Overview

Life is complicated. Points and miles might be even more so.

Alright, maybe that’s an exaggeration, but with so many currencies, programs, and strategies to consider, learning the ropes of points and miles can be a steep learning curve. Knowledge is power in this game, and the best place to start is the programs that facilitate the whole system.

We’re helping out by diving deep into each of them for you. Today we will center around one of the most valuable programs, Chase Ultimate Rewards.

Boasting some of the most valuable transfer partners and a unique feature that helps its baseline hover higher than any other program, it should play a central role in any strategy.

Let’s take a look!

The Bottom Line

Chase Ultimate Rewards offers incredible value thanks to its excellent range of transfer partners as well as its generous baseline value for its own portal redemptions. Any serious points and miles enthusiast needs to have at least one foot in the Ultimate Rewards Camp.

What Is Chase Ultimate Rewards

Chase Ultimate Rewards is the catch-all name for the eponymous bank’s rewards program, allowing customers to earn in return for spending on Chase-issued credit cards. Generally, the rewards themselves come in the form of points or cashback, which is what we’ll focus on today.

Known and lauded for its flexibility, Chase has several families of cards that earn in different ways but can be combined in some circumstances to maximize value.

What Is Chase Ultimate Rewards Cashback?

As it suggests, Chase’s cashback system rewards customers by offering cash in return for using its credit cards. A little confusingly, cashback is accrued in the form of Ultimate Rewards with a fixed value of 1 cent each.

The simplest way to redeem cashback is by a statement credit. You’d simply choose how much you want to apply and wait for the value to drop into your account. It might take a few weeks, but it’s coming.

You can also opt to redeem cashback for gift cards, which can be an okay deal if there’s a discount, as well as the ability to use them at the checkout on Amazon and Apple. We’d avoid Amazon, though—you’ll only get a 0.8 cents valuation there.

Why choose to earn Chase Ultimate Rewards cashback?

As with any other cashback system, the principal benefit is the flexibility. Whether choosing to receive a check, get a statement credit, or grab some gift cards, the cashback can chip in on anything from a new pair of shoes to the monthly grocery bill. Those who don’t travel enough to make the most of the scope will see plenty of value in racking up cashback.

Why wouldn’t you choose to earn cashback?

Cashback’s greatest strength belies its greatest flaw: its value is capped. While it’s great having the flexibility to redeem it on whatever you see fit, the ability to squeeze more than double the monetary value out of each point is reserved for its points system.

(Yes, it’s hard to keep up with. Cashback being called points, and points being called points is weird.)

Best Chase cashback cards

Chase Freedom Unlimited offers 5% cashback on travel purchased through Chase TravelSM, 3% on dining and drugstores, and 1.5% on everything else.

Prime Visa offers 5% back at Amazon.com, Amazon Fresh, Whole Foods Market, and on Chase Travel purchases with an eligible Prime membership, 2% back at gas stations, restaurants, and on local transit and commuting (including rideshare), and 1% back on all other purchases.

Ink Business Unlimited® Credit Card offers 1.5% cash back rewards on every purchase made for your business, with no annual fee.

Ink Business Cash® Credit Card offers 5% cash back in select business categories, also with a no annual fee.

- Best for: Beginners looking for a low risk entry point

- Annual Fee: $0

- APR: 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 18.99% - 28.49%.

- Reward Rate: 1.5%-5%

- Recommended Credit: 670-850

Chase Freedom Unlimited®

Earn a $200 Bonus

Offer Details:

Intro Offer: Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

Why we like it

The Chase Freedom Unlimited does seem like a strong choice for beginners, but its quirks mean it can still find a place in a seasoned points and miles enthusiast’s wallet. While it’s a cashback earning product, those with another Ultimate Rewards earning card can convert that cashback into super-valuable points. The unique bonus structure means the card can be a hugely valuable asset to anyone trying to build their Ultimate Reward points, effectively earning a minimum of 3% or 3 points per dollar on everything.

Reward details

5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards, and more.

3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service.

1.5% cash back on all other purchases.

Pros & Cons

Pros

-

Generous introductory earning rate

-

Strong earning rates after the introductory year

-

No annual fee

Cons

-

Another Chase card is required to earn points

-

Some cards have better rates after the introductory year

Terms Apply

What Are Chase Ultimate Rewards Points?

Chase Ultimate Rewards Points are the issuer’s unique currency, also earned by spending on points-earning credit cards. While not as flexible as cashback, points can be used in several ways, the most notable of which is for travel.

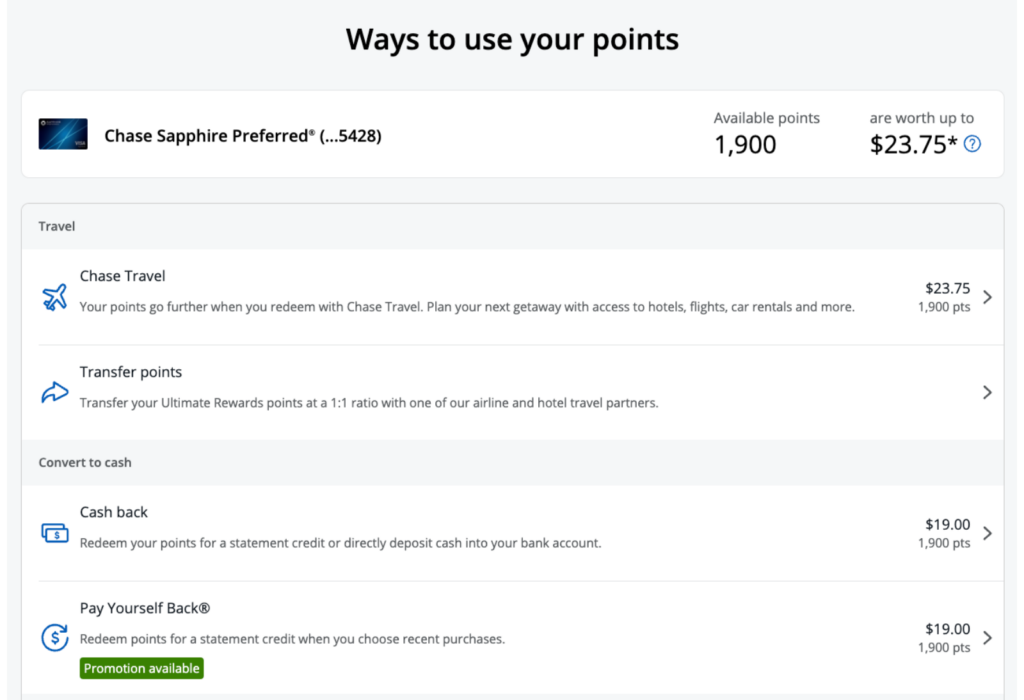

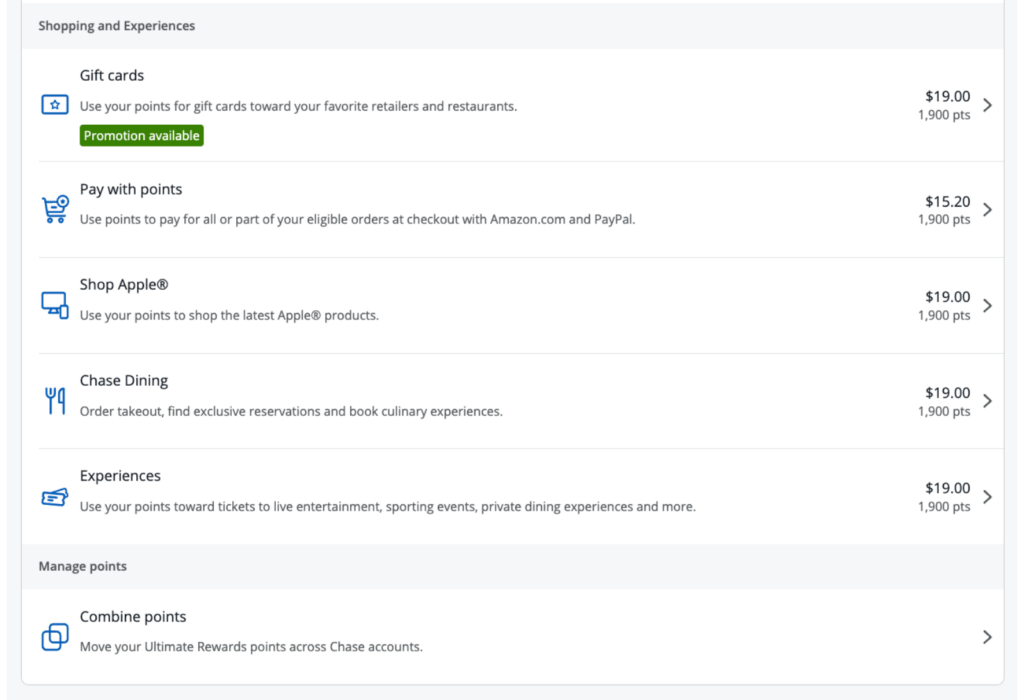

Ultimate Rewards can be redeemed on the Chase Travel℠ portal, as statement credits and other cashback-like ways, and by transferring them to one of the issuer’s airline and hotel partners. The latter is the most valuable redemption method if used well.

How much is a Chase Ultimate Rewards point worth?

The value of a Chase Ultimate Rewards point varies depending on the way it is used and the cards owned by any given customer.

For example, redeeming points on Chase’s travel portal could see you enjoy a valuation of 1.25 cents or 1.5 cents per point, based on whether you have the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve® Credit Card. This is already much more valuable than its competitors’ equivalent values.

But transferring points to one of Chase’s high-value travel partners could see that number double or even triple.

Why choose to earn Chase Ultimate Rewards points?

After reading the last section, it should be fairly obvious that the main draw of Ultimate Rewards points is the outsized value that can be achieved. Tremendous hotel partners like World of Hyatt let you book hotels worth thousands of dollars for a fraction of the price, while its outstanding airline options could see you flying business class on a $10,000 flight.

If you travel any amount throughout the year, Ultimate Rewards offer an amazing opportunity to save or expand your experiences in a way that cashback just isn’t capable of.

Why you wouldn’t choose to earn points?

There aren’t many reasons you wouldn’t want to earn Ultimate Rewards, especially as you can redeem them as a statement credit anyway. But if you simply don’t travel much, you may find more value in a cashback card’s earning rates. In that situation, it makes sense to go in a different direction.

Best Chase points cards

Chase Sapphire Preferred® Credit Card earns 5x total points on travel purchased through Chase TravelSM, 3x points on dining at restaurants, including eligible delivery services, takeout, and dining out, and 2x on other travel purchases.

Chase Sapphire Reserve® Credit Card earns 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM after the first $300 is spent on travel purchases annually.

- Ink Business Preferred® Credit Card earns 3X points on shipping and other select business categories.

- Best for: Beginner Travelers

Chase Sapphire Preferred® Card

60,000 Bonus Points

Offer Details:

Earn 60,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Why we like it

The Chase Sapphire Preferred Card is the ultimate all-around travel credit card—it fits perfectly into almost any points-earner’s wallet. Points novices can enjoy a significant intro bonus and easy to grasp spending categories with an approachable annual fee. The more experienced can utilize its high value earning potential as a secondary card and also gain access to Chase’s strong travel booking portal.

Reward details

5x on travel purchased through Chase Travel℠.

3x on dining, select streaming services and online groceries.

2x on all other travel purchases.

1x on all other purchases.

Pros & Cons

Pros

The $50 dollar hotel credit for stays purchased on the Chase Travel Portal already cuts the already approachable $95 annual fee significantly.

Earn up to $50 in statement credits each account anniversary year for hotel stays through Chase Travel℠

10% anniversary points boost – each account anniversary you’ll earn bonus points equal to 10% of your total purchases made the previous year.

A 10% annual points bonus is tacked on every year, adding a little more value.

Complimentary DashPass which unlocks $0 delivery fees & lower service fees for a min. of one year when you activate by 12/31/27. Plus, a $10 promo each month on non-restaurant orders.

Along with all of the above, cardholders also have access to a string of travel protections like rental coverage, cancellation insurance, and purchase protection.

Cons

Maximizing the value of Chase points can still be complicated for complete novices.

Competing cards like the Capital One Venture have a better earning rate for non-bonused spend.

It’s subject to Chase’s 5/24 rule. So, if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Terms Apply

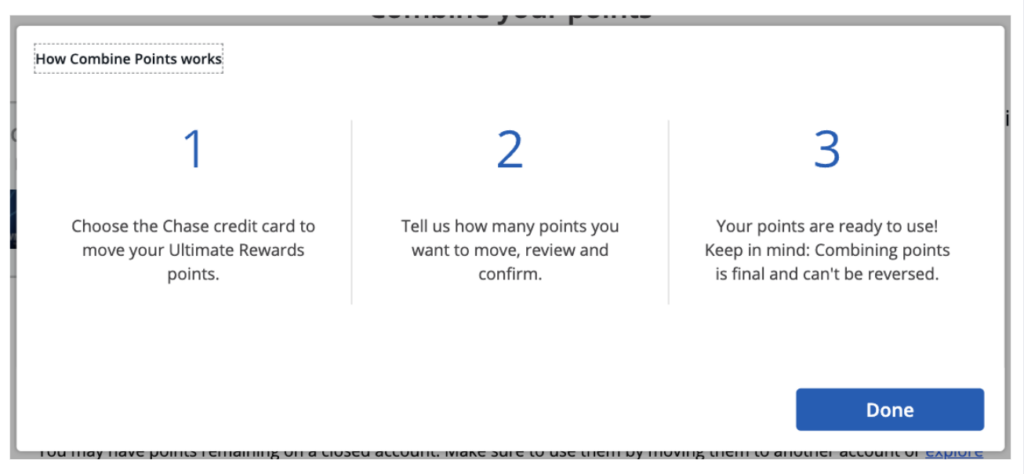

Moving Points Across Cards / People

Chase is one of the more generous issuers when it comes to sharing points. There are three basic ways of doing this.

The first isn’t technically pooling points, as you’re sharing them with yourself, but it’s a handy thing to know. If you own an Ultimate Rewards earning card and a cashback earning card, the accounts can be joined, and any cashback earned can be used as transferable points. It’s important to note this doesn’t go the opposite way.

The second method is a true pooling option. Chase allows customers to share points with other Ultimate Rewards members living in the same household. They don’t need to be family or married. They just need the same address. This is particularly helpful if someone has the Reserve card, as points earned on weaker cards can be made more valuable.

The final method applies only to airline and hotel partner transfers. It’s possible to transfer points to the loyalty account of an authorized user on the card. Again, this is helpful if they already have a pool of points on that account and you’re hoping to consolidate.

How to Redeem Chase Ultimate Rewards Points

Redeeming Chase Ultimate Rewards Points is why we do all this. Whether it’s saving you some money on a dream trip or elevating the whole experience, there are plenty of ways to maximize your points.

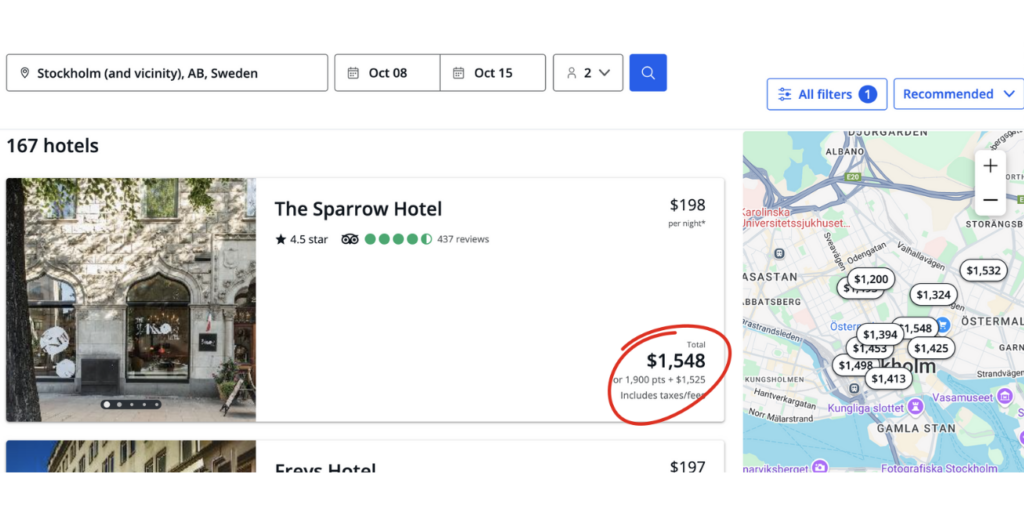

How to redeem points on Chase Travel℠

In most cases, we recommend avoiding issuer travel portals for redemptions. This is because you’re tied to a 1 cent per point rate, as well as limited purchase options. Chase Travel℠ differs thanks to a strong perk on each of its points-earning cards.

Those holding the Chase Sapphire Preferred® Card or the Ink Business Preferred® Credit Card can redeem their points at a value of 1.25 cents each. This means 100,000 points are worth $1,250, not $1,000. Reserve cardholders get an even better deal, with a 1.5 cents per point rate.

It’s important to note that it’s still possible to get a far better rate by transferring. But as fallbacks go, Chase Travel℠ is the best of the bunch.

To redeem your points on Chase Travel℠, perform a search as you would on any travel aggregator site. Once you’ve made your selection, you’ll head to the checkout page, where the rate will be listed in dollars and points. Opt for the points option and complete your purchase.

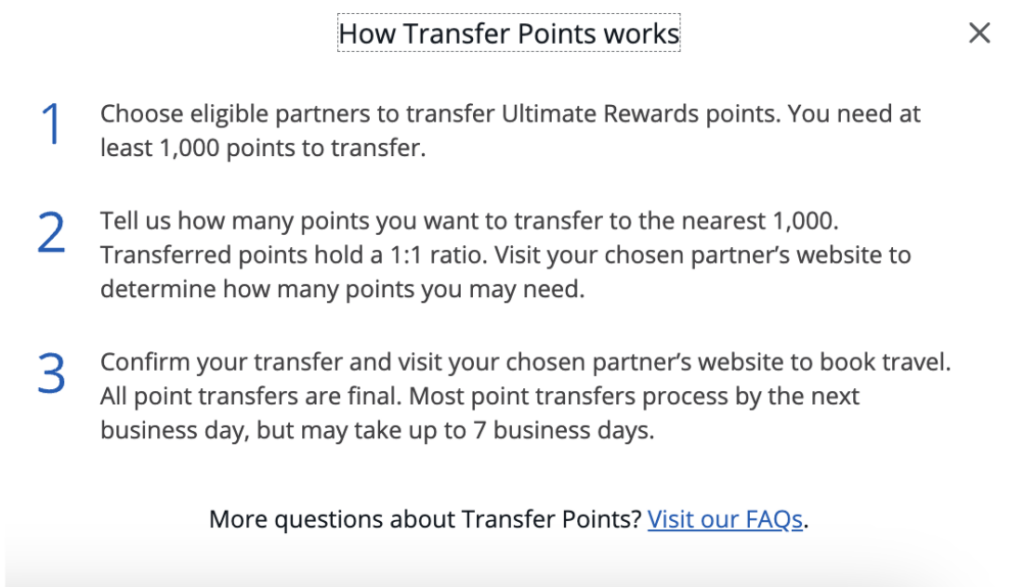

How to redeem points by transferring to a travel partner

Redeeming points with a travel partner is a little more complicated, but far more rewarding. Chase has built an outstanding list of high-value transfer partners, from top-tier hotel brands like Hyatt to renowned airline programs like Air Canada’s Aeroplan. We rate Chase as one of the most valuable programs out there for this reason.

To redeem your points, you’ll need to do a little research. We always recommend finding the flight or stay you want before transferring any points.

Once you’ve found your flight, navigate to your ultimate rewards homepage and click on the transfer section. Once there, you’ll find a list of programs you can send your Ultimate Rewards program to. Remember, you’ll need a membership with whichever program you need.

Select the program and the number of points you want to transfer. You’ll be required to list your membership for verification, and then your points will be on the way. Once they drop into your account, you can redeem them on the airline or hotel booking page.

Airline Transfer Partners:

Aer Lingus AerClub

Air Canada Aeroplan

Air France-KLM Flying Blue

British Airways Executive Club

Emirates Skywards

Iberia Plus

JetBlue TrueBlue

Singapore Airlines KrisFlyer

Southwest Airlines Rapid Rewards

United MileagePlus

Virgin Atlantic Flying Club

Hotel Transfer Partners:

IHG One Rewards

Marriott Bonvoy

World of Hyatt

The Point

Chase Ultimate Rewards is an immensely valuable program thanks to flexible redemption methods in both its cashback and points systems. The points system in particular offers amazing value, owing to its strong list of transfer partners and the ability to redeem points for higher value on the Chase Travel Portal.

by your friends at The Daily Navigator

by your friends at The Daily Navigator