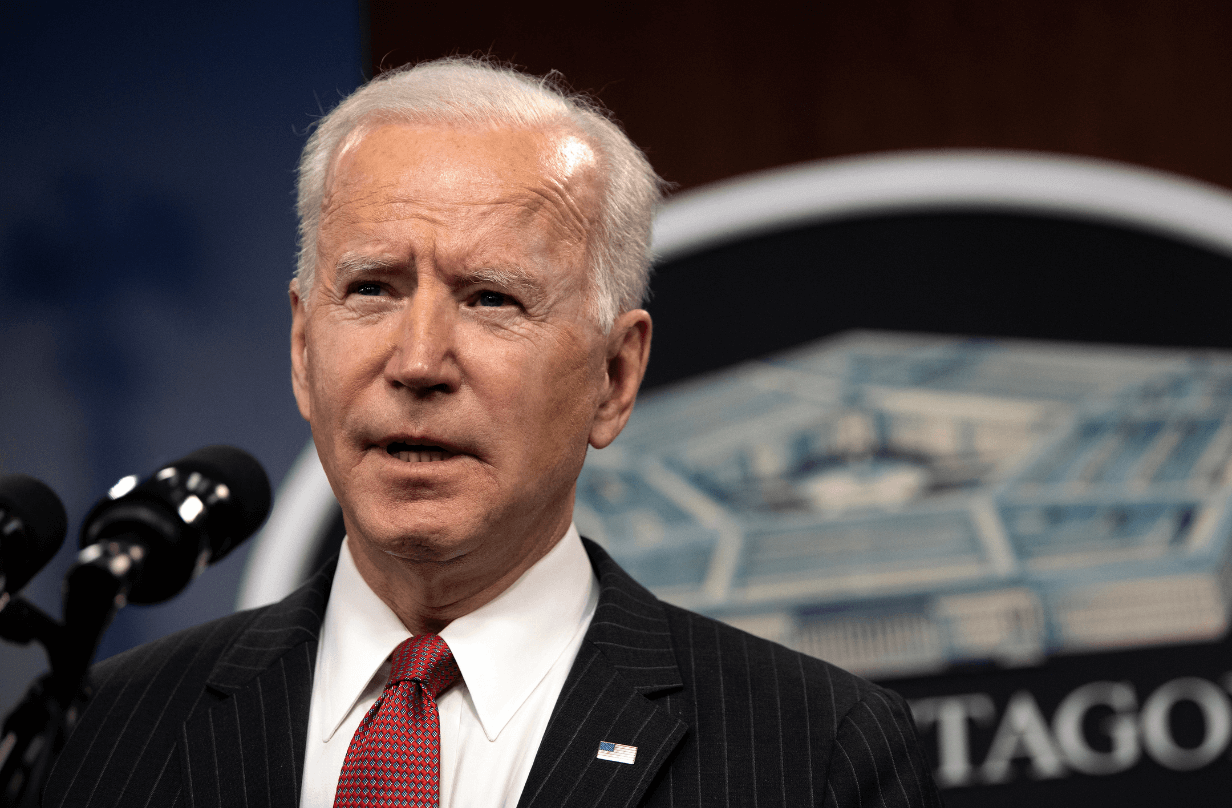

On Tuesday, President Biden signed the Inflation Reduction Act into law.

The purpose of the bill is to decrease inflation by reducing demand and bringing down budget deficits. The $750 billion package encompasses changes to healthcare, corporate taxes, and climate protections.

On the healthcare front, the act gives Medicare the power to negotiate the prices of some drugs and includes a $35/month cap on insulin purchased through Medicare.

The act also takes aim at companies paying little to no income tax, like Amazon. The new legislation will require corporations to pay a 15% minimum tax and a 1% tax on stock buybacks.

The taxes will raise over $700 billion in government revenue over the course of 10 years. Some of the additional revenue generated will go directly to the IRS with the goal of processing tax refunds more quickly and with better response rates. Another $430 billion will go towards reducing carbon emissions and extending health insurance subsidies under the affordable care act.

The other climate-focused initiatives include rebates for those who choose more clean and sustainable energy choices. For example, homeowners could receive rebates for including electric water heaters or installing solar panels and drivers can receive a $7,500 credit for buying an electric vehicle.

As for easing the pains of inflation in the short term? Most of the changes will take effect next year. In the short term, you’re not likely to notice a big change in prices. According to the University of Pennsylvania’s Penn Wharton Budget Model, the act might only bring prices down by about 0.1% over the next 5 years.

by your friends at The Daily Navigator

by your friends at The Daily Navigator