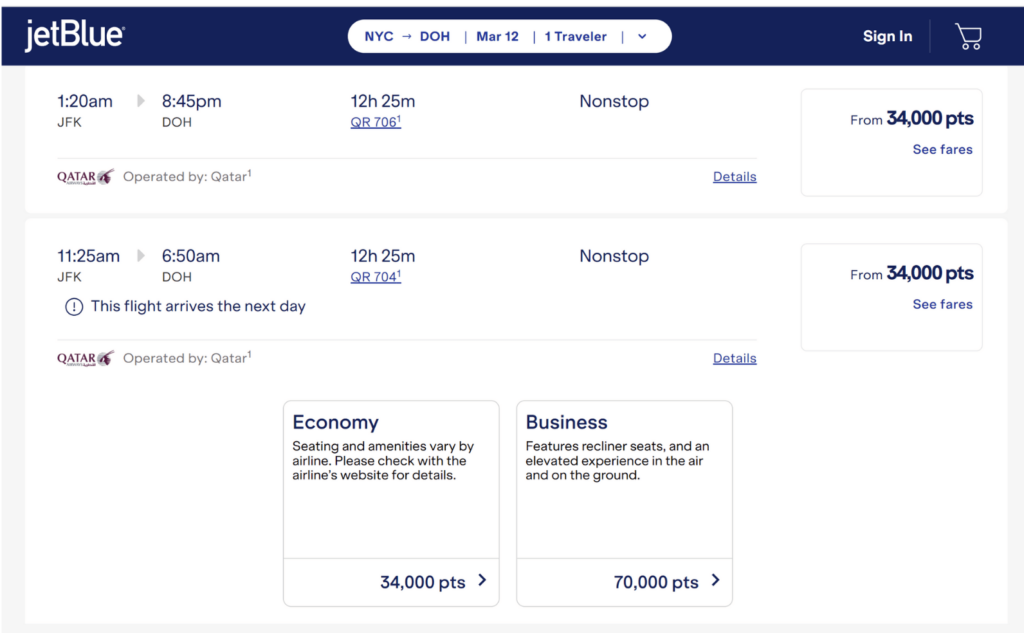

How to book flights to Qatar with JetBlue for almost nothing

The final option for booking flights to Qatar in a Qsuite is JetBlue TrueBlue. This one might surprise you, as it’s not generally considered a super-high-value airline for its partner flights. However, the airline has had a direct relationship with Qatar since 2013 and recently added the ability to book Qatar award flights using TrueBlue points.

The rates are set at the same as British Airways and American’s, so you’ll be looking at 70,000 TrueBlue points to grab a Qsuite. Here’s how to do it.

- Search for Qsuite availability using British Airways and American Airlines.

- Find the exact date and flight you want.

- Replicate the search on JetBlue’s portal and find the same flight. Ensure it’s listed before transferring points.

- Transfer the required points to your TrueBlue account.

- American Express, Citi, and Chase all transfer to TrueBlue

- Redo the search one more time and complete the purchase

Which credit card’s intro bonus could earn you those flights to Qatar?

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred’s current intro bonus of 75,000 points will come up over your goal. But keep in mind that to hit the bonus, you’ll need to spend $5,000 within three months of opening the card. Depending on your spending habits, its 3x points per dollar on dining and 2x points per dollar on travel will give you even more points to spare.

- Best for: Beginner Travelers

Chase Sapphire Preferred® Card

75,000 Bonus Points

Offer Details:

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Chase Sapphire Preferred Card is the ultimate all-around travel credit card—it fits perfectly into almost any points-earner’s wallet. Points novices can enjoy a significant intro bonus and easy to grasp spending categories with an approachable annual fee. The more experienced can utilize its high value earning potential as a secondary card and also gain access to Chase’s strong travel booking portal.

Reward details

5x on travel purchased through Chase Travel℠.

3x on dining, select streaming services and online groceries.

2x on all other travel purchases.

1x on all other purchases.

Pros & Cons

Pros

The $50 dollar hotel credit for stays purchased on the Chase Travel Portal already cuts the already approachable $95 annual fee significantly.

10% anniversary points boost – each account anniversary you’ll earn bonus points equal to 10% of your total purchases made the previous year.

Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

Along with all of the above, cardholders also have access to a string of travel protections like rental coverage, cancellation insurance, and purchase protection.

Cons

It’s subject to Chase’s 5/24 rule. So, if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Competing cards like the Capital One Venture have a better earning rate for non-bonus spend.

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

Terms Apply

Some points to consider

Economy flights to Qatar

This article is dedicated to finding Qsuites, but it’s far simpler to grab an economy flight. Award availability for the premium product is incredibly scarce but economy seat award availability is wide open for most of the year.

Using any of the options we’ve mentioned above, you can find a one-way from the US for 35,000 points plus taxes and fees. You’re not getting the luxury experience, but that’s an impressive rate all the same.

Origin in the US

While I’ve used examples from New York, Atlanta, and LAX, all the advice above applies to any airport served by Qatar Airways. The 70,000-point rate can be used on either coast. In some cases, you may have a layover—some LAX routes, for example, have a traditional business class for the first flight to Miami, then the full Qsuite experience from MIA to Doha.

The point

Qatar Airway’s Qsuite is the pinnacle of in-flight luxury and is widely hailed as the best business-class product in the world. While cash rates soar over $10,000 for one-way flights to Qatar, it’s more than possible to grab award flights for just 70,000 points. Just prepare for an adventurous search.

Read also: How to Fly to Hawaii Using Points and Miles

by your friends at The Daily Navigator

by your friends at The Daily Navigator