Overview

American Airlines’ AAdvantage program is one of the oldest and most widely used frequent-flyer programs in the world, and as one of the U.S.’s favorite airlines, it’s a natural go-to for many travelers hoping to score some free flights and benefits.

But, it’s also one of the more confusing at first glance, especially after recent changes that shifted how elite status is earned and how miles are best used. Whether you fly American regularly or just want another strong mileage currency in your back pocket, understanding how AAdvantage works can unlock serious value. Plus, with new ways to earn, it’s never been a better time to get to grips with the program.

Let’s take a deep dive into the ins and outs of the American Airlines AAdvantage program, and let you wrangle it into free travel.

What Is AAdvantage?

As should be pretty obvious, AAdvantage is American Airlines’ loyalty program. Like most loyalty systems, you earn AAdvantage miles by flying American and its partners, spending on co-branded credit cards, or using American’s shopping, dining, and travel portals. Those miles can then be redeemed for flights, upgrades, and other awards.

American is a founding member of the OneWorld Alliance, which means AAdvantage miles can be earned and redeemed across a wide range of international airlines, including British Airways, Japan Airlines, Cathay Pacific, Qantas, and Qatar Airways. It’s that partner access that helps make the program so valuable, as you’ll see later.

Miles earned through AAdvantage never expire as long as there is some account activity within 24 months, making it relatively easy to keep balances alive with occasional earnings or redemptions. With that said, if you’re not a frequent user, it’s worth checking in to make sure you don’t have any about to kick the bucket.

AAdvantage Miles vs Loyalty Points

It’s important to distinguish the two sides of a loyalty program. On one side, we have the redeemable miles. These are accrued in a number of ways and redeemable for flights, upgrades, and other purchases. It’s simply a currency acknowledged by the airline. In American’s case, these are called AAdvantage Miles.

On the other side, we have elite status tiers. In most programs, AAdvantage included, customers work their way through multiple tiers by spending or flying with the airline, earning the right to different kinds of perks along the way. These vary by airline and could be upgrades, lounge access, free checked luggage, and more. In America’s case, the metric for earning elite status is a Loyalty Point.

Elite Status and Loyalty Points

What Are Loyalty Points?

American Airlines no longer bases elite status purely on flying. Instead, it uses a metric called Loyalty Points. In the past, flying with the airline was the main metric, but today, nearly all mileage-earning activity counts toward Loyalty Points, including flights, credit card spending, shopping portal purchases, and dining rewards.

Similarly to AAdvantage Miles, this means you can earn elite status without flying constantly, which is a major shift from traditional frequent-flyer models. Once again, this shift, while seen throughout the industry, was controversial as it rewards those with bigger wallets as opposed to truly loyal customers.

Elite Status Levels

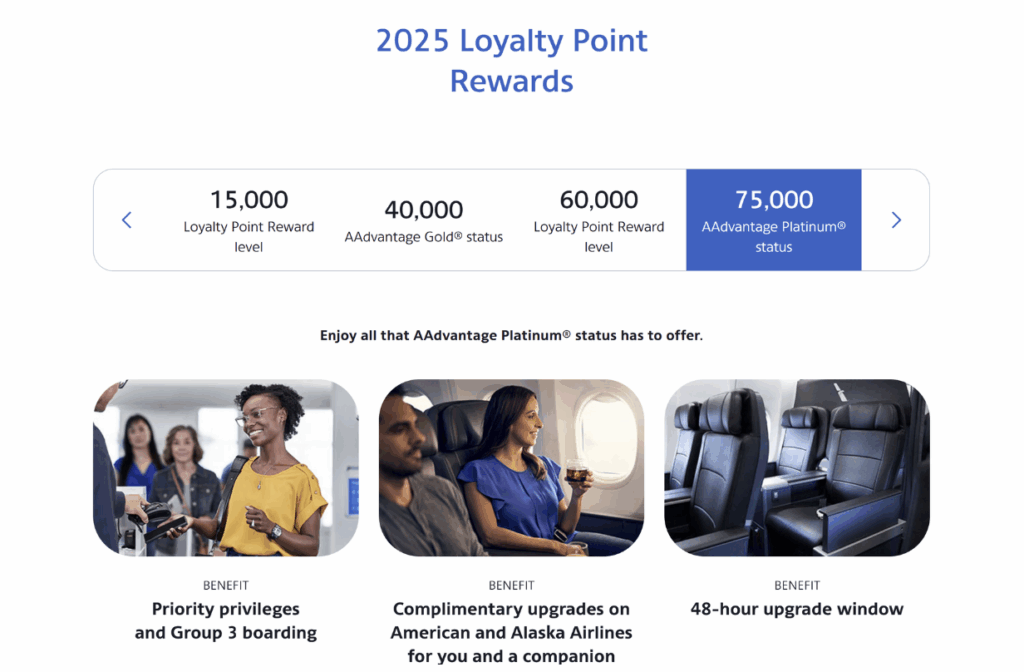

AAdvantage has multiple elite tiers, with each unlocking increasingly valuable benefits like complimentary upgrades, bonus miles on flights, preferred seating, and enhanced customer service.

Higher tiers also receive perks like systemwide upgrades, which can be used to move from economy to business class on eligible flights. Unlocking these perks can be a huge deal for regular flyers.

Loyalty Points accumulated during the qualification year dictate the tier a customer hits. The four published elite tiers are:

-

Gold – 40,000 Loyalty Points

-

Platinum – 75,000 Loyalty Points

Platinum Pro – 125,000 Loyalty Points

-

Executive Platinum – 200,000 Loyalty Points

Once earned, your status is valid for the remainder of the program year and the following membership year. There’s also an invite-only tier, ConciergeKey, which is not publicly attainable and generally based on high spending and corporate travel quirks. You gotta be special to get an invite for that one.

- Best for: American Airlines Fans

- Annual Fee: $ $0 intro annual fee, $99 after the first year

- Regular APR: 20.74% - 29.74% (Variable)

- Reward Rate: 1X - 2X

- Recommended Credit: 690-850

Citi®/AAdvantage® Platinum Select® World Elite Mastercard®

50,000 Bonus Points

Offer Details:

50,000 American Airlines AAdvantage bonus miles after you spend $2,500 on purchases in the first 3 months from account opening.

Why we like it

The Citi® / AAdvantage® Platinum Select® World Elite Mastercard® is a strong airline-centric card to have in your travel toolbox if your main airport is an American Airlines hub like Boston, Chicago, Dallas, or Charlotte, or if you just have a preference for the airline. Regular business travelers may want to upgrade for luxury perks like lounge access, but for everyone else, the low annual fee, 50,000 point intro bonus, solid miles-earning categories, and free checked bag perks are more than enough to validate the space in your wallet.

Reward details

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, and on eligible American Airlines purchases

Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases

Pros & Cons

Pros

The strong 50,000-point intro bonus is worth as much as $750, earned after spending $2,500 in three months.

Cardholders and up to four companions can enjoy a free first checked bag on any domestic American Airlines flight, comfortably justifying the $99 fee when used.

The card earns 2X miles for gas and dining purchases

Each eligible mile earned with the card also earns a loyalty point towards American Airlines elite status

A generous 25% discount on in-flight purchases when using the card round out the benefits

Preferred boarding on American Airlines flights

Cons

American Airlines miles can’t be transferred to other airlines or hotels (although they can be used to book AA partner flights)

Premium perks are reserved for pricier cards

Terms Apply

How You Earn AAdvantage Miles

Earning American Airlines miles has never been easier. As with other programs, the basic methods are very similar. But a reluctance to allow transfers from general credit cards made AAdvantage Miles a little more complicated than others. Let’s take a look at all the ways you can earn them.

Flying American Airlines

The simplest way to earn AAdvantage Miles is to fly with American Airlines. In years gone by, this was the only way to do so, meaning frequent business travelers were the only real demographic that could make a real dent in the program. That’s not the case today, but it’s still a solid way to earn for regular customers.

When flying American, miles are earned based on the ticket price rather than the distance. This is a controversial shift mirrored in other programs, too. General members earn miles per dollar spent on the base fare and carrier-imposed fees, while elite members earn more per dollar depending on their status tier.

This revenue-based system favors expensive tickets over long, cheap flights, which is important to keep in mind if you mostly fly economy on sale fares. This can be frustrating as, for example, a frequent business flyer (the people these programs originally targeted) could, once or twice a week, earn fewer miles in a month than a single business class flight.

Depending on your elite status tier, you’ll earn a specific number of miles per dollar spent. Here are the distinct rates:

General Member (no status): 5 miles per dollar

AAdvantage Gold: 7 miles per dollar (5 base miles + 2 elite bonus miles)

AAdvantage Platinum: 8 miles per dollar,(5 base miles + 3 elite bonus miles)

AAdvantage Platinum Pro: 9 miles per dollar (5 base miles + 4 elite bonus miles)

AAdvantage Executive Platinum: 11 miles per dollar (5 base miles + 6 elite bonus miles)

Flying Partner Airlines

In stark contrast, flying with partner flights still earns miles based on distance flown and fare class, not ticket price. This can sometimes be a better deal, especially on premium-cabin partner flights that credit generously to AAdvantage. This is something to consider when looking at flight options if miles accrual is your goal. The bonus earning rates above apply to partner airlines, too.

Credit Cards and Everyday Spending

Now the most popular way to earn, American Airlines co-branded credit cards make it possible to earn AAdvantage Miles every day. These cards earn not only on American Airlines purchases, but everyday spending, often with category bonuses and additional perks like free checked bags or priority boarding.

Beyond cards, AAdvantage also offers a shopping portal and a dining program that allow you to earn miles on purchases you’d make anyway. For many people, these non-flying sources make up the majority of their annual mileage earnings, especially if they only fly once or twice a year.

We’ll cover some changes in the next section, but in the past, this was the most economical way to earn miles with the airline. It does remain the simplest, but with some new partnerships, there are other options emerging.

Transfer Miles

Until this year, American Airlines had no true transfer partners. Technically, you can move points from Marriott and IHG, but the rates are so bad that I rarely recommend this. While you can move American Express Membership Rewards Points to Delta, JetBlue, and Southwest, and Chase Ultimate Rewards to United, American stood apart, requiring a more intentional strategy.

But as of 2025, that’s all changed. Citi has now added American as a direct transfer partner (it also supports American’s co-branded cards). This means that any Citi ThankYou points you accrue can be transferred to your American Airlines account when it suits you. This is great news, as it allows you to be more selective of when you use your AAdvantage Miles, only transferring when there’s a solid deal to be found.

All ThankYou points transfer at a 1:1 ratio unless there’s a limited-time transfer bonus.

- Best for: Everyday Earning

Citi Strata Premier℠ Card

75,000 Bonus Points

Offer Details:

75,000 Bonus Points after you spend $4,000 on purchases in your first 3 months of account opening - redeemable for $750 in gift cards or travel rewards at thankyou.com

Why we like it

The Citi Strata Premier Card is an underrated travel credit card that offers both high points-earning potential and simplicity. While the mid-tier card doesn’t come with any premium benefits, its earning on popular spending categories is almost unmatched. Holders earn 3X points on air travel, hotels, gas stations, supermarkets, and restaurants, making it ludicrously easy to accrue points. Throw in the healthy 75,000-point bonus and you’ve got a great haul of rewards on your hands.

Reward details

10 points per $1 spent on Hotels, Car Rentals, and Attractions booked on CitiTravel.com.

3 points per $1 on Air Travel and Other Hotel Purchases, at Restaurants, Supermarkets, Gas, and EV Charging Stations.

1 Point per $1 spent on all other purchases

Pros & Cons

Pros

The 75,000-point intro bonus is worth $750 in gift cards and well over $1,000 when transferred to travel partners, making the $95 dollar annual fee an afterthought. You could ignore the card for a decade, and it would still be worth it.

Its earning potential is phenomenal: Earning 3X points on categories like gas and supermarkets, which are part of the average American’s biggest expenses, means the Citi Strata Premier will work hard for you on a daily basis.

Cardholders get a $100 hotel benefit each year on a hotel purchase of $500 or more. Not the greatest perk in the world, but a nice saving on an unexpected hotel stay that wipes out the yearly fee itself.

As it’s a World Elite Mastercard, cardholders will enjoy varied benefits like Lyft credits, upgrades and breakfast at select hotels, and cell phone protection.

Cons

Citi’s transfer partners are mainly foreign airlines, so using the points on US-based carriers will require some extra research.

Other mid-tier cards may offer some more interesting perks.

Terms Apply

Redeeming AAdvantage Miles

Redeeming AAdvantage Miles is the fun (if a little complicated) part. Like other airlines, it’s devalued its miles multiple times in a series of program changes. But there’s still some strong value to be found, especially on partner redemptions.

Award Flights on American

American uses dynamic pricing for its own flights, meaning award prices fluctuate based on demand, route, timing, and whatever other metric the airline feels like using. Frustratingly, this means that it’s hard to pin down a solid value on a regular basis, but you’ll still see some rock bottom rates every so often.

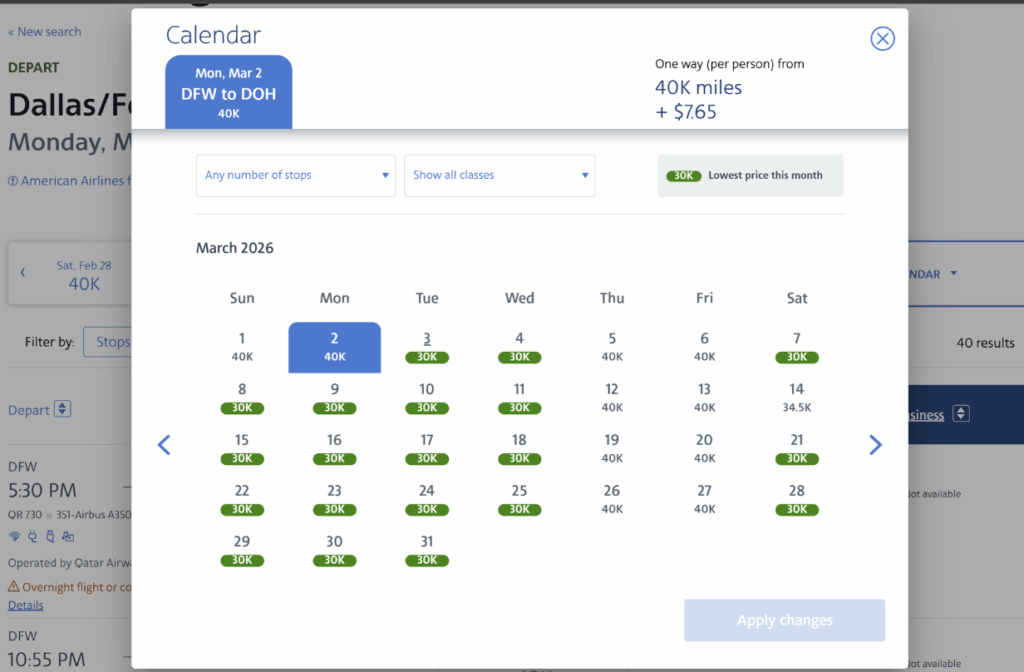

Partner Award Sweet Spots

While the airline ditched award charts for its own flights, it still uses fixed award charts for many partner airlines, and that’s where AAdvantage really shines. Premium-cabin partner awards, particularly on airlines like Japan Airlines or Qatar Airways, are often where AAdvantage miles stretch the furthest. It’s one of the best ways to score a seat in Qatar’s legendary Qsuite, and it’s made even easier thanks to American’s availability calendar.

Fuel surcharges are usually low or nonexistent when booking through AAdvantage, which gives it an edge over some foreign programs that add hefty fees to award tickets. British Airways, we’re looking at you.

Other Redemptions

Miles can also be used for upgrades, hotel stays, car rentals, and merchandise, but, as always, these are rarely strong value compared to flight redemptions. If you’re set on true value, stick to American’s sweet spots and book flights, no matter how tempting it may be to grab a quick gift card.

Is AAdvantage Worth It?

Value in this space is always a little subjective. The elite status side of things will be immensely valuable to regular American customers. Even flying two or three times a year with the airline can make it worth it when taking into account the Admirals Lounge access and free checked bags. For everyone else, putting all your eggs in this basket doesn’t really make sense.

AAdvantage Miles, on the other hand, can be viewed as a money-saving or experiential tool for anyone. Building a store of AAdvantage Miles (or Citi ThankYou Points) ready for deployment can be the difference between a free flight to Europe or Asia and a hefty cash rate.

Understanding and separating the two is vital for a well-rounded strategy. But, in short, yes, AAdvantage can be worth it for both American loyalists and casual flyers.

by your friends at The Daily Navigator

by your friends at The Daily Navigator