Overview

When sifting through your credit cards to pay for your online shopping, you might find yourself a little frustrated at the lack of bonus earning opportunities. Some cards have elevated spending on travel, restaurants, or other specific categories, but online shopping is left out in the cold. In this day and age, Amazon and other online outlets now make up as much as 25% of global commerce, which is a frustration for points and miles enthusiasts.

Thankfully, there is a way around this, at least to some extent.

Shopping portals allow us to maximize our shopping by adding some handy bonuses to thousands of online vendor purchases. They’re one of the simplest tools in the points-and-miles ecosystem, but also one of the least understood and under-utilized. In a mild oversimplification, you just click through a portal before you shop, and you get extra points or cash back for doing… the same thing you were already going to do.

Let’s take a look at the different kinds of portals, as well as how to use them for maximum value.

What Exactly Is a Shopping Portal?

A shopping portal is a website operated by a bank, airline, or cash-back company. When you click through the portal to a retailer, like Apple, Best Buy, Adidas, Macy’s, or hundreds of others, the portal earns a commission. Part of that commission gets passed back to you as points or cash back.

The major types of portals you’ll find are:

Airline portals: like those from United, American, Delta, Alaska, Southwest, and JetBlue.

Bank portals: Chase, Citi, Capital One, and others have their own versions.

Cash-back portals: independent sites that offer cash instead of points.

Each one has different earning rates, and those rates change constantly. One day, a retailer might offer 2x miles; the next day, it could be 12x. That’s why knowing where to look is half the battle.

How to Compare Portal Rates

Since earning rates vary, your best friend is a comparison tool. Websites like Cashback Monitor track portal payouts across all programs, letting you see exactly which airline, bank, or cash-back portal is offering the best rate at the moment. If American is paying 10 miles per dollar at Nike and Chase is offering 3 points, you go with the 10 miles. That should be a no-brainer.

The only exception to this is if a general credit card issuer like Amex or Chase is offering a rate that’s maybe just a little less than an airline or hotel. These points are more valuable than individual airline and hotel programs, so it’s worth prioritizing them slightly.

The key takeaway here is to never click through a portal without checking who’s paying the most.

Stacking Portals

A good technique for maximizing your miles is stacking. With this method, you pick a card that already has some bonus earning opportunities and route your purchase through the portal. So if you use a card that has 3x points per dollar at Walmart, then its shopping portal also has a 5x points per dollar offer, you’re now grabbing a whopping 8x points per dollar.

Grasping your card arsenal’s bonus categories is key to staying on top of this. If you’re never using the right card, you won’t get far. Be especially careful with some cards’ rotating bonuses. These often shift every quarter, making it more lucrative to use that specific card for certain things at that time of year.

Big Issuer Portals

Capital One

Capital One Shopping is a funny one. Technically, there are two wings to its portal. One, doesn’t even recquire a Capital One account and strictly earns cashback that’s redeemed in the form of gift cards and the like. Some of the earning rates there are super high and there is a huge number of options (although some are super-specific). For those with a Capital One card, the options are thinner on the portal, but still worth checking out whenever you’re about to indulge in some retail therapy.

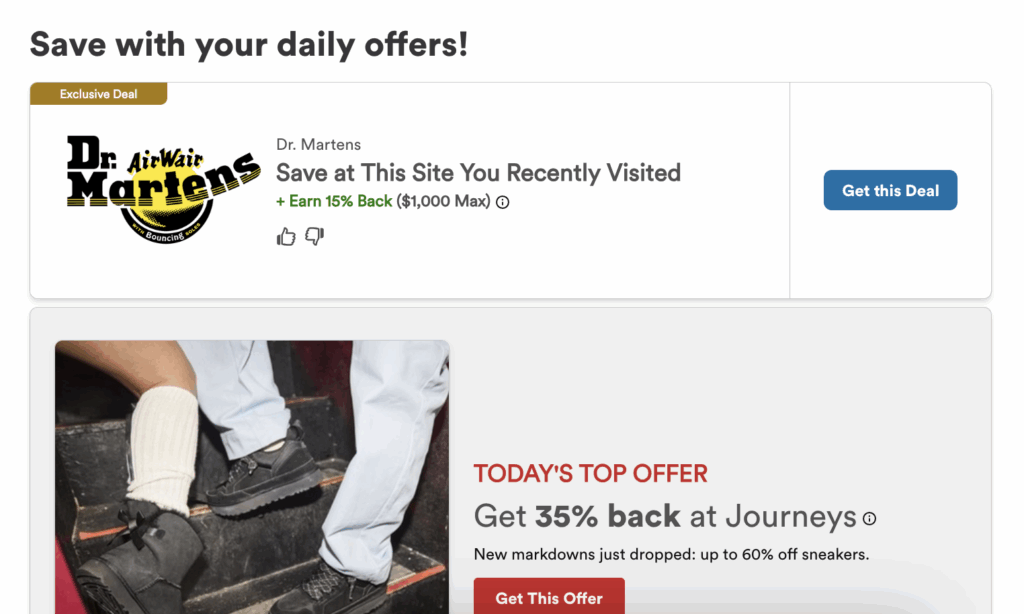

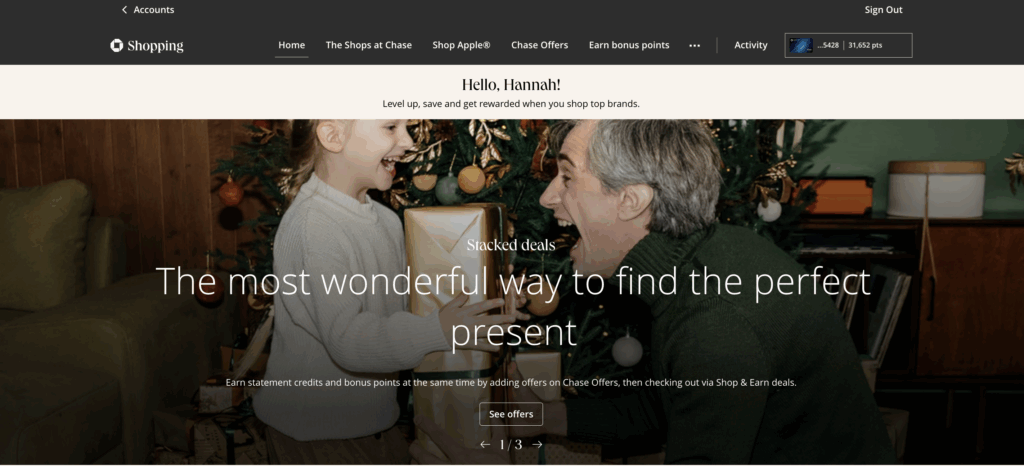

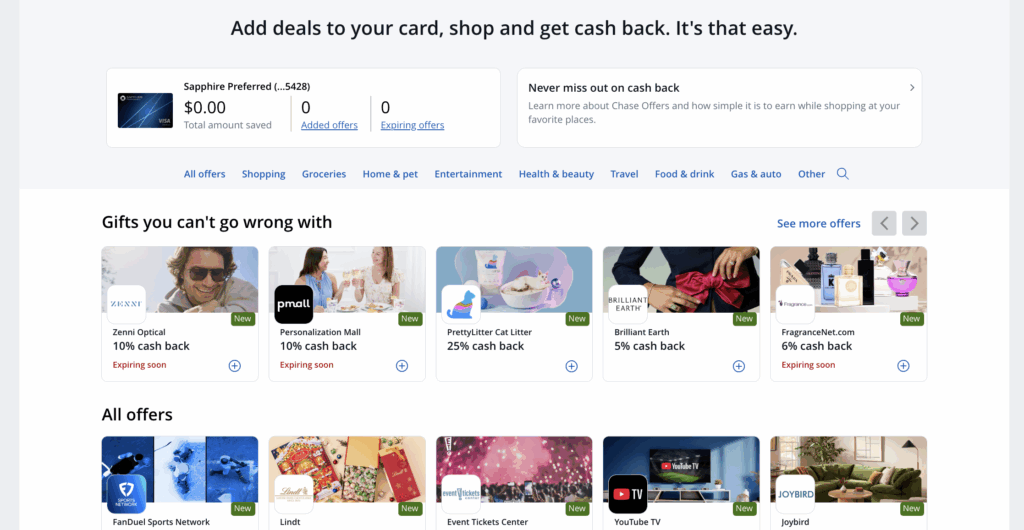

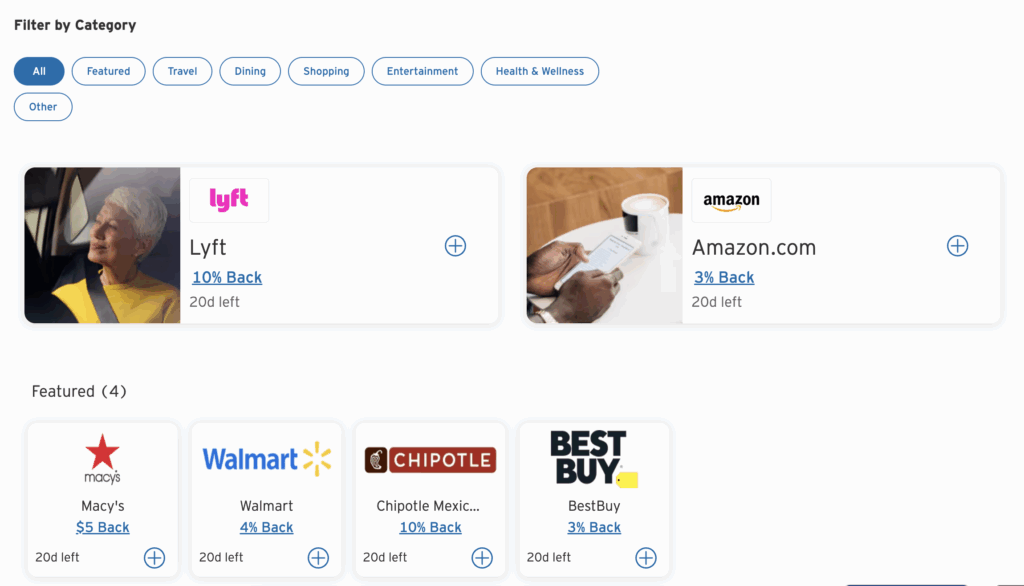

Chase Shopping

Chase’s iteration of a shopping portal is super easy to use. Found in your online account or in the app, you can skim through the cashback and points offers to see what takes your fancy. There are over 1,000 stores on there, with hundreds of names you’ll recognise, like Macy’s, KOHL’s, Sephora, and Nike. You can even set up a favorites list to check in on your regular stop-offs super-fast.

At the time of writing, I found deals like the following:

A huge 6x bonus points per dollar at Under Armour

6x points per dollar at CVS

8x points per dollar at Sam’s Club

5x points per dollar at New Balance

And tons more.

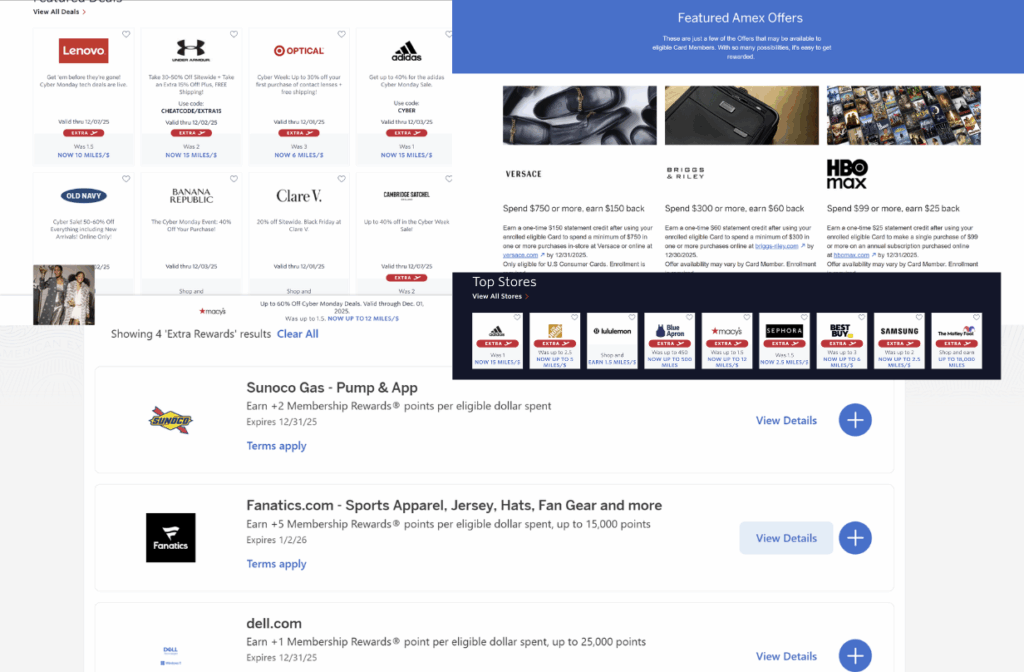

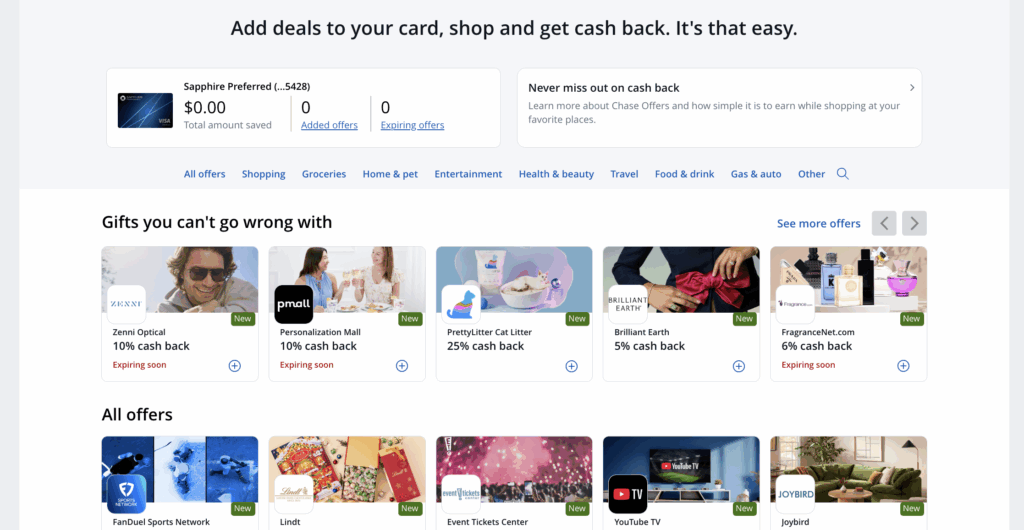

American Express

American Express’ portal is a little different. In fact, it’s technically not a portal. Instead of directing you to a site, it gives you a list of offers that can be activated on your card. Some of these are online, and others are in-store, but you must activate them or your card won’t register the bonus.

Frustratingly, this one has fewer points offers, focusing more on cashback. The offers also differ depending on which card you have, so make sure you switch between yours if you have more than one.

Citi

Citi operates in a similar manner to others, but again puts an emphasis on the cashback bonuses instead of points. This isn’t necessarily a bad thing — money back is good — but it’s not maximizing our spending in the way we want.

Airlines

Airlines are actually some of the best portals for earning points. Of course, the downside is that they’re (generally) worth less than transferable points, but at the rates offered in some of them, it can be more than worth it.

Just look at Delta, for instance. On top of discounts, I found:

Up to 6x miles per dollar at Best Buy

Up to 12x miles per dollar at Macy’s

Up to 9x miles per dollar on Kate Spade

Earn up to 18,000 miles by signing up with Motley Fool

The Point

Shopping portals are an excellent way to maximize your spending. By adding a quick check of your favorite portals to every shopping spree, you can find deals as high as 15x points per dollar, far outweighing anything else, all without changing your actual spending habits.

by your friends at The Daily Navigator

by your friends at The Daily Navigator