Ultimate Credit Score Guide

Check your credit score for free, discover the best credit tools, and get expert advice on building and repairing your credit.

The importance of credit

Your credit score impacts everything from loan approvals to interest rates and even job opportunities, making it a key factor in your financial future. Whether you’re looking to check your credit score for free, find the best tools to monitor and improve it, or learn how to boost your score fast, taking action today can open doors to better financial opportunities. Start here to take control of your credit and set yourself up for success.

Step 1: Get your score

Check your credit score for free and see where you stand with no strings attached.

Step 2. Learn the basics

Understand what impacts your score and how credit works with simple, helpful guides.

Step 3. Improve your score

Take action with expert tips, smart tools, and the right credit cards to help boost your score.

- Step 1: Get your score! 🎉

Know where you stand

Before you can improve your credit, you need to know where you stand. Checking your credit score is the first step. Checking your credit score gives you a clear snapshot of your current credit health and helps you track progress over time. Knowing your score also helps you understand what lenders see and what areas you may need to work on.

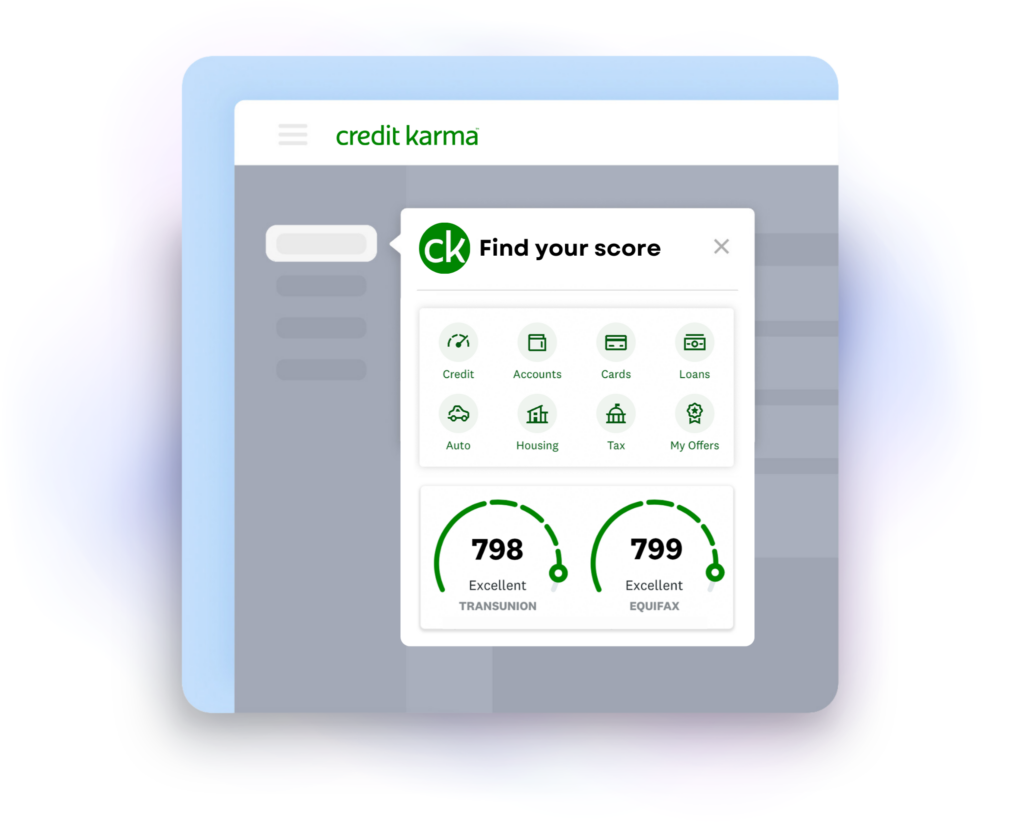

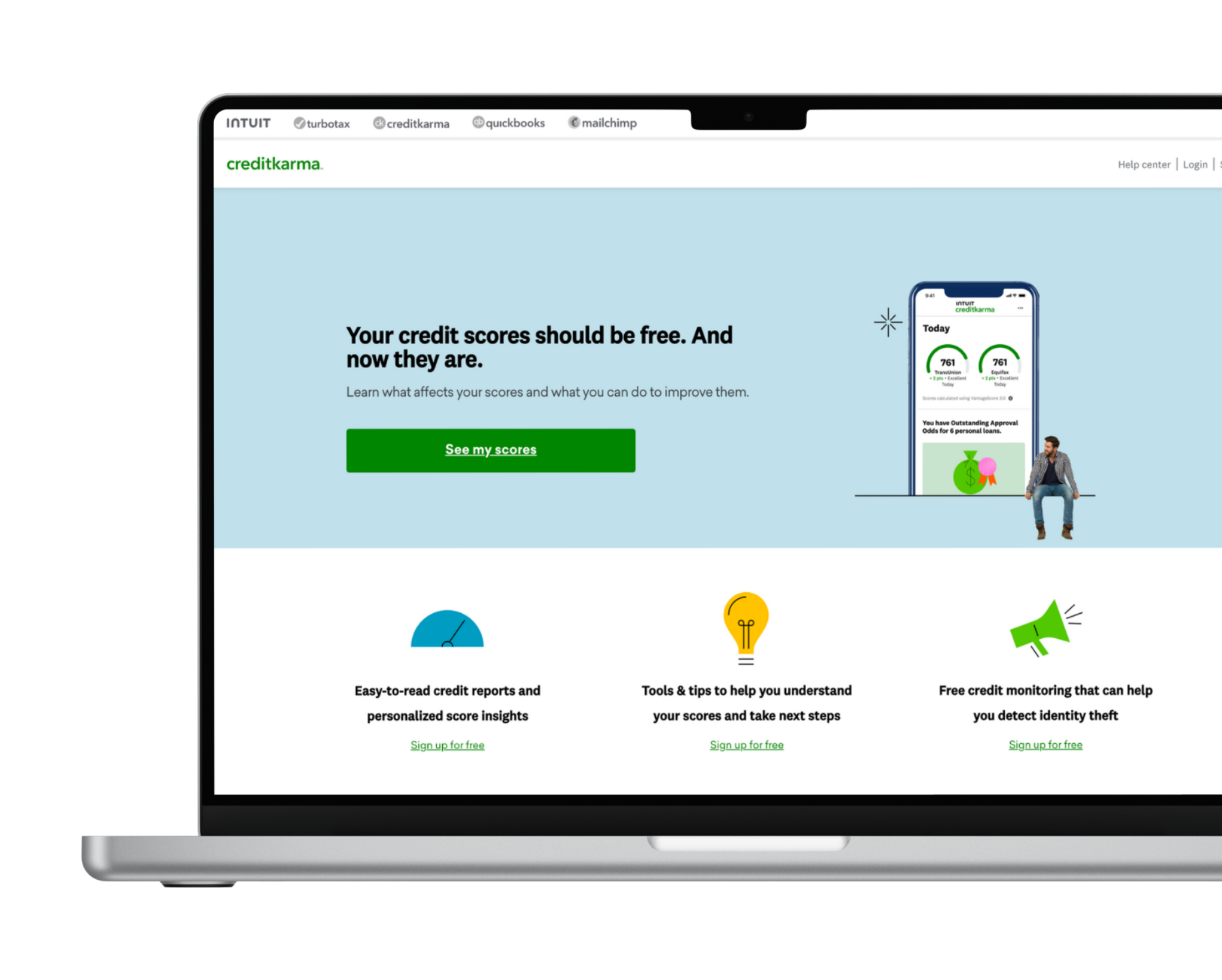

Find your credit score for free

Credit scores used to be out of reach for most people. Credit Karma decided that wasn’t right, so they made them free for everyone.

Additional Credit Tools

We've put together a list of the best credit tools. Some of these tools may be partners, but our picks are fully independent.

- Step 2: Learn the basics! 📖

What is a credit score?

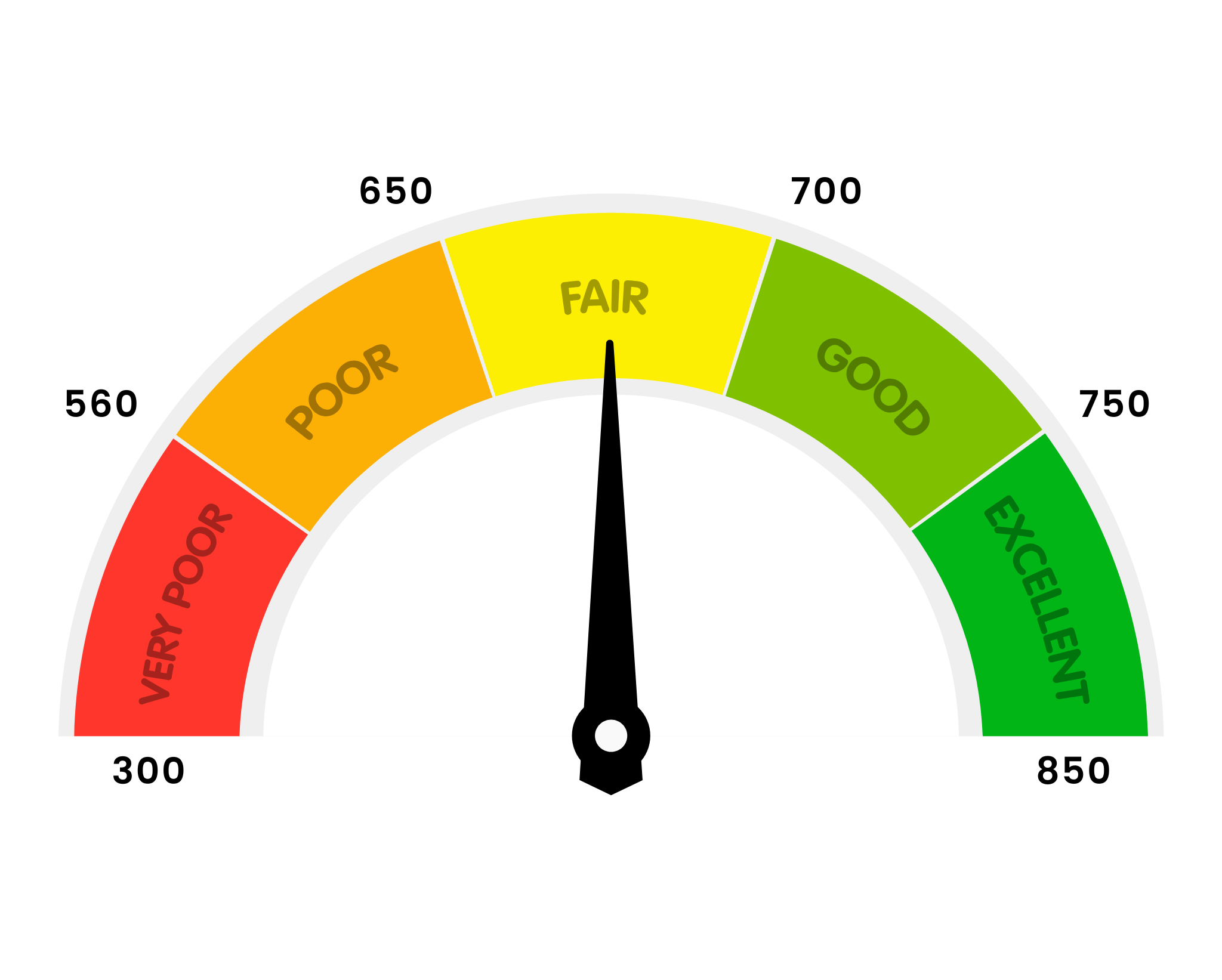

A credit score is a three-digit number that represents your creditworthiness, or how likely you are to repay borrowed money. It’s based on your credit history and is used by lenders, landlords, and even some employers to assess financial responsibility. Credit scores typically range from 300 to 850, with higher scores indicating better credit health. The score is calculated using factors like payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. A strong credit score can help you secure loans, lower interest rates, and open doors to better financial opportunities.

What's the difference between a score and a report?

Credit Score

A credit score is a three-digit number that represents your creditworthiness, or how likely you are to repay borrowed money. It typically ranges from 300 to 850 and is calculated based on factors like payment history, credit utilization, and account age. Lenders use this score to make quick decisions about loan approvals, interest rates, and credit limits. A higher score signals responsible credit use and can unlock better financial opportunities.

Credit Report

A credit report is a detailed record of your credit history, maintained by the three major credit bureaus: Equifax, Experian, and TransUnion. It includes information on past and current credit accounts, payment history, outstanding debts, inquiries, and any negative marks like late payments or collections. While your credit score is based on this report, lenders may review the full report to assess your financial behavior before making lending decisions.

The benefits of good credit

Your credit score impacts everything from loan approvals to interest rates and even job opportunitieial opportunities.

Easier Access to Loans & Credit Cards

A strong credit score makes it easier to qualify for loans, credit cards, and other financial products with higher limits and better approval odds.

Lower Interest Rates & Better Terms

Lenders offer lower interest rates to borrowers with good credit, helping you save thousands over time on mortgages, auto loans, and personal loans.

Approval for Rentals & Housing

Many landlords check credit scores when reviewing rental applications, as a strong credit history signals financial responsibility and lower risk.

Better Insurance Rates

Some auto and home insurance companies use credit scores to determine premium costs, meaning a higher score can help you qualify for lower rates.

Employment Opportunities

Employers in industries like finance and management may review credit reports, as responsible credit use can reflect strong decision-making skills.

More Financial Flexibility & Security

A good credit score gives you access to better financial products, emergency funds, and lower fees, allowing you to navigate expenses with confidence.

Easier Access to Loans & Credit Cards

A strong credit score makes it easier to qualify for loans, credit cards, and other financial products with higher limits and better approval odds.

Lower Interest Rates & Better Terms

Lenders offer lower interest rates to borrowers with good credit, helping you save thousands over time on mortgages, auto loans, and personal loans.

Approval for Rentals & Housing

Many landlords check credit scores when reviewing rental applications, as a strong credit history signals financial responsibility and lower risk.

Better Insurance Rates

Some auto and home insurance companies use credit scores to determine premium costs, meaning a higher score can help you qualify for lower rates.

Employment Opportunities

Employers in industries like finance and management may review credit reports, as responsible credit use can reflect strong decision-making skills.

More Financial Flexibility & Security

A good credit score gives you access to better financial products, emergency funds, and lower fees, allowing you to navigate expenses with confidence.

Want to learn more?

Explore these in-depth articles on credit scores

READ ARTICLE →

What is a Credit Score?

A credit score is a figure determined by one of three credit bureaus, designed to gauge an individual’s creditworthiness.

READ ARTICLE →

How to Improve Your Credit Score

Making the right decisions, paying and keeping down debt, and keeping on top of your credit lines can pave the path to a great credit score.

READ ARTICLE →

How to Manage Credit Card Debt

Getting out of debt is tough. But there are many ways to start the climb to a debt-free life.

READ ARTICLE →

Best Cards for Building Credit

- Step 3: Improve your score! 📈

Level Up Your Credit

Now that you've checked your credit score and learned the basics, it’s time to take action. Improving your score isn’t about quick fixes. It’s about building smart habits that make a lasting impact. Whether you're just starting out or rebuilding, these steps can help you boost your score and unlock better financial opportunities.

How to boost your credit score:

Make on-time payments

Payment history is the biggest factor in your score. Set up autopay or reminders to avoid missed payments.

Lower your credit utilization

Keep credit usage below 30% of your available limit to show responsible borrowing.

Avoid opening too many accounts at once

Multiple hard inquiries in a short time can lower your score.

Keep old accounts open

Closing accounts can shorten your credit history, which may lower your score.

Diversify your credit mix

Having a mix of credit types (loans, credit cards, etc.) can improve your score over time.

Common mistakes you can avoid

Avoid these common credit mistakes that can lower your score.

- Missing Payments

Missing payments – Even one late payment can lower your score and stay on your report for years.

- Maxing out

Maxing out credit cards – High utilization can signal financial strain and lower your score.

- Ignoring credit

Ignoring your credit report – Errors on reports can hurt scores so checking regularly helps catch mistakes.

- Applying too much

Applying for too much credit at once – Hard inquiries can lower your score, so space them out.

- Co-signing

Co-signing loans without caution – If the primary borrower misses payments, your score will take a hit too.

Steps you can take today

Open a Credit Card

Build credit by opening a secured or beginner-friendly credit card, making small purchases, and paying them off monthly.

Monitor Your Credit

Track your score, get alerts, and catch errors early with tools like Credit Karma or Experian for better credit management.

Report Rent & Bills

Use services like Experian Boost or RentTrack to add on-time rent and utility payments to your credit history automatically.

Learn More Strategies

Take the first step by exploring all the strategies that can boost your score, from reducing debt to managing accounts wisely.

Yesterday you said tomorrow.

Don’t wait any longer. Check your score, find the best tools, and start improving your credit today.

by your friends at The Daily Navigator

by your friends at The Daily Navigator