Overview

The world of points, miles, and credit card rewards is complicated. With so many ways to earn, redeem, and (unfortunately) waste your rewards, it can all be a little overwhelming.

But, as they say, knowledge is power.

Understanding the ins and outs of each system—its strengths, weaknesses, and sweet spots—allows you to maximize your rewards, whether you’re a business class big shot or just looking to save a little money at Christmas.

This time, we’re honing in on Capital One Rewards, one of the most popular systems. We’ll take a deep look into both its travel rewards and cashback scope, helping you understand how and when to use it best.

The Bottom Line

Capital One Rewards is a ludicrously valuable system. From its super-adaptable travel rewards to traditional cashback, there’s something for everyone here. Better yet, its high-earning cards cover more than any other, making it easy to rack up the miles.

What Is Capital One Rewards

Capital One Rewards is exactly what it says on the tin. It’s a system designed for consumers to earn rewards on their credit card spending.

Like most banks and credit card issuers, Capital One allots these rewards in the form of miles or cash back, designating specific cards for each. Which of the two types you opt for depends on your preference, but it’s possible to work around these limitations in a few ways, which we’ll get to later. In theory, customers could redeem their rewards on anything from free travel worldwide to getting money back on their groceries.

Each Capital One product has predetermined earning rates. For example, one card may offer 3% cashback on groceries, while another may offer 2x miles per dollar on travel.

The best way to earn a ton of either reward currency is to build a strong strategy around your spending, that maximizes your biggest categories. We’ll show you an example later.

What Is Capital One Cashback?

Cashback is the standard reward for many Capital One credit cards. As suggested, instead of earning miles, cardholders will receive a percentage back from their purchases. It typically appears in users’ accounts the following statement. For example, if I spend $1,000 on a Capital One card that earns 2% cashback, I’ll get $20 back to use as I see fit.

It represents a flexible way to earn rewards as it can be redeemed for anything. This makes it attractive for those who value flexibility and are looking at savings on different aspects of their life—for example, $500 in cashback could make Christmas spending a lot easier.

Generally, you can redeem it in the following ways:

Cashback in the form of a check or bank deposit. This offers a ton of flexibility and the chance to use it in everyday interactions

Statement credits. These apply credits to customers’ next statements, reducing the payment required.

Purchase reimbursement. Customers can choose specific recent credit card purchases to be reimbursed by the cashback.

Capital One Portals. The cashback can be redeemed directly on one of Capital One’s booking portals for travel or entertainment.

Direct purchases on partnering platforms. Companies like Amazon and PayPal allow Capital One users to redeem their cashback on their platforms once their accounts are linked.

Gift cards. Customers can redeem their cashback as gift cards.

Depending on which cards the customer owns, it may be possible to convert cashback into miles. But more on that later.

Why choose to earn Capital One cashback?

Cashback is flexible. No other rewards currency offers the ability to save on anything. Those who value this will always find a place for cashback. Another big benefit is that it’s easy to combine earnings from other card issuers. If you can receive a check or bank deposit for your earnings, you can do this with multiple issuers. Miles can be pooled in some situations, but it’s definitely not a catch-all rule.

Why wouldn’t you choose to earn Capital One cashback?

While cashback remains immensely flexible, it is limited in its value. With a few exceptions, your cashback value is whatever it says in your account. Capital One Miles, as we’ll see later, can be redeemed at far greater value. Those with an eye on maximizing their travel will swing away from cashback.

Our favorite cashback cards

Capital One Savor card offers unlimited 3% cash back at grocery stores, on dining, entertainment, and popular streaming services.

Capital One QuicksilverOne card offers 1.5% cash back on all of your everyday purchases.

Capital One Quicksilver card offers 1.5% cash back on all of your everyday purchases

- Best for: Capital One loyalists who want maximize entertainment spending

Capital One Savor Cash Rewards Credit Card

$200 cash bonus

Offer Details:

Earn a one-time $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening

Why we like it

The Capital One Savor fills a unique space in the rewards landscape. While it is a cashback card, those with a Capital One Venture Rewards Card can convert earning into Venture Miles to recieve outsized value. The 3% cashback rate on entertainment, dining, streaming services, and grcoery stores represents a significant return on major spending categories and can help consolidate a broader Venture Miles store.

Reward details

8% Cash Back on Capital One Entertainment purchases

Earn unlimited 5% cash back on hotels, vacation rentals and rental cars booked through Capital One Travel

3% Cash Back at grocery stores (excluding superstores like Walmart® and Target®), on dining, entertainment and popular streaming services

1% Cash Back on all other purchases

Pros & Cons

Pros

No annual fee

Decent intro bonus for a low threshold

Strong earning on big-spend categories

Can be redeemed as cashback or miles if cardholders has other Cap 1 products

Cons

Cardholders limited to cashback if they don’t have another Venture Miles earning card

Terms Apply

What Are Capital One Venture Miles?

Venture Miles, earned in the same way as cashback, is a more malleable reward currency. At their best, they’re worth far more than cashback could ever be, but if used poorly, their value could plummet below the 1 cent per mile mark.

Instead of a percentage, credit cards are given set mile rates. For example, the Capital One Venture Rewards Credit Card earn at least 2x miles per dollar on every purchase, so $1,000 of spending would leave you with 2,000 miles.

How are Venture Miles redeemed?

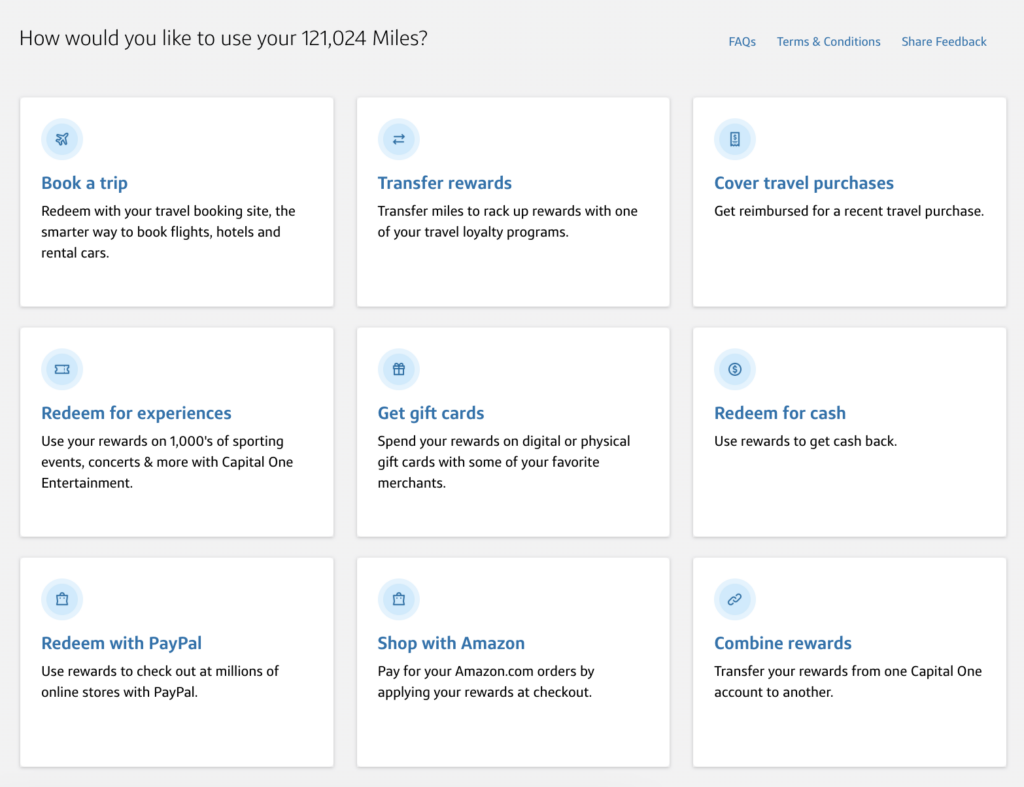

Like cashback, miles are not limited to one redemption method. It’s possible to use miles in the following ways:

Redeem for flights, hotels, and rentals on Capital One Travel – The simplest method, but not the best value, at 1 cent per mile.

Transfer them to one of Capital One’s airline and hotel partners to redeem as flights and stays. It is more complex, but generally the best value option.

Redeem on Amazon and PayPal for 0.8 cents per mile.

Redeem for recent travel purchased using your credit card. Again, 1 cent per mile.

Redeem your miles as cashback for a paltry 0.5 cents per mile.

Redeem your miles for gift cards at 1 cent per mile.

How much is a Venture Mile worth?

As you might be able to tell from the data above, assessing the value of a Venture Mile is complicated and depends on how it’s used.

When opening a credit card, you’ll often see Capital One advertising an introductory offer of 75,000 miles as being worth $750 in travel. Technically, this is correct, as Capital One values its miles at 1 cent each when redeemed on its travel portal. In this situation, the miles function almost exactly like cashback cards. It’s not a bad redemption, but it can be improved.

Redeeming the miles as cashback should be avoided at all costs. Half a cent per mile is a terrible redemption and a waste of your hard-earned rewards (in my humble opinion).

Transferring to a partner, however, could see immense value thanks to sweet spots in different programs. For a good business class redemption, squeezing as much as 10 cents from each mile is possible. That 75,000-mile bonus is likely worth closer to $2,000 on average or as much as $7,500 for a huge redemption.

Why choose to earn Capital One Venture miles?

As suggested, Venture Miles represent far greater potential value than cashback. In the right hands, one introductory bonus could grab dozens of domestic flights, an incredible business class experience, or a 5-star luxury hotel stay. Those who travel even once or twice a year could save thousands by concentrating on miles instead of cashback.

Also note that Capital One Miles will never expire as long as the account remains open and in good standing. So you can wait to use your Miles until the redemption works best for you.

Why wouldn’t you choose to earn Venture miles?

If you don’t travel enough, scraping value from your miles may not be as attractive. The flexibility offered by cashback can’t be replicated by miles and can go a long way toward easing some financial burdens. Generally, though, anyone traveling more than once or twice a year can find value from miles.

Our favorite points earning cards

Capital One VentureOne earns 5X miles on hotels, vacation rentals, and rental cars booked through Capital One Travel and 1.25X miles per dollar on every other purchase.

Capital One Venture Rewards earns 2X miles per dollar on every purchase and earns 5X miles on hotels, vacation rentals, and rental cars booked through Capital One Travel

Capital One Venture X Rewards earns 10X miles on hotels & rental cars booked through Capital One Travel, 5X miles on flights and vacation rentals booked through Capital One Travel, and 2X miles on all other purchases

Capital One Venture X Business earns 2X miles on every purchase. Book through Capital One Travel to earn 5X on flights and 10X on hotels and rental cars.

- Best for: Overall Travel

Capital One Venture X Rewards Credit Card

75,000 Bonus Miles

Offer Details:

Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

Why we like it

The Capital One Venture X is a direct competitor to the Chase Sapphire Reserve, and for many seeking a simpler earning scheme with premium perks, it could be the better option. But the Venture X truly shines with one benefit in particular: four free authorized users. Plus, every year on your cardholder anniversary you get 10,000 points to use for travel.

Reward details

10 Miles per dollar on hotels and rental cars booked through Capital One Travel

5 Miles per dollar on flights and vacation rentals booked through Capital One Travel

2 Miles per dollar on every purchase

Pros & Cons

Pros

-

Its great intro bonus of 75,000 miles is worth well over $1,000 when transferred to partner airlines and hotels, or a flat rate $750 when redeemed on the Capital One Travel Portal.

-

Cardholders get a bonus of 10,000 miles each year after their first account anniversary, which is nothing to shrug off, especially when a little bit short of that business class flight. It’s worth almost $200 depending on how you use it.

-

The $300 annual credit for purchases made on the Capital One Travel Portal, combined with the yearly free miles, more than annul the $395 annual fee.

-

Four authorized users can be added for free.

-

Enjoy access to 1,300+ lounges worldwide, including Capital One Lounge locations and participating Priority Pass™ lounges, after enrollment

-

A generous offering of travel insurance, protections and reimbursements round out an excellent array of benefits.

Cons

-

The $300 credit is a bit less flexible than the Chase Sapphire Reserve’s comparable benefit.

-

Miles earning is the same as the Sapphire Reserve on portal-based purchases, but less on general travel spending.

-

Capital One transfer partners are solid, but still don’t include any US-based airlines or hotels.

Terms Apply

The Best of Both Worlds

Earlier, we alluded to some exceptions to the limitations of cashback—and it’s a pretty big exception. While a cashback card earns what it says, if the cardholders also own a miles-earning card, they can convert their cashback earnings into miles. This is a huge perk and opens multiple avenues of earning streams that are typically off-limits.

Those hoping to hone in on Capital One miles can engage in a broader earning strategy by combining cashback and miles-earning cards. For example, they could open the Capital One Venture Rewards Credit Card and earn at least 2x miles per dollar. They could also open the Capital One Savor Rewards Credit Card and earn 3% on dining, groceries, entertainment, and some streaming services. Because they have both, the 3% effectively becomes 3x miles per dollar on those categories, giving their Venture Miles balance a welcome boost every month.

Note that this feature doesn’t go the opposite way. You’ll still be stuck at a cashback rate of 0.5 cents per mile with a miles-earning card.

How to Redeem Venture Miles

While there are multiple ways to redeem your miles, we will focus on the two that offer the most value—transferring to partners and redeeming on the Capital One Portal. The other options, while valid for the right person, are generally not advised. Gift cards, for example, can often be purchased at discounted prices, so you’d be better off buying them cheap and earning the miles.

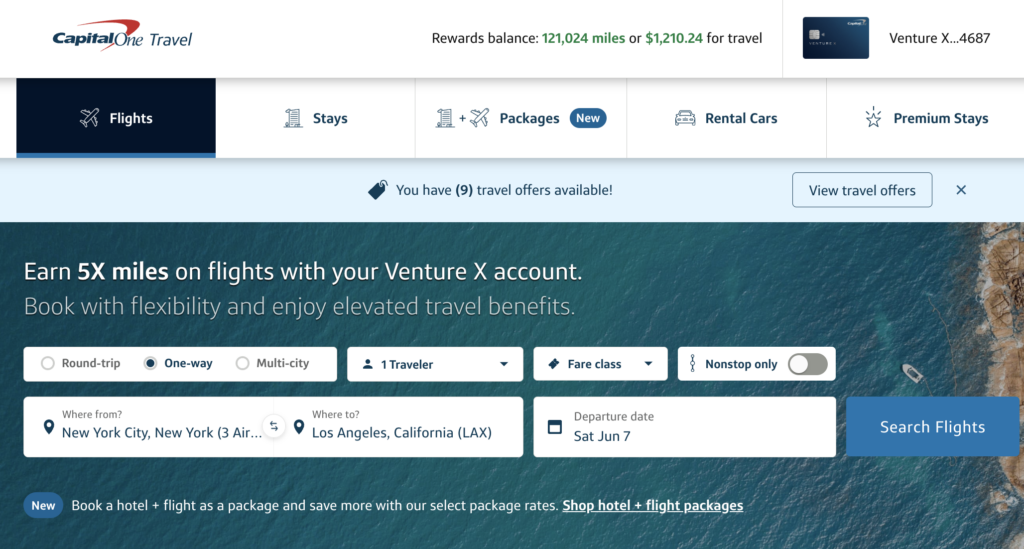

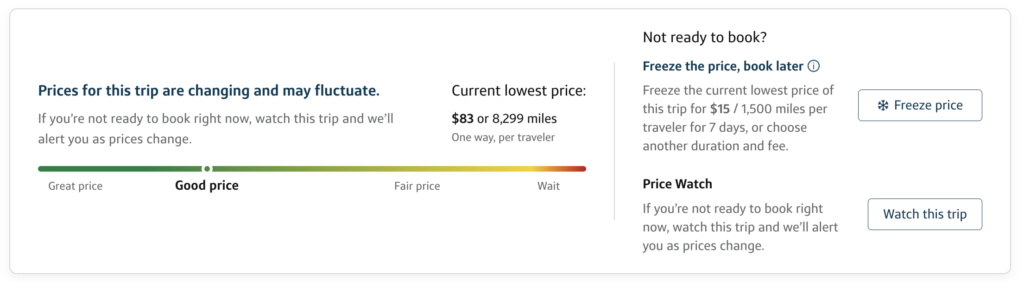

How to redeem miles on the Capital One Travel portal

Using your miles on Capital One’s travel portal is easy. The site functions much like a traditional aggregator like Expedia or Booking. Simply search for your flight, hotel, or rental car and sift through the options. You’ll see a cash price and a miles redemption rate listed.

Once you’ve made your choice, move through the purchase system like you would with cash or credit card. At the final payment option section, you’ll select Venture Miles as your payment and complete the transaction. Voila!

It’s worth remembering that your rates are limited here. You may find a flight for a cheaper rate elsewhere so it’s up to you whether it’s worth using miles for this redemption. And always remember that you’re tied to 1 cent per mile so if that flight costs, $1,000 you’ll need 100,000 miles.

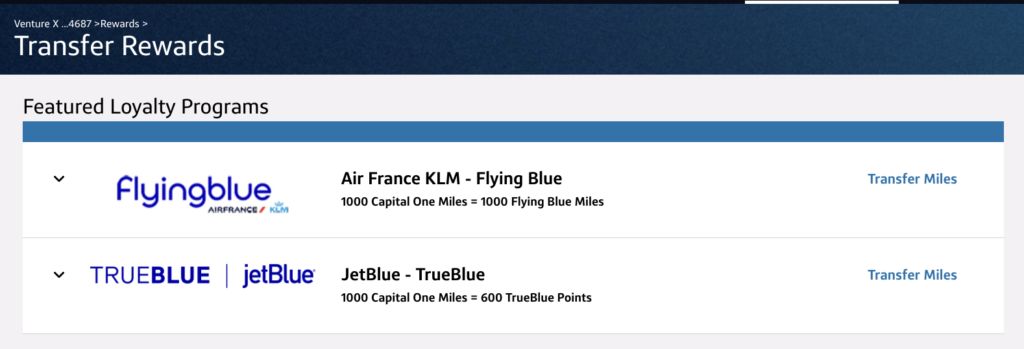

How to redeem miles by transferring to a travel partner

Capital One currently boasts a selection of 15+ airline and hotel partners. That means any cardholder with Miles in the bank can transfer them to each of the 15+ loyalty programs and redeem flights or stays.

Opting to do this in the right situation opens a world of value. Instead of the 1 cent per mile rate on the portal, it’s possible to take advantage of different programs’ sweet spots. It would take an entire article to cover the best redemptions on offer with Capital One. Luckily, we’ve done that, too—check it out here.

To transfer points, log into your account and find your account balance. From there, you’ll be given a number of redemption options. Choose the “Convert Rewards” option. You’ll then be offered a list of Capital One’s transfer partners and rates. Most of them are transferred at a 1:1 ratio, but a few will have less favorable rates.

Always search for the flight or stay you want before transferring your points. Doing so before this is a risk unless you’re confident in the value of that program.

Capital One Transfer Partners

Program | Transfer ratio |

Aeromexico Rewards | 1:1 |

Air Canada Aeroplan | 1:1 |

Air France-KLM Flying Blue | 1:1 |

All Accor Live Limitless | 2:1 |

Avianca LifeMiles | 1:1 |

British Airways Executive Club | 1:1 |

Cathay Pacific Asia Miles | 1:1 |

Choice Priveleges | 1:1 |

Emirates Skywards | 1:1 |

Etihad Airways Guest | 1:1 |

EVA Airways Infinity MileageLands | 2:1.5 |

Finnair Plus | 1:1 |

JetBlue TrueBlue | 5:3 |

Qantas Frequent Flyer | 1:1 |

Singapore Airlines KrisFlyer | 1:1 |

TAP Air Portugal Miles&Go | 1:1 |

Turkish Airlines Miles&Smiles | 1:1 |

Virgin Red | 1:1 |

Wyndham Reward | 1:1 |

The Point

Capital One’s credit cards offer a rewards system for everyone interested in making the most of their spending. From the flexible use of cashback to the high-value, high-flying potential of miles, the possibilities are endless.

by your friends at The Daily Navigator

by your friends at The Daily Navigator