Overview

Few destinations conjure wanderlust in the way Italy does. Rome, Milan, Florence, the Dolomites, the Amalfi coast…you know the list could go on for a while. It’s just that good.

But despite being popular by anywhere else’s standards, the southern island of Sicily always seems to find itself a little further down the list. That feels criminal. The sprawling island boasts some of Europe’s most epic landscapes and important cultural monuments, all set against the backdrop of the Mediterranean. And we haven’t even mentioned the food.

You can take this article as a sign for you to swing south beyond the “boot of Italy” and take in the last rays of summer. Or any time of the year, honestly.

To help you out, we’re going to show you how to get to Sicily using points and miles—so you can save all your money for the buckets of arancini you’ll be throwing down.

The Point:

It’s important to cast your net wide when working out how to get to Sicily using points and miles. Different programs can offer more or less value depending on the time of year. One thing is for sure, though—you’re not short of options for making your dream Italy trip far more affordable.

Our top card rec:

- Chase Sapphire Preferred® Card – A great bonus that will easily get you to Europe on points/miles and all around amazing travel credit card.

- Best for: Beginner Travelers

Chase Sapphire Preferred® Card

75,000 Bonus Points

Offer Details:

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Chase Sapphire Preferred Card is the ultimate all-around travel credit card—it fits perfectly into almost any points-earner’s wallet. Points novices can enjoy a significant intro bonus and easy to grasp spending categories with an approachable annual fee. The more experienced can utilize its high value earning potential as a secondary card and also gain access to Chase’s strong travel booking portal.

Reward details

5x on travel purchased through Chase Travel℠.

3x on dining, select streaming services and online groceries.

2x on all other travel purchases.

1x on all other purchases.

Pros & Cons

Pros

The $50 dollar hotel credit for stays purchased on the Chase Travel Portal already cuts the already approachable $95 annual fee significantly.

10% anniversary points boost – each account anniversary you’ll earn bonus points equal to 10% of your total purchases made the previous year.

Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

Along with all of the above, cardholders also have access to a string of travel protections like rental coverage, cancellation insurance, and purchase protection.

Cons

It’s subject to Chase’s 5/24 rule. So, if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Competing cards like the Capital One Venture have a better earning rate for non-bonus spend.

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

Terms Apply

How to get to Sicily using points and miles

When searching for your flights it’s important to make two separate searches each time. First, check out the rates for a full itinerary from your home city to Sicily—most likely Catania or Palermo. In some cases, this might be the best rate for any given airline.

Make a note of that, then search again for a major hub in Italy like Rome, Milan, or even Naples. You may find some of these rates far better when combined with a cheap domestic flight. We’ll take a look at both options in this article.

KLM/Air France Flying Blue points

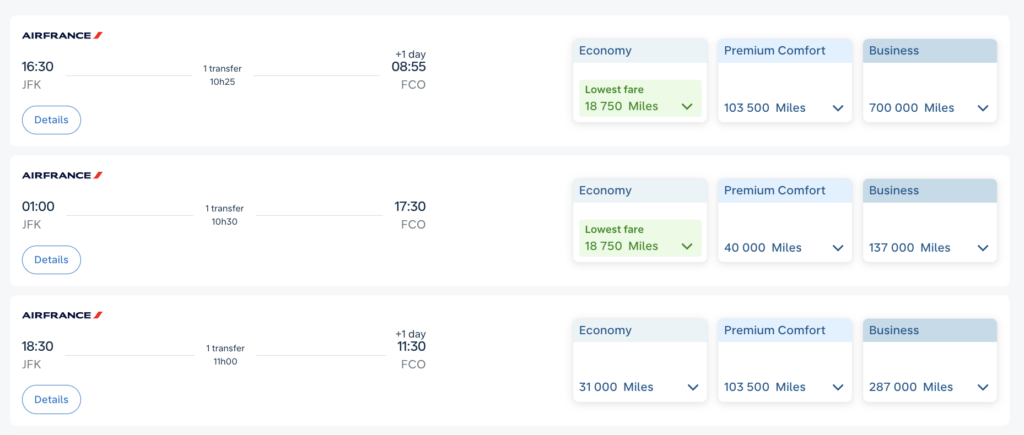

KLM and Air France’s joint loyalty program Flying Blue is one of the best ways to get to Sicily using points and miles. While the program is super dynamic and can show some truly eye-watering rates, its best can’t be beaten by any other airline.

There’s plenty of availability for flights to Italy for as low as 18,750 miles—a truly epic rate. Those are reciprocated on the way back. Fees can be a little high, so expect to pay at least $120 for each flight, but if the rate is that low it’s still an incredible deal.

Make a note of that, then search again for a major hub in Italy like Rome, Milan, or even Naples. You may find some of these rates far better when combined with a cheap domestic flight. We’ll take a look at both options in this article.

How to earn Flying Blue points

Almost all the major credit card issuers allow transfers to Flying Blue, allowing you to mix and match as you need. Considering you can move points from American Express, Chase, Citi, Capital One, Bilt, and even Wells Fargo, you’re spoiled for choice.

Our top recommendation:

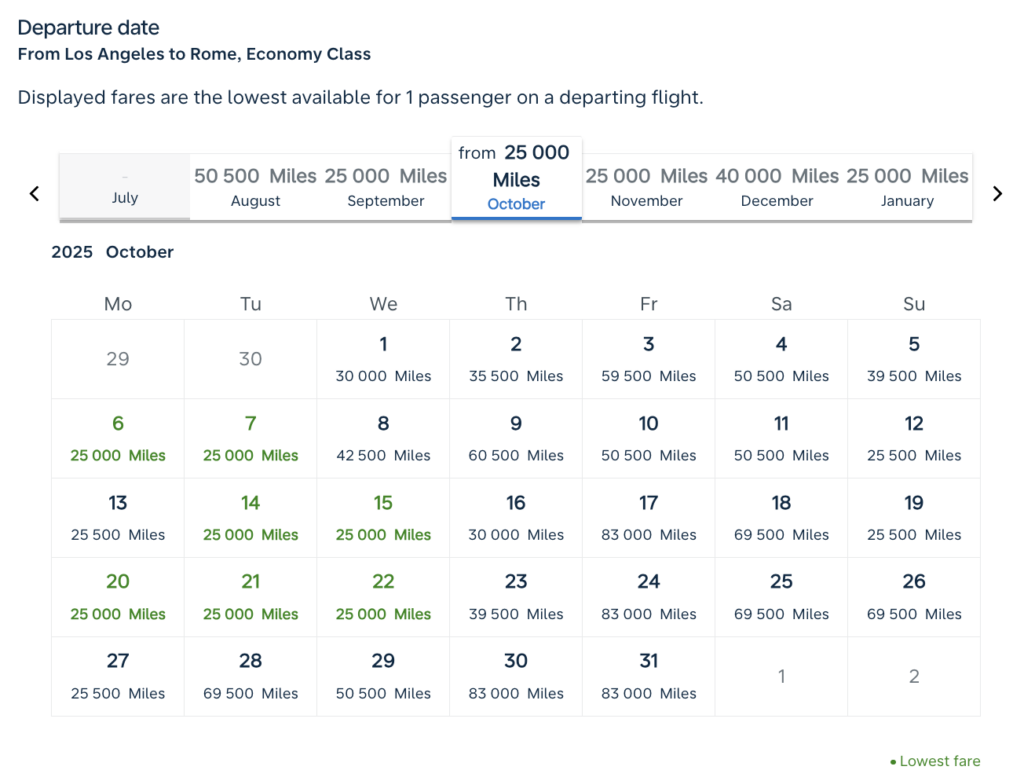

Rates from the West Coast hover at around 20,000 miles—also impressive—with the same rough fee setup. With some more investigation, you might find some 20,000-mile rates there, too, but availability is much slimmer. If it looks slim for flights all the way to Sicily, check out rates to Rome. There are plenty of flights to the capital for just 20,000 from LAX. From there, just grab a cheap domestic flight or use another program for a low rate.

The dynamic nature of the program means it’s best to try and book flights with KLM as far out from your intended departure as possible. That way, you’re afforded the most flexibility and won’t find yourself bound by specific dates.

United MileagePlus points

One of the most straightforward options for getting to Sicily comes from United. Despite being a dynamic system, MileagePlus offers fairly stable rates for flights the whole way to the island. Of course, most of the routes stop for varying lengths of connections in cities like Munich or Geneva, but that’s going to be the case regardless of which airline you use.

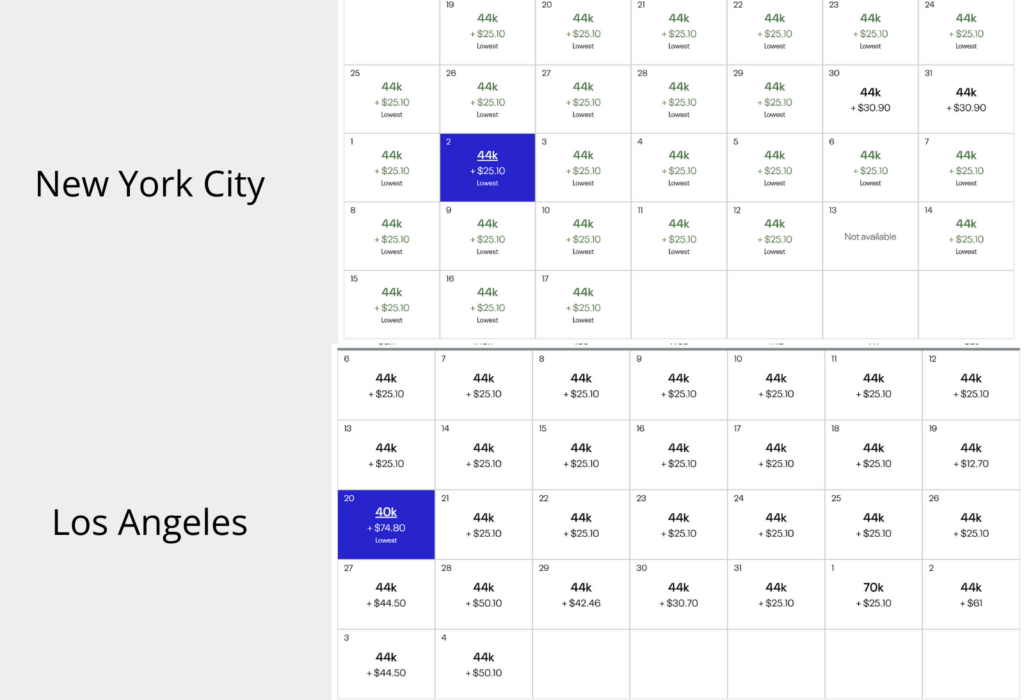

The average rate even in summer months hovers around 44,000 miles with fees as low as $25. By anyone’s standards, that’s a pretty great deal, especially when the convenience of having all the flights on the itinerary is accounted for. The good news is that those rates hold even on the West Coast. This could give United the upper hand on some programs that use distance-based award charts.

The dynamic nature of the program means it’s best to try and book flights with KLM as far out from your intended departure as possible. That way, you’re afforded the most flexibility and won’t find yourself bound by specific dates.

How to earn United MileagePlus points

United MileagePlus miles are fairly easy to earn, especially for those with a small business. Chase is the only credit card issuer that allows transfers to the airline, but luckily there are some great Chase cards out there.

Our top recommendations:

Ink Business Preferred® Credit Card – Great for small business owners

Those rates track if you do separate searches to other Italian cities, too. A one-way from NYC to Rome clocks in at around 36,000 miles, and United doesn’t seem to have any partners running routes to Sicily from there so you’d have to look elsewhere.

If you flew into Munich or Geneva for 36,000 points you could be smart and use the Excursionist Perk to grab the flights to Sicily for free. Check out how to use that here.

Air Canada Aeroplan points

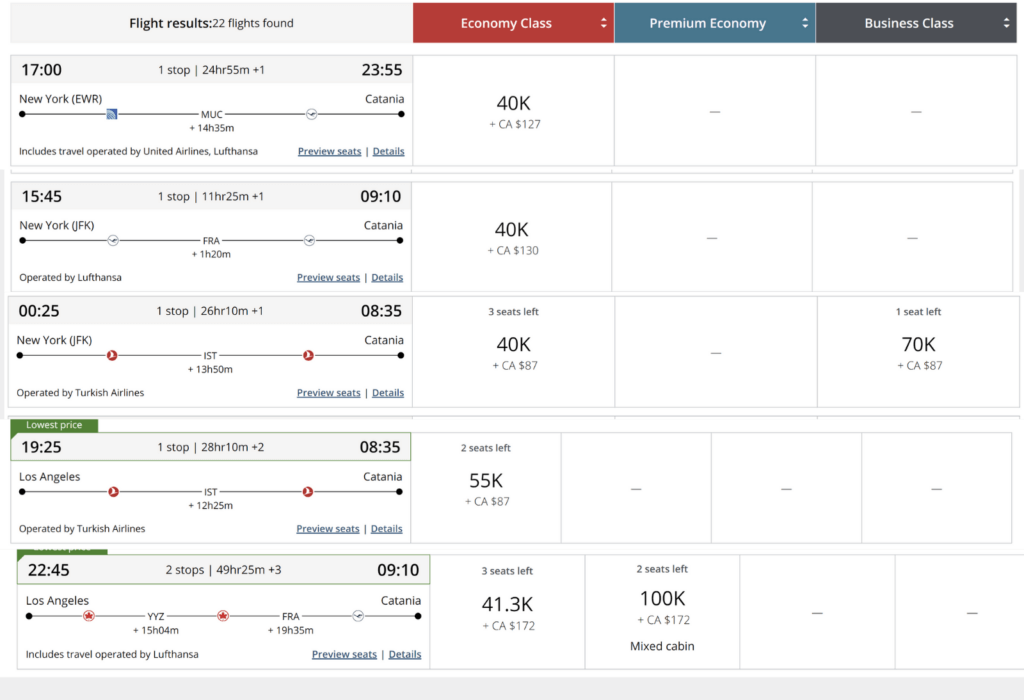

For a bit more stability (at least on the East Coast), you can opt for Air Canada’s Aeroplan program. The airline utilizes one of the best award charts on the market, using geographic zones and distances within them to set rates.

In this case, partner flights come in at 40,000 points plus around $100 CAD ($73 USD). Flights from the West Coast start at 55,000 points. You will see some far lower rates on the search page but, in most cases, these are Air Canada flights and the routes will be chaotic. Some take as long as 40 hours, so unless you have plenty of time and patience, you may want to give these a miss.

How to earn Aeroplan points:

One big advantage Aeroplan has over its partner United MileagePlus is the ease with which you can earn them. You can earn points by flying with the airline and its partners, opening a co-branded card, or transferring points from one of its many partners. The airline accepts transfers from American Express, Capital One, Citi, and Chase—giving you a wide range of cards to bolster your Aeroplan points.

Our top recommendation:

- American Express Platinum Card® will get you to Europe and back (maybe twice), plus allow you to travel in style with the many perks that come along with this card.

As Aeroplan is chart-based, you can rely on those rates and even take advantage of a business class seat for just 70,000 points from the East Coast. But United’s rates can be similar or less. Use Aeroplan as the baseline then check the dynamic programs like United to make sure you get the best rate in any given scenario.

Before you book

If you’ve read any of our other “how to” guides, you know it’s always a good idea to do some recon on the journey you’re hoping to take. By that we mean checking which airlines fly the route, how often they fly, and the rough prices of those flights. Don’t forget to check nearby airports, too.

The first thing you’ll come across on a Sicily flight search is the almost total absence of direct flights. Only one airline runs directly from the US to Sicily, and it’s one you’ve probably never heard of—Neos. The Lombardy-based Italian carrier runs flights from JFK on Mondays and Saturdays in the peak season with prices ranging from around $560 to $850.

Sadly, you won’t be able to use any points or miles with Neos, so it’s a connecting flight for you unless you’re happy to cough up the money.

Luckily, there are a ton of flights into Italy and nearby countries from around the US. Using a service like Dollar Flight Club will keep you in the loop for any flight deals leaving your home airport. Even in peak season, it’s possible to grab flights as low as $232 one-way, so if you have the cash available and don’t mind flying budget you have some solid options.

- Best for: Beginner Travelers

Chase Sapphire Preferred® Card

75,000 Bonus Points

Offer Details:

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Chase Sapphire Preferred Card is the ultimate all-around travel credit card—it fits perfectly into almost any points-earner’s wallet. Points novices can enjoy a significant intro bonus and easy to grasp spending categories with an approachable annual fee. The more experienced can utilize its high value earning potential as a secondary card and also gain access to Chase’s strong travel booking portal.

Reward details

5x on travel purchased through Chase Travel℠.

3x on dining, select streaming services and online groceries.

2x on all other travel purchases.

1x on all other purchases.

Pros & Cons

Pros

The $50 dollar hotel credit for stays purchased on the Chase Travel Portal already cuts the already approachable $95 annual fee significantly.

10% anniversary points boost – each account anniversary you’ll earn bonus points equal to 10% of your total purchases made the previous year.

Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

Along with all of the above, cardholders also have access to a string of travel protections like rental coverage, cancellation insurance, and purchase protection.

Cons

It’s subject to Chase’s 5/24 rule. So, if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Competing cards like the Capital One Venture have a better earning rate for non-bonus spend.

Chase has a once-per-lifetime rule for sign-up bonuses on their Sapphire cards, including the Sapphire Preferred, Sapphire Reserve, and Sapphire Reserve for Business. So, once you’ve earned a welcome bonus on any of these cards, you’ll never be eligible for the bonus again on the same card.

by your friends at The Daily Navigator

by your friends at The Daily Navigator