At a glance

- Best for: Frequent Southwest Fliers

Southwest Rapid Rewards® Priority Card

Earn Companion Pass + 40,000 bonus points

Offer Details:

Earn Companion Pass through 2/28/27 and 40,000 bonus points after spending $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Southwest Rapid Rewards® Priority Credit Card is the popular airline’s premium card offering and represents a solid piece of value for those who fly with the carrier at least once or twice a year. While premium, in this case, doesn’t stretch to the same lounge-based perks as some of its competitors, and a generous annual points bonus, making it well worth the fee.

Reward details

4x points per $1 spent on Southwest Airlines® purchases, including flights, inflight, and Southwest gift cards.

2x points for every $1 you spend at gas stations and restaurants

1X points on all other purchases.

Pros & Cons

Pros

-

The 7,500 annual bonus points are worth around $100 towards travel on Southwest.

-

25% discount on in-flight purchases when paying with the card

-

The intro bonus can be used when collecting points for the Companion Pass benefit.

-

Elite status can be earned with day-to-day spending, and not just flights.

Cons

-

The $229 annual fee can be steep if the card isn’t used to its full value.

-

No lounge access included

-

Southwest points cannot be transferred or used with any airline partners.

Terms Apply

Overview

There’s something pleasant about Southwest Airline’s rewards program. Rapid Rewards operates how most people assume airline points and miles. Earn miles. Redeem miles. Fly free. There’s no hassle or overpriced redemptions, and no steep learning curve. You pay for what you want at a (pretty much) set rate.

And for those who value that simplicity (or those who just love Southwest), the Southwest Rapid Rewards® Priority Credit Card might just be the best card on the market.

Combining practical and money-saving perks with strong earning rates and a stellar intro bonus, Southwest’s premium personal card is a must for any Southwest nut and more than worthy of a head-turn for everyone else.

Who is the Southwest Rapid Rewards Priority Card best for:

The card is best for Southwest loyalists who are serious about earning Rapid Rewards, but there’s more than enough going on here for even the casual Southwest flyer.

The Bottom Line:

As co-branded cards go, it’s one of the best, offering direct value and strong earning opportunities for customers. The more you fly Southwest, the further this card can take you.

Intro Bonus

The Southwest Rapid Rewards Priority Card is currently running a welcome bonus offer: Earn 40,000 points after spending $5,000 on purchases in the first 3 months from account opening. As Southwest Rapid Rewards are valued at a steady 1.4 cents each, that bonus is worth around $560 in flights.

While the figure may not be as high as other cards, few have a spending requirement that is as approachable. Just $1,667 a month in spending grabs that bonus. As you’ll discover later, Southwest Rapid Rewards are reliable as they’re tied to the cash price instead of fluctuating like other points and miles systems.

It’s important to note that you won’t be eligible for the bonus if you currently own a Southwest personal card or have received a new card member bonus in the past 24 months.

Pros & Cons

We think the Rapid Rewards Priority Card is a gem, but no product is perfect. Here’s a summary of the good and bad sides of the card.

Pros

- Easy to earn intro bonus

- Bonus points and credits each year

- Upgrade benefits

- Fast-track to companion passes

- Solid earning rates

- In-flight discounts

Cons

- $229 annual fee

- Points can only be used on Southwest flights

Benefits & Perks

7,500 Rapid Reward Points Anniversary bonus

On top of the statement credit, cardholders also enjoy an annual 7,500-point bonus. Again, there are no strings attached beyond keeping on top of things and paying your annual fee. The points will drop into your account on every cardholder anniversary.

7,500 points are worth over $100. If you’re operating a math level above third grade, that should tell you that the $75 travel credit and 7,500 point bonus are worth more than the annual fee. If you fly just once or twice a year with Southwest, these two benefits make the card worth it.

25% Back on In-flight Purchases

The card also offers 25% discounts on in-flight purchases in the form of a statement credit. Simply use the card to pay for anything mid-flight and you’ll be credited back the discount.

The airline is introducing assigned seating soon, though, so it’s not clear if this benefit will be impacted in the long run. Until then, just know the four upgrades are for each cardholder year. Not the calendar year.

10,000 Point Companion Pass Boost

One of Southwest’s best features is its Companion Pass. Once earned, the traveler can bring a specified companion with them on any flight at no cost other than the taxes and fees. It’s an incredible benefit for those who achieve it, but it does take some work.

Typically, it takes 100 qualifying flights or 135,000 Rapid Rewards points to earn it. This 10,000-point boost, combined with the 85,000 in the introductory offer gives you a headstart. The rest is on you.

Tier Qualifying Points Boost

As well as boosting your chances of earning a Companion Pass, the card also gives you a better shot at earning A-List status. A-list status isn’t as sexy as other airline programs, but it does grant you automatic Priority Boarding for you and everyone on your booking, a 25% earning bonus, same-day changes, and express check-in.

Cardholders earn 1,500 tier qualifying points for every $5,000 spent on the card with no limit on the number you can earn. You’ll need to hit 36,000 in a calendar year or fly 20 times to earn the status.

Travel Insurance and coverage

Last, but not least, the card gifts the holder multiple forms of coverage when it’s used in certain situations. These include:

Lost luggage reimbursement

Baggage delay Insurance

Extended Warranty Protection

Purchase protection

Earning rewards & redeeming points

The Southwest Rapid Rewards Priority Card offers several tiers of earning rates, allowing cardholders to rack up points on daily spending to redeem for future flights. The rates are solid and one of the best ways to rack up points if you fly Southwest a lot. However, other general cards earn similar rates and they can be transferred to other airlines. The value in this will depend on how you prefer to use your rewards.

Earning rewards

4x Points per Dollar on Southwest Purchases

Earn 4 points per $1 spent on Southwest Airlines® purchases, including flights, inflight, and Southwest gift cards.

2x Points per Dollar on multiple categories

Cardholders will earn 2x points per dollar spent on the following categories:

Gas stations and restaurants

Any purchase not included in these categories will earn 1x point per dollar.

Redeeming points

Redeeming points with Southwest is simple compared to other airlines. That’s because the airline ties the value of its points to the cash price of any given flight.

Other airlines use dynamic pricing, where award flights can be set using any range of metrics the carrier sees fit or award charts with set distance or regional parameters. While these can offer exceptional value in some cases, the complete opposite is often true, and learning to understand the system can take time and practice.

Southwest’s system, by comparison, is simple. With a rough valuation of 1.4 cents each, it’s almost impossible to get a bad deal on a flight. The higher the cash price, the higher the points rate, and the lower the cash price…you guessed it, the lower the points rate.

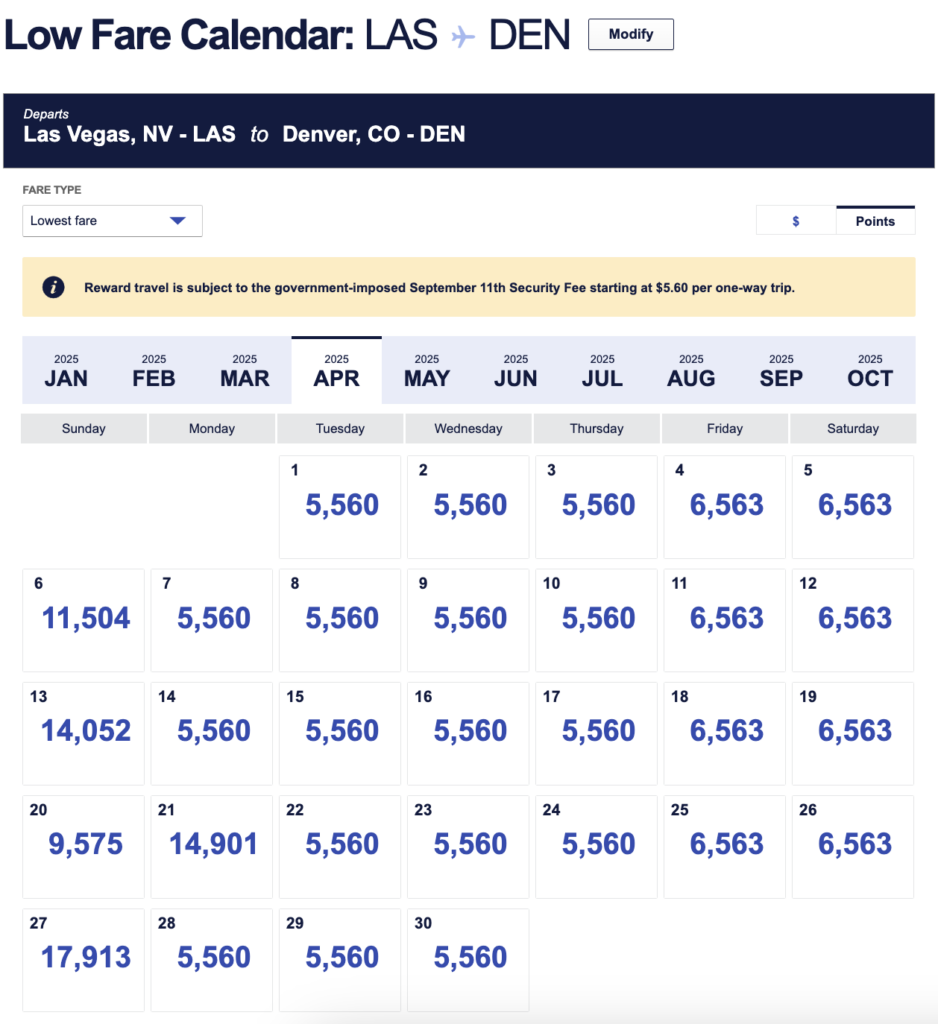

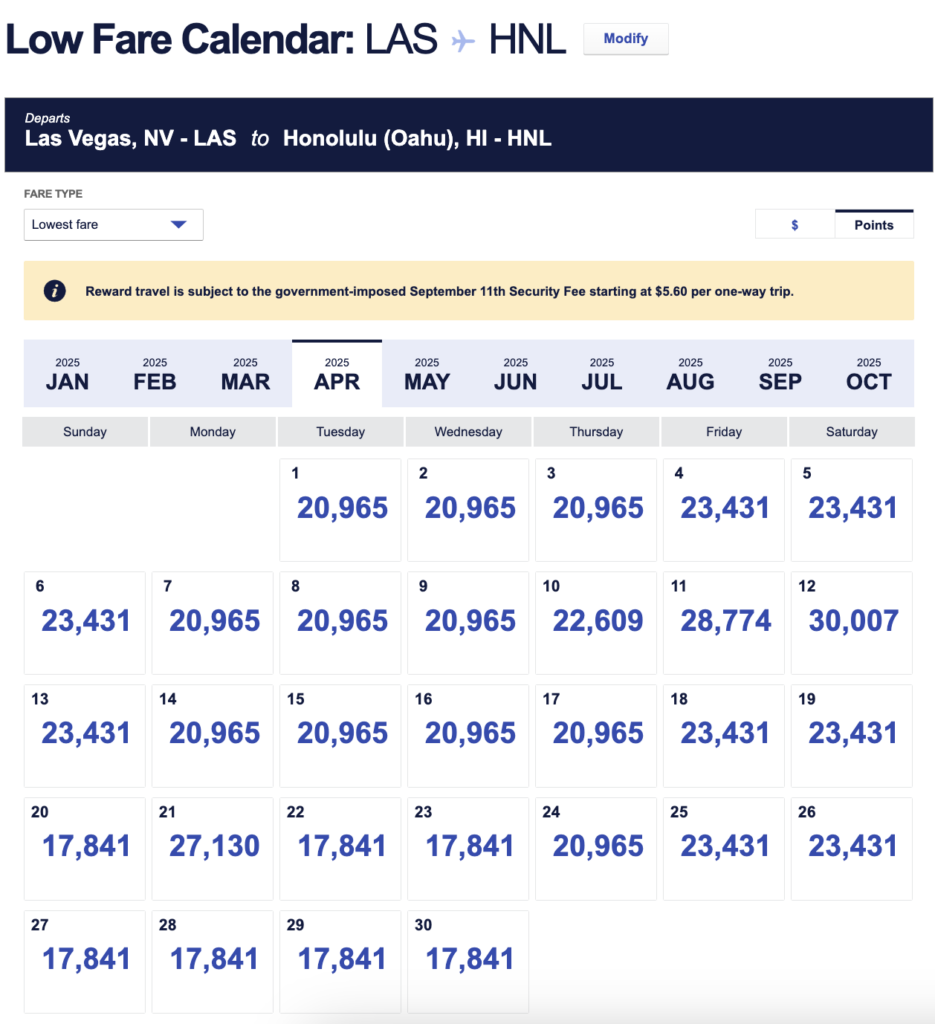

A quick search throws flights like Las Vegas to Hawaii for less than 20,000 points, while short flights can run as little as 6,000 points. How and when you use your points is up to you, but you can rest knowing you’re never getting a bad deal, at least from a rewards standpoint.

Is this card right for you?

If you’re a regular Southwest customer, this card should be a no-brainer. The benefits, earning opportunities, and value of the card are easily earned back in just a few flights a year. But even less frequent Southwest flyers can reap the benefits of this card on occasion.

- Best for: Frequent Southwest Fliers

Southwest Rapid Rewards® Priority Card

Earn Companion Pass + 40,000 bonus points

Offer Details:

Earn Companion Pass through 2/28/27 and 40,000 bonus points after spending $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Southwest Rapid Rewards® Priority Credit Card is the popular airline’s premium card offering and represents a solid piece of value for those who fly with the carrier at least once or twice a year. While premium, in this case, doesn’t stretch to the same lounge-based perks as some of its competitors, and a generous annual points bonus, making it well worth the fee.

Reward details

4x points per $1 spent on Southwest Airlines® purchases, including flights, inflight, and Southwest gift cards.

2x points for every $1 you spend at gas stations and restaurants

1X points on all other purchases.

Pros & Cons

Pros

-

The 7,500 annual bonus points are worth around $100 towards travel on Southwest.

-

25% discount on in-flight purchases when paying with the card

-

The intro bonus can be used when collecting points for the Companion Pass benefit.

-

Elite status can be earned with day-to-day spending, and not just flights.

Cons

-

The $229 annual fee can be steep if the card isn’t used to its full value.

-

No lounge access included

-

Southwest points cannot be transferred or used with any airline partners.

by your friends at The Daily Navigator

by your friends at The Daily Navigator