Overview

Points, miles, and credit card rewards are complicated. They’re designed that way. If they weren’t, everyone would fly business class every other week.

Unfortunately, there’s no magic bullet. No mysterious shortcuts. You just need to learn the system.

But while you need to take the initiative, we’re doing what we can to make that information as accessible as possible, taking deep dives into as many credit card, airline, and hotel programs as possible to get you on the path to points and miles mastery. Or cashback, but that didn’t sound as nice.

This time, we’re looking at one of the most popular reward systems out there—American Express Membership Rewards. Dig in, make notes, and by the end, you’ll be an Amex-pert…sorry.

The Bottom Line

American Express Rewards is one of the most valuable reward systems out there, bolstered by a formidable set of high-earning cards. That ease of accrual makes the program so attractive for many and should be a centerpiece of your broader rewards strategy.

What Is American Express Membership Rewards

As can be assumed, Membership Rewards is the name for Amex’s reward scheme. This encompasses both points and cashback earned on consumer and business credit card spending. The type of reward earned depends on the card owned. However, like other programs, ie Capital One’s Venture Rewards Credit Card program, it’s possible to turn cashback into points.

How much you earn also depends on the credit card or cards you own. Each one is assigned a specific earning rate in different categories. For example, you might earn 3% cashback on travel or 4x points per dollar on restaurants.

What Is American Express Cashback?

Cashback represents one of the two tiers of Amex’s rewards program. As suggested, instead of earning points, customers earn a percentage back from each of their purchases. In general, the rewards will appear in the user’s account in the next statement period, assuming they’ve kept the account in good standing. For example, if you spend $100 on a card that earns 2% cashback, you’d get $2 back in the next statement period.

Cashback remains the preferred reward option for most customers, owing to its flexibility. You can use your cashback on anything from a flight or hotel stay to your groceries and Christmas presents.

Cashback is redeemed in the form of a statement credit, which can be applied at any time to cover any particular purchase you want. You can opt to wait for a special purchase or just take some of the sting out of your most recent statement. Either way, it’s an excellent way to save.

It’s also possible to link your Amazon account and opt to use your cashback at the checkout.

Why choose to earn cashback?

As with other programs, the main draws of cashback are the ability to save money and do so in a flexible manner. There are no limits on what you can use it for, which is where points will often fall short.

Why wouldn’t you choose to earn cashback?

Cashback rewards can be severely limited compared to points and miles, at least where value is concerned. While points might be less flexible, it’s possible to get far more value from them. Cashback is fixed and can’t be maximized any further. If you have $1,000 in cashback, you have $1,000 to spend. If you have 100,000 points, you could squeeze $1,000 of value or push as high as $5,000 with a big redemption. Of course, if you’re not interested in travel, that might not be attractive to you.

Another limitation faced by Amex’s cashback is the limited ways to redeem. Other issuers offer multiple avenues, including mailed checks. Amex sticks solely to statement credits and Amazon. For most people, this is fine, but if you’re searching for something more specific, it’s maybe not for you.

Best American Express cashback cards

Blue Cash Preferred® Card from American Express offers between 1-6% on all purchases.

Blue Cash Everyday® Card from American Express offers 3% cash back at U.S. supermarkets, 3% cash back on U.S. online retail purchases, and 3% cash back at U.S. gas stations

- Best for: High Earning Power

- Annual Fee: $0 intro annual fee for the first year, then $95.

- APR: 20.24%-29.24% Variable

- Reward Rate: 1%-6%

- Recommended Credit: Good to Excellent

Blue Cash Preferred® Card from American Express

$250 intro offer

Offer Details:

Earn $250 after you spend $3,000 on purchases in your first 6 months of card membership

Why we like it

The American Express Blue Cash Preferred is an almost indispensable card for racking up serious cash back. Even considering its annual fee (which has a $0 annual fee the first year), it represents tremendous value. Combined with another, more specific rewards-earning, the Blue Cash Preferred could be the foundation of an outstanding cash-back earning strategy.

Reward details

6% Cash Back at U.S. supermarkets on up to $6,000 per year in purchases (then 1%).

6% Cash Back on select U.S. streaming subscriptions.

3% Cash Back on transit including taxis/rideshare, parking, tolls, trains, buses and more.

3% Cash Back at U.S. gas stations

1% Cash Back on other purchases

Pros & Cons

Pros

Earn a $250 statement credit after you spend $3,000 in eligible purchases on your new Card within the first 6 months.

Buy Now, Pay Later: Enjoy $0 intro plan fees when you use Plan It® to split up large purchases into monthly installments with a fixed fee. Pay $0 intro plan fees on plans created during the first 12 months from the date of account opening. Plans created after that will have a monthly plan fee up to 1.33% of each eligible purchase amount moved into a plan based on the plan duration, the APR that would otherwise apply to the purchase, and other factors.

Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon.com checkout.

$84 Disney Bundle Credit: With your enrolled Blue Cash Preferred® Card, spend $9.99 or more each month on an auto-renewing Disney Bundle subscription, to receive a monthly statement credit of $7. Valid only at Disney Plus.com, Hulu.com or Plus.espn.com in the U.S.

Cons

Not the most lucrative intro offer

What Are American Express Membership Rewards Points?

While earned in a similar way, Membership Rewards Points offer a different, more flexible redemption experience. Just like cashback, points are earned using specific points-earning credit cards with pre-determined rates. For example, you could earn 3x points per dollar on travel, 4x points per dollar on U.S. supermarkets and restaurants, or a flat rate of 1.5 points per dollar on everything.

How much is an American Express Membership Rewards Point worth?

This is where it gets a little confusing—but also a little exciting. While cashback has a fixed rate, points can be redeemed at vastly different values depending on how they’re used.

For example, if you redeem 100,000 points on the Amex Travel Portal, you’ll get $1,000 of flights or hotels. If, instead, you opt to transfer the points to one of American Express’s outstanding airline or hotel partners, you could redeem them for thousands more dollars, like a business class flight worth $6,000.

We value them at around 2 cents each, but it’s important to remember that this is a baseline figure you should strive for. It’s more than possible to redeem the points for less than 1 cent each or as much as 10 cents.

Why choose to earn points?

Membership Rewards points are some of the most valuable on the market. Its strong list of transfer partners, which we’ll highlight later, makes it a formidable tool for traveling for pennies on the dollar. Better yet, you can even use your points to get cashback. With that in mind, it doesn’t make a lot of sense to opt for cashback only when you can have the flexibility of both with Membership Rewards.

It’s also one of the easiest programs to earn points with. Amex has more points-earning cards than other major issuers, and each has excellent introductory offers and earning rates that can supercharge your earnings.

Why wouldn’t you choose to earn points?

Unless you’re completely set on cashback, there aren’t many reasons why you would opt out of Membership Rewards points. It’s a tremendous program offering real scope on your redemption options. Of course, if you don’t travel enough and know you’ll never use them for anything other than cashback, you may just not see the attraction. We’d recommend checking the rates on all your card options, though, as you could still come out better on the cashback side with points.

Best American Express points cards

American Express® Gold Card earns 4X points at restaurants worldwide, on up to $50K in purchases, 4X points at U.S. supermarkets, on up to $25K in purchases, and 3X points on flights booked directly with airlines, the card will earn 1x on the above once the spending cap is met

Delta SkyMiles® Gold American Express Card earns 2X miles for every eligible dollar spent on Delta purchases and at restaurants (including takeout and delivery in the U.S.) & U.S. supermarkets and earn 1X mile per eligible dollar on all other purchases.

American Express Green Card® earns 3X Membership Rewards® points on Travel, 3X Membership Rewards® points on Transit, and 3X Membership Rewards® points on Restaurants

- Best for: Foodies

American Express® Gold Card

60,000 Membership Rewards® Points

Offer Details:

60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases within your first 6 months of card membership

Why we like it

The American Express® Gold Card takes your dining and grocery spending to the next level, offering an impressive 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year, and 4X Membership Rewards® points per dollar spent at U.S. supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

To put this into perspective, if you spend $8,400 annually on dining and groceries, which aligns with the average American’s spending, you could earn enough points for a roundtrip flight to Hawaii. Meanwhile, the bonus alone is worth over $1,000, adding significant value to your everyday spending.

Reward details

4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

1X Membership Rewards® point per dollar spent on all other eligible purchases.

Pros & Cons

Pros

Earn 4X Membership Rewards® points per dollar spent at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

Earn 4X Membership Rewards® points per dollar spent at U.S. supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

$120 Uber Cash on Gold: Each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year. An Amex Card much be selected as the payment method for your Uber or Uber Eats transaction to redeem the Amex Uber Cash benefit

$84 Dunkin’ Credit: Earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin’ locations.

Get up to $100 in statement credits each calendar year for dining at U.S. Resy restaurants or making other eligible Resy purchases. That’s up to $50 in statement credits semi-annually. Enrollment required.

Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys, totaling up to $120 per year. Enrollment required.

Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

Apply with confidence. Know if you’re approved for a Card with no impact to your credit score. If you’re approved and you choose to accept this Card, your credit score may be impacted.

Cons

$325 annual fee

No major travel perks like its bigger sibling, the Amex Platinum

Moving Points Across Cards / People

Unlike other issuers, Amex does not allow points pooling or transfers between friends and family. The one exception is when the cardholder adds an authorized user. In this case, you can transfer points to the authorized user’s airline or hotel loyalty programs.

How to Redeem American Express Membership Rewards Points

Generally, there are two main ways to redeem Membership Rewards Points: The Amex Travel Portal and Travel Partner Transfers. There are a couple of other ways, but we recommend honing in on these two.

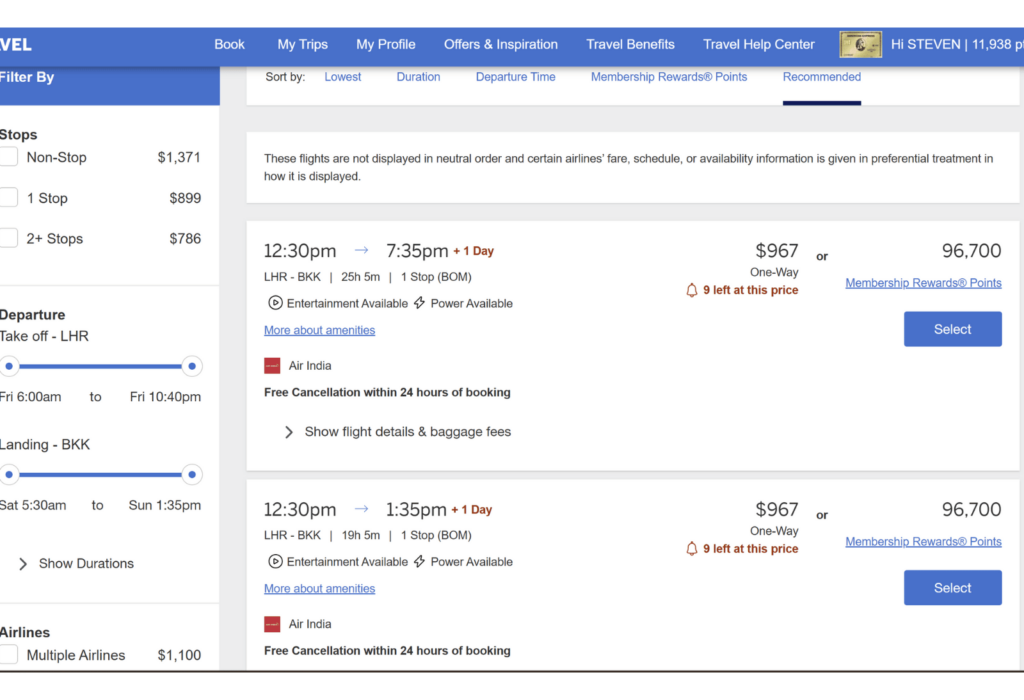

How to redeem miles on the Amex Travel Portal

The Amex Travel Portal is the most straightforward way to redeem your points. In this method, your points operate as a fixed-rate currency where each point equals one cent. The process is simple—treat the portal like any other travel aggregator. Key in your flight or hotel search and skim through the results.

You’ll see two rates: one for cash and one for points. Once you’ve made your selection, you’ll be able to select points at the checkout and redeem away.

The big downside to this method is that you’re tied to whatever rates Amex sets. If a cash ticket costs $1,000, you’ll need 100,000 points. There may be some better cash rates elsewhere. This limiting factor should be enough to convince you to try transferring points.

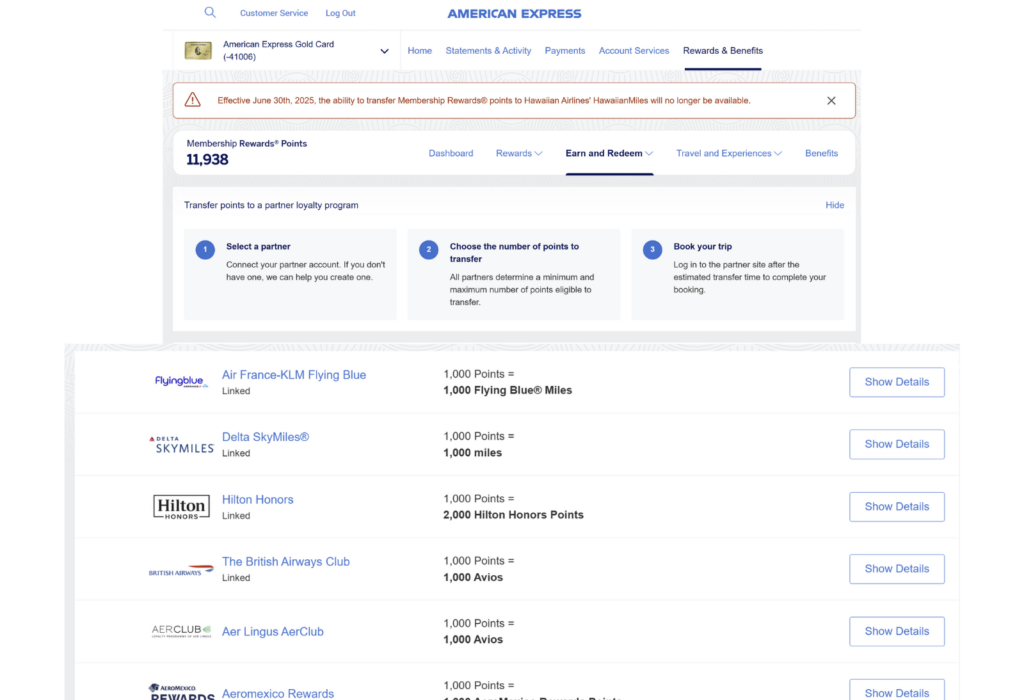

How to redeem miles by transferring to a travel partner

The second option is to transfer points to one of Amex’s airline and hotel partners. With 18 airlines and 3 hotel programs to choose from, you’re in a good position to maximize your points wherever you’re hoping to go. We’ll list all the partners below.

To transfer points, log in to your account and navigate to your awards and benefits section. In there, you’ll find an option to transfer points to a travel partner. Once there, you’ll see a list of airline and hotel loyalty programs. Enter how many points you want to send, taking note of the transfer ratio, and fill in your loyalty program details.

It’s vital to check for the flights or booking you want before transferring. Otherwise, you may transfer points for nothing and lose value in the long run.

Amex Airline Transfer Partners

Aer Lingus

AeroMexico

Aeroplan

Air France/KLM Flying Blue

ANA Mileage Club

Avianca LifeMiles

British Airways Executive Club

Cathay Pacific Asia Miles

Delta SkyMiles

Emirates Skywards

Etihad Guest

Hawaiian Airlines HawaiianMiles

Iberia Plus

JetBlue TrueBlue

Qantas Frequent Flyer

Qatar Airways Privilege Club

Singapore Airlines KrisFlyer

Virgin Atlantic Flying Club

Amex Hotel Transfer Partners

Hilton Honors

Marriott Bonvoy

Choice Privileges

The Point

American Express Rewards is one of the best reward programs around. While it has more restrictions than some issuers, the value of its points makes it a program to build a strategy around. With some of the strongest transfer partners, it’s more than possible to push points well above 5 cents each in a single redemption. Throw in the strong selection of high-earning cards and you’ve got a recipe for success.

by your friends at The Daily Navigator

by your friends at The Daily Navigator