- The Chase Ink Business Preferred

- Fly a roundtrip in Qatar Airways’ Qsuite

- Use United’s Excursionist Perk to fly 30 times in economy

- Fly the whole family to Hawaii and back with Southwest

- Fly business class to Europe and back twice

- Book 30 nights in a budget hotel or 5 nights in a 5-star Hyatt property

- The point

What are travel credit cards, and how do they work?

Travel credit cards are financial products that offer various rewards and benefits geared towards frequent travelers. They typically earn you points or miles for every dollar spent on eligible purchases. These rewards can be redeemed for flights, hotel stays, car rentals, and other travel-related expenses. Travel credit cards may also include perks like travel insurance, airport lounge access, and no foreign transaction fees.

How do I choose the best travel credit card for my needs?

Choosing the best travel credit card depends on your travel habits, spending patterns, and preferences. Consider factors like the type of rewards offered (points, miles, or cash back), the card’s annual fee, sign-up bonuses, earning rates, redemption options, and additional travel perks. Analyzing these features will help you find a card that aligns with your lifestyle and offers the most value.

What are the benefits of using a travel credit card over other types of credit cards?

Travel credit cards provide unique advantages for travelers, such as earning rewards specifically tailored to travel expenses. Additionally, many travel credit cards offer travel-related perks like free checked bags, priority boarding, and travel insurance. Some cards also waive foreign transaction fees, making them ideal for international travelers.

What is a sign-up bonus, and how can I qualify for it?

A sign-up bonus is a promotional offer provided by the credit card issuer to entice new cardholders. To qualify for a sign-up bonus, you usually need to meet specific spending requirements within a certain timeframe after opening the account. The bonus can be in the form of points, miles, or cash back, and it’s a great way to jump-start your rewards earning.

Do travel credit cards charge foreign transaction fees?

Not all travel credit cards charge foreign transaction fees. Many of the top-tier travel cards waive these fees, making them ideal for international travel. However, it’s essential to read the card’s terms and conditions to confirm this before using it abroad.

How can I maximize the rewards earned with my travel credit card?

To maximize rewards, use your travel credit card for everyday expenses and large purchases. Take advantage of bonus categories and special promotions to earn more points or miles. Consider combining your travel credit card with loyalty programs to stack rewards and get even more value out of your purchases.

We love the Chase Ink Business Preferred® Credit Card. It’s a powerhouse of a business card with some of the best earning rates out there. That fact alone should make it a wallet-staple contender for the long haul, but there’s an even bigger reason to be interested right now.

90,000 reasons actually.

For a limited time, the Chase Ink Business Preferred is offering new customers 90,000 Ultimate Rewards® points. That figure is up from the usual 100,000-point rate. All you need to do is spend $8,000 within three months of opening the card. That’s a spectacular offer with an achievable spending threshold for many.

That haul of points is worth a minimum of $1,500 when used on the Chase Travel℠ portal, but, as this article will show, you can squeeze thousands more dollars of value out of it if you’re so inclined. And why wouldn’t you be inclined?

But first…let’s check out the card

The Chase Ink Business Preferred is one of the best cards on the market for small business owners (and it’s much easier to qualify for the card than you think). Despite the approachable $95 annual fee, it’s bursting with value and makes a strong case for being your go-to card for years to come.

Here’s a high-end look at the card.

Qualifying for a small business card

When you think of a “small business,” you may envision a revenue amounting to tens or hundreds of thousands of dollars per year, multiple employees, a storefront, etc. But in fact, none of these things are required to get a small business card. You can qualify for the Chase Ink Business Preferred® Credit Card if you perform services such as babysitting, driving for Uber or DoorDash, tutoring, freelance writing, selling items on eBay or Etsy and more — the list goes on.

A small business doesn’t even have to be your main job. As long as you’ve got a for-profit venture, you qualify for the card—though whether you’re approved will depend on additional factors.

Annual fees and bonus offers

As mentioned above, the Ink Business Preferred’s annual fee is just $95. With a fee that low, you won’t see a lot of perks, but it more than makes up for that with its intro bonus and future earning potential.

The elevated intro bonus is monumental, making it the best time to open the card in a long time (and probably for a long time to come). We don’t know how long it will be around for, so if you’re on the fence, don’t wait too long.

Earning potential

The Chase Ink Business Preferred comes into its own with its generous and super adaptable earning rates. For the right business owner, it’s indispensable.

You’ll earn 3X points per dollar on:

- Travel (includes airfare, hotels, Ubers, trains, car rentals, tolls, parking, etc.)

- Shipping

- Advertising purchases made with social media sites and search engines

- Internet, cable, and phone services

If you’re a business owner with big expenses in these categories, your eyes probably just lit up. You’ll have that earning rate on up to $150,000 of purchases a year.

Everything else will earn 1X point per dollar, as well as everything beyond that $150,000 mark.

- Best for: Business Travel

Chase Ink Business Preferred® Credit Card

90,000 Bonus Points

Offer Details:

90,000 Bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

Why we like it

The Ink Business Preferred Business Card pulls attention with its big intro bonus, currently sitting at 90,000 points. That’s worth in $900 cash back, $1,500 toward travel when redeemed through Chase Travel℠, or even more when transferring to Chase’s travel partners like Hyatt, United Airlines, British Airways and more. But the card shows its real value with its high-earning bonus-spending categories. Freelancers and business owners alike will earn 3 points per dollar on the first $150,000 spent on travel and select business categories each account anniversary year.

Reward details

3X points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

1X point per $1 on all other purchases – with no limit to the amount you can earn

Pros & Cons

Pros

Simply put, for small business owners and freelancers it’s one of the best cards for turning business spending into valuable travel. The bonus alone is worth $900 cash back, $1,500 toward travel when redeemed through Chase Travel℠, or potentially more when transferring to Chase’s travel partners like Marriott or Air Canada.

It also offers some stellar protections including a comprehensive reimbursement on damaged or stolen cell phones, and primary rental car coverage.

It has a reasonable $95 annual fee.

If you have another Chase card like the Sapphire Preferred or Reserve, or even a cash back earning Chase card, you can pool your points and make them more valuable.

Cons

It does lack some of the juicier benefits attached to other business credit cards likes the The Business Platinum Card® from American Express. But with the low fee, it’s hard to argue with its value proposition.

It’s subject to Chase’s 5/24 rule. So if you’ve opened five cards in the last two years, you’re most likely not going to be accepted.

Terms Apply

How to use the Chase Ink Business Preferred 90k-point bonus for huge value

1. Qatar Airways’ Qsuite

One bonus is enough to send you to 36,000 feet in the most luxurious seat in the world—the Qatar Airways Qsuite.

We’ve covered this incredible experience before and we will again, as it’s an aspirational flight for many points and miles enthusiasts. High-end dining, unbelievable seating pods, incomparable service, and major travel bragging rights are all the norm.

A flight from New York or Los Angeles to Doha can run as high as $10,000 when paid in cash, so you’re looking at $20,000 for a roundtrip. That’s madness. But with the 90,000-point intro bonus, you could do it for pocket change.

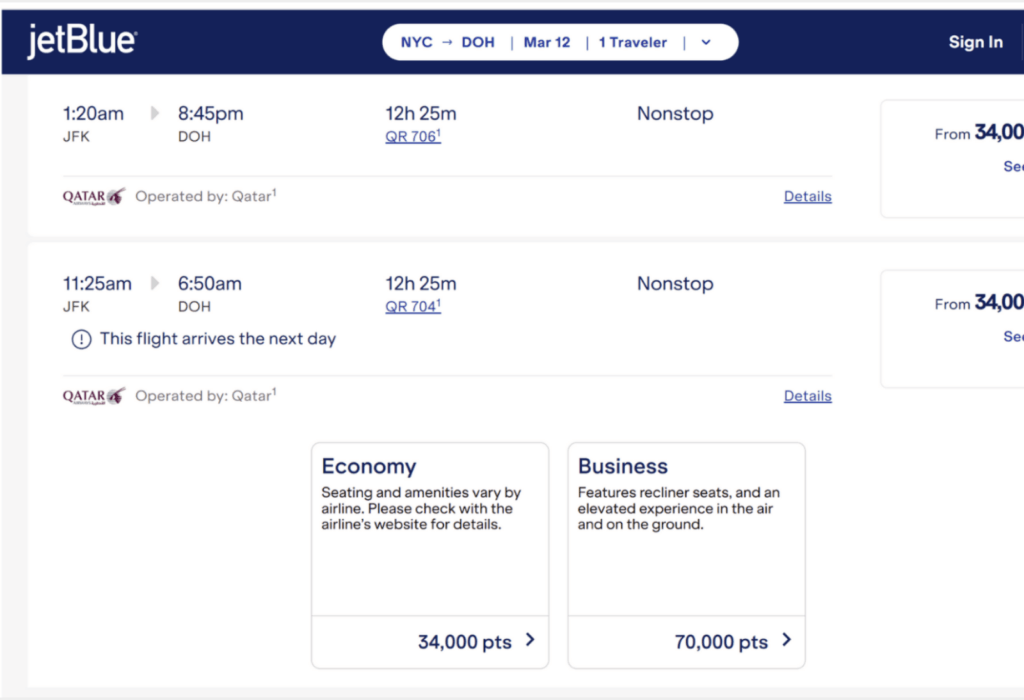

You have a couple of options for booking the flights using your Ultimate Rewards points. Arguably the simplest way is to transfer them to JetBlue. The US airline has been a Qatar Airlines’ partner for years and recently expanded the partnership to include Qsuite booking capabilities.

You’ll need to search for availability, but you can book a seat for 70,000 points and just a few bucks in taxes and fees. That’s incredible.

“But 70,000 multiplied by 2 is 140,000 points,” I hear you cry.

True, but if you’re using your card for those handy 3X points-per-dollar earning categories, you could earn another 24,000 points on top of the bonus. You’d even have enough left for a quick domestic flight, too.

Go on, treat yourself.

2. Book 30 flights in the US and abroad

This one is a bit mad, but if you’re a big traveler, both for work and pleasure, you could literally fly 20 short-haul flights in the US and another 10 within another continent.

Sounds specific. It is specific. But also pretty cool. Let’s look at a hypothetical.

Let’s say you work in New York, but travel a lot to Boston for meetings and whatever business owners do. A roundtrip flight costs somewhere in the realm of $250 on any given day—sometimes more, sometimes a little less. If you have to take that trip 10 times a year, you’re dropping at least $2,500 on flights.

If we use our 90,000-point bonus, we’d be able to score 10 roundtrips between NYC and Boston by transferring them to United. You’d only pay $5 in fees, so you’re saving your company $2,400 in flights.

But, if we’re smart with our points, we could wrangle even more value using the United Excursionist Perk. We have a big article on it here, but in short, the perk allows you to book a free flight in the middle of a multi-city itinerary. The only stipulations are that the first and last flights in the itinerary end in the same zone, and the middle flight takes place in a separate zone.

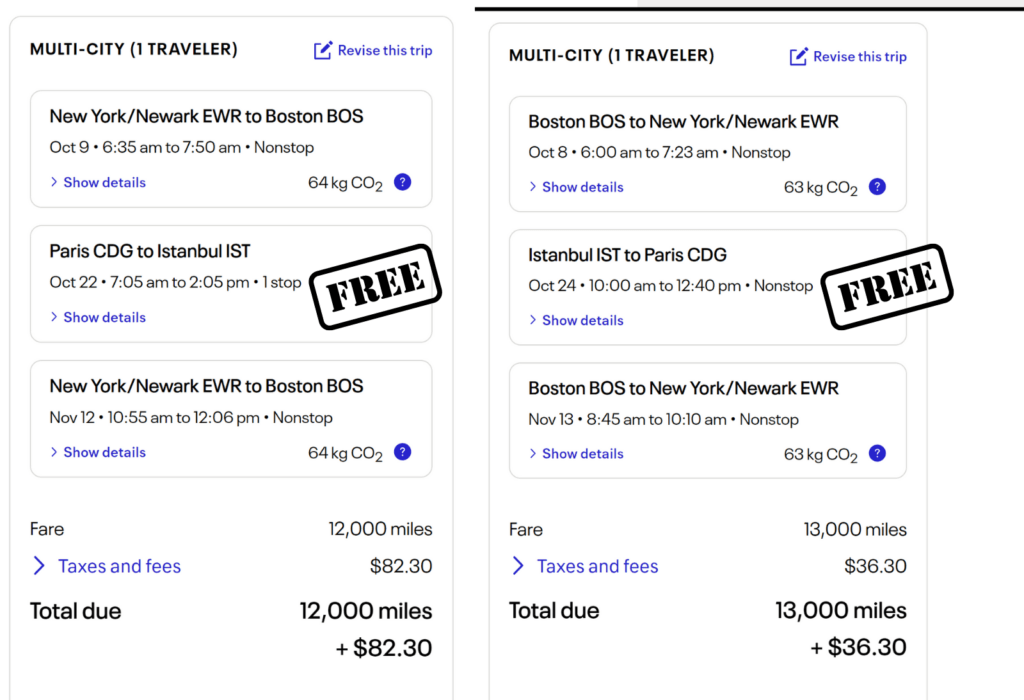

So in this case, if you felt creative you could book 10 roundtrips between New York and Boston with a flight in a different country between each. Here’s an example itinerary combo to cover two NYC to Boston trips with intra-Europe flights in between. You’d have to book flights to Paris elsewhere.

Part 1

- October 9 – New York to Boston (6,000 points)

- October 22 – Paris to Istanbul (free)

- November 12 – New York to Boston (6,000 points)

Part 2

- October 10 – Boston to New York (6,000 points)

- October 26 – Istanbul to Paris (free)

- November 13 – Boston to New York (6,000 points)

Those Paris to Istanbul flights could be as much as $400 for a roundtrip—that’s more savings for you. It’s not just tied to Europe. You could fly around Japan for free, or maybe South America or Africa.

It’s a pro move, but it’s pretty damn cool.

3. Fly the family to Hawaii and back

After the complexities of the last redemption, here’s a pleasantly simple one for you. Take your whole family to Hawaii and back for almost nothing by transferring the points to Southwest.

Assuming there’s a max of five…the fourth kid gets left behind, I guess. And I’m afraid this one is just for West Coasters. Those on the East, hang on, I’ve got something else for you.

Southwest works a little differently from other airlines. Instead of using award charts or even dynamic pricing, it ties the points rates to the cash price of any given flight. In other words, the more expensive the flight, the more points you’ll need.

With this in mind, flexibility is your friend. Use the Southwest low fare calendar view to find the best rates on any given day and base your trip around that. I’ve found plenty of flights for just over 10,000 points each way. If you can tie up a return leg for around the same rate, you’ll be able to fly a family of five to the islands and back for just $5.60 each.

Make sure you do your research on dates before you move your points. Once they’ve moved, they’re not coming back.

4. Grab two roundtrip flights to Europe in business class

For my East Coasters, I have an easy way for you to fly business to Europe and back. Twice. With only $109 in fees each time. That’s pretty epic. Who needs Hawaii anyway?

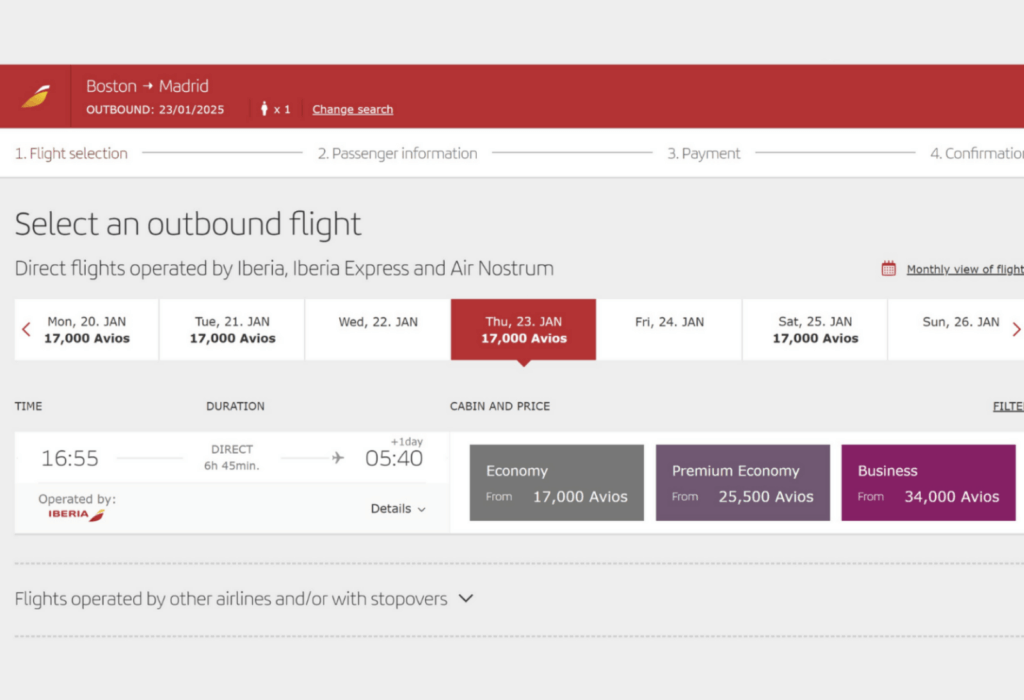

This redemption is widely viewed as one of the best value moves out there. You’ll transfer your points to Iberia, Spain’s flagship carrier, to redeem a business class seat for just 35,000 Avios. If you’re as astute with your numbers as I assume you are, you’ll notice again that it adds up to 140,000 points. Take the same advice as the Qatar redemption, in this case, to make up the difference or move some points from British Airways via another card to top up.

The biggest hurdle here, as with most business class redemptions, is finding award availability. First, you’ll need to check on the Iberia website for peak and off-peak times. Those 35,000-point flights are off-peak rates, so narrow down your search to those periods.

Once you’ve done that, head to the American Airlines portal and perform a business class search for the route you need. Look at the calendar view and find dates that have a 56,000-mile rate. Make a note of these, then head back to Iberia and search for those dates. It’s gonna be hit-and-miss, but the flights are there, I promise. Just keep calm if the website glitches.

If you’re not on the East Coast, you’ll be able to grab the same flights for around 42,500 Avios. That’s still a great deal.

5. Stay a long time in cheap hotels, or a few days in epic ones

Chase is one of the only credit card companies that allows transfers to World of Hyatt. If you’re unfamiliar with the hotel’s loyalty program, you’re missing out. Its award chart is unfathomably generous, offering members the chance to stay in truly spectacular hotels for nothing.

The hotel brand classifies each of its properties in categories ranging from 1-8, with 1 being the cheapest and most basic, and 8 being the most luxurious and expensive. With that said, a Category 8 can still be booked for as low as 35,000 points. Aim for off-peak times to maximize your points.

Here are just a few redemptions you could make:

Five nights in five-star luxury in Paris: Hotel du Louvre

One of Paris’ most spectacular old hotels, Hotel du Louvre can cost as little as 25,000 World of Hyatt points to book. If you can string together enough days at that rate, you can enjoy five free nights there. Rooms there average around $600 a night. Do the math. That’s $3,000 in value.

Spend over a month in a Category 1 hotel

Category 1 hotels in the World of Hyatt program start at just 3,500 points. While it’s unlikely you’ll be able to string together enough nights for one mega stay at that rate, in theory, you can redeem 34 nights for nothing—36 if you include 8,000 minimum points earned by your initial spending goal.

While the bulk of these hotels are basic affairs like airport hotels or handily-located business hotels, there are some pretty exciting properties abroad. One that sticks out is the Park Hyatt Chennai. It’s a luxury hotel in India that feels like it’s being severely underpriced. But the market it’s in dictates the category. Other favorites include the Hyatt Regency in Pahang, Malaysia, the Hyatt House in Johannesburg, and the Hyatt Oryx in Doha.

Go crazy and get a lot of a little or a little of a lot.

The point

The Chase Ink Business Preferred is running an incredible 90,000-point elevated intro bonus that can score you thousands of dollars in value. Whether you use it on luxury flights, multiple economy runs, or hotels, the sky is the limit with the bonus. Better yet, as it’s a business card it doesn’t fall under Chase’s 5/24 rule, giving you the chance to earn some more Ultimate Reward points even if you’ve already opened too many cards on the personal side.

by your friends at The Daily Navigator

by your friends at The Daily Navigator