- Before searching for business class flights to London

- Use British Airways to book business class flights to London

- Use American Airlines to book business class flights to London

- Use ANA to book business class flights to London

- Use United to book business class flights to London

- Use Virgin Atlantic to book business class flights to London

- The point

What are travel credit cards, and how do they work?

Travel credit cards are financial products that offer various rewards and benefits geared towards frequent travelers. They typically earn you points or miles for every dollar spent on eligible purchases. These rewards can be redeemed for flights, hotel stays, car rentals, and other travel-related expenses. Travel credit cards may also include perks like travel insurance, airport lounge access, and no foreign transaction fees.

How do I choose the best travel credit card for my needs?

Choosing the best travel credit card depends on your travel habits, spending patterns, and preferences. Consider factors like the type of rewards offered (points, miles, or cash back), the card’s annual fee, sign-up bonuses, earning rates, redemption options, and additional travel perks. Analyzing these features will help you find a card that aligns with your lifestyle and offers the most value.

What are the benefits of using a travel credit card over other types of credit cards?

Travel credit cards provide unique advantages for travelers, such as earning rewards specifically tailored to travel expenses. Additionally, many travel credit cards offer travel-related perks like free checked bags, priority boarding, and travel insurance. Some cards also waive foreign transaction fees, making them ideal for international travelers.

What is a sign-up bonus, and how can I qualify for it?

A sign-up bonus is a promotional offer provided by the credit card issuer to entice new cardholders. To qualify for a sign-up bonus, you usually need to meet specific spending requirements within a certain timeframe after opening the account. The bonus can be in the form of points, miles, or cash back, and it’s a great way to jump-start your rewards earning.

Do travel credit cards charge foreign transaction fees?

Not all travel credit cards charge foreign transaction fees. Many of the top-tier travel cards waive these fees, making them ideal for international travel. However, it’s essential to read the card’s terms and conditions to confirm this before using it abroad.

How can I maximize the rewards earned with my travel credit card?

To maximize rewards, use your travel credit card for everyday expenses and large purchases. Take advantage of bonus categories and special promotions to earn more points or miles. Consider combining your travel credit card with loyalty programs to stack rewards and get even more value out of your purchases.

Ah, London. You ugly, beautiful, ancient, modern contradiction of a city. The Big Smoke has positioned itself at the heart of the world’s tos-and-fros for centuries, fostering innovation, culture, and art, all while spending the better part of the last millennium as the planet’s defacto business capital.

While things are a little different now, the city is as exciting as ever. History and modernity rub shoulders on every corner, and it’s bursting with more blockbuster attractions than a two-week itinerary can hold. But don’t worry if you’ve already been—it retains more than enough mystery to validate multiple return visits.

But there’s no denying it’s expensive. Cutting your spending when possible is always a plus, and where better to start than your business class flights to London? Because why wouldn’t you be flying business class?

Let’s take a deep dive into how to score business class flights to London using points and miles.

Before you start searching for business class flights to London

Let’s deal with the elephant in the room: the UK’s damn fees.

There’s no getting around it. The UK might have the worst fees and surcharges in the points and miles world. It’s made worse by its homegrown carriers like British Airways and Virgin Atlantic’s excessive fuel surcharges that often end up costing as much as a flight itself.

There are a few ways to work around this, which we’ll look at in the article, but don’t be surprised when you make your first search and see a $1,000+ fee on top of your points.

Considering these fees, there are a few important things to remember.

Are you maximizing your points value or saving as much cash as possible?

This is a key question that will help dictate which option works best for you. It’s more than possible to take advantage of an excellent points rate with some high fees and still come out with a strong points value. But whether that’s the goal for you or not is another question. On the other hand, paying more points but avoiding those fees at all costs might be the end goal for you.

There’s no correct answer—it’s all up to you.

Convenience over competence

Again, we’ll be providing you with some options that require you to work a little outside the box. That means your travel day won’t necessarily be as simple as a one-and-done flight. You might be re-routing through other airports or redeeming multiple bookings. If wasting time is a no-no, and you want to step off one plane and be done with it, you may have to concede some points or cash to earn the privilege.

Which airlines run business class flights to London?

Finding business class flights to London isn’t hard. New York sees as many as 36 direct flights a day to the British capital, while Boston, DC, Los Angeles, Chicago, Orlando, and more all fly multiple flights a day.

On top of that, there’s more than one airport to fly into. Heathrow may be the most well-known and busiest, but there are six airports servicing London: Heathrow, Gatwick, Stanstead, London City, Luton, and Southend.

Heathrow and Gatwick are the only airports with direct connections to the US, but the others can come in handy if you opt for one of the more roundabout options further down the line.

All the major US airlines have direct flights to London, and JetBlue recently added a few to Gatwick. British Airways and Virgin Atlantic are the dominant forces going back and forth.

How to find business class flights to London

Finding business class flights to London using points isn’t terribly hard. Getting as much value from them is slightly trickier, and you can expect the award availability to decrease in correlation with the fees and surcharges attached.

As with any search, we recommend you do some recon on the flights leaving your own airport to check the rough cash prices for the dates you want to travel. Don’t search for “Heathrow.” Search for all London airports. We’d also recommend being as flexible as possible with dates and airlines, as well as giving yourself a good amount of time before your intended departure. The earlier the better in most cases.

How to find business class flights out of London

Many of the fees and surcharges imposed by the British government are on flights leaving the UK. For this reason, you may be able to find a great redemption arriving in London, but on the return leg, see the fees jump by a few hundred dollars.

You have some options in this case.

Bite the bullet and take the fees

Depending on which airline you use, the fees might not be brutal. If it’s only a few hundred dollars and the value on the flight is still high, you can just bite the bullet and take the cash hit. It’s not ideal, and it’ll hurt your pride a little, but it’s a simple way to get home.

Route yourself elsewhere

This falls under the convenience vs. competence section. One way to avoid those fees is to route yourself elsewhere. You can do this by finding a super cheap cash flight or points redemption to a nearby city like Dublin, Amsterdam, or Paris. You need to ensure that whatever you spend isn’t enough to drop the value of the big flight. If you’re paying $200 just to avoid paying $150 in fees, was it really worth it? Don’t be stupid, but do your research to see if something makes sense.

Use a stopover perk

Some airlines include stopover benefits on specific types of flights. For example, United’s Excursionist Perk, or Aeroplan’s 5,000-point stopover. Utilizing these to route yourself through a different airport can be a good way to lower your fees without losing too many extra points (if any). We’ll look at one or two examples later on.

How to find business class flights to London with British Airways

We’ll start with the most obvious option, the UK’s flagship carrier, British Airways. The biggest plus to using BA is that award availability is pretty damn easy to come by. Every search I performed from upcoming dates all the way to March 2025 generated business class seats we could redeem.

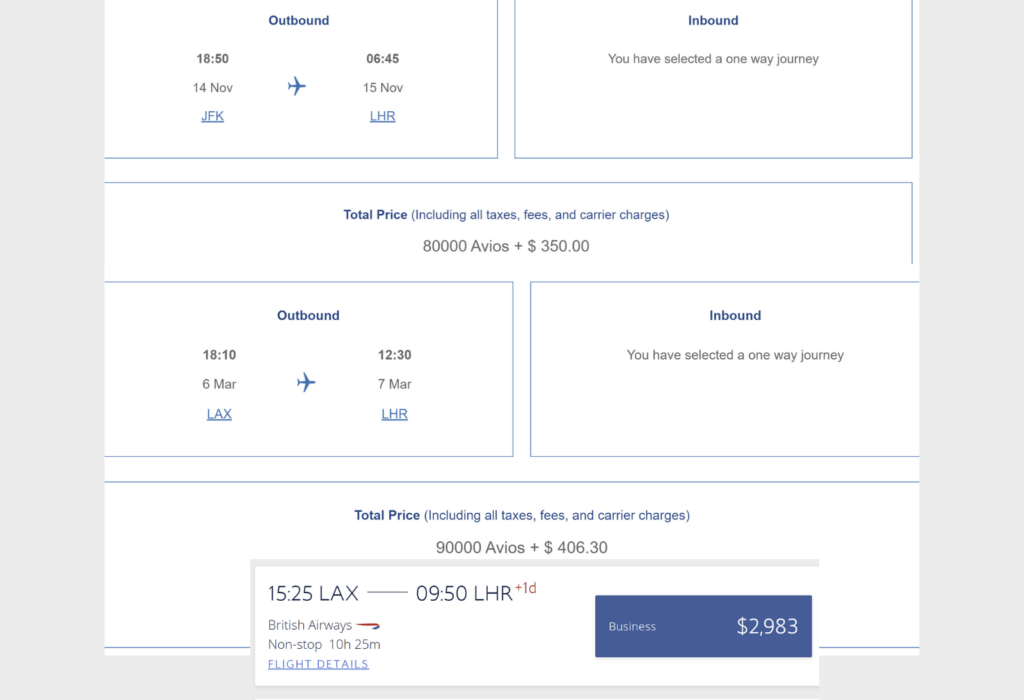

As I mentioned before, the fees are higher than we’d like, but that doesn’t necessarily mean it’s a terrible deal. If we check out the two shown in the picture from NYC and LA, we see 80,000 and 90,000 Avios redemptions plus $350 from New York and $406 from LA. Considering the value of the LA flight is $2,983, we’re still getting around 2.86 cents per point.

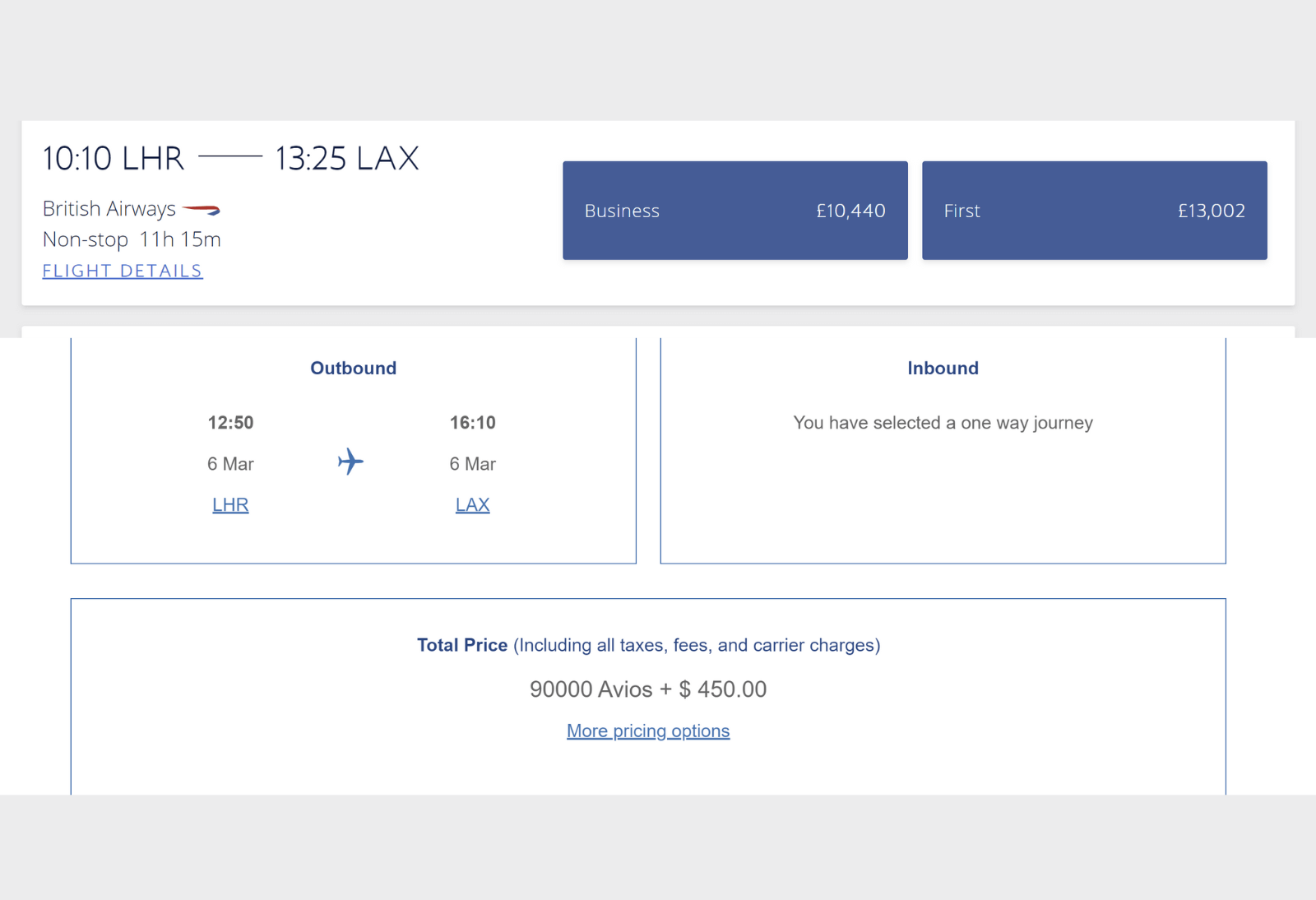

If we’re talking value, this is still good and $406 for 10-hour business class flights to London is a pretty solid saving by anyone’s standards. Going the opposite way, those fees rise to $450 for the LAX flight, so you’re looking at 180,000 points plus $900 in fees.

Insanely, the London-LAX flight is over $12,000 for some reason. So you’re getting an incredible 12 points per point there. Mathematically speaking, it’s a good deal.

But, if you’re not the kind of person who would ever spend $12,000 on a flight (most of us), you may still be looking at that figure and wondering if you can find business class flights to London without almost $1,000 in fees.

How to find business class flights to London with American Airlines

American Airlines is one of British Airways’ closest partners. In fact, the relationship gifts BA some of its best sweet spots—in particular, short-haul flights on AA.

In this case, American is an incredible choice for flights into London. It also shows British Airways flights in its searches, so you can see how mad you would be to opt for the British carrier over American.

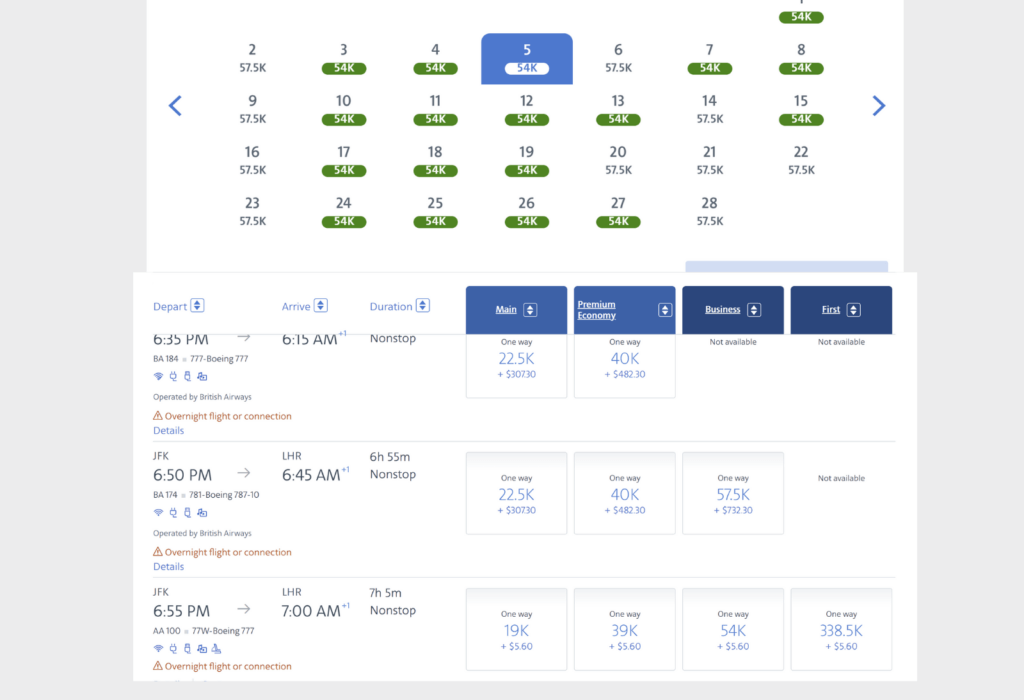

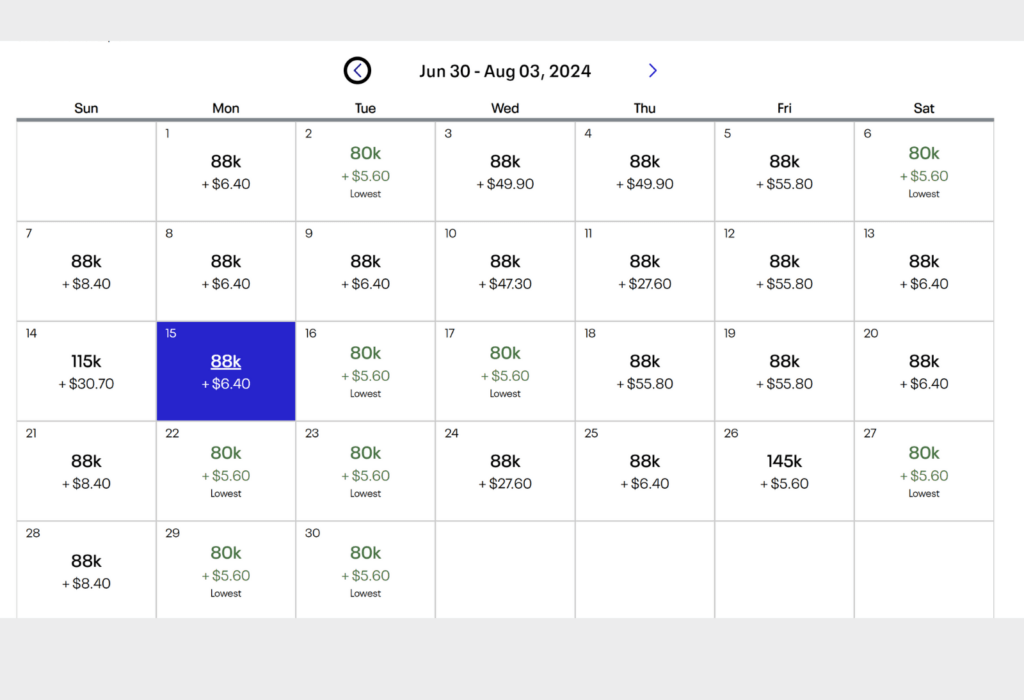

Use American’s handy calendar tool to search for broad dates and see the lowest rates for each day. A quick glance shows plenty of availability for 54,400 AAdvantage miles. That’s a good deal less than the BA option, and with only $5.60 in taxes, it’s an outstanding value.

The fees do rise to over $300 for the return leg, but that’s still half the fees you’d incur on British Airways.

How to earn enough AAdvantage miles

The only downside to American Airlines is that its AAdvantage program isn’t as easy to earn points as other airlines. There are currently no credit card companies that allow transfers to the airline, so you’re stuck with flying with the airline and its partners or opening a co-branded card like the CITI® / AAdvantage® Platinum Select® World Elite Mastercard®.

Its 50,000-mile intro bonus will leave you just short of a one-way flight to London, but considering the $2,500 spending threshold required, it shouldn’t take much more to go beyond that figure.

- Best for: American Airlines Fans

- Annual Fee: $ $0 intro annual fee, $99 after the first year

- Regular APR: 20.74% - 29.74% (Variable)

- Reward Rate: 1X - 2X

- Recommended Credit: 690-850

Citi®/AAdvantage® Platinum Select® World Elite Mastercard®

50,000 Bonus Points

Offer Details:

50,000 American Airlines AAdvantage bonus miles after you spend $2,500 on purchases in the first 3 months from account opening.

Why we like it

The Citi® / AAdvantage® Platinum Select® World Elite Mastercard® is a strong airline-centric card to have in your travel toolbox if your main airport is an American Airlines hub like Boston, Chicago, Dallas, or Charlotte, or if you just have a preference for the airline. Regular business travelers may want to upgrade for luxury perks like lounge access, but for everyone else, the low annual fee, 50,000 point intro bonus, solid miles-earning categories, and free checked bag perks are more than enough to validate the space in your wallet.

Reward details

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, and on eligible American Airlines purchases

Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases

Pros & Cons

Pros

The strong 50,000-point intro bonus is worth as much as $750, earned after spending $2,500 in three months.

Cardholders and up to four companions can enjoy a free first checked bag on any domestic American Airlines flight, comfortably justifying the $99 fee when used.

The card earns 2X miles for gas and dining purchases

Each eligible mile earned with the card also earns a loyalty point towards American Airlines elite status

A generous 25% discount on in-flight purchases when using the card round out the benefits

Preferred boarding on American Airlines flights

Cons

American Airlines miles can’t be transferred to other airlines or hotels (although they can be used to book AA partner flights)

Premium perks are reserved for pricier cards

Terms Apply

How to find business class flights to London with All Nippon Airways (ANA)

Next up is Japanese flagship carrier All Nippon Airways (ANA), and its incredible award chart. The airline is arguably the highest-value program out there and can be wrangled into incredible high-value redemptions.

The only downside to ANA is that it’s only possible to book roundtrip award tickets. This removes some of the flexibility you could have to avoid fees. With that said, its rates are excellent and the fees remain remarkably low.

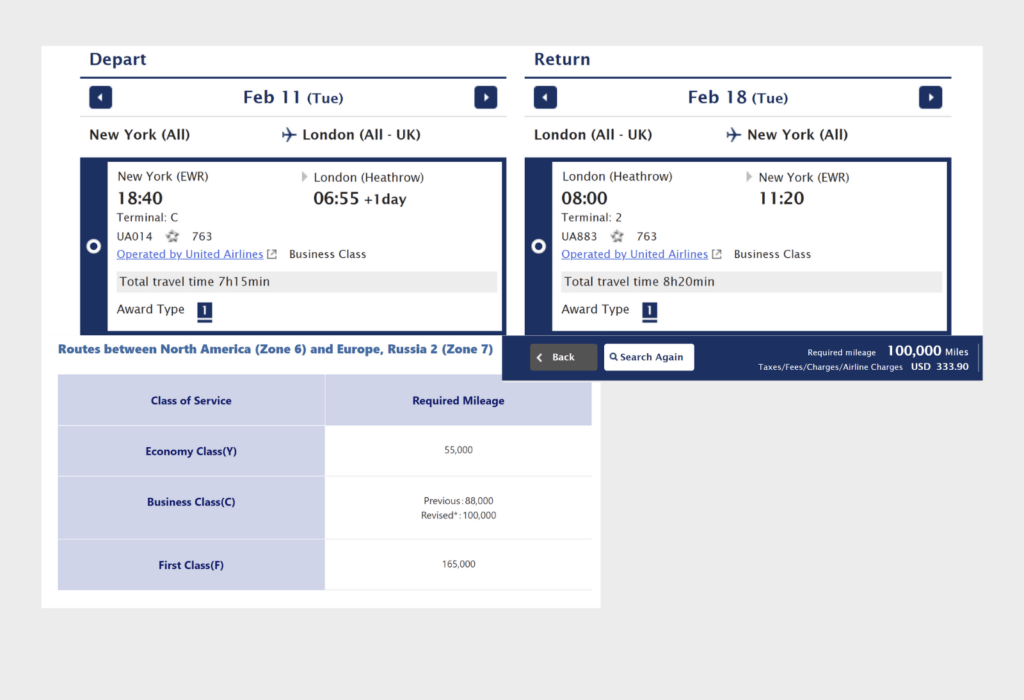

According to the ANA award chart, you can book roundtrip flights from the US to Europe for 100,000 miles plus taxes and fees. In my quick search, that checked out perfectly, with a roundtrip coming in at that rate plus $333.90. The flight itself is with United, so you could end up in its excellent Polaris class seat.

At 50,000 points each way, it’s clocking in almost 10,000 miles less than American Airlines with comparable fees. To book those flights with United would cost around $3,000.

How to earn enough ANA Mileage Club miles

One major difference between AAdvantage and ANA Mileage Club is the latter’s ability to receive miles from American Express. Opening a card like the American Express Platinum Card® gifts you transferable points you can move to ANA when the time is right. If you don’t need to use ANA, you can move them to any of Amex’s other partners to achieve maximum value. American’s miles are limited to its own airline and can’t be transferred.

To earn the as high as 175,000 point intro bonus on the Platinum, you’ll need to spend $12,000 within six months of opening an account.

- Best for: Luxury Perks

American Express Platinum Card®

As high as 175,000 Membership Rewards® Points

Offer Details:

You may be eligible for as high as 175,000 Membership Rewards® points after you spend $12,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Why we like it

The Amex Platinum was once the sole dominating force in the luxury credit card space. While it now faces some stiff competition, it still offers unbeatable perks like unprecedented airport lounge access, elite status at Hilton and Marriott, and some outstanding statement credits making the mammoth $895 worth it for some.

Reward details

Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings.

You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

Pros & Cons

Pros

-

Large intro bonus

Incredible lounge access

-

Statement credits worth over $3,500 annually.

-

Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

Cons

-

The $895 annual fee is brutally high. Too high for many that can’t, or don’t want to take full advantage of its benefits.

-

Points-earning rates are low unless spending directly on flights or with the Amex Portal.

-

Some of the benefits, like travel credits, are more limited and are harder to use than competing cards’ offerings.

How to find business class flights to London with United Airlines

United operates a ton of flights between the US and London, so grabbing a spot in its coveted Polaris class is easy in terms of availability. Whether you opt for it will depend on the points you have at your disposal.

United operates a dynamic system, so the miles required can fluctuate pretty heavily, but the average saver rate sits at around 80,000 miles each way. The taxes and fees on the way there are a negligible $5.60 while the return leg shoots to around $328. The cash requirement matches that of ANA and American but represents a considerably lower value. It’ll set you back 60,000 points less to fly United by booking with ANA.

How to earn enough United MileagePlus miles

The only reason you should opt to redeem these flights with United over ANA or American is if you’re tied to a Chase card. Opening the Chase Sapphire Preferred® Card or Chase Sapphire Reserve® would get you 100,000 or 125,000 points respectively, after spending $6,000 within three months of opening them. But that leaves you short. That’s a long way to go.

- Best for: Luxury Travel

- Annual Fee: $795

- Variable APR: 19.49% - 27.99% Variable

- Reward Rate: 1X - 10X

- Recommended Credit: 740-850

Chase Sapphire Reserve®

125,000 bonus points

Offer Details:

Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

Why we like it

This card just got a major re-vamp and you can now get more than $2,700 in annual value with Sapphire Reserve!

Reward details

8x points on Chase TravelSM

4x points on flights and hotels booked direct

3x points on dining

1x points on all other purchases

Pros & Cons

Pros

-

The points are worth up to 2 cents a piece when used directly on Chase’s Ultimate Rewards Portal, offering a simple but high-value use for your points.

-

Plenty of excellent transfer partners allow points to be maximized

-

Some excellent partnerships with Doordash and Lyft add to its value.

-

Priority Pass membership allows access to over 1,300+ airport lounges and restaurants.

Cons

-

It’s subject to Chase’s 5/24 rule. So if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

-

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

Terms Apply

How to (not) find business class flights to London with Virgin Atlantic

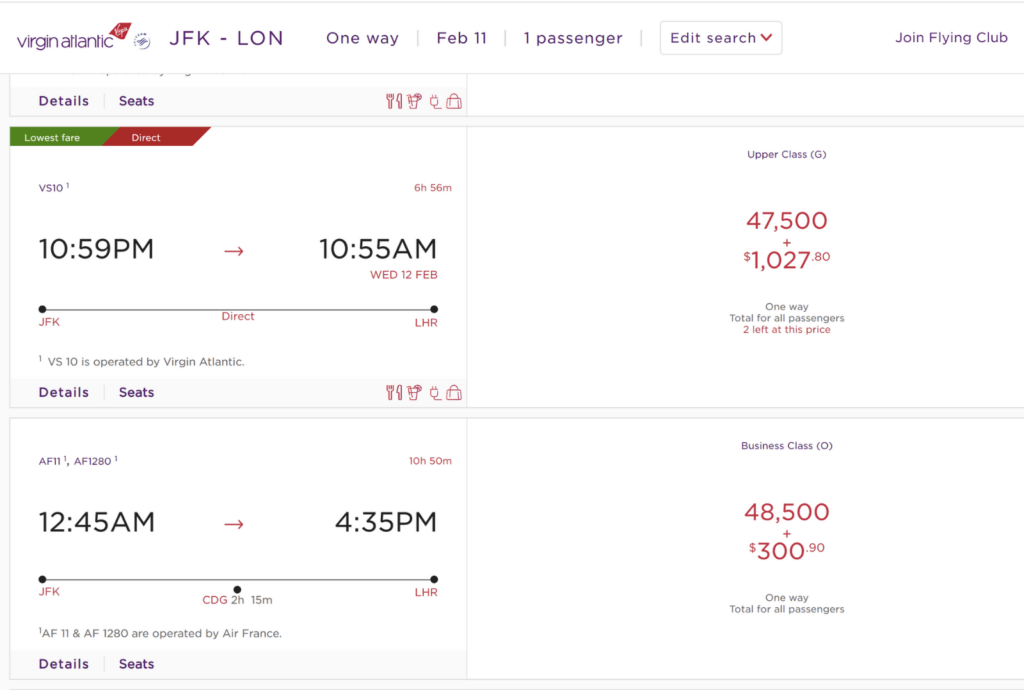

I’m putting Virgin Atlantic in here because technically it can be a good deal—mathematically speaking. If you opt to fly with Virgin, you’ll be able to book business class flights to London for 47,800 points.

Not bad, right? Up there with the best.

Check the $1,027 fee. Not so fun now.

Fees on the way out run around $640. So you’re looking at almost $1,700 for a points redemption. I’d avoid this unless you’re someone who regularly pays for business class flights in cash anyway and likes flying Virgin. It’s effectively a discount for you.

Now, there are slightly better options on the site, like an Air France route for just over $300 and the same 47,800 points. Once again, the combined fees on this would be high, and you could transfer your points to ANA or United depending on the cards you have at your disposal to pay a fair bit less.

How to earn enough Virgin Atlantic Flying Club points

The upside to Flying Club is that it’s incredibly easy to earn its points. You can transfer from almost every major credit card issuer—that’s Amex, Chase, Capital One, Citi, and Bilt.

For example, the 75,000 intro bonus on the Capital One Venture X Rewards Credit Card could comfortably earn you a one-way business class flight to London. You’ll need to spend $4,000 within 3 months of opening the card to earn them.

- Best for: Overall Travel

Capital One Venture X Rewards Credit Card

75,000 Bonus Miles

Offer Details:

Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

Why we like it

The Capital One Venture X is a direct competitor to the Chase Sapphire Reserve, and for many seeking a simpler earning scheme with premium perks, it could be the better option. But the Venture X truly shines with one benefit in particular: four free authorized users. Plus, every year on your cardholder anniversary you get 10,000 points to use for travel.

Reward details

10 Miles per dollar on hotels and rental cars booked through Capital One Travel

5 Miles per dollar on flights and vacation rentals booked through Capital One Travel

2 Miles per dollar on every purchase

Pros & Cons

Pros

-

Its great intro bonus of 75,000 miles is worth well over $1,000 when transferred to partner airlines and hotels, or a flat rate $750 when redeemed on the Capital One Travel Portal.

-

Cardholders get a bonus of 10,000 miles each year after their first account anniversary, which is nothing to shrug off, especially when a little bit short of that business class flight. It’s worth almost $200 depending on how you use it.

-

The $300 annual credit for purchases made on the Capital One Travel Portal, combined with the yearly free miles, more than annul the $395 annual fee.

-

Four authorized users can be added for free.

-

Enjoy access to 1,300+ lounges worldwide, including Capital One Lounge locations and participating Priority Pass™ lounges, after enrollment

-

A generous offering of travel insurance, protections and reimbursements round out an excellent array of benefits.

Cons

-

The $300 credit is a bit less flexible than the Chase Sapphire Reserve’s comparable benefit.

-

Miles earning is the same as the Sapphire Reserve on portal-based purchases, but less on general travel spending.

-

Capital One transfer partners are solid, but still don’t include any US-based airlines or hotels.

Terms Apply

How to find business class flights to London in unconventional ways

If you’re a true penny pincher and looking to avoid those fees at all costs, there are some roundabout ways to save. Remember, though, these are not the simplest itineraries, and if you’re counting your PTO, you could be giving up a day to travel.

Utilize stopover perks

The best way to avoid London’s fees (and the easiest to work with) is to use a select airline’s stopover perks. These vary from airline to airline, but generally speaking, they allow you to book a longer stopover for free or for a far lower number of points than normal.

For example, if you opted for United’s Excursionist Perk, you could book a stopover in Dublin for free and only pay the small fees attached to a shorter flight. In this instance, you could fly into London for the same rate we mentioned up top, then route through Dublin before flying back to the US. As the fees from Dublin are tiny, you’d end up paying far less than you would flying directly from London.

Of course, you’re adding a stop in Dublin which might feel like a waste of time depending on your schedule.

Get creative

This one can be slightly more complicated, as you’re effectively using the same principle as the stopover, but doing it yourself. Dublin serves as a good example of this again. If you can find a cheap mode of transport, whether that’s using a budget airline like Ryanair, or taking the train/ferry to other countries, it’s possible for you to dodge the fees in London.

Of course, you need to ensure whatever you spend to get to the destination doesn’t cost the same or more than the fees would have been for you.

The point

Finding business class flights to London isn’t the problem. Avoiding the high taxes, fees, and surcharges is. Whether you’re seeking high points value or minimum cash spend, leave no rock unturned in your quest to find the best flights.

by your friends at The Daily Navigator

by your friends at The Daily Navigator