Overview

We spend a lot of time telling you how valuable points are. And recently, we’ve been telling you how valuable the holidays are for earning those points. But, if we’re honest, we could maybe do a little more to show you exactly how much they can do for you.

So in this piece, we’re going full-on practical, taking a hypothetical holiday-card-opening situation and showing you how far those points could go. Of course, there are more than two ways to do this, but we’ve picked some pretty amazing cards that you can do wonderful things with.

Let’s get stuck in.

Option 1: Chase Sapphire Reserve®

The Chase Sapphire Reserve is one of the most expensive cards on the market. But it also comes with an immense introductory offer that could take you a long, long way. Opening this card now and using it to cover your holiday expenses could see you flying to Europe next year for almost nothing.

The card is currently running an epic 125,000 Ultimate Rewards points in return for spending $6,000 within three months of opening the card. If you hit the welcome bonus and include the spending, you’ll have a total of 131,000 points in your account at least.

How could you earn that bonus?

Obviously, everyone’s holiday spending is vastly different. Some projections anticipate the average American dropping $1,700 on Christmas alone this year – a huge figure. But, if you have a family, travel expenses, work nights out, friend events, and maybe host a big dinner, that figure doesn’t seem too crazy.

On top of the Christmas spending, you’ve got averages in the following ballparks:

$832 on groceries a month

$1,098 on transportation per month

$300 on entertainment per month

And that’s just scraping the essentials. Based on that, the average American would comfortably hit the 125,000 points within two months. Those on the higher end of the averages could well have it within a matter of weeks.

- Best for: Luxury Travel

- Annual Fee: $795

- Variable APR: 19.49% - 27.99% Variable

- Reward Rate: 1X - 10X

- Recommended Credit: 740-850

Chase Sapphire Reserve®

125,000 bonus points

Offer Details:

Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

Why we like it

This card just got a major re-vamp and you can now get more than $2,700 in annual value with Sapphire Reserve!

Reward details

8x points on Chase TravelSM

4x points on flights and hotels booked direct

3x points on dining

1x points on all other purchases

Pros & Cons

Pros

-

The points are worth up to 2 cents a piece when used directly on Chase’s Ultimate Rewards Portal, offering a simple but high-value use for your points.

-

Plenty of excellent transfer partners allow points to be maximized

-

Some excellent partnerships with Doordash and Lyft add to its value.

-

Priority Pass membership allows access to over 1,300+ airport lounges and restaurants.

Cons

-

It’s subject to Chase’s 5/24 rule. So if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

-

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

Terms Apply

What Could You Do With Them?

This is where it gets fun. Chase has some of the best transfer partners around, making it easy to use those points for super high value. That $6,000 of spending could easily get you almost $3,000 in free travel. Here are all the partners Chase currently has:

Airlines

Aer Lingus AerClub

Air Canada Aeroplan

Air France–KLM Flying Blue

British Airways Executive Club (Avios)

Emirates Skywards

Iberia Plus

JetBlue TrueBlue

Singapore Airlines KrisFlyer

Southwest Rapid Rewards

United MileagePlus

Virgin Atlantic Flying Club

Hotels

World of Hyatt

IHG One Rewards

Marriott Bonvoy

Think the list looks small? You’d be right. It has one of the lower partner counts in the market. But don’t be fooled: Chase has always valued quality over quantity, and its selection makes it the second most valuable points currency behind Bilt.

Here‘s an idea of what you could do with those 125,000 points next year.

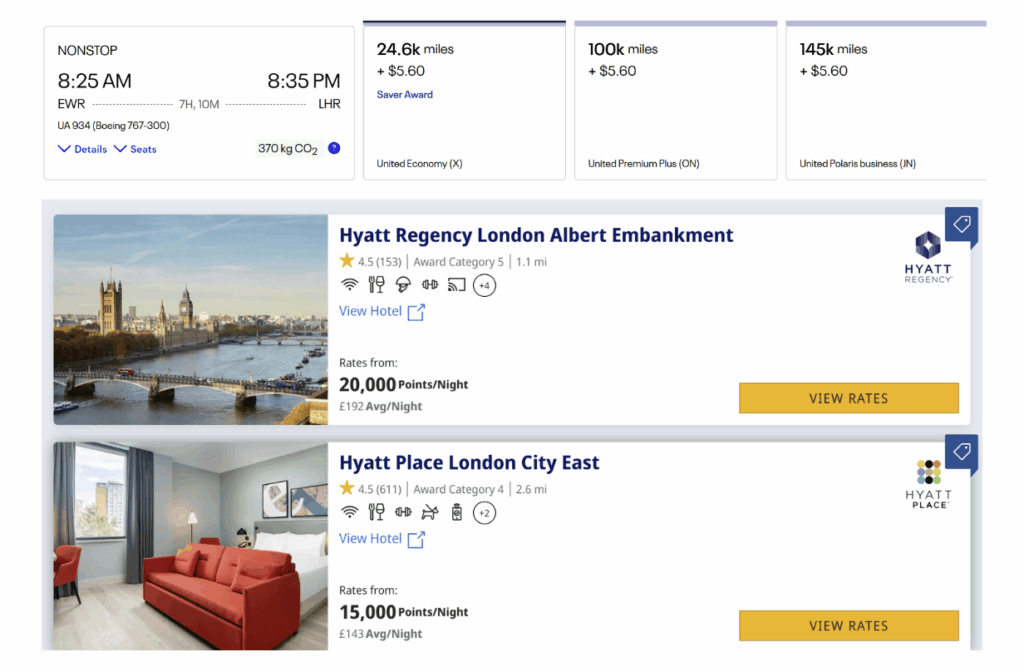

A four-night solo London jaunt

Transfer to United Airlines and grab a round-trip from New York to London for under 50,000 points and $10

Transfer the rest of the bonus to World of Hyatt, book four nights in the Hyatt Regency Embankment hotel for 80,000 points.

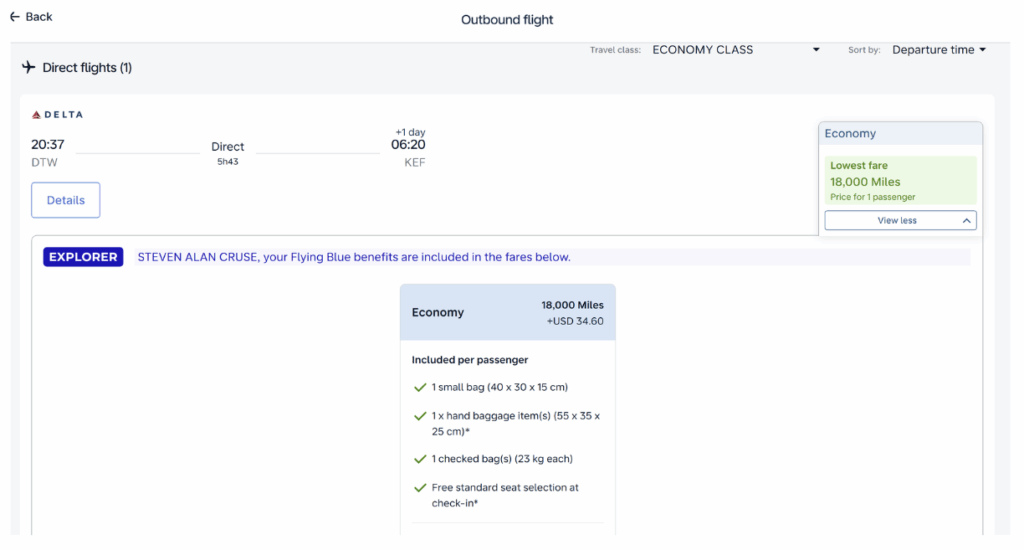

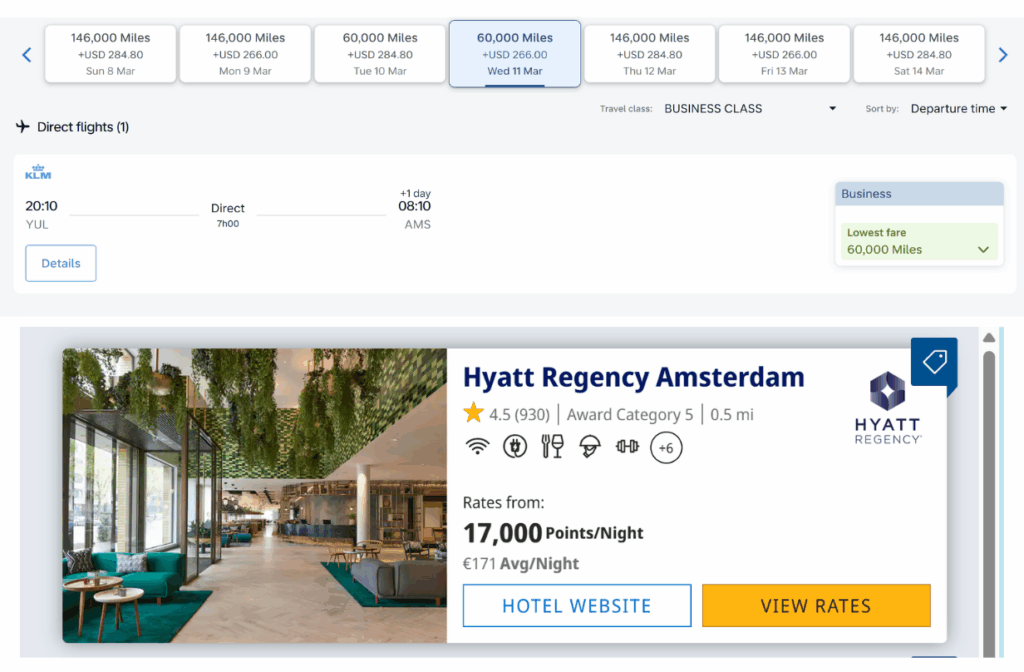

Check out the midnight sun in Iceland in May

Transfer points to KLM/Air France Flying Blue and grab one-way flights to and from Reykjavik for just 18,000 points and $34

Sadly, hotels in Iceland aren’t as great for points, but the bonus is almost enough to fly a family of four out there and back.

Fly Business Class from Montreal to Amsterdam and back

The hotel will be down to you, but 60,000 points to KLM/Flying Blue is enough to grab a business class seat from the Canadian city to Amsterdam.

If you’re not fussed about business class, you can grab one of KLM’s regular deals for 15-20,000 points in economy, and grab a 5-night off-peak stay with the Hyatt Regency in the middle of the city.

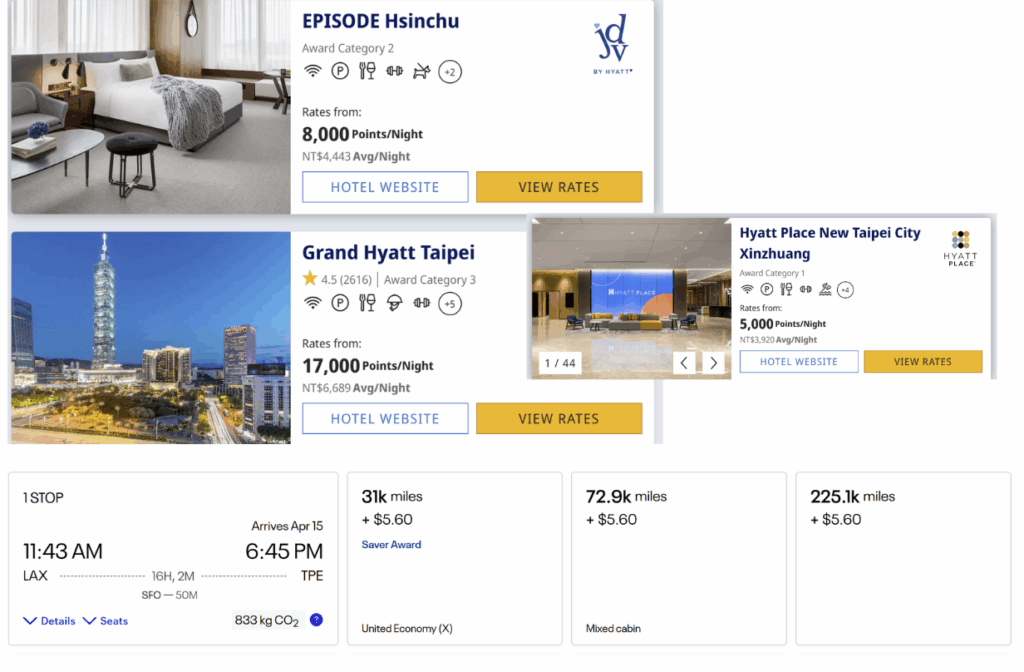

Go Big in Taiwan

Transfer points to United again, and you can grab a round-trip to Taiwan for 62,000 miles plus around $10 in fees.

Transfer the rest of your points to World of Hyatt, and you’ll have enough to stay for almost two weeks in the Hyatt Place New Taipei City

You read that right. That’s a two-week vacation in Asia for $10.

Option 2: American Express Platinum Card®

The Platinum Card is very much the Sapphire Reserve’s rival. Matching it on multiple fronts, it’s currently advertising a bonus worth amanych as 175,000 Membership Rewards® points when you spend $12,000 within your first six months of card membership. That upper limit is an immense point injection of one of the most valuable currencies out there.

But there’s a catch: unlike fixed bonuses from other issuers, Amex’s “as high as” language means not everyone sees the same offer. Some new applicants receive the full 175,000 points, while others are offered a lower amount based on their profile. 175,000 is the best-case scenario, and it’s what we’ll work with today.

Still, for anyone planning a heavy stretch of holiday and early-year spending, even the lower-tier offers can translate into a massive pile of points, especially with a six-month runway to hit the requirement.

How could you earn that bonus?

Of course, average spending habits remain the same as in the last section. This card just has a higher spending threshold. Despite the higher volume of spending overall, the monthly average works out lower at just $1,333.

There are plenty of potential cardholders who could rattle through the spending threshold by the end of the holiday season. For everyone else, it’s likely to give them a good head start with plenty of time to spare for 2026 holiday bookings.

- Best for: Luxury Perks

American Express Platinum Card®

As high as 175,000 Membership Rewards® Points

Offer Details:

You may be eligible for as high as 175,000 Membership Rewards® points after you spend $12,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Why we like it

The Amex Platinum was once the sole dominating force in the luxury credit card space. While it now faces some stiff competition, it still offers unbeatable perks like unprecedented airport lounge access, elite status at Hilton and Marriott, and some outstanding statement credits making the mammoth $895 worth it for some.

Reward details

Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings.

You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

Pros & Cons

Pros

-

Large intro bonus

Incredible lounge access

-

Statement credits worth over $3,500 annually.

-

Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

Cons

-

The $895 annual fee is brutally high. Too high for many that can’t, or don’t want to take full advantage of its benefits.

-

Points-earning rates are low unless spending directly on flights or with the Amex Portal.

-

Some of the benefits, like travel credits, are more limited and are harder to use than competing cards’ offerings.

What Could You Do With Them?

Amex has an outstanding collection of transfer partners at its customers’ disposal, helping them grab well upwards of 2x cents per point on their redemptions. Wrangling them into a high-value stay is down to you, but it’ll be slightly tough to cover accommodation with the ridiculously valuable World of Hyatt at your disposal. If your budget can cope with it, it may be worth checking out another card — maybe a World of Hyatt co-branded product or a Hilton one to bolster your transferable points.

Airlines

Aer Lingus AerClub

AeroMexico ClubPremier

Air Canada Aeroplan

Air France–KLM Flying Blue

ANA Mileage Club

Avianca LifeMiles

British Airways Executive Club (Avios)

Cathay Pacific Asia Miles

Delta SkyMiles

Emirates Skywards

Etihad Guest

Hawaiian Airlines HawaiianMiles

Iberia Plus

JetBlue TrueBlue

Qantas Frequent Flyer

Singapore Airlines KrisFlyer

Virgin Atlantic Flying Club

Hotels

Choice Privileges

Hilton Honors

Marriott Bonvoy

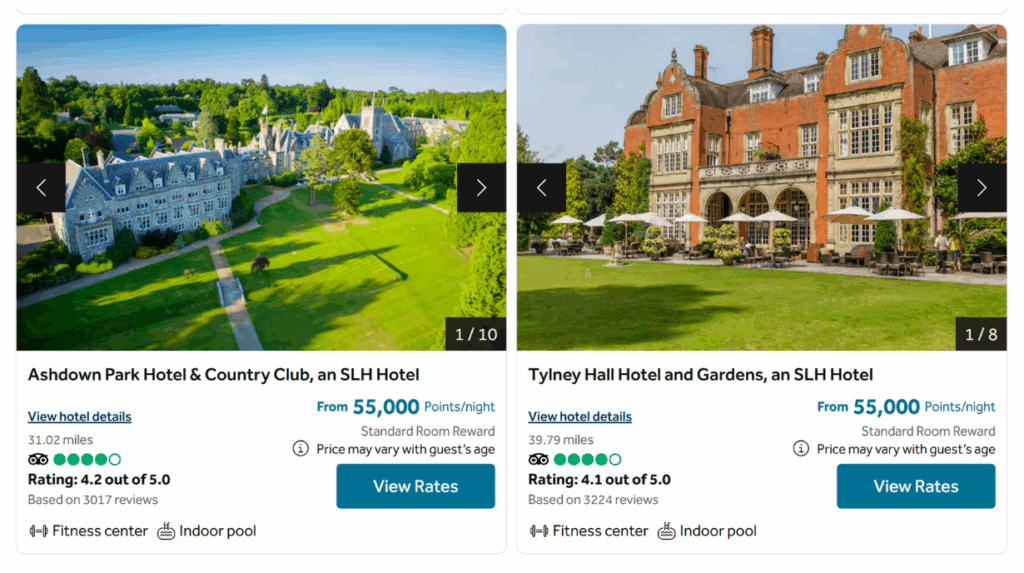

Another London adventure

Transfer to Virgin Atlantic and grab a round-trip from multiple cities in the US to London for under 12,000 points. There will be taxes and fees adding $100 on the way there, and upwards of $200 on the way back, but it still equates to insane value. If you don’t want to pay fees as high, look at other options for the way back.

While the fees with Virgin are annoying, a couple flying there and back would have 318,000 Hilton Honors points after transferring them at Amex’s rate of 1:2. That could grab you over a week in some solid London hotels, using the fifth night free benefit, or some truly astounding properties for five or six nights. The $100 in taxes seems a little fairer now, considering the hotel above would cost $1800 for six nights.

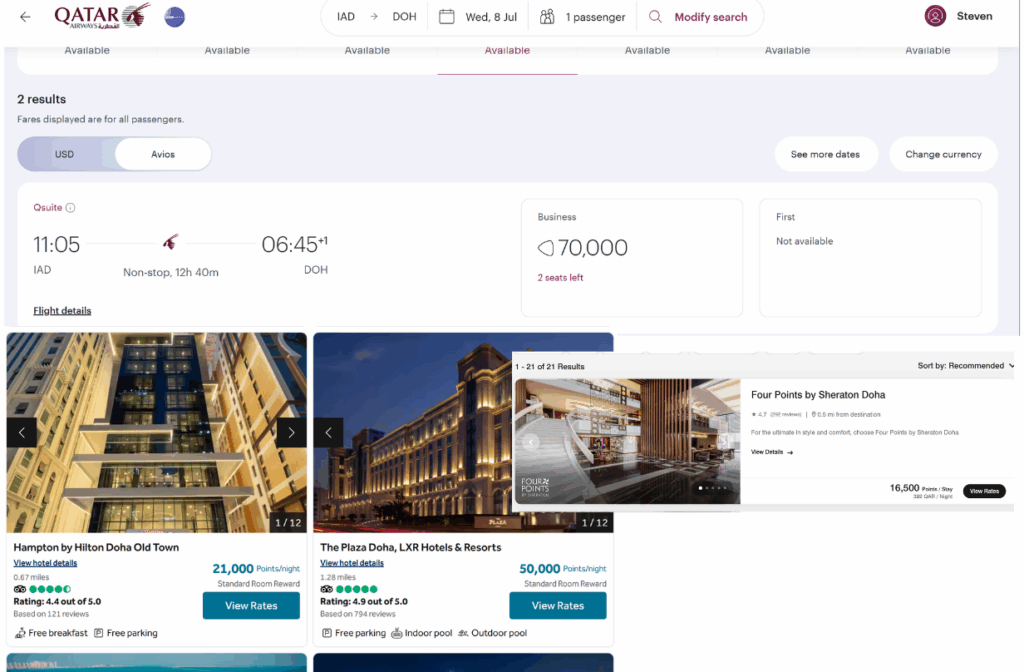

Go big with the QSuite

Transfer points to Qatar Airways via British Airways, and you’ll have enough points to get a round-trip from multiple US cities to Doha in the legendary Qsuite. These flights regularly reach the $10,000 mark in cash. You’d be getting upwards of 14 cents per point this way and still have 43,000 left.

Those 40,000 could grab you five nights in a Hampton Inn or a couple of nights in a Marriott Four Points hotel. That’s an incredible deal.

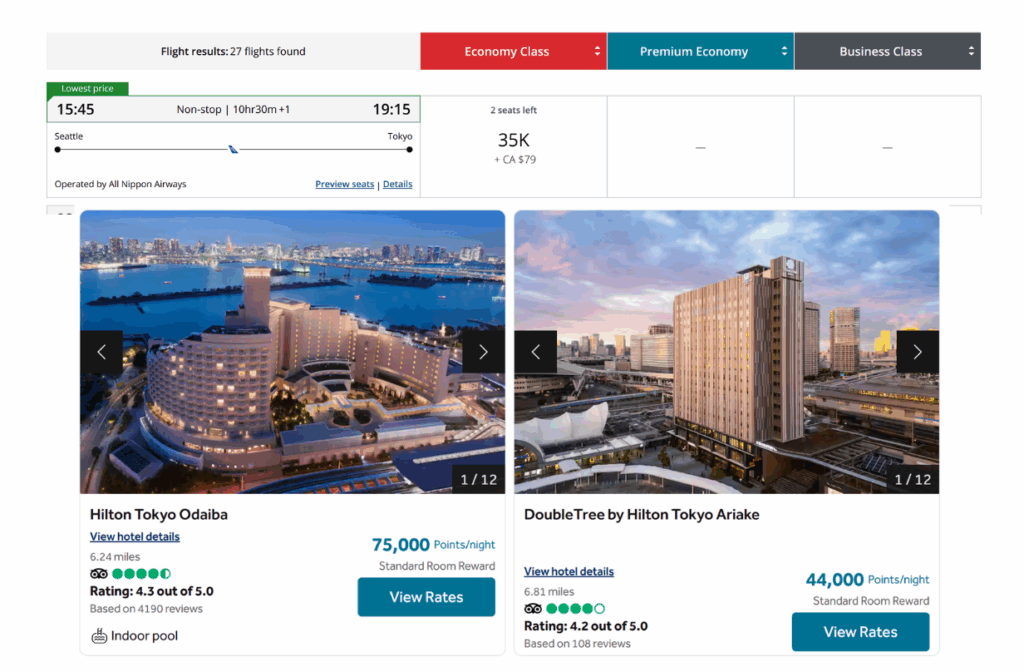

Get on Tokyo time for pennies

Air Canada’s ever-reliable Aeroplan can get you to Tokyo and back for around 70,000 points thanks to its award chart.

From there, use Hilton’s fifth night free benefit again to grab upwards of six nights in Japan’s greatest city. Half the financial battle of Japan is accommodation and flights. The rest of your money is yours to blow on ramen and sake.

The Point

Remember, these are individual cards. We’ve grabbed all these redemptions using nothing but the introductory bonus. If you’re already ahead on your points, you have even more scope.

Do some serious digging into how much you’re likely to spend this holiday season. If it’s a considerable amount, seriously look at grabbing a new card to maximize that spending and turn it into something spectacular.

by your friends at The Daily Navigator

by your friends at The Daily Navigator