You must stay organized if you’re serious about building your points and miles. Opening several cards can get complicated, and with some cards now requiring substantial annual fees, you could easily find yourself in debt on a card you’ve only used once.

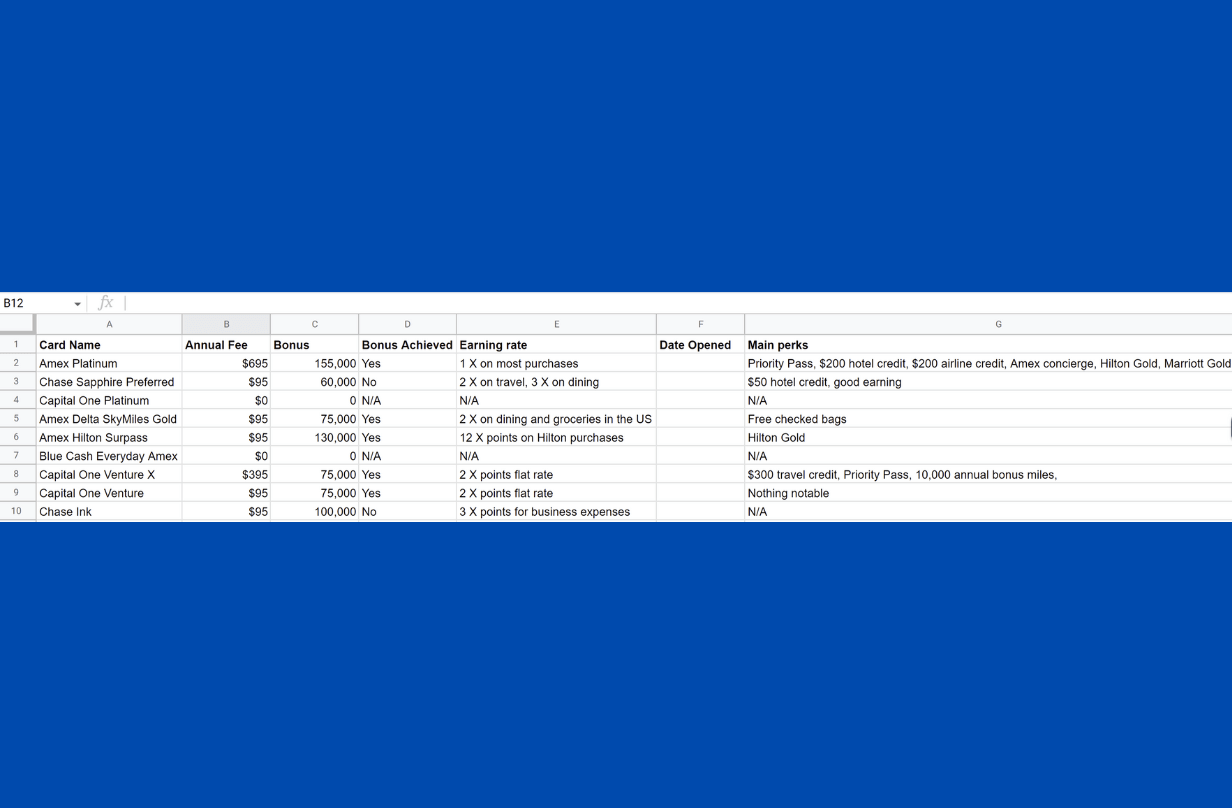

I strongly advise building a spreadsheet to keep tabs on all your cards. This way, you can anticipate when fees are due, the benefits they offer, and your earned points. I’d recommend including the following details similar to the picture above.

What to put in your travel hacking spreadsheet

The card name

Date opened

The annual fee and when it’s due

The intro bonus and whether you’ve earned it

Its earning rate

Its most notable perks

If you have debt on the card

As you can see from the snapshot above, the Amex Platinum is very expensive. But it offers $200 in hotel credits, which I’ll use strategically to save even more. It also provides Hilton Gold status, negating the Hilton Surpass’ biggest perk. That’s an argument for closing the Surpass, which costs $95 a year. While the Delta Gold card offers me free checked bags, the Platinum comes with a $200 airline credit statement that I can use for the same thing.

All in all, the Platinum’s high $695 annual fee is reduced to $305 if I want to keep the benefits. Whether I will keep it is another story, but the spreadsheet helps me see all that clearly and stay organized throughout the year.

by your friends at The Daily Navigator

by your friends at The Daily Navigator