Overview

Citi has always flown somewhat under the points and miles radar compared to its competitors. Amex, Chase, and Capital One tend to steal the limelight with their premium products, leaving ThankYou points a little…ahem…thankless in the corner.

Sorry.

But those with a Citi card in their wallet know the power of this points currency, and have made those products central pillars of their strategy for years. And it’s only getting better. New cards and valuable transfer partners are being added all the time, helping make Citi become less of a fringe option and more of a no-brainer.

To highlight the power of Citi’s ThankYou Points, we’ve compiled a list of some of the best redemptions you can make with them.

What Cards Can Earn You Citi ThankYou Points?

Citi currently offers three different ThankYou Points earning cards. As is the general model across the board, it opts for a premium, mid-range, and no-annual-fee option. On top of this, if you own both a cashback card and a points-earning card, you can convert your cashback into ThankYou points, too. This immediately broadens the scope for earning big.

Check out some of the cards below.

- Best for: Everyday Earning

Citi Strata Premier℠ Card

75,000 Bonus Points

Offer Details:

75,000 Bonus Points after you spend $4,000 on purchases in your first 3 months of account opening - redeemable for $750 in gift cards or travel rewards at thankyou.com

Why we like it

The Citi Strata Premier Card is an underrated travel credit card that offers both high points-earning potential and simplicity. While the mid-tier card doesn’t come with any premium benefits, its earning on popular spending categories is almost unmatched. Holders earn 3X points on air travel, hotels, gas stations, supermarkets, and restaurants, making it ludicrously easy to accrue points. Throw in the healthy 75,000-point bonus and you’ve got a great haul of rewards on your hands.

Reward details

10 points per $1 spent on Hotels, Car Rentals, and Attractions booked on CitiTravel.com.

3 points per $1 on Air Travel and Other Hotel Purchases, at Restaurants, Supermarkets, Gas, and EV Charging Stations.

1 Point per $1 spent on all other purchases

Pros & Cons

Pros

The 75,000-point intro bonus is worth $750 in gift cards and well over $1,000 when transferred to travel partners, making the $95 dollar annual fee an afterthought. You could ignore the card for a decade, and it would still be worth it.

Its earning potential is phenomenal: Earning 3X points on categories like gas and supermarkets, which are part of the average American’s biggest expenses, means the Citi Strata Premier will work hard for you on a daily basis.

Cardholders get a $100 hotel benefit each year on a hotel purchase of $500 or more. Not the greatest perk in the world, but a nice saving on an unexpected hotel stay that wipes out the yearly fee itself.

As it’s a World Elite Mastercard, cardholders will enjoy varied benefits like Lyft credits, upgrades and breakfast at select hotels, and cell phone protection.

Cons

Citi’s transfer partners are mainly foreign airlines, so using the points on US-based carriers will require some extra research.

Other mid-tier cards may offer some more interesting perks.

Terms Apply

Citi Transfer Partners

While you can use your points to book travel using Citi’s travel portal, it’s a far better value to transfer points to one of the issuer’s high-value airline and hotel transfer partners. This way, you can stretch far beyond the 1 cent per point valuation you’ll be stuck with on the former. Here are all of Citi’s transfer partners, along with the transfer ratio used for each.

American Airlines AAdvantage: 1:1

ALL Accor Live Limitless: 2:1

Aeromexico Rewards: 1:1

Air France-KLM Flying Blue: 1:1

Avianca LifeMiles: 1:1

Cathay Pacific Asia Miles: 1:1

Choice Privileges: 1:2

Emirates Skywards: 5:4

Etihad Guest: 1:1

EVA Air Infinity MileageLands: 1:1

JetBlue TrueBlue: 1:1

Leading Hotels of the World Leaders Club: 5:1

Preferred Hotels & Resorts (I Prefer): 1:4

Qantas Frequent Flyer: 1:1

Qatar Airways Privilege Club: 1:1

Singapore Airlines KrisFlyer: 1:1

Shop Your Way: 10:1

Thai Royal Orchid Plus: 1:1

Turkish Airlines Miles&Smiles: 1:1

Virgin Atlantic Flying Club: 1:1

Virgin Red (airlines + hotels): 1:1

Wyndham Rewards: 1:1

Now let’s take a look at the best way to wrangle these partners into high-value redemptions.

- Best for: American Airlines Fans

- Annual Fee: $ $0 intro annual fee, $99 after the first year

- Regular APR: 20.74% - 29.74% (Variable)

- Reward Rate: 1X - 2X

- Recommended Credit: 690-850

Citi®/AAdvantage® Platinum Select® World Elite Mastercard®

50,000 Bonus Points

Offer Details:

50,000 American Airlines AAdvantage bonus miles after you spend $2,500 on purchases in the first 3 months from account opening.

Why we like it

The Citi® / AAdvantage® Platinum Select® World Elite Mastercard® is a strong airline-centric card to have in your travel toolbox if your main airport is an American Airlines hub like Boston, Chicago, Dallas, or Charlotte, or if you just have a preference for the airline. Regular business travelers may want to upgrade for luxury perks like lounge access, but for everyone else, the low annual fee, 50,000 point intro bonus, solid miles-earning categories, and free checked bag perks are more than enough to validate the space in your wallet.

Reward details

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, and on eligible American Airlines purchases

Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases

Pros & Cons

Pros

The strong 50,000-point intro bonus is worth as much as $750, earned after spending $2,500 in three months.

Cardholders and up to four companions can enjoy a free first checked bag on any domestic American Airlines flight, comfortably justifying the $99 fee when used.

The card earns 2X miles for gas and dining purchases

Each eligible mile earned with the card also earns a loyalty point towards American Airlines elite status

A generous 25% discount on in-flight purchases when using the card round out the benefits

Preferred boarding on American Airlines flights

Cons

American Airlines miles can’t be transferred to other airlines or hotels (although they can be used to book AA partner flights)

Premium perks are reserved for pricier cards

Terms Apply

1. Fly Transatlantic Business or Economy with Virgin Atlantic

Virgin blew everyone’s minds when it revamped its loyalty program. With its award chart on the way out, everyone feared the worst, but it’s one of the few airlines that has made a dynamic program (maybe) better than its chart. It has devalued its points slightly since then, but there are still some incredible deals to be found.

At the top of that list is its transatlantic offerings. A Saver Rate can clock in as low as 6,000 points with $111 in taxes and fees, with Business Class Seats coming in as low as 29,000 points with around $591 in taxes. Those fees seem high, and it might put you off, but you’re getting incredible value if you’re willing to pay it.

Just for the sake of understanding, grabbing the business class seat in the image would get you around 6.7 cents per point, and the economy option would get you 3.7 cents per point. Those aren’t small numbers.

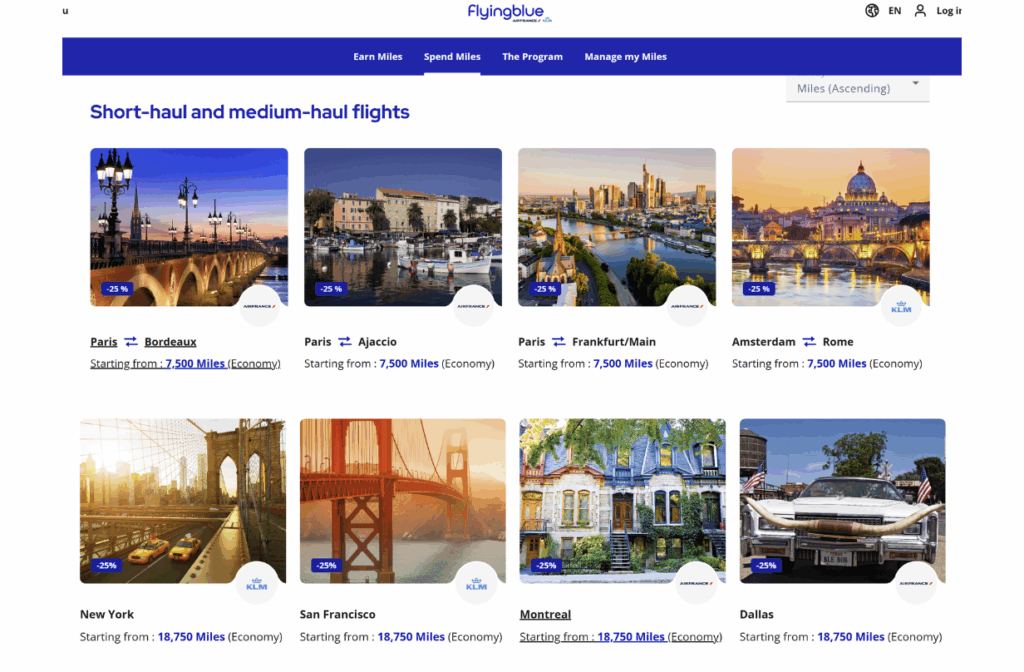

2. Use KLM/Air France Flying Blue’s Saver Deals

Flying Blue, the joint loyalty program between Air France and KLM, is arguably the most reliable program out there for value. At first glance, it may not seem so, but despite its dynamic pricing model, it has some of the steadiest saver rates on the market and even better monthly deals.

The sale rates shift from month to month, but there are usually so many that it’s not unlikely you’ll be too far from one of the airports listed. It’s great for shorter flights that bounce around Europe for as little as 6,500 points and equally great for longer flights, clocking in at around 18,750 points for destinations in Europe and beyond.

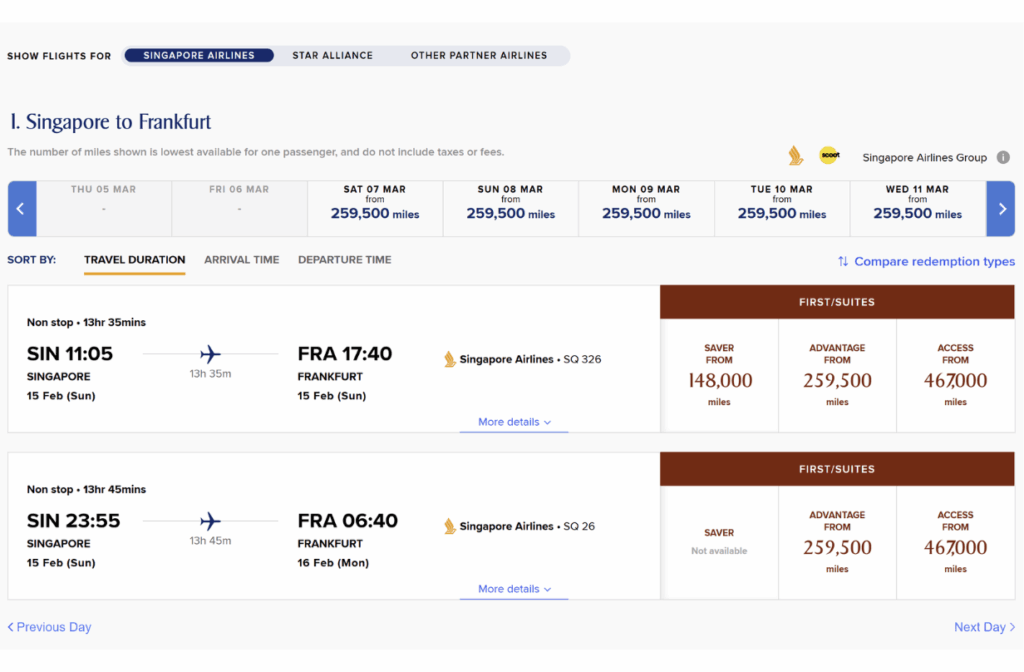

3. Use Singapore KrisFlyer to Try Out Singapore Suites

Singapore Suites remain one of the most sought-after seats in the airline industry. Calling it a seat is a little reductive, though. It’s effectively a luxury hotel room in the sky. Ideally suited for long journeys to make the most of the lavish experience, it’s hard to find availability for and even harder to book.

But it is possible, and Citi ThankYou points can be transferred to KrisFlyer to book this lauded experience for around 148,000 points. That feels like a lot, but keep in mind that a cash rate for a New York to Frankfurt, or Frankfurt to Singapore route can cost as much as an eyewatering $10,000. That rate alone squeezes over 9 cents per point out of your haul, making it one of the best redemptions around.

I repeat, they are hard to find. I struggled to come across any rock-bottom suites offers today just because it would take too damn long, but they are there, I promise. I’ve found them before.

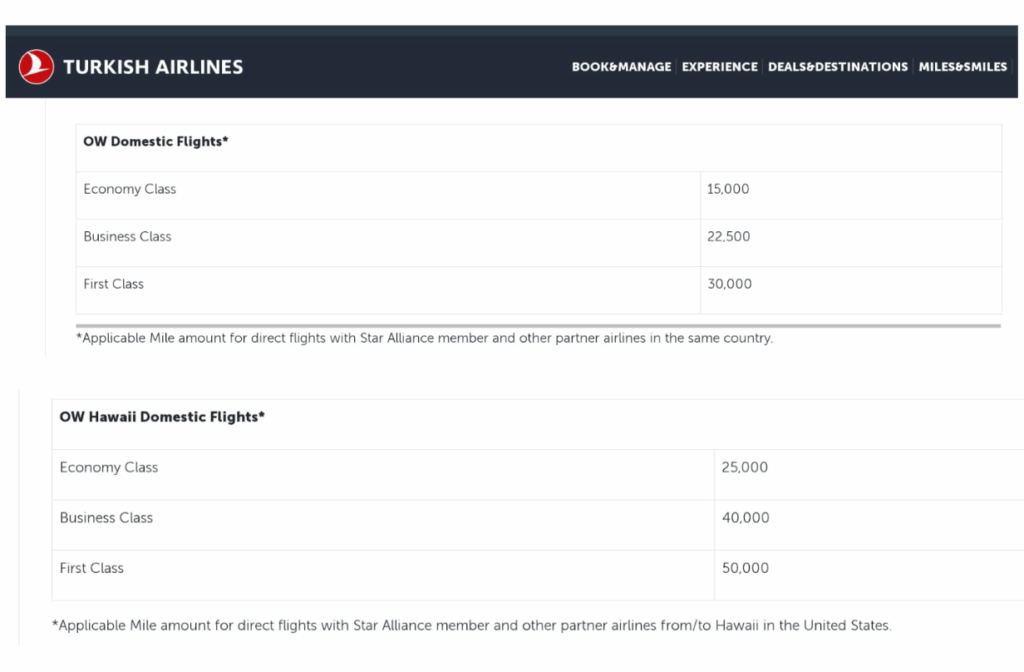

4. Book Ridiculously Cheap Star Alliance Flights with Turkish Miles&Smiles

Turkish Airlines is a frustrating airline these days. Its Miles&Smiles program once had arguably the best single award redemption in the points game, but recent devaluations have seen that gutted. All of its US partner flight award rates went up, which ticked everyone off. But the reality is that it’s still not a terrible deal and offers consistency when there might not be any elsewhere.

For 15,000 miles, you can book a domestic flight anywhere in the US (or any other country). On a day-to-day basis, could there be better deals than this? Sure. But not always, and having that fallback is great. It’s also the only program that could let you fly in a transcontinental flight in a United Polaris Class seat. It’s even possible to grab trans-Atlantic business class seats for 45,000 miles.

The downside is that the website feels like it was built in 2006 and never updated. So you need to work with the glitchy interface to get where you need to be. For those who hold out, though, there is some serious value.

5. Take AAdvantage with American Airlines

In the past, American Airlines AAdvantage Miles were only accessible if you flew with the airline or opened a co-branded card. Now, with Citi taking over the running of the airline’s cards and adding it as a direct transfer partner, that’s all changed.

Americans’ own flights aren’t phenomenal value. You’ll find some good domestic rates depending on the day, but on the whole, its dynamic pricing isn’t the most reliable. If you look for off-peak flights to Europe, you will find some excellent rates that regularly fall below 20,000 miles with little to no fees. Having these at your disposal is amazing, and one to base a trip around — especially if you’re searching for flat-out savings as opposed to points value. You’ll also find strong business class redemptions to Europe, clocking in at around 57,000 – 67,000 miles each way — also incredible. Just keep an eye on which airline you’re flying with, as some will pass on fees.

While its own flight redemptions have gone dynamic, its partner award chart remains intact. This can offer incredible opportunities around the globe on some excellent airlines. Business class redemptions will open up across the board, while its economy redemptions are just as good. It’s a big deal that Citi has American as a partner now.

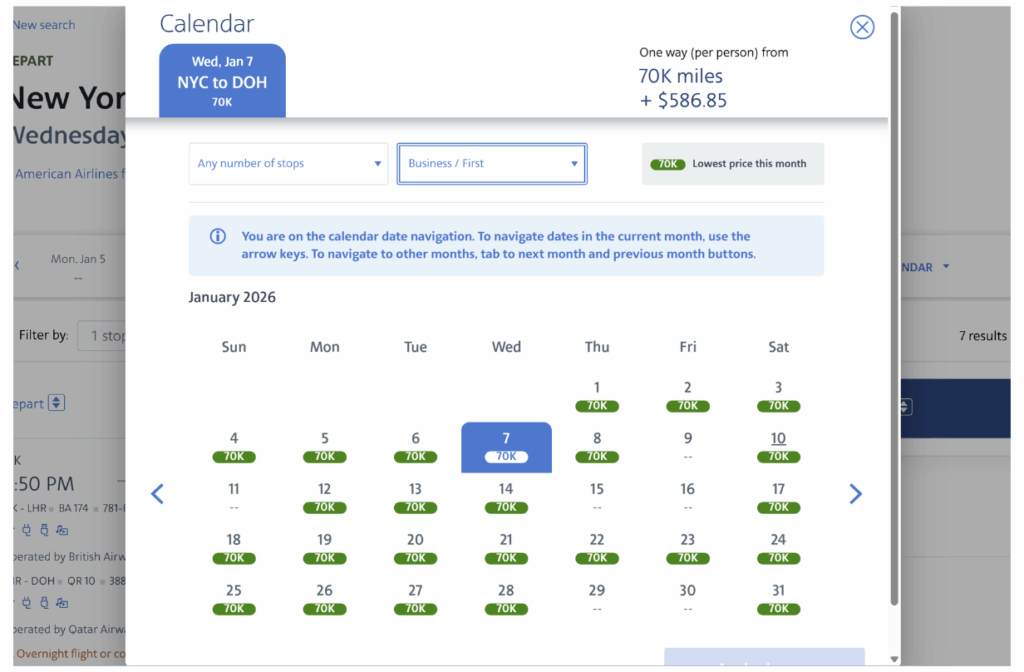

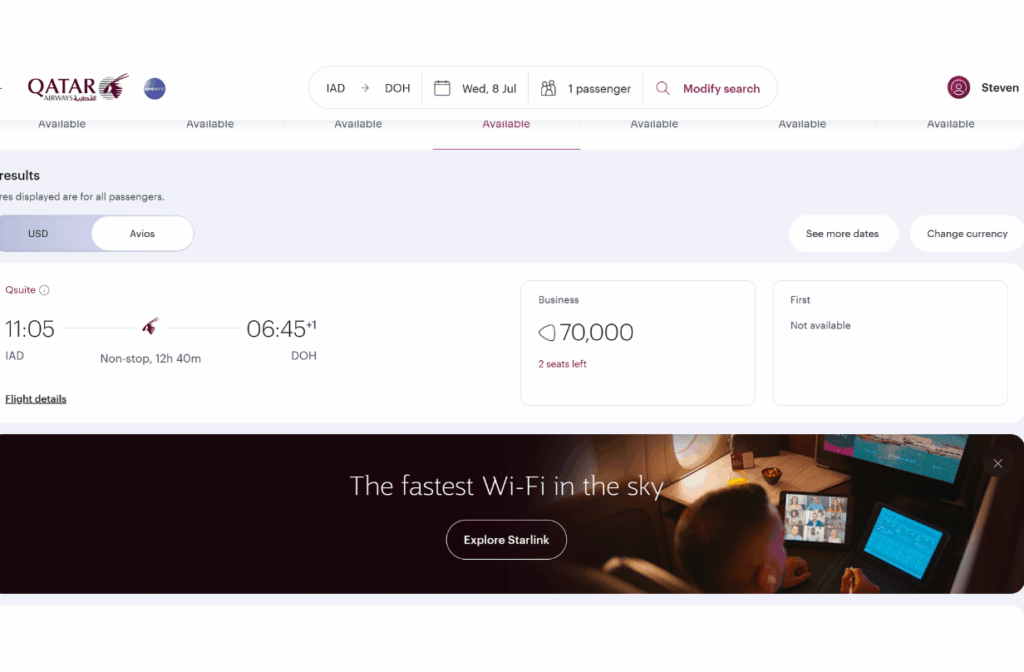

6. Fly Qatar’s Epic Qsuite

The Qsuite is another of the world’s best seats in the air. While not as over the top as the Singapore Suite, it’s set the standard for a high-end business class product. Amazingly, it’s possible to book this seat for just 70,000 points by transferring to Qatar, American Airlines, or even JetBlue.

Availability, yet again, can be hard to crack, but with so many flights heading from the US to the Middle East, you have a good shot at finding one of these at that rate. Considering cash rates can soar towards $10,000 each way, it’s an incredible deal. Just make sure to look out for fees.

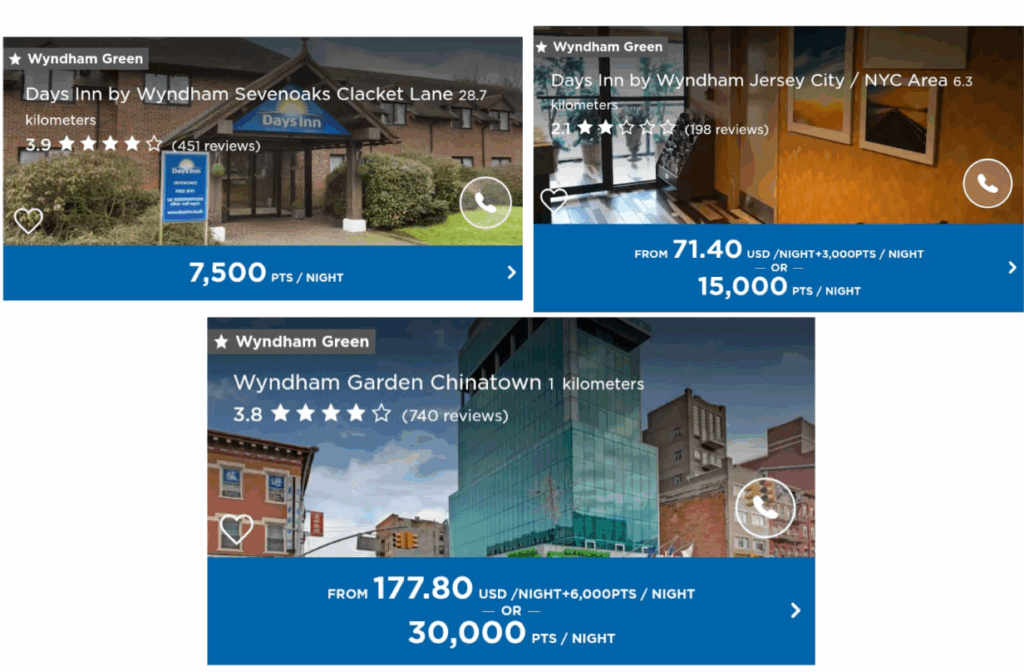

7. Book a solid value hotel stay with Wyndham.

Wyndham’s loyalty program doesn’t get as much attention as Hilton, Hyatt, or Marriott, but if you’ve ever taken the time to check it out, you’ll know there are some serious deals to be had. The company has hotels all around the world, so you’ll never be far from one, even if you’ve never actually stayed in one of its properties.

The company takes a unique stance with its redemption rates. Instead of an award chart or dynamic pricing, it simply slots each of its hotels into a bracket of 7,500, 15,000, or 30,000 a night. There are no off-peak or peak times, and no sneaky shifts — the rates are just the rates.

Transferring your Citi points to Wyndham at the right moment can offer amazing value and save you some serious money on accommodation during your next trip.

The Point

Citi ThankYou Rewards Points are a severely underrated currency that offers tons of high-value redemption options. The addition of American Airlines has further increased that value, meaning there has never been a better time to get your hands on some Thankyou points or Citi Credit Cards.

by your friends at The Daily Navigator

by your friends at The Daily Navigator