Overview

Portugal is something of a traveler’s dream. Glittering beaches rub shoulders with pulsating cities, while medieval castles and cobbled towns frame the impossibly beautiful vineyards. And, of course, you can drink a lot of port. That’s reason enough.

But even with its growing popularity, flights to Portugal from NYC and beyond can still be pricey. Thankfully, points and miles can remove some of the financial burden, or at least let you shift it to copious volumes of wine.

The country’s main gateway is Lisbon, so we’ve worked the bulk of our research with that hub in mind. While we’ve opted for flights to Portugal from NYC, many of these sweet spots will work regardless of where you are in the US.

Let’s take a lot of some of the best ways to find points and miles flights to Portugal from NYC.

The Point:

While flights to Portugal from NYC might not be quite as high value as some of Europe’s other major destinations, there are still a ton of ways to get there for almost nothing. As shown in the third option, getting creative with other hubs can be a great way to save points and money!

Our top card rec:

Chase Sapphire Preferred® Card: This card is the most approachable option. Its welcome bonus is enough to grab flights to Portugal from NYC and beyond. You’ll need to find some for the flight home, though.

- Best for: Beginner Travelers

Chase Sapphire Preferred® Card

75,000 Bonus Points

Offer Details:

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Chase Sapphire Preferred Card is the ultimate all-around travel credit card—it fits perfectly into almost any points-earner’s wallet. Points novices can enjoy a significant intro bonus and easy to grasp spending categories with an approachable annual fee. The more experienced can utilize its high value earning potential as a secondary card and also gain access to Chase’s strong travel booking portal.

Reward details

5x on travel purchased through Chase Travel℠.

3x on dining, select streaming services and online groceries.

2x on all other travel purchases.

1x on all other purchases.

Pros & Cons

Pros

The $50 dollar hotel credit for stays purchased on the Chase Travel Portal already cuts the already approachable $95 annual fee significantly.

10% anniversary points boost – each account anniversary you’ll earn bonus points equal to 10% of your total purchases made the previous year.

Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

Along with all of the above, cardholders also have access to a string of travel protections like rental coverage, cancellation insurance, and purchase protection.

Cons

It’s subject to Chase’s 5/24 rule. So, if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Competing cards like the Capital One Venture have a better earning rate for non-bonus spend.

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

Terms Apply

How to get to Portugal using points and miles from NYC

Before any search, it’s important to understand the routes you’re searching. There are usually five direct flights to Portugal from NYC every day, mainly coming from JFK and Newark airports. Delta, United, TAP Air Portugal, and Swiss Air are among the carriers with direct flights, so those airlines and their partners are a great place to start.

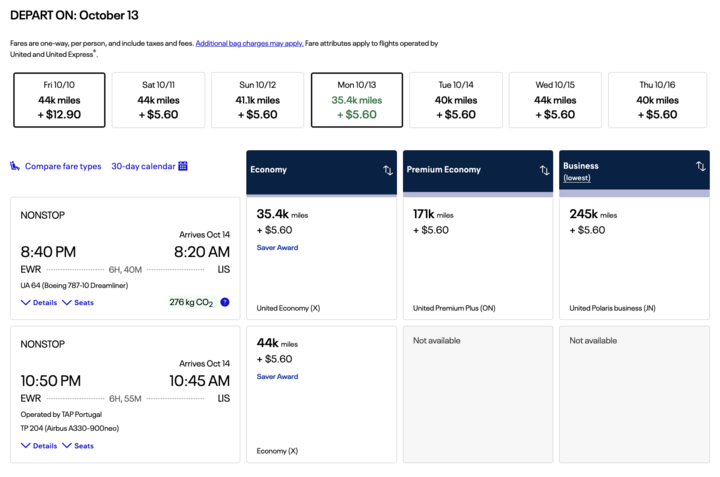

United MileagePlus Points

United is a great place to start your search for flights to Portugal from NYC. As it’s one of the airlines utilizing nonstop flights, it’s a straightforward option with no fuss or long travel days. It’s a dynamic system, which means rates can fluctuate depending on a number of factors, but rates as low as 35,000 miles plus $5.60 in taxes and fees are readily available depending on your dates.

While you could find lower, it’s a simple redemption with strong value.

How to earn UnitedMileage points

United’s MileagePlus miles are a breeze to earn. While they don’t have as many transfer options, opening one of the excellent Chase cards can give you an easy boost. Outside of transferring, you can earn miles by flying with the airline or its partners or opening a co-branded credit card.

Our top recommendation:

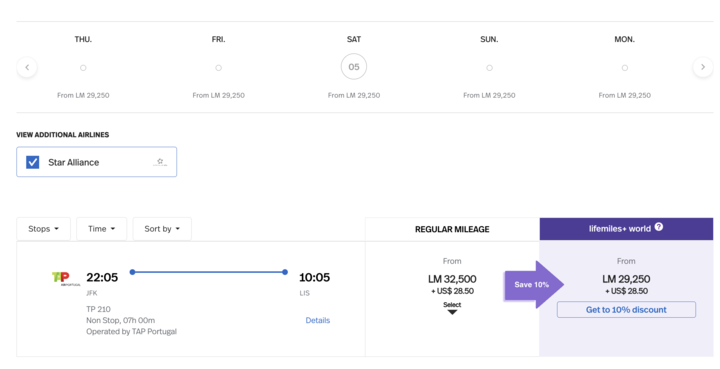

Avianca LifeMiles

Avianca is an airline you may not default to when searching for award flights. It’s understandable—why would you reach for a Colombian airline you may never have heard of? But in this case, Avianca might be one of your best bets for cheap flights to Portugal from NYC.

As the airline partners with TAP Portugal and Swiss Air—two of the airlines with direct flights to Portugal from NYC—you can grab an easy itinerary for as low as $29 and 30,000 LifeMiles. Not too shabby at all.

How to earn Avianca LifeMiles points

Avianca’s greatest strength is the ease with which you can earn its miles. American Express, Capital One, Chase, and Citi all transfer to the South American carrier’s loyalty program, so even if you’ve spread your points a little thin across multiple accounts, you could still pull off a redemption.

Our top recommendation:

The American Express® Gold Card: This is one of the best cards for redeeming flights to Portugal from NYC with Avianca. The card currently comes with an impressive intro bonus that could get you there an back!

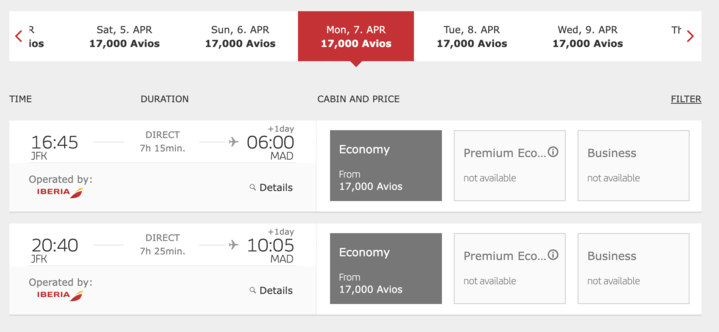

Iberia Avios points

This one is more complex but could save you more points than any other method. Instead of flights to Portugal from NYC, we’re going to look for flights to Madrid, and then book a separate flight from there to Lisbon.

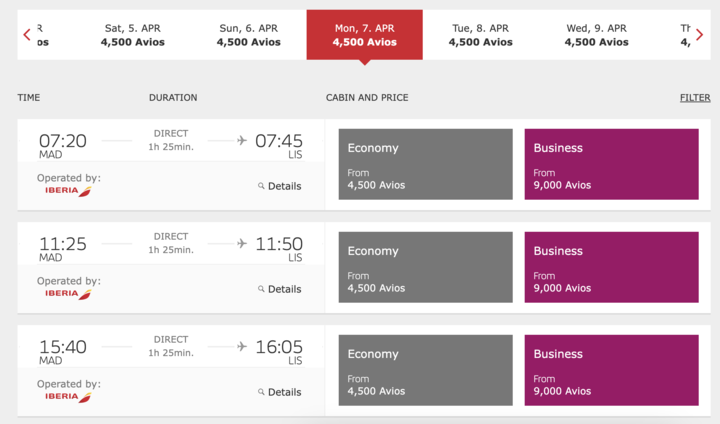

Using Iberia Avios, we can grab a flight to Madrid for as little as 17,000 points. This is where it gets weird. If you booked a flight with Iberia all the way to Lisbon, it would cost 28,000 Avios.

But if you split the flights, you’ll pay that 17,000 Avios rate to Madrid then just 4,500 to Lisbon, you’ll only pay 21,500 Avios for the whole trip. 6,500 Avios might not seem like a big deal to save, but remember, if you’re paying that for a roundtrip, you’ve saved enough points to cover a domestic flight in the US or a Caribbean flight from the Southern US.

How to earn Iberia Avios points:

Iberia is an incredibly easy loyalty program to transfer points to. The reason for this is twofold: first, you can transfer points from credit card accounts with American Express, Chase, and Bilt; second, you can move Avios between any other airline that uses Avios, like British Airways, Qatar, and Aer Lingus.

Using this method, even if you don’t have an Amex, Chase, or Bilt card, you could still move points to your Iberia account using a Citi card by moving them to Qatar and then Iberia. Easy. But for simplicity, here are some excellent cards you can use.

Our top recommendation:

The Platinum Card® from American Express: While it does have a hefty annual fee, it’s nullified by a mega intro bonus. You could do the trip twice or treat that special someone.

Before you book

If you’ve read any of our other “how to” guides, you know it’s always a good idea to do some research before booking your trip. That means checking which airlines fly the route, how frequently they operate, and the general price range for tickets. Don’t forget to look into nearby airports as well—sometimes a short train ride can save you hundreds.

The good news is that finding a direct flight from New York to Lisbon is much easier than to some other European destinations. Multiple airlines, including TAP Air Portugal, Swiss Air, and United, offer nonstop service from JFK and New York, with flights running daily. Prices mostly range from $300 to $900 round-trip, depending on the season and how far in advance you book.

But if you’re flexible with layovers, you can often find even cheaper fares with budget carriers routing through other European hubs. Using a service like Dollar Flight Club can help you stay on top of deals—one-way tickets under $300 pop up more often than you’d think, especially if you’re open to off-peak travel times.

- Best for: Beginner Travelers

Chase Sapphire Preferred® Card

75,000 Bonus Points

Offer Details:

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Chase Sapphire Preferred Card is the ultimate all-around travel credit card—it fits perfectly into almost any points-earner’s wallet. Points novices can enjoy a significant intro bonus and easy to grasp spending categories with an approachable annual fee. The more experienced can utilize its high value earning potential as a secondary card and also gain access to Chase’s strong travel booking portal.

Reward details

5x on travel purchased through Chase Travel℠.

3x on dining, select streaming services and online groceries.

2x on all other travel purchases.

1x on all other purchases.

Pros & Cons

Pros

The $50 dollar hotel credit for stays purchased on the Chase Travel Portal already cuts the already approachable $95 annual fee significantly.

10% anniversary points boost – each account anniversary you’ll earn bonus points equal to 10% of your total purchases made the previous year.

Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

Along with all of the above, cardholders also have access to a string of travel protections like rental coverage, cancellation insurance, and purchase protection.

Cons

It’s subject to Chase’s 5/24 rule. So, if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Competing cards like the Capital One Venture have a better earning rate for non-bonus spend.

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

by your friends at The Daily Navigator

by your friends at The Daily Navigator