Overview

Oh, Paris.

The City of Love.

The City of Light.

The City of Hefty Wallet Depletion.

Paris’ wonder is irrefutable, but there’s no avoiding its devastating effect on our bank accounts. While it’s possible to keep things on a budget, flights and hotels in particular tend to prise at the purse strings.

But for those willing to plan a little further in advance, points, and miles are the ultimate cheat codes for dirt-cheap trips to one of the world’s greatest cities. To that end, I’ll show you how to travel to Paris on points and enjoy an almost entirely free trip to the French capital.

Bon chance!

The Point:

Learning how to get to Paris with points may seem intimidating, but with careful planning and an understanding of your own spending habits, it’s possible to achieve a fully covered luxury trip in just a few months.

Our top card rec:

Before you earn

Before you make any decisions with your finances, you need to build, at the very least, a rough idea of what you need your points to achieve. Is your goal simply to keep prices down? Or are you shooting for a luxury experience typically beyond your budget?

These rough trajectories should dictate your decision-making process and the length of time you’ll need to hit your targets. For example, someone hoping for a cheap trip and nothing more can probably do this faster than someone looking for business class flights and a five-star hotel.

It’s important to take inventory of your finances. Take note of your monthly spending and any future one-off expenses. These can help you understand which intro bonuses are achievable.

Go do that, and come back. I want you to do this responsibly.

How to fly to Paris on points

If you’re new to points and miles, I’d recommend checking out some of our beginner guides first. Better yet, check out my online crash course where I’ll walk you through everything you need to know about traveling with points.

But if you have a little understanding, let’s take a look at the basics of how to travel to Paris on points.

To do this effectively, we’ll use several tried and true points and miles tactics:

Introductory credit card bonuses

Value-maximizing transfers

Airline and hotel-specific credit card perks

Free night certificates

Two-player mode

A systematic combination of these concepts can get you to Paris and back with a hotel stay included for almost nothing.

Setting the controls

To show you how to travel to Paris on points, I’ll run through a hypothetical concept: a couple looking for a luxury trip. The trip will be around a week long and will fly from New York. We’ll assume both couples have 12 months until their trip.

The luxury couple has an average monthly credit-card-payable spend of $4,500. Assume they have strong credit but neither have many credit cards, giving them scope for the products they can open.

Award availability

If you can travel somewhere in luxury for almost nothing, budget travel will be a piece of cake. So we’ll start with the bigger undertaking: luxury travel.

Half of the battle with luxury points travel is finding availability. Airlines with super high-end cabins, like the Qatar Airways Qsuite or Delta’s Delta One, are sparing with award availability and travel hacking’s popularity surge means those seats disappear fast. Most airlines release booking availability about a year in advance, although the exact times differ from carrier to carrier.

Booking this as far in advance is your best bet for getting the dates you want and the best rate possible. But I’d recommend flexibility with dates and airlines to maximize your chances. If you’re set on specifics, you’re limiting yourself.

Scope out the options

In this scenario, I’d recommend the couple search for direct business class flights to Paris from all NYC airports. This gives them the full spectrum of carriers and available dates. From there it’s all about putting their knowledge of the individual carriers to use. I’ll cover a couple of solid redemptions in the next section.

It’s also a good idea to check other prominent routes to Europe. For example, Iberia’s flights from the East Coast to Madrid are widely regarded as the best value transatlantic business class redemption. While flying to Madrid may not be ideal, adding a connecting flight to Paris from there can still wind up more affordable than a direct flight on another airline. This is another area where flexibility pays heavy dividends.

Business class flights

Air France via Virgin Atlantic

The natural place to start is with France’s flagship carrier, Air France. KLM is tied to the airline via the Flying Blue loyalty program. The Flying Blue program itself can offer some incredible value, but its odd hybrid system isn’t too reliable. It does have an award chart, but that only specifies the lowest rate a flight could be. Other factors determine the actual rate, which could be more than 150,000 miles.

If you start on the Flying Blue website, look for the 55,000-mile rate. That’s the entry rate for North America to Europe flights. If it’s higher than that, keep looking until you find it.

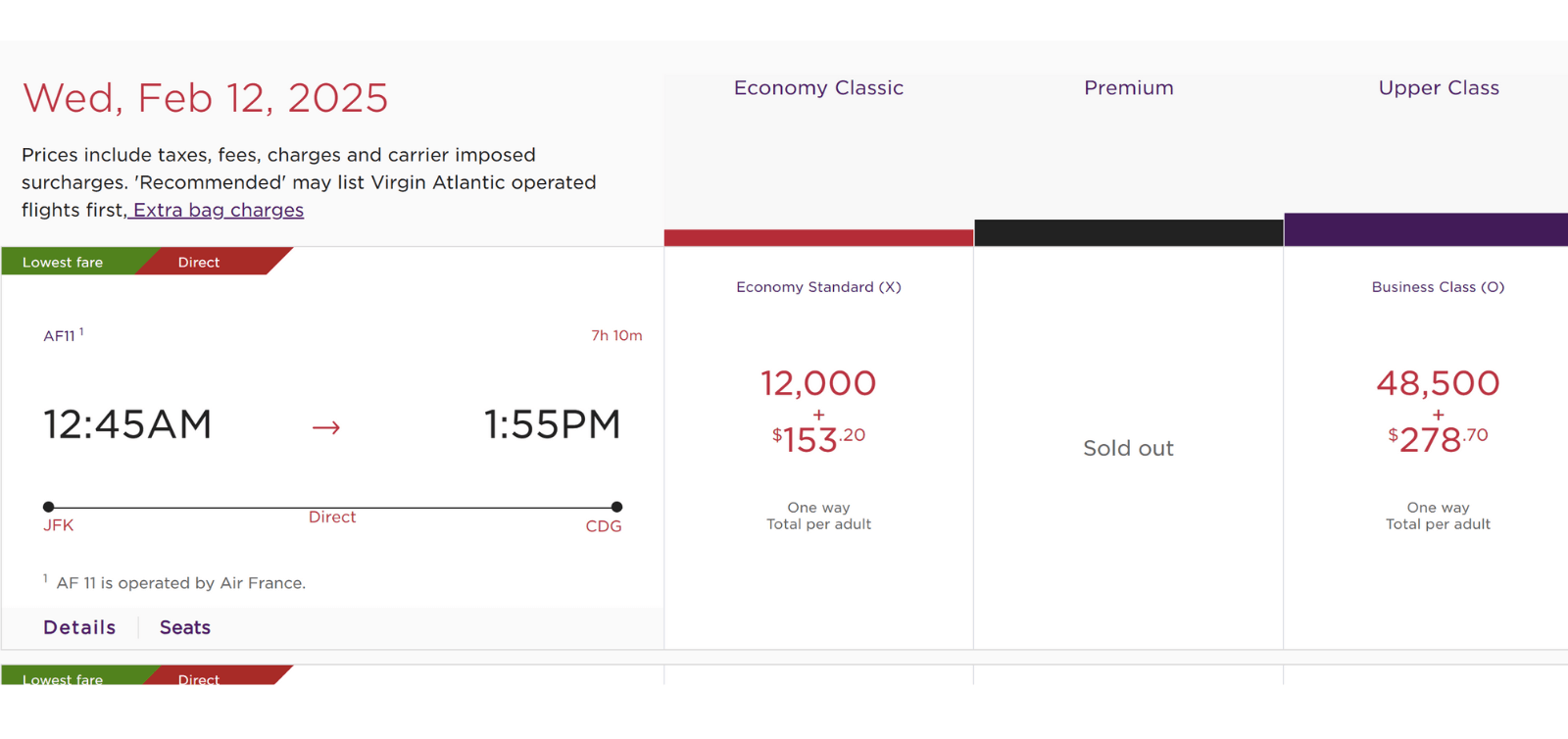

Your other option is to head to Air France’s partner, Virgin Atlantic.

The British airline has some tremendous rates on business class flights going both ways. A quick search found a ton of availability well into 2025 for just 48,500 points plus around $200 in taxes. That’s an excellent deal.

Better yet, Virgin has regular transfer bonus promotions from its credit card partners. If you find a 25 percent transfer bonus, you’re effectively paying around 39,000 points for that business class flight. Always keep a look out for these.

Which cards could earn that bonus:

Virgin Atlantic is one of the easiest points currencies to earn. All the major credit cards transfer to the carrier’s loyalty program, so any combination of general travel cards could be a winner.

In this case, I’d recommend the couple opt for a major general card like:

All three of these card’s intro bonuses have enough points for the couple to use.

ANA Mileage Club

While Virgin may give the most obvious business class route to Paris, it’s not the only one. Depending on the time of year, the flexibility of the traveler, and the available points, there are other options.

Japanese Airline All Nippon Airways (ANA) is a glittering beacon of hope in the points and miles world. With an amazing award chart that designates values based on simple zones, it offers spectacular value if you can find availability.

Its award chart, shown below, has a set roundtrip rate of 100,000 points. Its main partner in the region is United, so you’ll need to search for Polaris availability well in advance before giving it a go. If you can find them, it’s an unbelievable way to get to Paris.

American Express is the only credit card transfer partner, so the same recommendation of the Platinum Card applies in this case.

Air Canada Aeroplan

Air Canada’s Aeroplan is another one to keep an eye on. It also uses an award chart but fuses zones and distances into a more complex iteration than ANA’s. Still, East Coast airports like Newark can take advantage of the 60,000-point business class rate. It’s possible to grab United’s Polaris at this rate, but availability is scarce right now.

A more reliable bet is to opt for a stopover. While it will cost a little more, there are plenty of routes for 70,000 points going through places like Vienna or Portugal. In some ways, this is a win—a longer flight in business lets you take full advantage of the experience.

Summary of credit card moves

Our couple could comfortably score roundtrip business class flights to Paris by opening two credit cards. We’ve suggested the Platinum for its high bonus and the potential for that to increase further for one or both of them. If they’re savvy with their decision-making and timing, transfer bonuses and layovers make the trip possible. l’d be ready to book within four months.

How to stay in Paris on points

We’ve got them a business class ticket there and back. But where are they going to stay? Well, they want to go luxury—it’s Pari after all—but they don’t want to pay.

It’s a tall order, but it’s definitely doable with some serious strategy. Once again, flexibility can change the game here. While it’s nice to have brand loyalty in some cases, spreading your scope to other brands can change everything.

As a rule, hotel redemptions tend to have less direct value than flights. But when your goal is a cheap trip, that needs to stretch to your accommodation. Prior research is essential, and it’s always good to have a backup plan as rates can shift dramatically depending on the program you’re using.

How to book seven nights for free in Paris

Seven nights in Paris is a tall order by any means, but there are some sneaky ways to do this, even if you’re opting for luxury hotels. For free stays at any brand, you need to rely on two distinct tactics: free award nights and points redemptions.

While these sound similar, they are different. Points redemptions require a transaction to take place in the same way you would use money. For example, one night in a hotel might cost 30,000 points.

Free award nights differ as they can be used without points. These are typically offered as a reward for spending a set amount of nights or money with a particular brand. Other times, they may come as a perk on a co-branded card.

A combination of these methods can grab us that free week in Paris.

World of Hyatt redemptions

Your first stop on any free hotel quest should be World of Hyatt. Even using other brand’s promotional rates, Hyatt will almost always have more accessible prices and Paris is no different.

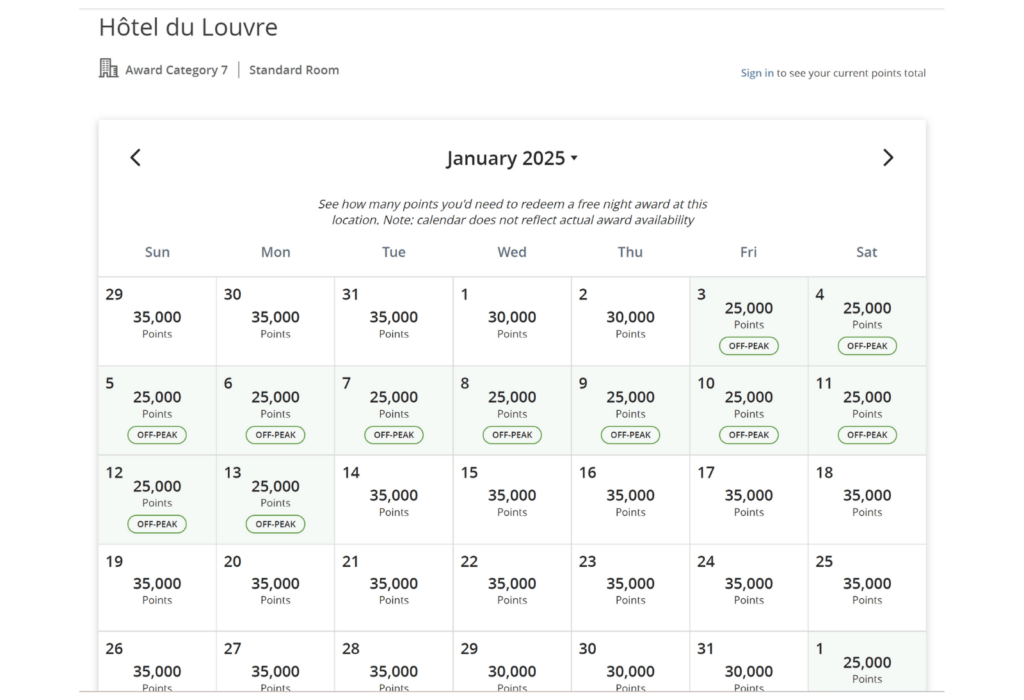

Hyatt categorizes its hotels from 1 to 8, with 8 being the most luxurious properties. As it uses a standardized award chart, you can guarantee the rate of a standard room based on whether it’s off-peak, peak, or standard. Searching for off-peak availability is key to the best rates, so shoulder seasons should be a priority.

If we search for Hyatt properties in Paris, we can find the Hotel du Louvre, a stunning five-star hotel literally a block from the museum of the same name. I can confirm how good this place is. A cheap night in this hotel averages at around $500. It regularly soars beyond $1,000.

Because the Hotel du Louvre is a Category 7 property, its off-peak rate is just 25,000 World of Hyatt points a night. It’s possible to find an entire week at this rate, which would bring the total to 175,000 points. That’s a big number but well within reach for some.

Which cards could get you those points?

No World of Hyatt card has a bonus large enough to cover those points. In fact, you’re better off opting for a couple of other cards, especially if you’re a small business owner with some expenses to cover. Chase is the only credit card issuer that allows transfers to Hyatt, so you’ll need to stick to that family of cards.

The Ink Business Preferred® Credit Card is the most straightforward path to those points. With a mammoth 90,000-point intro bonus, our couple could be more than halfway there after spending $8,000 within three months. Of course, you need to have a small business to qualify, but don’t despair just yet—a lot more people qualify than you’d assume.

The other card to get them over the finish line would be the Chase Sapphire Preferred® Card. It’s currently running a 75,000-point intro bonus after spending $5,000 within three months. Our couple could hit that in a month with their average spending.

- Best for: Beginner Travelers

Chase Sapphire Preferred® Card

75,000 Bonus Points

Offer Details:

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Chase Sapphire Preferred Card is the ultimate all-around travel credit card—it fits perfectly into almost any points-earner’s wallet. Points novices can enjoy a significant intro bonus and easy to grasp spending categories with an approachable annual fee. The more experienced can utilize its high value earning potential as a secondary card and also gain access to Chase’s strong travel booking portal.

Reward details

5x on travel purchased through Chase Travel℠.

3x on dining, select streaming services and online groceries.

2x on all other travel purchases.

1x on all other purchases.

Pros & Cons

Pros

The $50 dollar hotel credit for stays purchased on the Chase Travel Portal already cuts the already approachable $95 annual fee significantly.

10% anniversary points boost – each account anniversary you’ll earn bonus points equal to 10% of your total purchases made the previous year.

Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

Along with all of the above, cardholders also have access to a string of travel protections like rental coverage, cancellation insurance, and purchase protection.

Cons

It’s subject to Chase’s 5/24 rule. So, if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Competing cards like the Capital One Venture have a better earning rate for non-bonus spend.

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

Terms Apply

Hilton Free Night Rewards and points sharing

Hilton’s award rates are generally not as strong as Hyatt’s. The brand operates a dynamic system, so redemptions fluctuate depending on several factors.

But there are still some incredible redemptions to find, and with some careful planning, it could work out perfectly.

Take a hotel like the Hilton Opera. It’s another stunning property (again, I can confirm) and points rates can run from 50,000 points and beyond. They seem to average at around 80,000 points. Hilton runs a fifth-night free promotion when booking with points. At that rate, they’d need 320,000 points to score five nights for free. That’s a lot of points. But here’s what they could do.

Which cards could get you those points?

Hilton has a strong selection of co-branded cards boasting huge intro bonuses. The Hilton Aspire is the premium choice and currently has a huge bonus of 150,000 points after spending $6,000 within six months of opening the card. The downside is the huge annual fee that’s getting a little harder to achieve maximum value. It would still help them in this situation, but we’re trying to avoid spending wherever possible.

Instead, if both of them open the middle option, the Hilton Honors American Express Surpass® Card, they could achieve all their goals and a little more.

The card has a $150 annual fee (see rates and fees), but comes with a 130,000-point bonus earned after spending $3,000 within six months. If you’re counting correctly, you’ll know that only comes to 260,000 points. We’re very short.

But, the Surpass has another perk: if the holder spends $15,000 on the card in a calendar year, they’ll receive a free award night. Before we even look at the free night, let’s look at the earning rate. The card has some high earning rates, like 6x points per dollar on U.S. restaurants and U.S. supermarkets, but even if a purchase doesn’t fall into an elevated category, it’ll still earn 3x points per dollar.

Let’s do the math again.

Two intro bonuses of 130,000 points earned by spending $3,000 within six months is 260,000 points.

The lowest volume of points they’d earn from that spending alone is 18,000 (3 x $6,000).

If they continue to spend on the card and hit that $15,000 mark within a calendar year, they’ll earn at least 45,000 points.

260,000 + 45,000 = 305,000.

We’re almost there.

In fact, if they can spend another $2,500 on supermarkets, online retail, or restaurants before they book their hotel, they’ll hit their 320,000-point target.

They now have five nights plus a free award night—six nights total.

- Best for: Free Hilton Stays

- Annual Fee: $150

- APR: 19.49%-28.49% Variable

- Reward Rate: 3X - 12X

- Recommended Credit: Good to Excellent

Hilton Honors American Express Surpass® Card

130,000 Hilton Honors Bonus Points + a Free Night Reward

Offer Details:

Earn 130,000 Bonus Points plus a Free Night Reward after you spend $3,000 in purchases on the Card in the first 6 months of Card Membership. Offer Ends 4/15/2026.

Why we like it

The Hilton Honors American Express Surpass® Card is an excellent hotel card, with a strong intro bonus. It’s worth having this card even for a couple of stays a year, as the $150 annual fee is already validated by the free breakfast and strong points earnings. If free Hilton nights is the goal, its earning potential is stellar, with 4X points for each dollar on U.S. online retail purchases, and 3X points for all other eligible purchases on your card.

Reward details

Earn 12X Hilton Honors Bonus Points for each dollar of eligible purchases charged on your Card directly with a hotel or resort within the Hilton portfolio.

Earn 6X Points for each dollar of purchases on your Card at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations.

Earn 4X Points for each dollar on U.S. Online Retail Purchases.

Earn 3X Points for all other eligible purchases on your Card.

Pros & Cons

Pros

Strong intro bonus, which could translate to multiple free nights or one night in a luxury property in some places

Enjoy complimentary Hilton Honors™ Gold status with your Card. Plus, spend $40,000 on eligible purchases on your Card in a calendar year and you can earn an upgrade to Hilton Honors Diamond status through the end of the next calendar year. Terms and Limitations apply.

Earn a Free Night Reward from Hilton Honors after you spend $15,000 on eligible purchases on your Card in a calendar year.

Enjoy complimentary Hilton Honors(TM) Gold Status

Cons

No automatic free anniversary nights

You’ll need a lot of Hilton points to redeem for a free night at a luxury property

$150 annual fee

Does the math add up?

The last part was a little confusing and needed some hyper-specific spending to meet the goal. It wasn’t optimized points earning, but it was designed with one trip in mind. Throwing the $15,000 figure around seems like a lot, but let’s take a look at the realities of their spending and whether our advice would add up.

Remember, we said the couple spends an average of $4,500 a month. If they take our advice and open a Platinum card each to cover their business class flights with Air France, they’ll be able to hit the intro bonuses on both cards in under four months.

If they choose the complex Hilton redemption, they’d both need to spend $3,000 within six months. Their monthly spending would allow them to earn those bonuses in less than two months.

Opening the cards one at a time, a timeline could look like this:

January: Open Platinum #1 and spend $4,500

February: Spend $3500 on Platinum #1, open Platinum #2, and spend $1,000

March: Spend $3,000 on Platinum #2, open Hilton Surpass #1, and spend $1,500

April: Spend $1,500 on Surpass #1, open Surpass #2, and spend $3,000

From there, if they wanted to hit the $15,000 mark, they would simply continue to use the Hilton card. It would take around four months to ensure they earned enough points.

If they wantexd to go crazy, they could even throw in the Chase Sapphire Preferred and Chase Ink Business Preferred card and spend a whopping 13 days in Paris for absolutely nothing. The total expenditure to earn all of those points would be $48,500 including $8,000 of business spending.

That amounts to around $3,375 of monthly spending—comfortably below their average. They’d still have enough spending left to hit more intro bonuses.

Remember, this was a luxury trip

Keep in mind that this plan was built to fly business and stay in luxury hotels. If your goal is simply to get to Paris, your scope is even greater. You have more flexibility and could push your points into an even longer trip, include your entire family, or take several trips to other destinations.

by your friends at The Daily Navigator

by your friends at The Daily Navigator