- Before you book

- How to get to Sicily using points and miles with KLM/Air France Flying Blue

- How to get to Sicily using points and miles with American Airlines

- How to get to Sicily using points and miles with ANA

- How to get to Sicily using points and miles with United

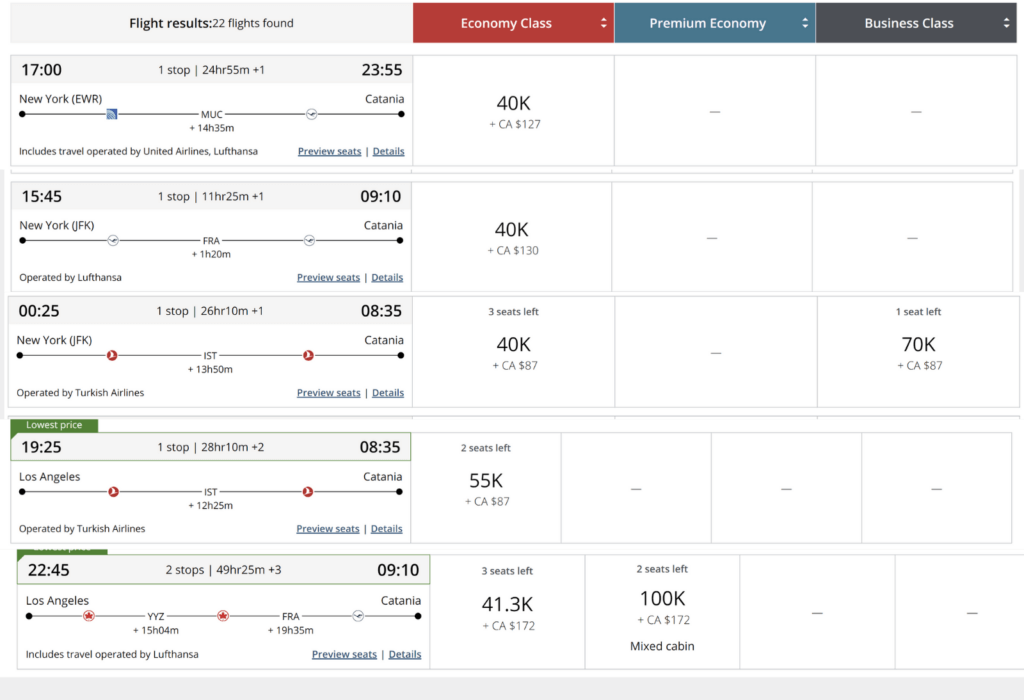

- How to get to Sicily using points and miles with Air Canada

- The point

What are travel credit cards, and how do they work?

Travel credit cards are financial products that offer various rewards and benefits geared towards frequent travelers. They typically earn you points or miles for every dollar spent on eligible purchases. These rewards can be redeemed for flights, hotel stays, car rentals, and other travel-related expenses. Travel credit cards may also include perks like travel insurance, airport lounge access, and no foreign transaction fees.

How do I choose the best travel credit card for my needs?

Choosing the best travel credit card depends on your travel habits, spending patterns, and preferences. Consider factors like the type of rewards offered (points, miles, or cash back), the card’s annual fee, sign-up bonuses, earning rates, redemption options, and additional travel perks. Analyzing these features will help you find a card that aligns with your lifestyle and offers the most value.

What are the benefits of using a travel credit card over other types of credit cards?

Travel credit cards provide unique advantages for travelers, such as earning rewards specifically tailored to travel expenses. Additionally, many travel credit cards offer travel-related perks like free checked bags, priority boarding, and travel insurance. Some cards also waive foreign transaction fees, making them ideal for international travelers.

What is a sign-up bonus, and how can I qualify for it?

A sign-up bonus is a promotional offer provided by the credit card issuer to entice new cardholders. To qualify for a sign-up bonus, you usually need to meet specific spending requirements within a certain timeframe after opening the account. The bonus can be in the form of points, miles, or cash back, and it’s a great way to jump-start your rewards earning.

Do travel credit cards charge foreign transaction fees?

Not all travel credit cards charge foreign transaction fees. Many of the top-tier travel cards waive these fees, making them ideal for international travel. However, it’s essential to read the card’s terms and conditions to confirm this before using it abroad.

How can I maximize the rewards earned with my travel credit card?

To maximize rewards, use your travel credit card for everyday expenses and large purchases. Take advantage of bonus categories and special promotions to earn more points or miles. Consider combining your travel credit card with loyalty programs to stack rewards and get even more value out of your purchases.

Few destinations conjure wanderlust in the way Italy does. Rome, Milan, Florence, the Dolomites, the Amalfi coast…you know the list could go on for a while. It’s just that good.

But despite being popular by anywhere else’s standards, the southern island of Sicily always seems to find itself a little further down the list. That feels criminal. The sprawling island boasts some of Europe’s most epic landscapes and important cultural monuments, all set against the backdrop of the Mediterranean. And we haven’t even mentioned the food.

You can take this article as a sign for you to swing south beyond the “boot of Italy” and take in the last rays of summer. Or any time of the year, honestly.

To help you out, we’re going to show you how to get to Sicily using points and miles—so you can save all your money for the buckets of arancini you’ll be throwing down.

Before you book

If you’ve read any of our other “how to” guides, you’ll know it’s always a good idea to do some recon on the journey you’re hoping to take. By that we mean checking which airlines fly the route, how often they fly, and the rough prices of those flights. Don’t forget to check nearby airports, too.

The first thing you’ll come across on a Sicily flight search is the almost total absence of direct flights. In fact, only one airline runs directly from the US to Sicily, and it’s one you’ve probably never heard of—Neos. The Lombardy-based Italian carrier runs flights from JFK on Mondays and Saturdays in the peak season with prices ranging from around $560 to $850.

Sadly, you won’t be able to use any points or miles with Neos, so unless you’re happy to cough up the money, it’s a connecting flight for you.

Luckily, there are a ton of flights into Italy and nearby countries from around the US. Keep in mind that even in peak season it’s possible to grab flights as low as $232 one-way, so if you have the cash available and don’t mind flying budget you have some solid options.

How to get to Sicily using points and miles

When searching for your flights it’s important to make two separate searches each time. First, check out the rates for a full itinerary from your home city to Sicily—most likely Catania or Palermo. In some cases, this might be the best rate for any given airline.

Make a note of that, then search again for amajor hub in Italy like Rome, Milan, or even Naples. You may find some of these rates far better when combined with a cheap domestic flight. We’ll take a look at both options in this article.

How to get to Sicily using points and miles with KLM/Air France Flying Blue

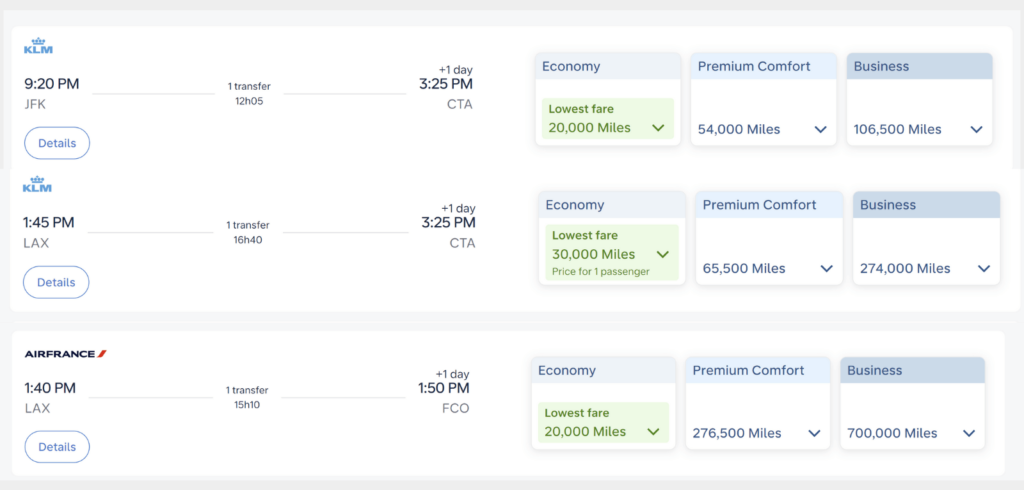

KLM and Air France’s joint loyalty program Flying Blue is one of the best ways to get to Sicily using points and miles. While the program is super dynamic and can show some truly eye-watering rates, its best can’t be beaten by any other airline.

There’s plenty of availability for flights to Siciliy for as low as 20,000 miles—a truly epic rate. Those are reciprocated on the way back. Fees can be a little high, so expect to pay at least $120 for each flight, but if the rate is that low it’s still an incredible deal.

Rates from the West Coast hover at around 20,000 miles—also impressive—with the same rough fee setup. With some more investigation, you might find some 20,000-mile rates there, too, but availability is much slimmer. If it looks slim for flights all the way to Sicily, check out rates to Rome. There are plenty of flights to the capital for just 20,000 from LAX. From there, just grab a cheap domestic flight or use another program for a low rate.

The dynamic nature of the program means it’s best to try and book flights with KLM as far out from your intended departure as possible. That way, you’re afforded the most flexibility and won’t find yourself bound by specific dates.

How to earn enough KLM/Air France Flying Blue miles

Not only does Flying Blue offer some of the best rates to Sicily, but it’s one of the easiest programs to earn miles with. Almost all the major credit card issuers allow transfers to Flying Blue, allowing you to mix and match as you need. Considering you can move points from American Express, Chase, Citi, Capital One, Bilt, and even Wells Fargo, you’re spoiled for choice.

If you’re paying at least $1,666 a month in rent, the Bilt Mastercard® could fly you to Sicily for almost nothing with Flying Blue. While it doesn’t have an intro bonus of any kind, it’s the only card designed to pay for and earn on rent. That $1,666 figure would earn you at least 20,000 transferable points a year and send you off to the Mediterranean.

- Best for: Renters

Bilt Mastercard®

Link a credit or debit card to start stacking Bilt Points with your usual card rewards

Why we like it

The no annual fee Bilt Mastercard® is a very unique product that can turn points earned from one of your largest monthly expenses into a heap of travel rewards and other redemption options. It’s the only card that allows you to pay your rent with no transaction fees—you’ll earn 1X points on rent, up to 100,000 points a year. Many landlords don’t accept credit cards or they charge a convenience fee to use a credit card to pay rent—making it an intriguing option for renters across the US. Plus, you can link a credit or debit card to stack Bilt Points with your usual rewards.

Reward details

3x points on dining

2x points on travel

1x points on other purchases

1x points on rent without the transaction fee, up to 100,000 points in a calendar year. When you use the card 5 times each statement period using your Bilt Mastercard, you’ll earn points on rent and qualifying net purchases.

Pros & Cons

Pros

The greatest benefit is obvious: redeeming points earned from rent into travel rewards with no transaction fees attached.

Bilt has some excellent and unique transfer partners, like United Airlines and Hyatt.

Decent points-earning potential in other categories like 2X points on travel, 3X points on dining, and 1X points on rent (up to 100,000 points in a calendar year) and other purchases.

You can earn interest on Bilt Points when you reach Silver status.

A few other nice benefits are included, such as Cellular Telephone Protection.

Cons

No sign-up bonus

Use the card 5 times each statement period to earn points. So you can’t use it solely for rent. I’d advise putting some restaurant bills on it, as you’ll grab 3X points on those transactions.

Terms Apply

How to get to Sicily using points and miles with American Airlines

American Airlines offers a solid alternative for how to get to Sicility using points and miles. It’s a slightly more difficult mileage currency to earn, but if you can get your hands on them your Italy trip will cost pennies.

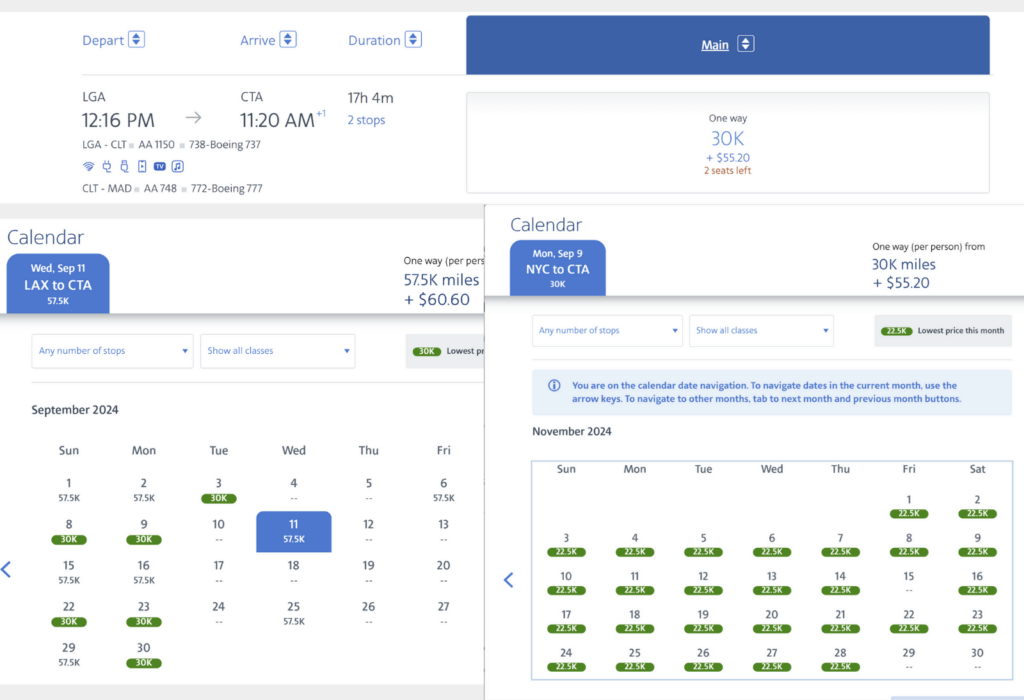

Your best bet is to use American’s handy calendar view. Once you’ve plugged in your search you’ll be able to see the lowest rate on any given day. There are plenty of rates as low as 30,000 miles even during the summer. If you’re happy to visit in the colder months, you can find rock bottom rates of just 22,500 miles—pretty incredible value even if you’re not enjoying quite as much warmth.

Those rates hold up whether you’re on the East or West Coast, so no one in the US is losing out on the value in this case.

How to earn enough American Airlines AAdvantage miles

American Airlines offers incredible value with its AAdvantage loyalty program. But that value isn’t as straightforward to earn. There are no credit card issuers that allow transfers to the program, leaving you to earn by flying with the airline and its partners or opening a co-branded card.

It does have a few strong cards to its name, with our favorite being the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®. It’s currently running a 50,000-mile intro bonus earned after spending $2,500 within three months of opening the card. While it’s not as big a bonus as others on the list, grabbing a roundtrip to Italy is a strong return on the low spending threshold of just $833 a month.

- Best for: American Airlines Fans

- Annual Fee: $ $0 intro annual fee, $99 after the first year

- Regular APR: 20.74% - 29.74% (Variable)

- Reward Rate: 1X - 2X

- Recommended Credit: 690-850

Citi®/AAdvantage® Platinum Select® World Elite Mastercard®

50,000 Bonus Points

Offer Details:

50,000 American Airlines AAdvantage bonus miles after you spend $2,500 on purchases in the first 3 months from account opening.

Why we like it

The Citi® / AAdvantage® Platinum Select® World Elite Mastercard® is a strong airline-centric card to have in your travel toolbox if your main airport is an American Airlines hub like Boston, Chicago, Dallas, or Charlotte, or if you just have a preference for the airline. Regular business travelers may want to upgrade for luxury perks like lounge access, but for everyone else, the low annual fee, 50,000 point intro bonus, solid miles-earning categories, and free checked bag perks are more than enough to validate the space in your wallet.

Reward details

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, and on eligible American Airlines purchases

Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases

Pros & Cons

Pros

The strong 50,000-point intro bonus is worth as much as $750, earned after spending $2,500 in three months.

Cardholders and up to four companions can enjoy a free first checked bag on any domestic American Airlines flight, comfortably justifying the $99 fee when used.

The card earns 2X miles for gas and dining purchases

Each eligible mile earned with the card also earns a loyalty point towards American Airlines elite status

A generous 25% discount on in-flight purchases when using the card round out the benefits

Preferred boarding on American Airlines flights

Cons

American Airlines miles can’t be transferred to other airlines or hotels (although they can be used to book AA partner flights)

Premium perks are reserved for pricier cards

Terms Apply

How to get to Sicily using points and miles with All Nippon Airways (ANA)

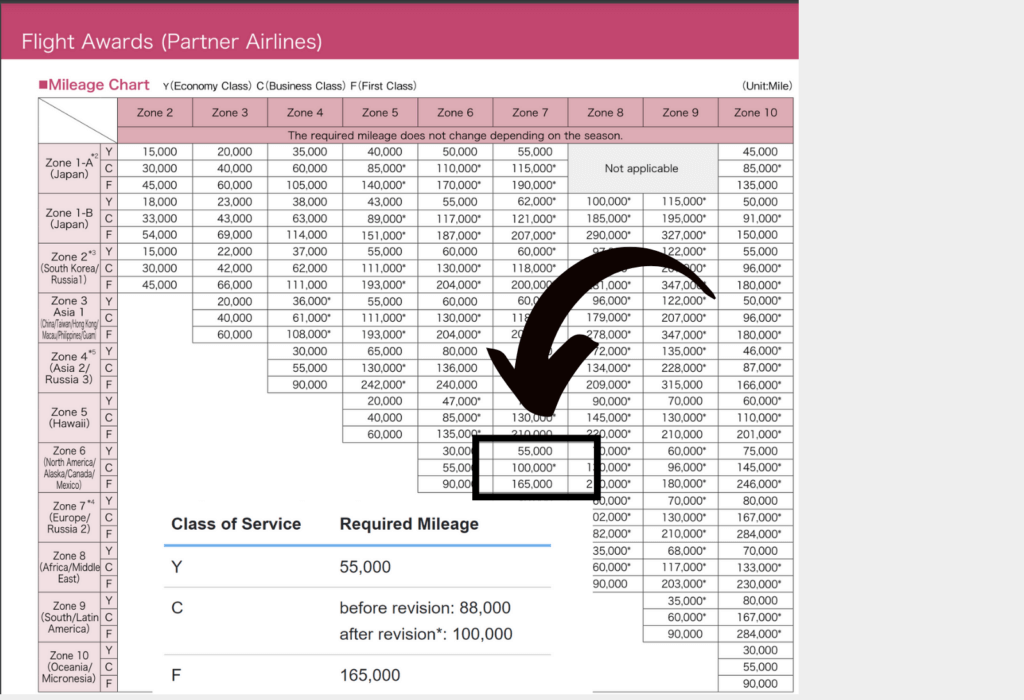

Japan’s flagship carrier All Nippon Airways offers spectacular value on its award redemptions around the world. Its business class flights are particularly impressive and worth chasing despite the program’s quirks. Economy flights are nothing short of amazing, too.

The airline operates a zone-based award chart with no distance requirements for most flights, so it’s the same rate regardless of where you’re flying from or into as long as it’s in the specified zone. In this case, a roundtrip from the US (zone 6) and Europe (zone 7) is priced at just 55,000 points. If you’d prefer a business class seat, you can do so for only 100,000 points—again, roundtrip.

The downside to the program is that every redemption has to be a roundtrip. This could limit you to specific dates or make it awkward if your trip will feature more than one destination. Still, the incredible value on offer makes it a major contender.

Just be patient with its interface—it can be a little glitchy.

- Best for: Foodies

American Express® Gold Card

Earn as high as 100,000 Membership Rewards® Points

Offer Details:

You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Why we like it

The American Express® Gold Card takes your dining and grocery spending to the next level, offering an impressive 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year, and 4X Membership Rewards® points per dollar spent at U.S. supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

To put this into perspective, if you spend $8,400 annually on dining and groceries, which aligns with the average American’s spending, you could earn enough points for a roundtrip flight to Hawaii. Meanwhile, the bonus alone is worth over $1,000, adding significant value to your everyday spending.

Reward details

4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

1X Membership Rewards® point per dollar spent on all other eligible purchases.

Pros & Cons

Pros

-

Earn 4X Membership Rewards® points per dollar spent at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

-

Earn 4X Membership Rewards® points per dollar spent at U.S. supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

-

Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

-

Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

-

Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

-

Get up to $100 in statement credits each calendar year for dining at U.S. Resy restaurants or making other eligible Resy purchases. That’s up to $50 in statement credits semi-annually. Enrollment required.

-

Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys, totaling up to $120 per year. Enrollment required.

-

Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

-

Apply with confidence. Know if you’re approved for a Card with no impact to your credit score. If you’re approved and you choose to accept this Card, your credit score may be impacted.

Cons

-

$325 annual fee

-

No major travel perks like its bigger sibling, the Amex Platinum

aHow to earn enough ANA MileageClub miles

ANA only allows transfers from one credit card issuer—American Express—but, if you’re going to pick just one, that’s a great option. That’s because Amex has a strong line of cards all with generous bonuses.

You could opt for the Platinum card, or grab the foodie favorite, the American Express® Gold Card, and earn as high as 100,000 points after spending $6,000 within six months of opening the card. Plus, receive 20 percent back in statement credits on eligible purchases made at restaurants worldwide within the first six months of card membership, up to $100 back. Limited time offer. Offer ends 11/6/24.

We’re huge fans of this card and always push it as a longterm wallet staple. While the bonus might not be quite enough for the business class roundtrip, its earning potential could get you there in no time.

How to get to Sicily using points and miles with United MileagePlus

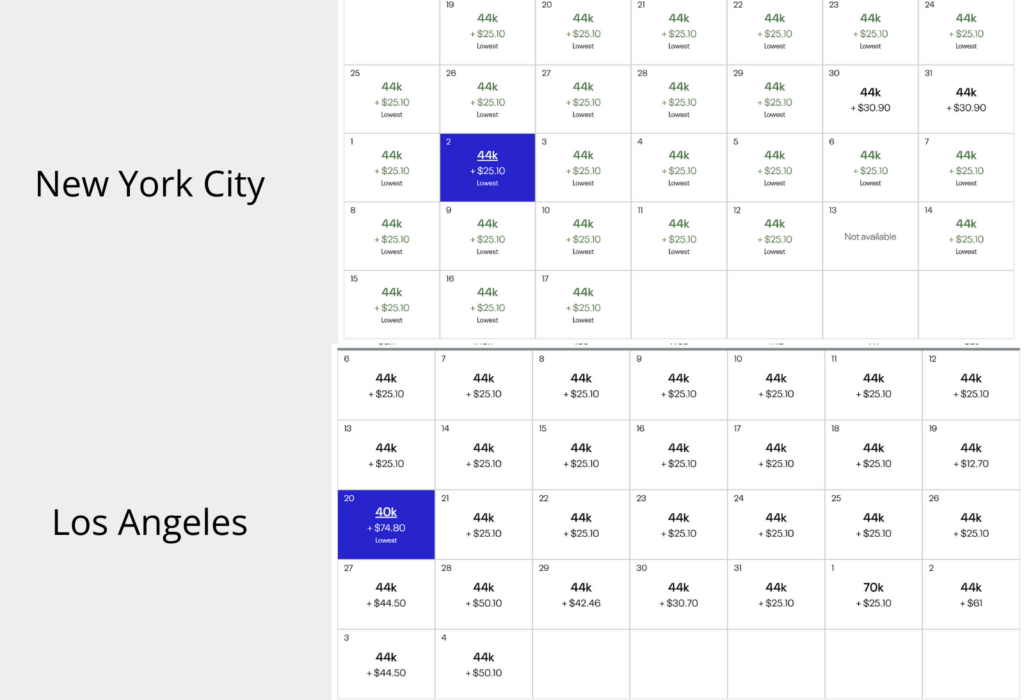

One of the most straightforward options for getting to Siciliy comes from United. Despite being a dynamic system, MileagePlus offers fairly stable rates for flights the whole way to the island. Of course, most of the routes stop for varying lengths of connections in cities like Munich or Geneva, but that’s going to be the case regardless of which airline you use.

The average rate even in summer months hovers around 44,000 miles with fees as low as $25. By anyone’s standards, that’s a pretty great deal, especially when the convenience of having all the flights on the itinerary is accounted for. The good news is that those rates hold even on the West Coast. This could give United the upper hand on some programs that use distance-based award charts.

Those rates track if you do separate searches to other Italian cities, too. A one-way from NYC to Rome clocks in at around 36,000 miles, and United doesn’t seem to have any partners running routes to Sicily from there so you’d have to look elsewhere.

If you flew into Munich or Geneva for 36,000 points you could be smart and use the Excursionist Perk to grab the flights to Sicily for free. Check out how to use that here.

- Best for: Business Travel

Chase Ink Business Preferred® Credit Card

100,000 Bonus Points

Offer Details:

Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

Why we like it

The Ink Business Preferred Business Card pulls attention with its big intro bonus, currently sitting at 100,000 points. That’s worth in $1,000 cash back, $1,500 toward travel when redeemed through Chase Travel℠, or even more when transferring to Chase’s travel partners like Hyatt, United Airlines, British Airways and more. But the card shows its real value with its high-earning bonus-spending categories. Freelancers and business owners alike will earn 3 points per dollar on the first $150,000 spent on travel and select business categories each account anniversary year.

Reward details

3X points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

1X point per $1 on all other purchases – with no limit to the amount you can earn

Pros & Cons

Pros

-

Simply put, for small business owners and freelancers, it’s one of the best cards for turning business spending into valuable travel.

-

It also offers some stellar protections including a comprehensive reimbursement on damaged or stolen cell phones, and primary rental car coverage.

-

It has a reasonable $95 annual fee.

-

If you have another Chase card like the Sapphire Preferred or Reserve, or even a cash back earning Chase card, you can pool your points and make them more valuable.

Cons

-

It does lack some of the juicier benefits attached to other business credit cards like The Business Platinum Card® from American Express. But with the low fee, it’s hard to argue with its value proposition.

-

It’s subject to Chase’s 5/24 rule. So if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Terms Apply

How to earn enough United MileagePlus miles

United MileagePlus miles are fairly easy to earn, especially for those with a small business. Chase is the only credit card issuer that allows transfers to the airline, making the Chase Sapphire Preferred® Card or Chase Sapphire Reserve® cards great options. They both have a big bonuses earned after spending $5,000 within three months of opening an account.

Small business owners could opt for the Ink Business Preferred® Credit Card and its whopping bonus!

How to get to Sicily using points and miles with Air Canada Aeroplan

For a bit more stability (at least on the East Coast), you can opt for Air Canada’s Aeroplan program. The airline utilizes one of the best award charts on the market, using geographic zones and distances within them to set rates.

In this case, partner flights come in at 40,000 points plus around $100 CAD ($73 USD). Flights from the West Coast start at 55,000 points. You will see some far lower rates on the search page but, in most cases, these are Air Canada flights and the routes will be chaotic. Some take as long as 40 hours, so unless you have plenty of time and patience, you may want to give these a miss.

As Aeroplan is chart-based, you can rely on those rates and even take advantage of a business class seat for just 70,000 points from the East Coast. But United’s rates can be similar or less. Use Aeroplan as the baseline then check the dynamic programs like United to make sure you get the best rate in any given scenario.

How to earn enough Aeroplan points

One big advantage Aeroplan has over its partner United MileagePlus is the ease with which you can earn them. You can earn points by flying with the airline and its partners, opening a co-branded card, or transferring points from one of its many partners. The airline accepts transfers from American Express, Capital One, Citi, and Chase—giving you a wide range of cards to bolster your Aeroplan points.

Grabbing American Express Platinum Card® can gift you enough points to book a roundtrip from the East Coast to Sicily. It boasts an impressive as high as 175,000-point intro bonus, earned after spending $12,000 within six months of opening the card. Plus, it lets you travel in style thanks to its epic perks.

- Best for: Luxury Perks

American Express Platinum Card®

As high as 175,000 Membership Rewards® Points

Offer Details:

You may be eligible for as high as 175,000 Membership Rewards® points after you spend $12,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Why we like it

The Amex Platinum was once the sole dominating force in the luxury credit card space. While it now faces some stiff competition, it still offers unbeatable perks like unprecedented airport lounge access, elite status at Hilton and Marriott, and some outstanding statement credits making the mammoth $895 worth it for some.

Reward details

Get more for your travels with 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel®, including Fine Hotels + Resorts® and The Hotel Collection bookings.

You earn 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year.

Pros & Cons

Pros

-

Large intro bonus

Incredible lounge access

-

Statement credits worth over $3,500 annually.

-

Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

Cons

-

The $895 annual fee is brutally high. Too high for many that can’t, or don’t want to take full advantage of its benefits.

-

Points-earning rates are low unless spending directly on flights or with the Amex Portal.

-

Some of the benefits, like travel credits, are more limited and are harder to use than competing cards’ offerings.

The point

When working out how to get to Sicily using points and miles, it’s important to cast your net wide. Depending on the time of year, different programs can offer more or less value. One thing is for sure, though—you’re not short of options for making your dream Italy trip far more affordable.

by your friends at The Daily Navigator

by your friends at The Daily Navigator